yujie chen/iStock Editorial via Getty Images

Investment thesis

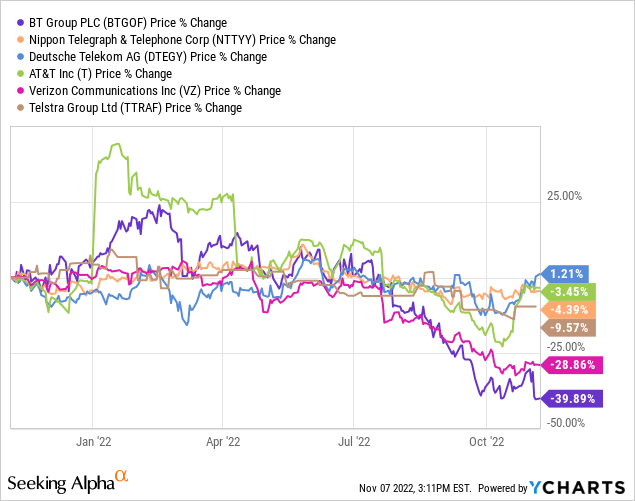

BT Group plc’s (OTCPK:BTGOF) shares have significantly underperformed its global peers, stemming from a weakening and unstable UK economy. Whilst valuations are low, with the lack of any positive catalysts in the near term, we see no immediate reasons to invest. We rate BT Group shares as neutral.

Quick primer

BT Group is the world’s oldest telecommunications, with roots dating back to 1846. It remains the UK’s largest consumer mobile (with the EE brand), fixed, and converged communication provider with a relationship with over 45% of UK households. It has enterprise and global service divisions and operates a fixed-access network called Openreach, which wholesales connectivity to other communication providers.

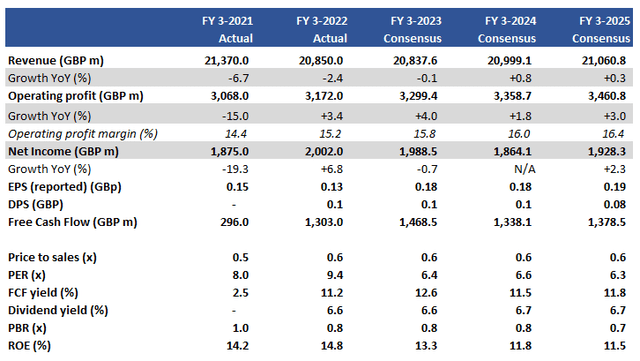

Key financials with consensus forecasts

Key financials with consensus forecasts (Company, Refinitiv)

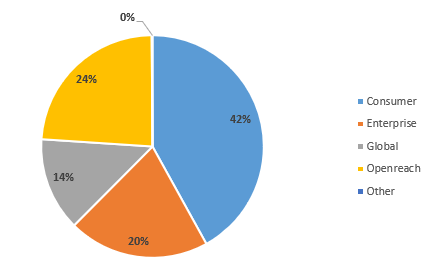

Sales split by segment H1 FY3/2023

Sales split by segment H1 FY3/2023 (Company)

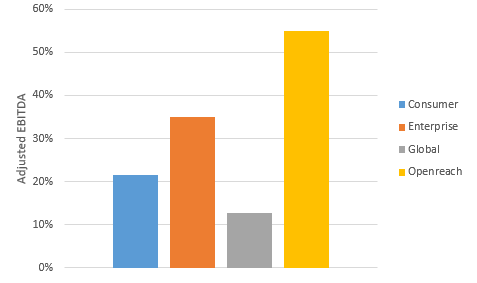

Adjusted EBITDA margin per segment H1 FY3/2023

Adjusted EBITDA margin per segment H1 FY3/2023 (Company)

Our objectives

BT Group has experienced notable underperformance YTD versus its global peer group, with Deutsche Telekom (OTCQX:DTEGY), AT&T (T), and NTT (OTCPK:NTTYY) showing relatively strong outperformance. The telecommunication sector is ex-growth but stable and tends to perform regardless of business cycles, influenced more by technology with next-generation network roll-outs. Traditionally viewed as a conservative area to invest, we want to investigate whether BT Group is attractive given its significant share price correction.

