G0d4ather

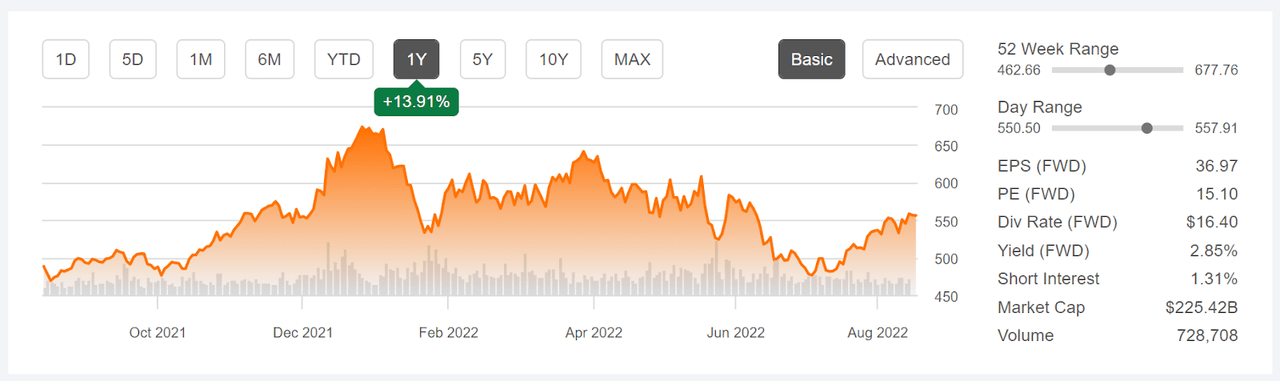

Broadcom (NASDAQ:AVGO) has rallied since early July, rising from a closing price of $476.30 on July 5th to $556.10 today, August 15th. This gain of 16.7% over the last 6 weeks has brought the stock back to a positive return for the trailing 12 months. AVGO has substantially outperformed the iShares Semiconductor ETF (SOXX) over the past 12 months, with total returns of 18.6% and -6.0% (respectively), but the 3-year annualized total returns are almost identical for AVGO (29.6% per year) and SOXX (30.3%).

Seeking Alpha

Above is 12-Month price chart and basic statistics for AVGO

AVGO reports Q3 results on September 1st, a little over 2 weeks from now. The company has delivered strong earnings growth over the past 2 years. The expected EPS for Q3 is $9.56 per share, 37% above the EPS for Q3 of last year. Looking ahead, the consensus outlook is for continued solid earnings growth. The expected EPS growth rate over the next 3 to 5 years is 16.4% per year.

ETrade

Trailing (4 years) and estimated future quarterly EPS for AVGO above. Green (red) values are amounts by which EPS beat (missed) the consensus expected value

I last wrote about AVGO almost a year ago, on September 1, 2021, at which time I maintained a neutral / hold rating on the shares. The Wall Street consensus rating on AVGO was bullish, with a consensus 12-month price target that implied a total return (including the dividend) of 10.7% over the next year. The valuation was reasonable, with a forward P/E of 18. In analyzing a stock, I also rely on the traders’ consensus view that is implied by the prices of options, the market-implied outlook. At the start of September of 2021, the market-implied outlook was predominantly neutral to January of 2022. The market-implied outlook also provides an estimate of expected volatility, and the value was 30% (annualized). As a rule of thumb for a buy rating, I look for an expected total 12-month return that is at least ½ the expected volatility. Taking the analyst consensus price target at face value, AVGO fell below this threshold.

Seeking Alpha

Above is Previous analysis and subsequent performance for AVGO vs. the S&P 500

In the 11 ½ months since my post, AVGO has returned a total of 15.4%, as compared to -3.7% for the S&P 500 (SPY).

For readers who are unfamiliar with the market-implied outlook, a brief explanation is needed. The price of an option on a stock is largely determined by the market’s consensus estimate of the probability that the stock price will rise above (call option) or fall below (put option) a specific level (the option strike price) between now and when the option expires. By analyzing the prices of call and put options at a range of strike prices, all with the same expiration date, it is possible to calculate a probabilistic price forecast that reconciles the options prices. This is the market-implied outlook. For a deeper explanation and background, I recommend this monograph published by the CFA Institute.

For reference, readers may be interested in my analyses of MU, TXN, and INTC, also using the market-implied outlook.

As we approach the Q3 earnings report, and with almost a year since my last post on AVGO, I have generated an updated market-implied outlook for the stock and compared this with the current Wall Street consensus outlook in reconsidering my rating.

