HAKINMHAN/iStock via Getty Images

Article Thesis

The Brookfield group of companies has always been somewhat complicated to analyze due to being a web of companies that are interwoven with each other. Brookfield Asset Management Ltd (NYSE:BAM), the new asset management pure-play that was recently created, has made things even more complicated. However, this creates some opportunity for investors, as BAM is currently trading with a forward dividend yield of 4.7% based on the announced dividend for 2022, which seems like a great value based on the company’s expected growth and high quality. I do believe that buying BAM today with a yield of close to 5% will make for a compelling total return a couple of years down the road.

A Complicated Company Got Even More Complicated

In the past, there were several Brookfield entities investors could invest in on the stock market. This includes the infrastructure business (BIP)(BIPC), the Renewable Energy business (BEP)(BEPC), the private equity business (BBU), the reinsurance business (BNRE), and the previous head of the empire, the “old” Brookfield Asset Manager, which had the ticker ‘BAM’.

But that old BAM has now been split as well, making things even more complicated. The new ‘BAM’ is an asset-light asset manager that primarily generates profits via fees from the assets it manages for outside investors. The “old” BAM, the head of the empire that owns stakes in all the other Brookfield entities, is now called Brookfield Corporation (BN) (BN:CA).

When investors buy into the new or current BAM, they are thus no longer investing in the head of the Brookfield empire, which is important to know. Instead, they invest in an asset manager pureplay, but that is highly attractive.

What Makes Brookfield Asset Management Ltd Attractive?

I do believe that this will be one of Brookfield’s fastest-growing entities (the new BAM is 75% owned by BN, the new head of the empire). The Brookfield empire is an alternative-asset-management-focused conglomerate, and the new BAM, as the asset management pureplay, will benefit the most from the expected growth in assets under management. Brookfield has, in the past, oftentimes noted that the empire sees gigantic potential for AUM growth, due to growing wealth in emerging countries, due to investors seeking inflation protection via “real asset” investments, due to the potential for new investments that is created by decarbonization efforts across the world, and so on.

Brookfield’s asset management arm, which is now controlled by Brookfield Asset Management Ltd, has shown highly compelling growth in the past. Assets under management grew at a double-digit pace, with fee-bearing capital — responsible for recurring cash flows to BAM — growing at an above-average rate for many years. Going forward, I expect compelling growth as well, due to Brookfield’s great brand and leadership position as a “real asset” manager, and due to the aforementioned megatrends that will be a boon for the alternative asset managing industry as a whole.

Brookfield Asset Management Ltd will not own significant assets directly, and there is little need to put cash towards capital expenditures. Due to its asset-light business model, the company can return the vast majority of its profits to its owners directly. Since the new BAM is 75% owned by BN, the majority of those dividends will be flowing to BN, the head of the empire. Still, minority shareholders that own a position in the new BAM will benefit from generous dividend payments as well.

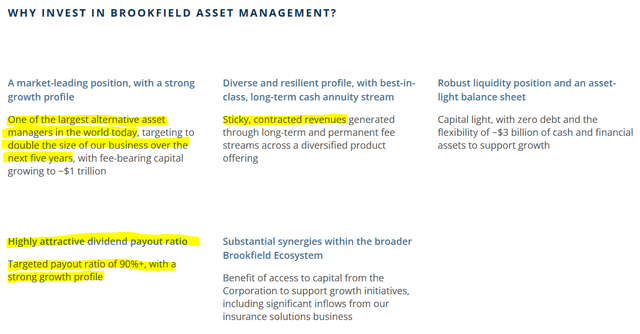

The following image shows some of BAM’s advantages, as shown on the company’s website (this should be taken with a grain of salt, of course, but everything seems factual to me):

Brookfield Asset Management Ltd

BAM is a leader in its space, has grown at a compelling rate in the past, and seeks to grow at a hefty pace in the future, too. Doubling the business over five years means a 14%-15% annual growth rate — considering the company’s track record, that is definitely achievable, although not guaranteed, of course. Even if BAM were to grow its business at just half the targeted rate, i.e. around 7% per year, that would still be very solid, I believe, considering the undemanding valuation (more on that later).

Due to the fact that the majority of BAM’s revenue will come from management fees, its revenue is sticky and should remain resilient even during economic downturns and other macro crises. This makes BAM suitable for risk-averse investors as well, as there is a low likelihood that revenues will fall a lot even in case we enter a recession next year.

The company’s targeted 90%+ payout ratio means that BAM will, unlike BN, be a strong income investment. The majority of Brookfield’s other entities, such as BIP, are income investments as well, although that does not hold true for BBU. Based on recently declared dividends, BAM will be the highest-yielding entity in the Brookfield family, making it especially attractive for income seekers.

