cemagraphics/E+ via Getty Images

Exactly a month ago, I published a bullish “Brookfield Asset Management Has Become A Screaming Buy” (NYSE:BAM). To save you time, I will recap it briefly: the announced spin-off of 25% of Brookfield’s asset management business (Manager) made it timely to revalue the company as the sum of the parts. My answers were ~$55B for Manager and $30B for invested capital, producing $85B or ~$54 per share. These figures were in sharp contrast with Brookfield’s own estimates of $80B and $50B for the same components. I was also arguing that under certain assumptions Manager could be worth as much as $65B.

Since the publication, BAM went down from $45+ to $43+ accompanied by the elevated volatility for all alternative managers. Coincidentally, several negative posts were published regarding BAM and its peers questioning their business model in the new environment.

Under these circumstances, I keep buying and do not think that alternative managers’ business model is under stress. At least for the biggest and most sophisticated such as BAM, Blackstone (BX), Apollo (APO), KKR (KKR), and Carlyle (CG).

These companies have been around for a long time, their founders and executives are well familiar with the vicissitudes of the stock market, their leverage is well-controlled, and their resources in terms of money, human intelligence, satisfied customers, and assets are enormous. Where is the existential threat that makes them go down 5-8% on a bad day?

Interest rates increase is the first thing that comes to mind. But it does not exist in isolation from the related inflation, market turbulence, and possible recession. Let us see how these factors can affect the business of alternative asset managers. We will use primarily BAM (with its major public subsidiaries – Brookfield Infrastructure (BIP) (BIPC), Brookfield Renewable (BEP) (BEPC), Brookfield Reinsurance (BAMR), and Brookfield Business (BBU) (BBUC)) as an example.

Are there any immediate threats?

Starting with the obvious, Brookfield and its subsidiaries are not facing an immediate need to refinance their major obligations. Just on the contrary: BAM and subsidiaries are primarily utilizing fixed-rate debt with long-dated maturities. During the long period of low rates, the companies refinanced most liabilities on the balance sheets and extended their maturities, sometimes very far in the future. The debt, with rare exceptions on the investee level, is investment-grade or structured as investment grade. Neither Brookfield nor its subs are guaranteeing investees’ obligations. The Brookfield empire carries or has access to enormous liquidity at different levels to assure safety.

Consolidated Brookfield is a gigantic well-diversified company, a kind of a business empire, that operates in various industries and geographies and utilizes multiple business models and investment vehicles. Higher interest rates, inflation, and market volatility are unfavorable for certain parts of the empire, largely indifferent for others, and beneficial for some. The management will adapt to changes in interest rates and other factors by beefing up the segments with the highest ROI under given conditions.

Fee-related earnings (FRE)

BAM generates ample and predictable cash flows as fees on the assets it manages. Most assets represent either permanent or long-term capital vehicles that guarantee fees coming either forever or for many years. In bond parlance, BAM is a low-duration stock that should be less sensitive to the changes in interest rates. This is very different from some growth stocks that are counting on cash to be earned far in the future if at all.

FRE is BAM’s crown jewel and the same is true for other alternative managers. Its importance will be further emphasized in the spin-off of BAM’s asset manager that should happen before the year-end. This business generated about $1.27 in free cash per share growing by 31% over the last 12 months. The lion’s share of capital under management (~80%) is locked up within long-term private funds or public vehicles and investors cannot withdraw funds unilaterally on short notice – fees will keep coming for many years regardless.

Whatever is happening in the economy can affect this business (at least within the next several years) in two ways. First, the market capitalization of public vehicles (think of BIP, BEP, etc.) can suffer in the bear market and generate lower fees. Secondly, growth in FGAUM (fee-generating assets under management) may slow down.

The first factor does not seem so important. BIP, BEP, and BBU partnerships (together with their corporate twins BIPC, BEPC, and BBUC) represent less than $60B out of $329B of total FGAUM. Most FGAUM are in private funds and are not marked to the market.

The second factor is real and the growth of FGAUM may become slower with time but it is not certain and more remote than some people think. Here are some figures: in Q1 2021, FGAUM was $278B and has added $51B (18%) for the subsequent four quarters (I measure FGAUM accounting for 62% ownership of Oaktree). How much will be added to FGAUM over the next four quarters?

Answering it, I would like to draw your attention to 3 facts:

- On March 31, 2022, Brookfield had $70B in uncalled fund commitments. The market slide has uncovered plenty of targets for these funds that did not exist before. During the last bear market in the spring of 2020, Brookfield used a similar situation to secure a material position in Canadian Inter Pipeline on the open market that was later converted to a multibillion profitable acquisition.

- Currently, BAM is marketing its flagship infrastructure fund which is expected to bring $25B. Maybe it will take longer to reach this number. For example, I have read that it is taking more time for Apollo to close its flagship fund that they are marketing right now as well. But we do not know whether this delay is due to the long-lasting effects of the new macro environment or the shorter-lasting effect of the market turmoil. Anyway, Brookfield infrastructure investments, on exit, generated IRRs north of 20% and I doubt prospective customers will forego this opportunity.