Wall Street Consensus Outlook for AVGO

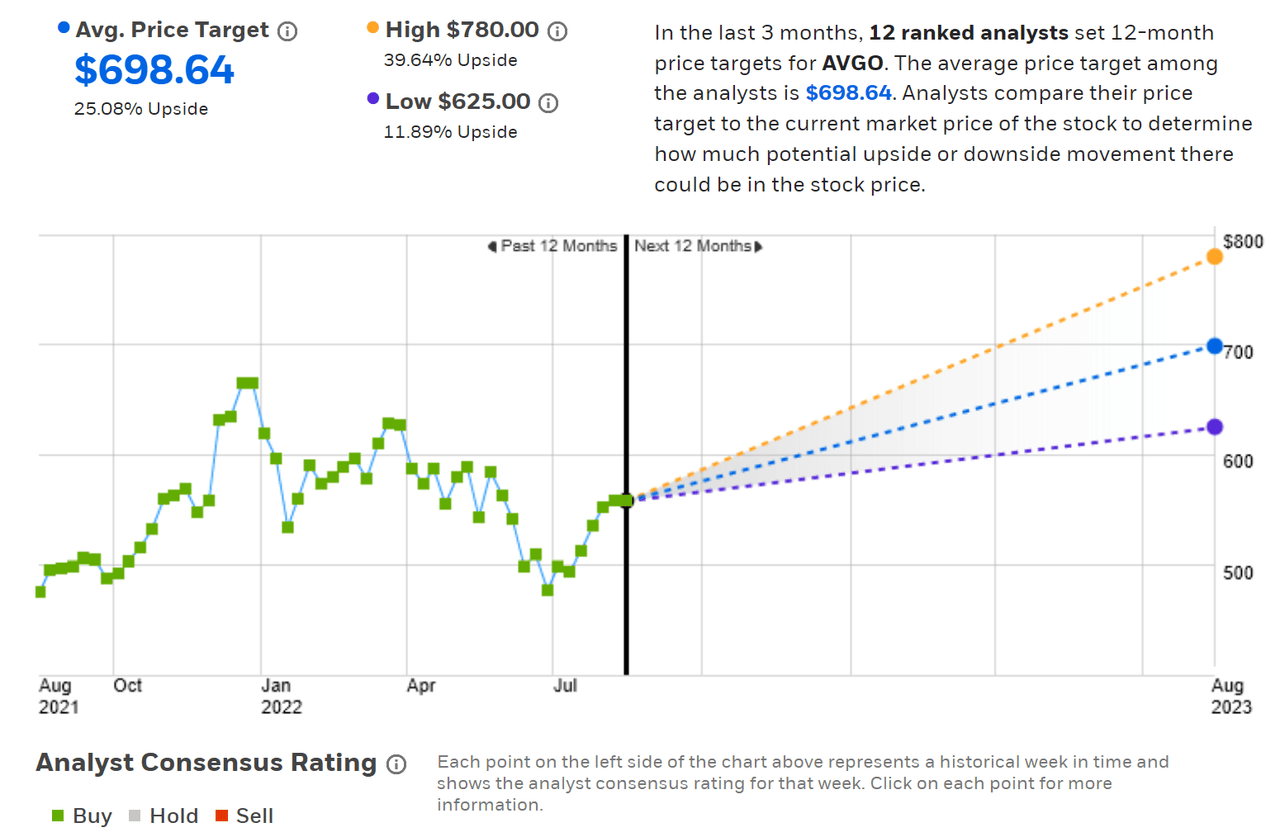

ETrade calculates the Wall Street consensus outlook for AVGO by aggregating ratings and price targets from 12 ranked analysts who have published their views over the past 3 months. The consensus rating is bullish and the consensus 12-month price target is 25.1% above the current share price. The expected return implied by the consensus price target is more than twice what it was in my previous analysis.

