Patcharapong Sriwichai/iStock via Getty Images

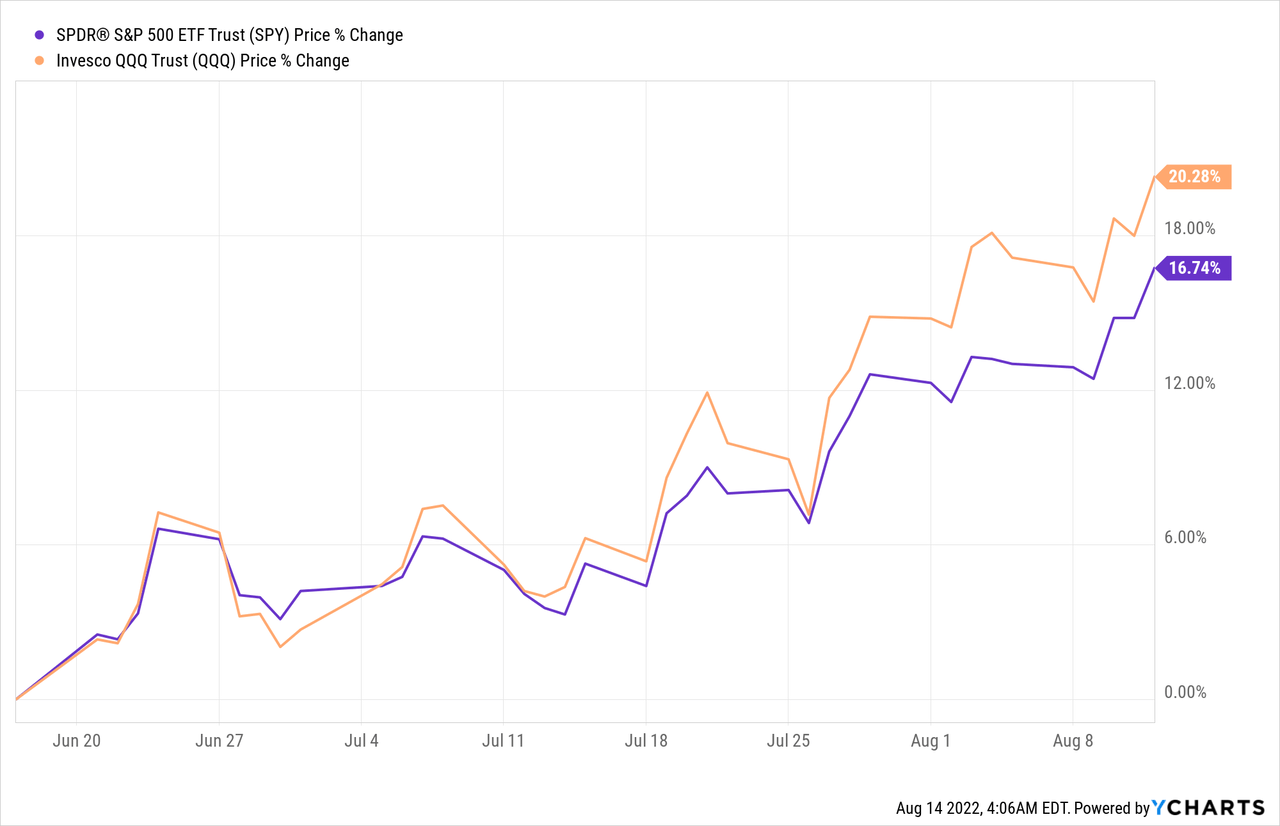

The market has risen quite significantly over the past few weeks. The S&P 500 (SPY) is up by 17% and Tech stocks (QQQ) by 20%:

As a result, increasingly many investors are now asking themselves whether it is too late to invest. You may feel like you missed the opportunities and that the train left the station already.

If you fit in this group of investors, don’t worry.

There are still plenty of opportunities in some sub-sectors of the market. I am here referring specifically to REITs (VNQ), which are still trading at historically low valuations after the recent recovery.

