serts

Brookfield Asset Management (NYSE:BAM)(NYSE:BAMR) just reported excellent third quarter results, and is very well positioned to thrive in the current environment with a record level of investable capital of over $125 billion.

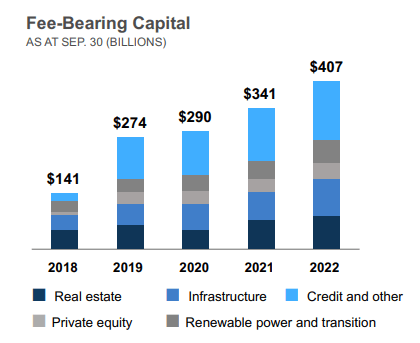

Fund raising continues to go extremely well, with a significant amount of capital coming into its flagship funds and complementary strategies. Fee-bearing capital now stands at $407 billion, representing a $15 billion increase during the quarter and $65 billion or 19% over the last twelve months. Clearly, the asset management part of the business is firing on all cylinders.

Brookfield Investor Presentation

The Insurance Solutions business continues to grow and is providing a natural hedge against interest rate increases. Largely sitting on cash and short-term investments since the acquisition of American National, the company has now started to invest in a variety of higher earning strategies.

In other news, shareholders approved the distribution and listing of 25% of the asset management business. The company remains on track to complete the distribution and listing by the end of this year. For every four shares you own of Brookfield today, you will receive one share of the newly listed manager company. This company is expected to generate approximately $2 billion of distributable earnings, and to pay out approximately 90% of that in cash dividends. It is expected to have basically no debt, and actually a net cash position of $3 billion. Brookfield anticipates being in a position to communicate to the market the dividend rate for the distributed asset management business for fiscal 2023 before the start of trading in December.

Q3 2022 Results

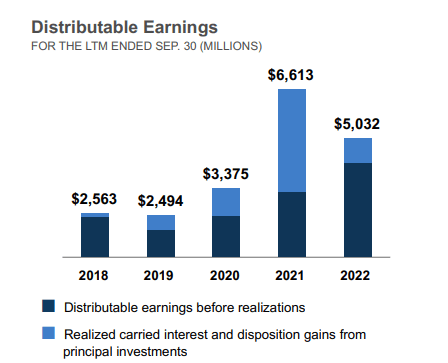

Financial results were excellent, with Distributable earnings of $1.4 billion for the quarter and $5 billion over the last 12 months. These results are especially impressive when considering the tough economic environment.

Brookfield Investor Presentation

FFO and net income for the quarter were $1.5 billion and $716 million, respectively. Operating FFO was $1.2 billion for the quarter, a 30% increase compared to the prior year period. The Insurance Solutions business had an excellent quarter, generating almost $160 million of distributable earnings.

Brookfield ended the quarter with record liquidity at approximately $125 billion of deployable capital. This includes approximately $36 billion of core liquidity and $89 billion of uncalled fund commitments.

The asset management business is on track to have its largest fundraising year ever. Since the end of the last quarter, it had inflows of $33 billion and ended the quarter with $407 billion of fee bearing capital, which is up almost 20% compared to the prior year. Fee related earnings were $531 million in the quarter and $2.1 billion over the last 12 months. The company has total accumulated unrealized carried interest of $9 billion, which is up almost 30% from last year.

Investment Opportunities

During the earnings call, there was a question related to what investment opportunities the company is seeing, especially as it now has so much deployable capital. CEO Bruce Flatt sounded very optimistic that the current economic environment should result in more opportunities to invest the massive $125 billion of deployable capital:

And increasingly, we’ve been seeing and continue to see, and I think we’ll increasingly see over the next while, while this environment persists, many more opportunities coming to us, that you wouldn’t have imagined six, twelve months ago.

Insurance Business

The insurance business is growing up quickly and becoming a significant contributor to earnings. This quarter, it delivered about $160 million in Funds from Operation. This is impressive given that it was only about two years ago that the company announced plans to build out this strategy.