- On March 31, only ~$5B of FGAUM was sourced from Brookfield Reinsurance. During the current quarter, Brookfield closed the acquisition of American National with another $30B coming under BAM management. With this acquisition, BAM also got insurance licenses in all states and can grow its insurance business organically now. More insurance acquisitions should follow as well. The insurance industry benefits from higher interest rates and BAM is hopeful to source $200-300B through BAMR eventually.

These facts make it almost certain that growth in FGAUM will continue at a brisk pace at least for another year. While I do not expect the 31% growth achieved in the prior 12 months, FRE should grow in line with FGAUM. Thus, the main component of BAM’s value remains unscathed.

FRE generated ~$2B in free cash over the last 12 months. Upon the spin-off, almost all this cash will be paid out as dividends (90% payout ratio per Mr. Bruce Flatt). I used 25 multiple for my base case as it corresponds to a 4% yield. Other Brookfield dividend-paying subs (BIP, BEP, BIPC, BEPC) are trading at below 4% yield (as low as 3.31% yield for BIPC!) while growing much SLOWER than Manager.

Carry

This part of Brookfield’s business will suffer because it will be more difficult to exit existing investments. It can take more time and will be done at lower prices. But carry, in my opinion, represents a small fraction of BAM’s value. In my last post, I ascribed only $5B to carry which is ~10 times smaller than the value of FRE. A loss of, say, a billion here is of no importance.

Invested Capital

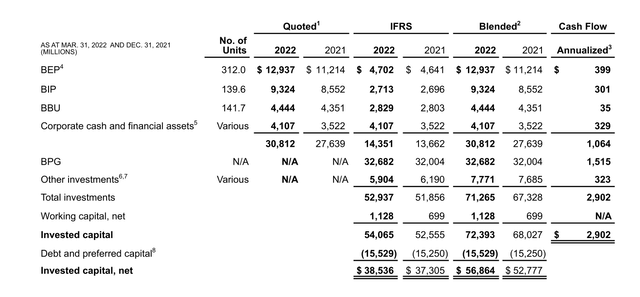

Almost all of BAM’s capital is invested through public BIP, BEP, BBU, BAMR, and private Brookfield Property Group (BPG, former BPY). If we use IFRS numbers, BPG dominates. However, market caps of BIP, BEP, and BBU are several times higher than their IFRS values and the picture becomes less skewed as represented on the slide below.

Brookfield’s supplementary filings

Brookfield is shrinking its real estate footprint, but it is still much bigger than desirable. Will real estate drop in value due to higher interest rates? The answer would be unambiguous yes unless for inflation. With high inflation, the picture is less clear, but this segment is still likely to suffer. In particular, it may become more difficult for Brookfield to exit certain properties that it wants to get rid of, primarily some of its less popular malls. Brookfield’s peer in this regard, Simon Property (SPG), has lost ~40% of its value in 2022. However, for Brookfield, malls represent a fraction of its real estate footprint, and the company wants to sell only the weakest of them.

BEP and BIP should not be that sensitive to the new environment. Their revenues consist primarily of contractual cash flows stipulated for many years ahead. Debt is fixed with remote maturities. The gradual growth of financing costs should be offset or even exceeded by inflation accelerators built into many of their customer contracts.

BBU represents a traditional private equity business. Some of its weaker investees should be adversely affected by the new environment. Exiting older investees will be more challenging as well. At the same time, there should be plenty of new targets for this business. In any case, BBU is too small to make a difference.

Brookfield estimated the value of its invested capital at $50B, higher than its IFRS value. I was more conservative remembering well that BPY was always trading at discount to its book. My estimate of $30B is based on 15 multiple of ~$2B in operating FFO after deducting preferred dividends, corporate costs, and interest expenses. $2B consists mostly of reliable long-term rents and stable cash flows from BIP and BEP. I avoided using IFRS data that appears of limited value: it overestimates BPG and underestimates BIP and BEP.

Conclusion

So far, I have not uncovered anything new that would affect my valuations from the previous publication. While volatility is psychologically unpleasant and may persist, it provides good buying opportunities for BAM and its peers.

Will BAM, APO, and peers use the same opportunities for material buybacks? It depends as alt managers vary in terms of cash supplies, valuations, and availability of other strategic tools at their disposal. We will provide two examples.

BAM has just spent $5B for the acquisition of American National and is hopeful to lift its stock price with the spin-off of its Manager. That is why I do not expect major buybacks from them though some limited actions are certainly possible.

Apollo seems the cheapest of the pack. It is somewhat surprising as half of their business is in retirement/insurance which is a beneficiary of higher rates. Its management announced several times that at these levels its stock might be the best application for its excess capital. They also have a significant buyback authorization already in place. However, they are still in the early stages of generating this excess capital and may not have sufficient dry powder yet.

What is the biggest risk for Brookfield’s business model? In my opinion, a prolonged period of high interest rates. If investment-grade rates stay high (7% and higher) for a long time (more than 5 years or so), then sooner or later Brookfield will be forced to refinance its substantial debt on all levels at much higher rates and it will noticeably affect its profitability.

Be the first to comment