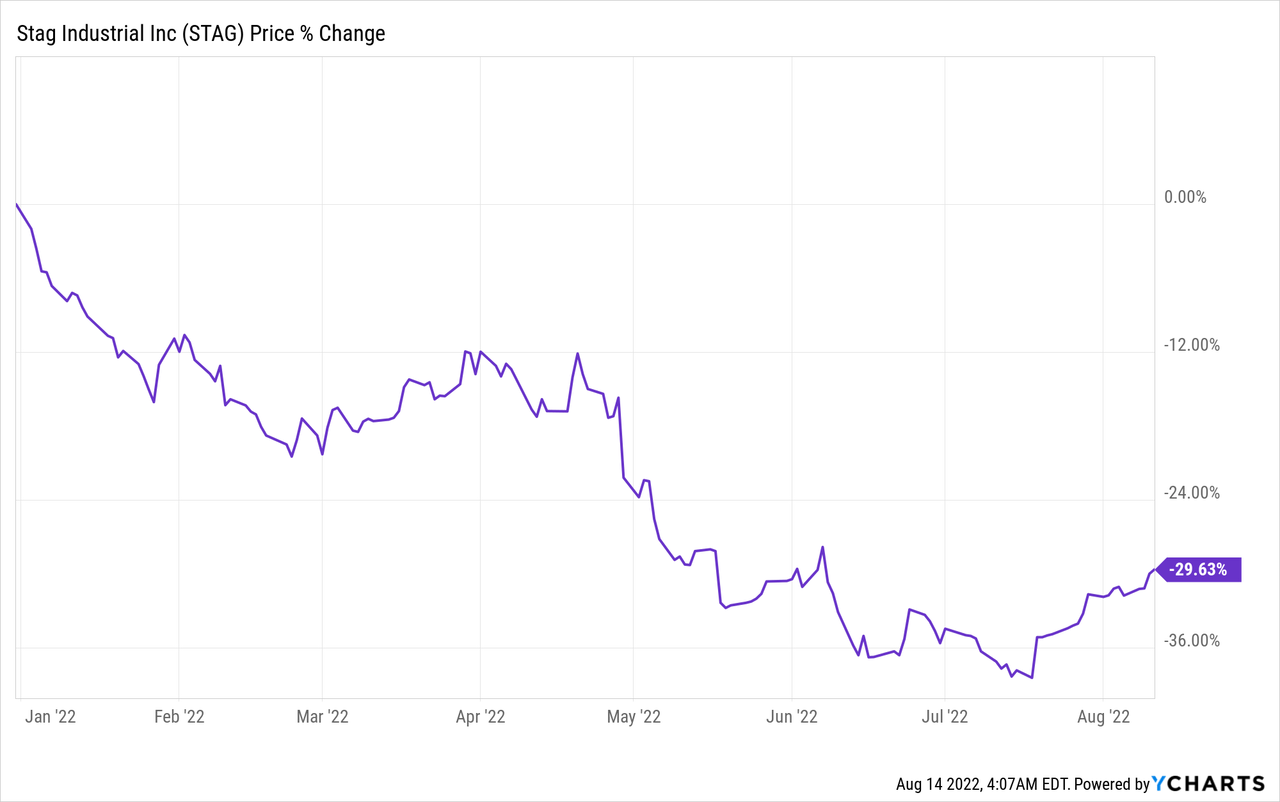

To give you an example: Yes, it may be a bit late to buy Amazon (AMZN), which has risen by 30%+ over the past months, but you could buy one of its biggest landlords, STAG Industrial (STAG), which is still priced at a 30% discount at the moment:

I like this chart because it clearly illustrates that there is a mismatch between the performance of the operator/tenant and the real estate owner/landlord, and it creates an opportunity for sophisticated investors. Here, you couldn’t argue that STAG is facing greater headwinds than Amazon because it is actually the opposite.

The point here is that REITs are today priced at a historically large discount relative to most other stocks.

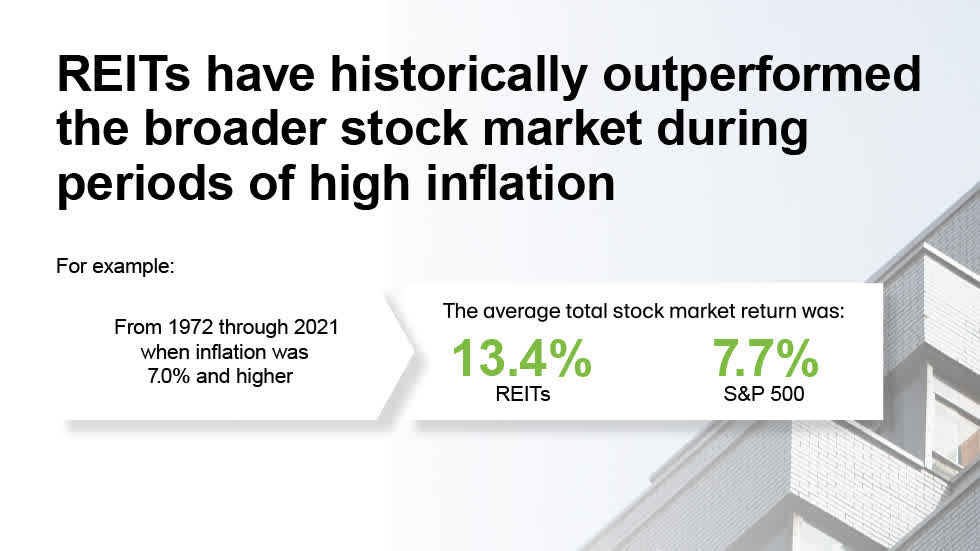

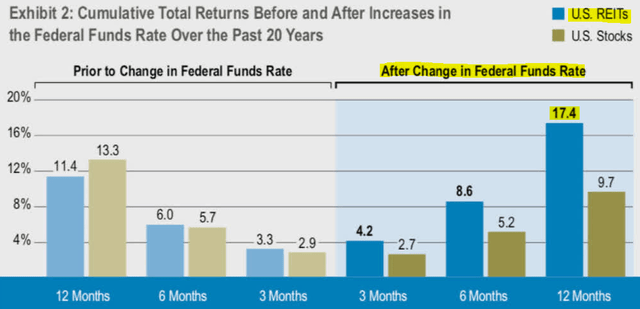

They sold off particularly heavily because investors fear that interest rate hikes will have a significant negative impact on their earnings.

