djmilic

Thesis

We recently started covering the BlackRock Science and Technology Trust (NYSE:BST), and upon our review we assigned it a Sell rating. It is important to keep in mind that holdings in a CEF do not necessarily need to be toxic for them to lose value, they just need to be overpriced. Starting valuation levels are extremely important in today’s environment where short dated treasury yields are at 4% and very likely heading to 5%. The moniker TINA is gone, and TARA is now in vogue.

Our initial article asserted that the fund was overvalued from both an intrinsic perspective (i.e. the holdings) as well as from a structural perspective (premium to NAV rather than a discount):

We expected the downward momentum to continue, with an expected -10% to -12% negative performance in BST for the next leg down. The negative move is going to be driven by two factors: i) the fund is going to revert to a -5% discount to NAV as we saw in the June selloff, ii) as a high-beta technology play, BST will suffer in the market-wide selloff. BST’s recent positive performance off the June lows was 50% driven by a reversion to a premium to NAV for the fund from a -5% number. We are going to revisit that discount. Fundamentally, the CEF’s performance is also going to be under pressure – software and semiconductors are the main sub-sectors here, and they are under pressure. As we saw from Nvidia (NVDA), the guidance in the sector is weak, and the semiconductor space will be under pressure going forward. Market analysts are predicting significantly more pain for semiconductor stocks.

Let us benchmark what we asserted and the latest market developments.

Overpriced Factor #1: Premium to NAV

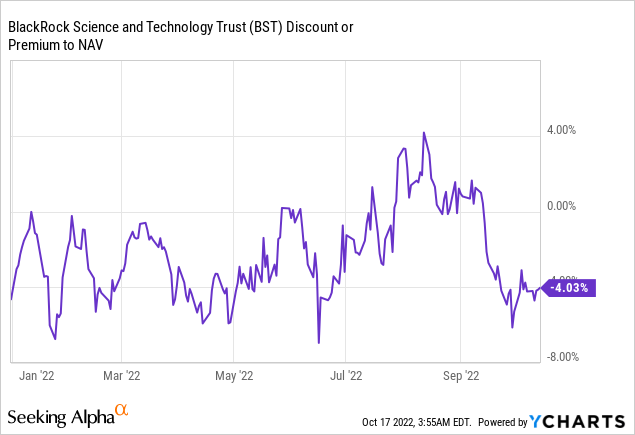

When we wrote our initial fund analysis the CEF was trading at a very slight premium to NAV:

As we correctly predicted the fund has moved to a discount of nearly -5% of NAV as of the writing of this article. It is important to understand the compounding effect of the widening of a discount to net asset value, especially for high beta assets like technology. When the market moves against the collateral, we see substantial widenings of the discounts for high beta names.

Overpriced Factor #2: Semiconductor Holdings

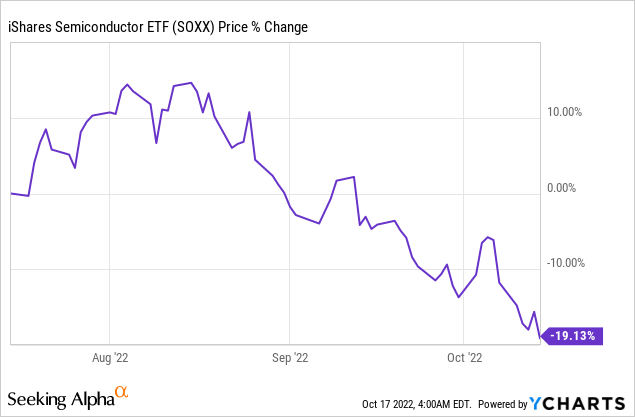

Boy oh boy has this sector been on a move as of late. Let us have a look on how it has fared since August:

Down almost -20% since our article, the sector has been a fast moving target. Ranging from new regulation aimed to prevent China accessing cutting edge technology to a general malaise in the space given a slowdown of computer sales, we have seen just bad news coming out from the sector. We are not saying by any means that the bottom is in here, far from it. However a vertical down-move has occurred very fast, which is notable. Eventually semi-conductors will start forming a bottom and valuations will come down to “cheap” levels.

Overpriced Factor #3: High Beta Technology Equities

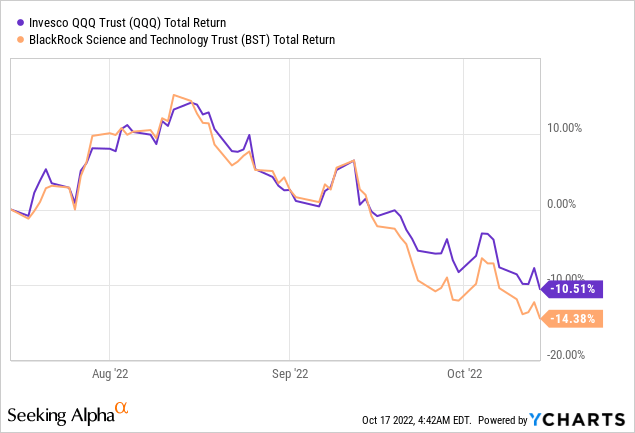

High beta tech names tend to move more than the general market. When tech sells off, high beta tech sells even harder. As the Nasdaq moved lower after its August bear market rally, BST followed:

Technology stocks have been driven by a low rates environment for the past 5 years. That risk factor has now disappeared and the valuation re-set for the sector is occurring before our eyes. Since earnings and cash-flows for most names in the sector are years away, we are getting a significant P/E de-rating.

Performance

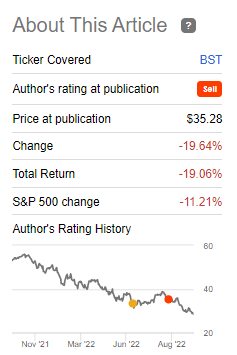

BST is down almost -20% since our article, easily exceeding our -15% target:

Sell Rating (Seeking Alpha)

Heeding our Sell call would have saved an investor almost two years of dividends. It is important to always frame CEFs within a macro frame-work and correctly understand the drivers behind each fund’s performance. While BST was a great holding for a zero rates environment, that fundamental thesis is gone.

BST Outlook

While our target has been met and we are moving to Hold (i.e. Neutral) on BST, the long term outlook for the CEF is not rosy. We believe we have entered a new era of stickier, higher inflation, and higher rates will be here for longer. This translates into an environment where tech is going to de-rate down and stay down. In our opinion we are not going to see a “V” shaped recovery in tech and it will take years to make back the money lost in BST. Valuations are going to be constrained for longer and BST is going to bounce in a lower range going forward. It is an unfortunate situation for those who chose to ride out the storm as holders and are now sitting on massive unrealized losses in the name.

Conclusion

The BlackRock Science and Technology Trust is a closed-end fund focused on technology equities. The vehicle is down almost -20% since our Sell rating, with almost 2 years of dividend income lost in the process. The factors that we outlined in our Sell recommendation drove the move, including premium to NAV, beta to tech names and semiconductor stocks. With our target met, we are moving to Hold on the name, but the future is not rosy for BST. In our opinion the era of easy money from central banks is gone, and we are not going to experience a “V” shaped recovery in tech. Prepare for lower valuations for longer in the sector, with BST bound to a lower pricing range.

Be the first to comment