ETrade

Wall Street analyst consensus rating and 12-month price target for AVGO above

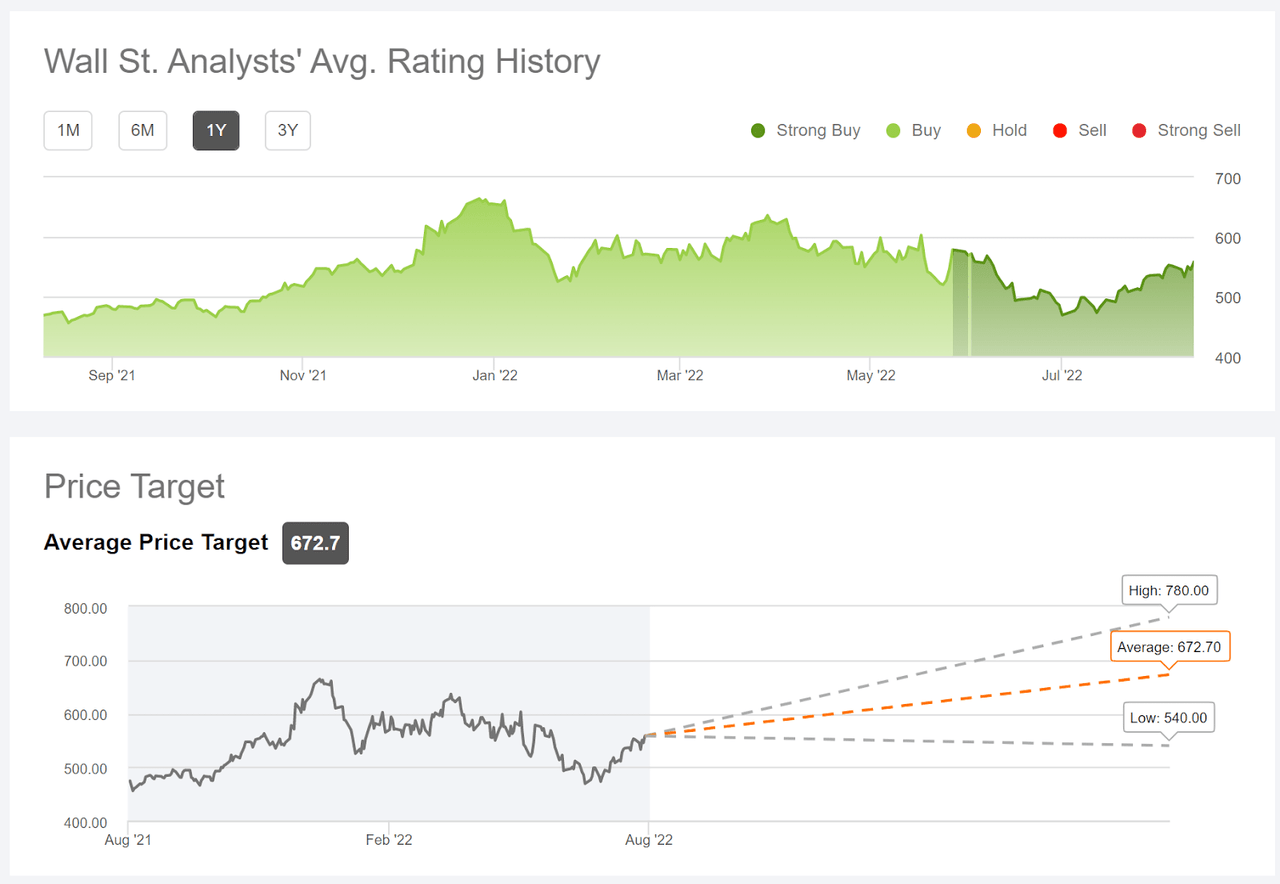

Seeking Alpha’s version of the Wall Street consensus outlook is calculated using ratings and price targets published by 26 analysts over the past 90 days. The consensus rating is bullish and the consensus 12-month price target is 20.4% above the current share price.

Seeking Alpha

Wall Street analyst consensus rating and 12-month price target for AVGO

The consensus outlook from Wall Street has been bullish over all of the past year, and the consensus 12-month price target has risen substantially. The expected total return for the next year is 25.6% (averaging the two consensus price targets and adding the dividend).

Market-Implied Outlook for AVGO

I have calculated the market-implied outlook for AVGO for the 5.2-month period from now until January 20, 2023, using the prices of call and put options that expire on this date. I chose this specific expiration date to provide a view through the end of 2022 and because the options expiring in January are particularly actively traded.