The acquisition of American National, together with the growing pension risk transfer business, and the acquisition of numerous reinsurance blocks have grown the insurance capital to approximately $45 billion. When asked about the potential for further organic and acquisition driven growth for the business, CFO Nick Goodman had the following to say:

The earnings growth in the short term has really been about investing the significant capital that we have that was largely sitting in cash and short-term assets and reallocating them now investing into still very high credit quality, but much higher yielding opportunities. And that spread expansion is a significant boost for earnings.

From an organic perspective, obviously with American National platform, we’re out there originating product every day, and we are still looking at building strategic partnerships with insurance companies in the market and being a good partner and trying to grow through that way.

And that can be a combination of pension risk transfer from which we’re building a very strong market position in Canada and looking to grow that globally into Europe and the U.S. at some point. And it’s also just through life and annuity products and just being a partner for insurance companies across a whole host of opportunities.

So, I’d say the organic comes largely through pensioners transfer and American National, and inorganic through opportunities we continue to see in the market through blocks and strategic partnerships.

Valuation

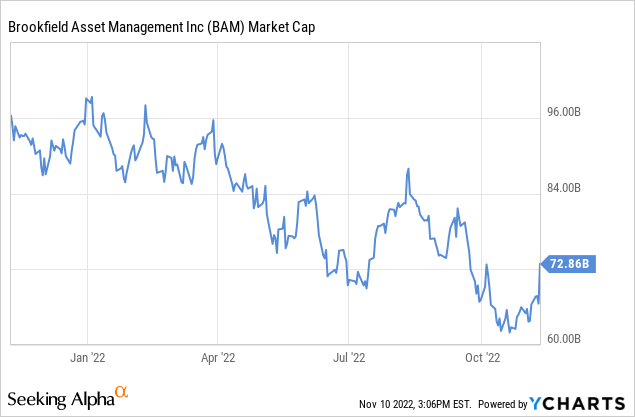

We believe shares are somewhat undervalued at current prices. Traditional valuation like EV/EBITDA metrics are less reliable when applied to a complex conglomerate like Brookfield. Instead, the way we think about its valuation is that the market cap right now is about $73 billion. Distributable earnings for the last twelve months were ~$5 billion, and the amount of profit from realization was relatively low, so the recent distributable earnings were of very high quality and mostly recurrent. This means shares are trading at roughly 15x distributable earnings, which we believe is a very reasonable valuation for a company growing as fast as Brookfield is growing.

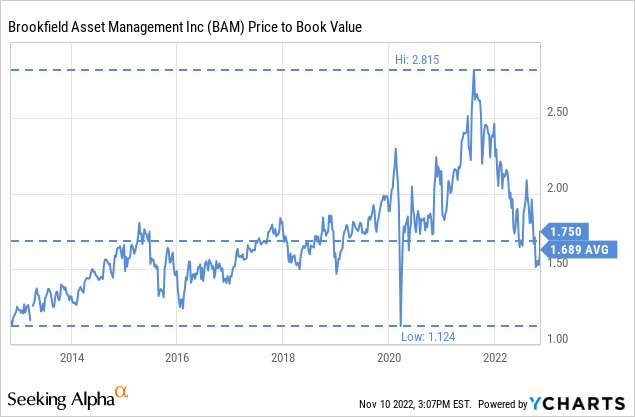

Based on price to book value, shares are trading very close to their ten-year average. This reaffirms our belief that shares are currently fairly valued. We are therefore rating shares a ‘Buy’ at current prices, but they are not far from being a ‘Strong Buy’ based on how well the business has been performing.

Risks

Brookfield is well known for using significant amounts of non-recourse long-term debt in its investments, which adds a level of risk due to the leverage. That said, we believe that the quality of its assets, the broad diversification, and the amount of liquidity available to the company, significantly reduce the investment risk.

Conclusion

Brookfield delivered once more a strong quarter, especially when considering the tough economic conditions. Two businesses that are doing particularly well are the asset management business, which has had a record fund raising and 25% of which will soon be distributed to Brookfield shareholders, and the Insurance Solutions business, which is now contributing significant amounts of FFO. Shares appear somewhat undervalued at roughly 15x distributable earnings for the trailing twelve months, and close to their historical price/book multiple.

Be the first to comment