Limited positives in H1 FY3/2023 results

The UK economy is under intense pressure from exogenous factors such as the Russian invasion of Ukraine, and by shooting itself in the foot as the government released and then retracted a ‘mini-budget’ that blasted up borrowing costs and damaged the country’s financial market reputation. BT often describes itself as underpinning economic growth in the UK, but unfortunately, it appears to be suffering as a result of being so integral to its home market. A tightening fiscal policy announcement is also expected next week on 17th November 2022.

H1 FY3/2023 results disappointed the market with profits before tax falling 17.6% YoY, but comments made about inflation (particularly energy) driving the need for accelerated cost savings were a major negative. The original cost savings target has been raised from GBP2.5 billion/USD2.1 billion to GBP3.0 billion/USD2.6 billion by the end of FY3/2025. The business is incapable of driving sustainable earnings in its current form. Imposing cost cuts will be very difficult to execute given inflationary pressures (rising energy costs are hard to hedge), as well as workforce unrest over pay, which in the summer led to strikes and customers missing out on getting broadband connections to their homes.

Free cash flow at interim fell to GBP64 million/USD55 million from GBP360 million/USD313 million YoY as capex rose GBP705 million/USD613 million (page 15) as efforts continue to expand its FTTP (fibre-to-the-premises) by Openreach for its fixed network build and connections. BT is investing GBP15 billion/USD13 billion to help Openreach’s FTTP network reach 25 million UK premises by December 2026 (currently at 8.8 million), of which 6.2 million of those will be in rural or semi-rural areas. Openreach is the most profitable business by EBITDA margin for BT and is crucial for its future success. However, there is still some way to go before capex levels can begin to normalize.

Rising debt and need for patience

Net debt levels increased by GBP801 million/USD696 million to GBP19.0 billion/USD16.5 billion in H1 FY3/2023, resulting in a net debt-to-equity ratio of 1.2x which is not too high risk, but higher than more liquid peers such as NTT on 0.9x who are also asset-rich with long term investments. The debt schedule shows a large spike in maturities in FY3/2026 (page 51), highlighting that BT’s financing costs are going to increase over the medium term. Expanding leverage and rising financing costs are not positive but with a current interest coverage ratio of 3.8x, there is still room for maneuver.

There are not many positives to talk about BT in the short term; management continues to sell the long-term story whereby free cash flow expands by at least GBP1.5 billion/USD1.3 billion from FY3/2023 to FY3/2031, effectively doubling in eight years. The key driver remains the roll-out of FTTP, selling converged mobile/fixed services with value-add services on top to lower churn and increasing ARPA (average revenue per account) and capex is peaking this year at around GBP5.0 billion/USD 4.3 billion. The key question appears to be whether the business can navigate the next few years financing its FTTP roll-out successfully, whilst operating its legacy businesses without too much disruption. The business environment will remain challenging with the Bank of England forecasting a 2-year recession from the summer of CY2022.

Valuation

Consensus forecasts estimate flat growth into FY3/2024 and FY3/2025, which may look too optimistic given the company is embarking on cost reductions to combat margin pressure. Negative sentiment may be coming from the fact that earnings may decline, and dividends per share may be cut despite the payout policy based on maintaining or growing it YoY. The current estimated dividend yield of 12% looks slightly stretched but is an attractive level of return.

Risks

Upside risk comes from BT managing to cut costs successfully, demonstrating a recovery profile in earnings. The FTTP roll-out could accelerate and the sales mix could start to improve faster than expected.

Downside risk comes from inflationary cost pressures increasing going forwards, both for energy as well as staff wages which will dampen margins. The cost-of-living crisis could result in falling ARPA and increasing customer churn, for both retail consumers and enterprises.

Conclusion

Despite the immediate difficulties of cost inflation faced by BT Group, we feel that downside risk is limited given the recent share price correction. However, there is no easy way for the company to post a recovery profile, and it will have to navigate a hard 2 years until the FTTP project nears completion and capex demand begin to fall back. Current valuations are in value territory with PBR 0.8x and dividend yield above 10%, but we expect to see weakening results in the next 6-12 months. With no immediate reasons to invest, we rate BT Group plc shares as neutral.

Be the first to comment