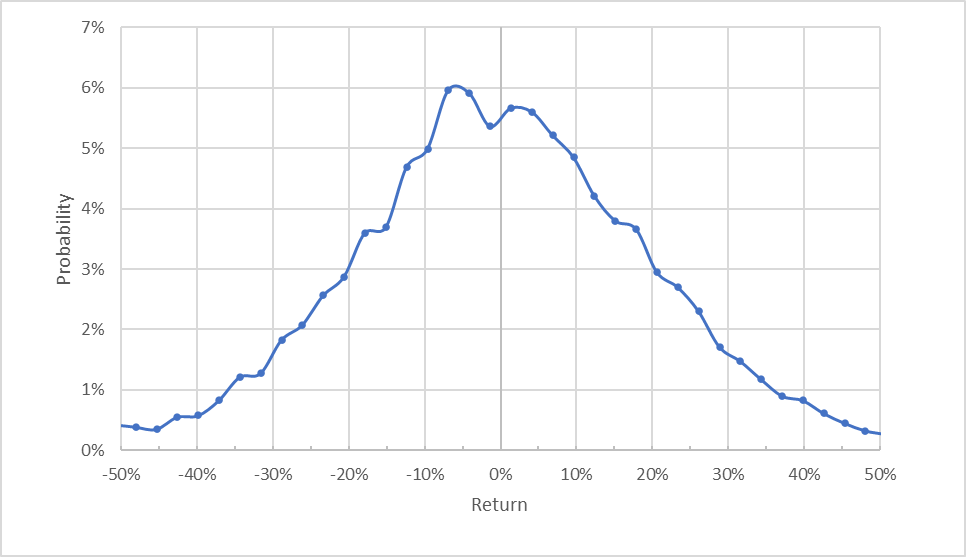

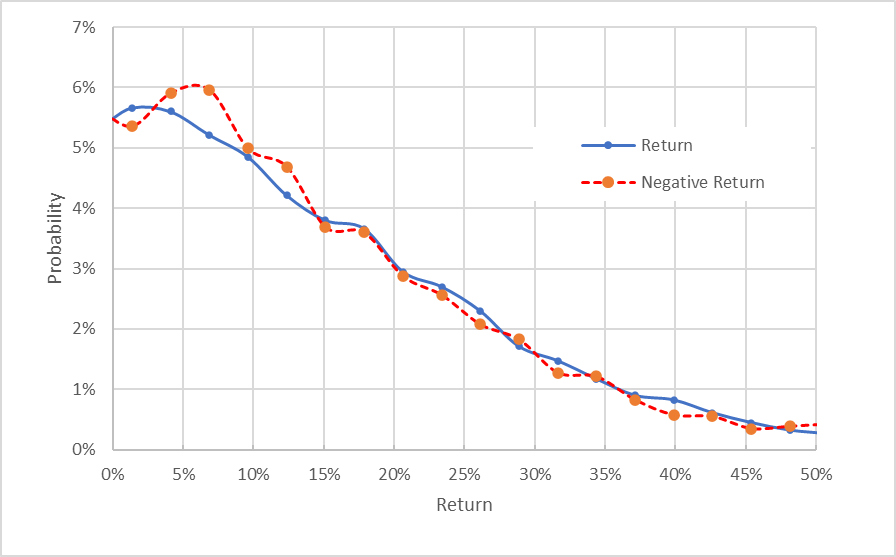

The standard presentation of the market-implied outlook is a probability distribution of price return, with probability on the vertical axis and return on the horizontal.

Geoff Considine

Market-implied price return probabilities for AVGO for the 5.2-month period from now until January 20, 2023 above

The market-implied outlook for the next 5.2 months is generally symmetric, with comparable probabilities for positive and negative returns of the same size, although the peak in probability is slightly tilted to favor negative returns. The expected volatility calculated from this distribution is 32%, slightly higher than the value from my previous analysis, 30%.

To make it easier to compare the relative probabilities of positive and negative returns, I rotate the negative return side of the distribution about the vertical axis (see chart below).

Geoff Considine

Market-implied price return probabilities for AVGO for the 5.2-month period from now until January 20, 2023, above. The negative return side of the distribution has been rotated about the vertical axis

This view shows that the probabilities of positive and negative returns match up quite well (the dashed red line and the solid blue line are almost on top of one another). The probabilities of negative returns are slightly elevated for smaller-magnitude negative returns, but the probabilities of large-magnitude returns match very closely. This market-implied outlook is very similar to the one from a year ago, although the outlook from last year exhibited a more persistent negative tilt, albeit of a small magnitude. In that outlook, the probabilities of negative returns were slightly higher than for positive returns across almost the entire chart (the red dashed line was on or above the solid blue line for all outcomes).

Theory indicates that the market-implied outlook is expected to have a negative bias because investors, in aggregate, are risk-averse and thus tend to pay more than fair value for downside protection. There is no way to measure the magnitude of this bias, or whether it is even present, however. Considering this potential bias, I interpret this market-implied outlook as neutral with a bullish tilt.

Summary

My assessment of semiconductor companies relies entirely on valuation and 2 forms of consensus outlooks, along with considering fundamentals. The first outlook is the Wall Street consensus. The second is the market-implied outlook, which represents the consensus view among buyers and sellers of options. A year ago, both the market-implied outlook and the Wall Street consensus outlook somewhat underestimated AVGO’s potential for growth. Today, the Wall Street consensus is considerably more bullish, with an expected 12-month total return of 25.6%. The updated market-implied outlook continues to be predominantly neutral, although now with a bullish tilt. The expected total return from the Wall Street consensus far exceeds my target threshold of at least ½ the expected volatility (32%). The valuation continues to be reasonable, the dividend yield is fairly attractive, and the company has been increasing the dividend at a rapid clip. In late May, The Board of Directors authorized up to $10B in share buybacks through the end in 2023. I am changing my rating on AVGO from neutral / hold to bullish / buy.

Be the first to comment