BAM As An Income Investment

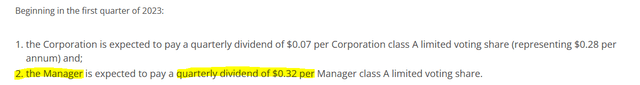

The company has, in early December, stated that it would pay out $1.28 per share next year:

Brookfield

“The Manager” refers to the new BAM, Brookfield Asset Management Ltd, while “the corporation” is Brookfield Corporation/BN. An annualized dividend of $1.28 per share pencils out to a dividend yield of 4.7% based on a current share price of $27 for BAM.

A dividend yield of almost 5% is attractive in absolute terms, of course, but the story is even better when we account for the growth that can be expected from BAM. If the company hits its 14%-15% business growth goal in the long run, and if we assume that profits will grow at a similar rate (which could be conservative as operating leverage should allow for profit growth to come in higher than revenue growth), then a mid-teens earnings growth rate should allow for a mid-teens dividend growth rate — after all, the payout ratio is more or less fixed. The combination of a yield of close to 5% and a dividend growth rate of well above 10% would be excellent for dividend growth investors. Even if BAM grows just half as fast compared to the company’s target, the dividend growth rate would likely be in the 7%-8% range. That would still be compelling when combined with a high starting dividend yield.

For comparison, other Brookfield entities such as BIP and BEP are offering dividend yields in the 3%-4% range and have a dividend growth target of around 7%. BAM looks better, I believe.

This brings up the question of why BAM is trading so cheaply today, or why its dividend yield is so high when its growth outlook is compelling. I believe that this is mostly due to the complexity of the structure.

With the old BAM becoming the new BN, many investors suddenly had a small position in the new asset management pure-play in their portfolios when the new BAM was partially spun off. Many likely didn’t understand the new BAM and have sold their position, adding selling pressure that has led to a share price decline in the new BAM. At the same time, many investors likely don’t know about new BAM’s dividend yield — there is little information available unless one visits Brookfield’s website. The new BAM thus could be an under-the-radar pick for now, which naturally provides a buying opportunity for investors. When new BAM has made some earnings reports and some dividend declarations, it likely will receive more attention, and I doubt that shares will remain this cheap. Instead, shares could get bid up to a dividend yield that is comparable to what we see at BIP and BEP — that could result in 20%+ share price gains, all else equal.

Valuation

Since the new BAM has not reported any earnings results yet, it’s hard to put a direct value on this stock, except by using dividend yield as a valuation tool. Goldman Sachs (GS) has recently started BAM with a Buy rating, as reported here on Seeking Alpha. The analysts believe that BAM will earn around $1.75 per share in 2024. There’s no guarantee for that, of course, but we can use it as a base-case scenario. If that holds true, BAM is valued at 15x 2024’s net profit today — for a market leader with a strong growth outlook, that does not seem expensive. If Goldman Sachs is correct about BAM’s earnings, and if we assume that BAM will pay out 90% of that via dividends, then the dividend would be around $1.60. For someone buying shares at $27, that would make for a yield on cost of 5.9% in two years. That would be quite compelling, although there is the possibility that Goldman Sachs is overestimating BAM’s earnings potential, of course, thus this isn’t set in stone.

Risks To Consider

I do believe that the largest risk is complexity. The Brookfield empire is hard to understand, and that could be a headwind for BAM, as some investors will not be interested in owning something they don’t understand (that’s what Buffett taught us, after all).

I do believe that there is little inherent risk in the business model, as BAM has no debt, and since it does not require meaningful capex, while its revenue is sticky. Still, if BAM were to grow less than expected, that could be a risk, as investors may react negatively to growth disappointments.

Some investors have also voiced concerns about BN potentially “taking under” BAM if the share price remains low. While this is possible, I do not think that it’s likely, as it would not make a lot of sense for BN to partially spin off BAM just to buy it back a little later. Brookfield also does not seem like an untrustworthy entity to me — the company has been good to investors in the past, after all.

Takeaway

Brookfield Asset Management Ltd is a high-quality asset management pureplay that should experience considerable growth in the future. At the same time, BAM is complicated and hard to understand, which is why shares are rather cheap today. Investors can expect a compelling dividend yield next year that should climb further over the years. Based on its yield and undemanding (expected) earnings multiple, BAM has significant share price upside potential as well. I wouldn’t be surprised to see BAM experience an upward rerating once it has reported quarterly earnings and announced dividends a couple of times, thus this could be a stock with considerable upside throughout 2023.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment