Mishella/iStock via Getty Images

Introduction

My thesis is that Brookfield Asset Management (BAM) will continue to be a good investment for shareholders who have a long time horizon. The 4Q21 letter to shareholders shows that $1 million invested 30 years ago is worth $111 million today for a CAGR of 17% compared to an S&P 500 CAGR of 11% and a 4% CAGR for investments in 10-Year U.S. Treasuries. I am optimistic that Brookfield will continue to outperform the S&P 500 over long periods of time.

The Brookfield parent owns 48% of Brookfield Renewable Partners (BEP), 27% of Brookfield Infrastructure Partners (BIP) and 64% of Brookfield Business Partners (BBU).

Separating Part Of The Asset Management Business

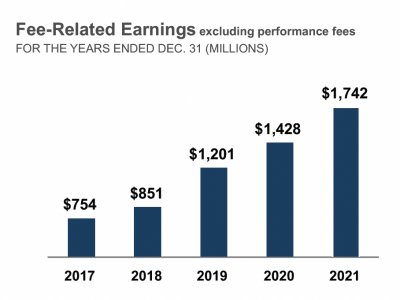

Buttressed by the Oaktree acquisition, Brookfield’s asset management business has grown well from 2017 to 2021. Fee-related earnings have gone up nicely from $754 million in 2017 to $1,742 million in 2021. This excludes performance fees which were $157 million in 2021 such that the actual 2021 total was $1,899 million. This actual total is different from the annualized total of $1,803 million which management uses for plan value:

Brookfield fee-related earnings (Brookfield 4Q21 supplemental)

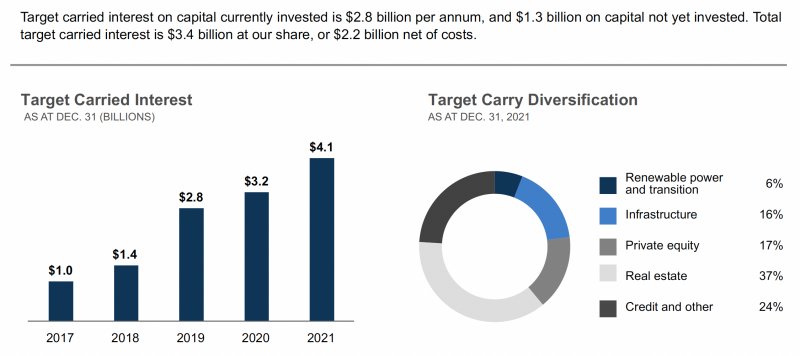

Target carried interest has risen nicely as well, going from $1 billion in 2017 to $4.1 billion in 2021. Per the verbiage below, the $4.1 billion for 2021 is different from the $3.4 billion gross at Brookfield’s share and the $2.2 billion net at Brookfield’s share which is used for plan value:

Brookfield target carry (Brookfield 4Q21 supplemental)

The 4Q21 letter makes the point that some new investors can be stymied by the nuances of complexities involved in asset-heavy businesses while some legacy investors recognize that Brookfield’s capital has been one of their operating strengths. One way to attract both types of investors is to split a percentage of the asset management business into a separate security. It was made clear in the 4Q21 call that if this happens it will be a full security and a listed company, not a tracking stock. The BAM parent would still own some of it but a part of it like 1/4th or 1/3rd would be separated and distributed to shareholders:

Separating a part of our Manager in the public or private market, while ensuring it still benefits from the capital we have at overall Brookfield, could open up growth options to us that do not exist today, as we dislike ever issuing shares at less than what we believe to be at least their full fair value. In addition, as our reinsurance and investment operations grow, separating a part of the Manager might make sense in order to allow investors who only want exposure to the Manager, to own a separate security.

In the 4Q21 call, CFO Goodman talks about 2 things happening over the last few years. The first is that Brookfield’s asset management business has become one of the largest in the world. The second is that markets have evolved such that asset-light managers are preferred.

CEO Flatt talks about Brookfield having their cake and eating it too in the 4Q21 call. He notes that if either the new asset management security or the existing parent trades below fair value, then they can buy shares into treasury and increase value:

If we can have our cake and eat it too, i.e., we can have our capital up top, investors that want to invest into the parent company will stay there, keep their shares in that company, and they’ll have us invest their capital plus they’ll own a part of the manager. But if we list part of [the] manager [business] separately, it would enable those investors who choose to or want to own an asset-light asset manager the ability to do that.

Valuation

In the past, management has shown the plan value but I don’t see it in the 4Q21 supplemental. Applying the template management has used in the past, I get $124.5 billion.

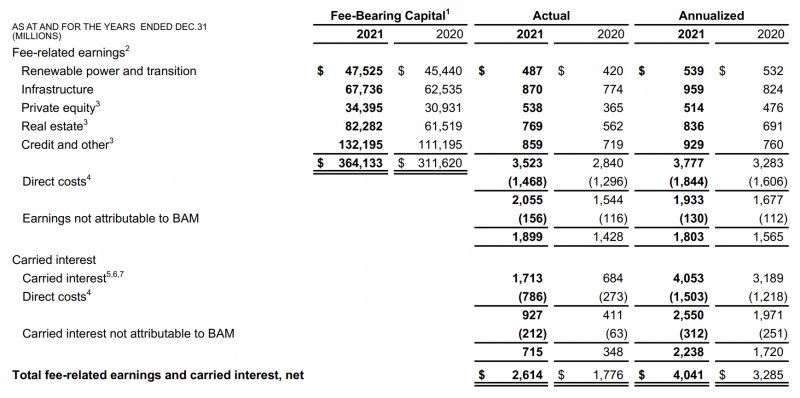

We see 2 of the asset management numbers for plan value on slide 6 of the 4Q21 supplemental. We have $1.8 billion fee-related earnings and $2.2 billion target carry. In the past, management has used a 25x multiplier for fee-related earnings and a 10x multiplier for net target carry. In the 4Q21 call, CFO Nick Goodman said the multiple for fee-related earnings in the last Investor Day presentation was 25x to 40x. The year-over-year growth in fee-related earnings was 15% while there was 30% growth for target carry:

Brookfield asset management plan value (Brookfield 4Q21 supplemental)

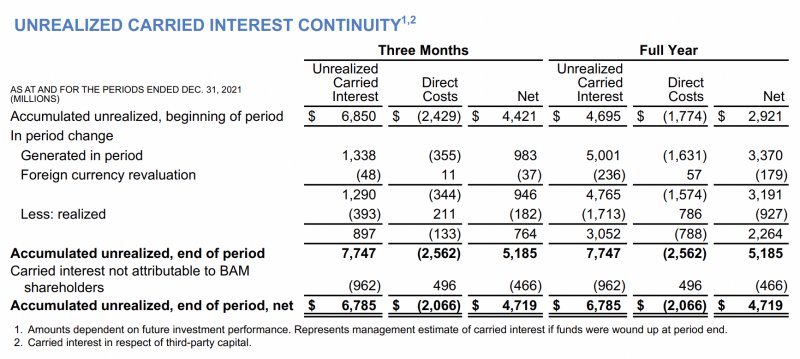

The 3rd asset management component, net accumulated unrealized carried interest, comes to $4.7 billion per slide 17 of the 4Q21 supplemental:

net accumulated unrealized carry (Brookfield 4Q21 supplemental)

Summing up, this gives us the following for the asset management side of the plan value:

$45.0 billion fee-related earnings [25*$1.8 billion]

$22.0 billion target carry [10*$2.2 billion]

$4.7 billion accumulated unrealized carried interest, net

——————

$71.7 billion

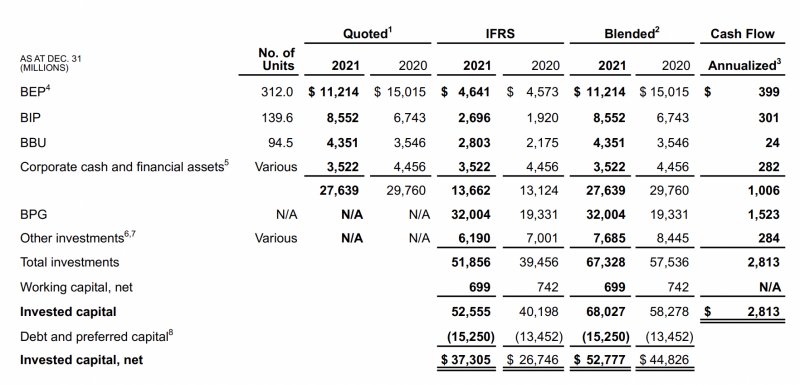

The invested capital plan value is $52.8 billion per slide 7 of the 4Q21 supplemental:

Brookfield invested capital (Brookfield 4Q21 supplemental)

Adding the $71.7 billion asset management and the $52.8 billion invested capital gets us to a plan value total of $124.5 billion. Seeing as the 4Q21 supplemental shows 1,651.6 million total diluted shares at the end of the period, this comes to about $75 per share which is well above the February 11th share price of $58.05.

In the 4Q21 letter, it is revealed that Brookfield has a value of $120 billion to $150 billion or $75 to $90 per share. I believe they get to the high end of $90 per share by using a fee-related earnings multiple of 40x instead of 25x which would mean a fee-related earnings business value of $72 billion instead of $45 billion:

Based on the comparable multiples of pure-play, asset-light alternative investment managers, the equity value of our separated asset management business [i.e., “our Manager”] would likely be in the range of $70 billion to $100 billion [circa $45-$60 per share]. To be very clear, that excludes the equity capital that we have invested in our businesses, which today is around another $50 billion net [circa $30 per share].

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Be the first to comment