But what the market appears to ignore is that REIT balance sheets are today the strongest in history with low debt and long maturities. Moreover, interest rates are only rising because of high inflation, which is actually very beneficial for REITs.

The inflation affects 100% of their assets/revenue, but the rate hikes only affect the debt, which is typically ~30% of the balance sheet.

Therefore, the positive impact of inflation is greater than the negative impact of rate hikes in most cases, and this explains why REITs have historically been such strong performers during times of rising rates / high inflation:

NAREIT

Cohen & Steers

Yet, due to misconceptions, many REITs are down by 20 or even 30% at the moment.

We are accumulating them at High Yield Landlord, and below, we highlight two of our favorite positions that we expect to soar in the coming years:

Most REIT investors stick to US REITs because they don’t have access to research on foreign opportunities.

Moreover, most REIT investors also tend to focus on the largest capitalization. Again, this is not necessarily by choice. They simply don’t know about the smaller REITs.

There is nothing wrong with that. However, if you actually made the effort to learn about smaller REITs, especially those with foreign listings, you would find some undiscovered gems that trade at large discounts relative to larger and better-known REITs in the US.

BSR REIT is a great example of that.

It is a small cap REIT that’s structured in Canada and as a result, it trades at a large discount to US large cap peers. However, the interesting thing is that BSR’s properties are actually all in the US.

It owns a portfolio of highly desirable apartment communities that are almost exclusively located in rapidly growing cities of Texas like Austin, San Antonio, Dallas, and Houston.

BSR REIT

Its rents are rising rapidly with new leases including 15%+ rent hikes. This is largely because there are so many companies and people moving to Texas at the moment and not enough has been built to meet this growing demand. Even Tesla (TSLA) and Elon Musk moved there. They are moving there to lower their cost of living and enjoy more favorable taxation among other reasons.

Typically, you would expect a REIT that’s growing so rapidly to trade at an expensive valuation.

But because BSR isn’t known to most US investors, it is currently priced at a near 30% discount to its net asset value. This essentially means that you get to buy highly desirable properties that are diversified, professionally managed, and liquid, at 70 cents on the dollar.

BSR REIT

Its latest NAV estimate is $22.35 but its share price is currently just $16.80. We think that it is only a question of time before this spread closes, unlocking 30%+ upside to shareholders who buy it today. Its larger US peers like Mid-America (MAA), Equity Residential (EQR), and Independence Realty (IRT) commonly trade at closer to NAV or even at premiums to NAV, and that’s despite enjoying slower growth.

While you wait for the discount to close, you also earn a monthly ~3% dividend yield and the company keeps growing its value at a rapid pace.

If the market fails to close the discount, I would not be surprised if it was bought out by a larger player. Blackstone (BX) has taken private many of the smaller undervalued apartment REITs over the past year. BSR REIT would a be natural next target for them.

We hold a large position in our Core Portfolio at High Yield Landlord.

Whitestone REIT (WSR)

WSR is another example of a small-cap REIT that’s unfairly cheap simply because most investors aren’t familiar with it.

WSR is a REIT that owns service-oriented shopping centers, just like its larger peer Regency Centers (REG), but WSR trades at a materially lower valuation due to its much smaller size, and that’s despite actually enjoying faster growth prospects.

Whitestone REIT

Unlike many of its larger peers, WSR owns properties mainly in rapidly growing sunbelt markets.

Most of its assets are in Arizona and Texas and its single biggest market is Phoenix, which enjoyed some of the fastest property price appreciation during the pandemic.

Whitestone REIT

The REIT has guided for ~16% FFO per share growth in 2022, which is one of the fastest growth rates in the entire REIT sector. It is able to grow so fast because its rents are growing, its occupancy rate is rebounding, and the REIT is also cutting costs.

Yet, it is only trading at 11x FFO and an estimated 25% discount to NAV, which is far lower than most of its peers. Additional evidence that the company is undervalued is the fact it is still priced at a large discount to pre-covid levels, even as its portfolio is more valuable than ever before.

We expect 30% upside, and while we wait, the fair value of the company continues to grow at a rapid pace, and we earn a 4.5% dividend yield.

Bottom Line

Most stocks are now a lot more expensive than they were just a few weeks.

The recovery was quick and strong in most sectors of the market.

But REITs still offer plenty of opportunities, especially among small-caps and foreign REITs, which are commonly overlooked by most investors.

We are heavily investing in those at High Yield Landlord, expecting a recovery that will unlock significant gains in the coming years.

Be the first to comment