JamesBrey

When we last covered Brookfield Renewable Partners L.P. (NYSE:BEP) and Brookfield Renewable Corporation (BEPC), we took the unusual step of slapping a sell rating on one of the most popular renewable energy stocks. Nobody liked that lump of coal in their stocking, but we did give investors a clear alternative, and for that, you just had to finish reading the title.

Seeking Alpha

We cover the trajectory of all the securities we mentioned there and tell you how we see this playing out next.

The Common Shares

BEP was the worst performing security in our last article and the sell rating was vindicated.

Seeking Alpha

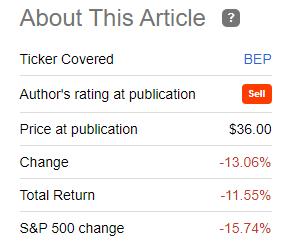

The fundamentals, though, seem to be improving. BEP’s Q2-2022 showed numbers about in line with expectations with funds from operations (FFO) coming in at 46 cents a share. BEP’s numbers generally are quite predictable and only occasionally does it get impacted by below average renewable energy generation factors. For the full year, the consensus is at $1.55, a number we have no problem getting behind. This would follow a $1.45 run-rate in 2021, so investors have the growth move continuing, despite BEP attaining some serious size over the years.

BEP Presentation

The latest investor day conference call showed management’s confidence in playing this out further with expectations of 7-12% FFO growth per share. Those numbers were a bit shocking as we did not think BEP would double down on such ambitious plans in the middle of the market turmoil. About 2-3% is supposed to come from inflation resets, a similar amount from margin expansion and the rest from its developmental pipeline.

BEP Presentation

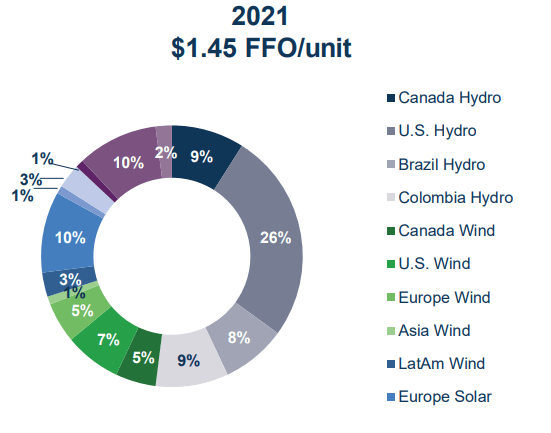

The stock now trades at under 20X FFO and at about 18X 2023 estimates. This valuation compression is something we have been warning about since early 2021 and we think there is a bit more to go. In an ideal world, we would like to see at least a 5% dividend yield on BEP. That may sound like a lot, but have a look at what it has yielded historically.

We will add that for the bulk of the last decade, the 10 year Treasury yield was under 3% and BEP still managed to consistently yield over 5%. So this compression is not over and we stand by our call that those that bought at the January 2021 peak price won’t break even this decade, even after dividends. We are, however, upgrading this to a “hold/neutral”, as valuation is no longer a tremendous headwind.

Brookfield Renewable Partners L.P. 5.25% PFD CL A (NYSE:BEP.PA)

This was an in-between security for us and we suggested that it likely would beat the common shares in the near future. BEP.PA was at $21.58 at the time and with a total return of negative 7.7%, it did beat BEP and BEPC, although it is not exactly something worth celebrating. BEP.PA shares remain extremely safe from a credit standpoint and also remain an interesting way to play less hawkish Federal Reserve. That said, there are better choices today than there were 6 months back in the fixed income space. BEP.PA is not one we would buy here on a relative basis.

Class A Preferred Limited Partnership Units, Series 15 (BEP.PRO:CA)

In April, the security we really championed were the BEP.PRO listed on the TSX. They were our “high-yield, low-risk” play, thanks to their reset clauses. These did perform well and delivered a total return of just negative 1.5%. We loved these as they were in our primary currency and the combination of a floor rate of 5.75%, plus potential of higher payment, made these more resilient than the average preferred offering.

The Annual Fixed Distribution Rate for each Subsequent Fixed Rate Period will be equal to the greater of: (1) the sum of the Government of Canada Yield on the 30th day prior to the first day of such Subsequent Fixed Rate Period plus 3.94%, and (2) 5.75%.

Source: BEP.PRO Prospectus

The Government of Canada yield here refers to the 5 Year Government of Canada bond, which is at 3.33%. The current reset would be at 7.27% yield on par, which is far higher than the current payout. The current consensus is that the central banks will begin cutting rates sometime in late 2023 or early 2024. BEP.PRO volatility likely increases into this environment, but its 5.75% floor rate will protect it from an extremely aggressive rate cut trajectory. At present, we find other securities to be better priced than BEP.PR.O, though we continue to own this one.

Verdict

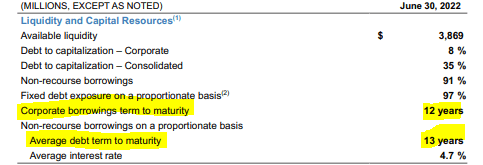

BEP carries massive asset level debt load and the 6.7X debt to EBITDA is still high in relation to asset base. This is offset by the company having not rolled the dice on interest rates and having established decade long weighted average maturity rates.

BEP Presentation

The bulk of the borrowings are at an asset level and that helps the common shares to some extent and makes the preferred shares remarkably safe against any turbulence. We still think this is not the best buy point for the common shares but we would expect positive total returns from here over longer timeframes, thanks to the dividend yield. The Cash Secured Puts and Covered Calls are now getting extremely enticing and likely offer very low risk double-digit yield setups. This is similar to the low-risk entry we got on BEP’s parent, Brookfield Asset Management (BAM), in June. This is one we might pursue and issue and an alert for our subscribers if conditions merit.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment