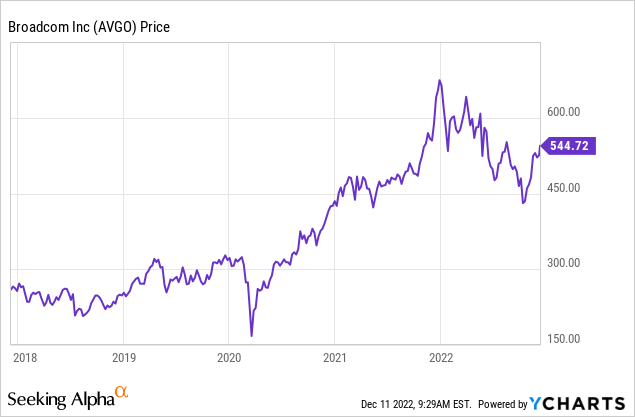

Justin Sullivan

Broadcom (NASDAQ:AVGO) is a global technology company that designs and supplies semiconductor and infrastructure software solutions. The semiconductor industry had a major boom in 2020 and there was even a “chip shortage”, due to the vast amount of demand. However, in 2022 electronics demand has waned but Broadcom looks to have been relatively insulated. The company reported solid financial results for the fourth quarter of the fiscal year 2022, beating both revenue and earnings growth estimates. In this post I’m going to break down its business model, financials, and valuation, let’s dive in.

Tech Business Model

Broadcom has innovation at its core with its roots stemming from AT&T, Bell Labs, and HP’s semiconductor division. Today, the company provides semiconductor solutions for a range of applications from Wi-Fi and data center chips to motor drive controls and financial services infrastructure.

The company is at the forefront of cutting-edge technology solutions. In 2020 the company announced the first-ever Wi-Fi 6 chip which was used in the Samsung Galaxy S21 Ultra. Then in 2022, the company announced the world’s first Wi-Fi 7 chipset solutions, which is double the speed of the prior standard Wi-Fi 6. The lockdowns of 2020, caused a surge in remote working, and people are increasingly relying on fast Wi-Fi to do important jobs, stream video, and play high-powered games. According to a study, cited by Broadcom 75% of consumers have plans to purchase additional Wi-Fi devices in 2022. Therefore Broadcom should be poised to benefit from the increasing need for super-fast Wi-Fi solutions.

In 2022, Broadcom also delivered the world’s first 50G automotive Ethernet Switch. This is expected to help power the increasing number of connected automobiles on the road which require high bandwidth.

The company has scored partnerships with Chinese social media and gaming giant Tencent to accelerate the commercialization of a Co-packaged Optics Network switch.

VMware Acquisition

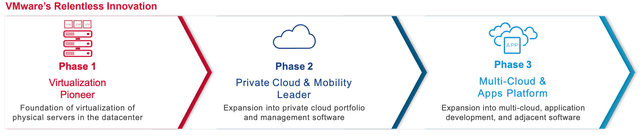

In May 2022, Broadcom announced plans to acquire VMware for a staggering $61 billion in cash and stock. VMware is most known for being a pioneer in “Virtualization” software. For example, if you want to run windows on your MacBook you would most likely use “VMware Fusion” to do this. However, VMware has so many more parts to the business. For example, the company has been a pioneer in “software-defined” networking for the data center, which helps with “virtualizing” networking and storage. In addition, the company has expanded to become a leader in multi-cloud application development and software.

VMWare (Investor presentation)

The hybrid cloud market was valued at $71.23 billion in 2021 and is forecasted to grow at a rapid 18.4% compounded annual growth rate up until 2030. In fact, one study indicates that 77% of IT decision-makers are moving towards a hybrid cloud model. Hybrid cloud basically means the usage of multiple cloud infrastructure providers (AWS, Azure, Google Cloud) as opposed to just one cloud provider. This can be done for a variety of reasons from legacy software, cloud specializations and not wanting to give one organization leverage over your business. In addition, many companies wish to keep some of their IT onsite for security or data sovereignty reasons. For example, the rapidly growing social media company TikTok has chosen Oracle (ORCL) as its cloud database provider for the storage of customer details in specific countries, after a backlash over concerns the company has been sending U.S. customer data to the Chinese government.

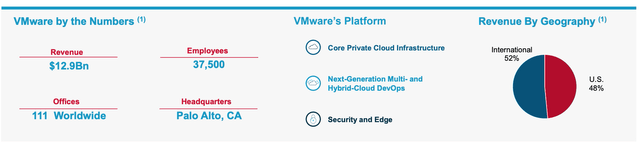

The acquisition of VMware will offer a software service that will complement Broadcom’s hardware solutions. Overall I think this acquisition would be a strong positive as it would effectively be a merger of two technology pioneers. However, the acquisition is not finalized yet and EU regulators have launched an anti-trust probe into the deal. EU regulators plan to finish the initial scrutiny of the deal by December 20th, which is a positive sign given some of these cases can drag on for many months. Broadcom is no stranger to acquisition challenges and in 2017, the company had its proposed $130 billion acquisition of Qualcomm blocked by the Trump administration. This was because the company has close ties with China and Huawei specifically.

VMware by numbers (Investor presentation)

Growing Financials

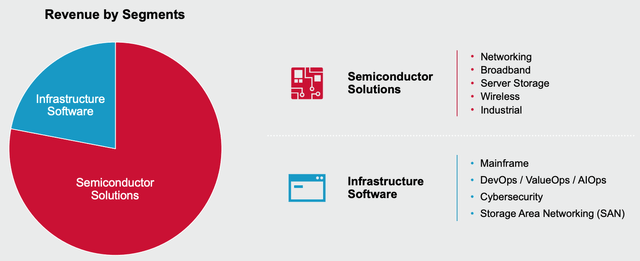

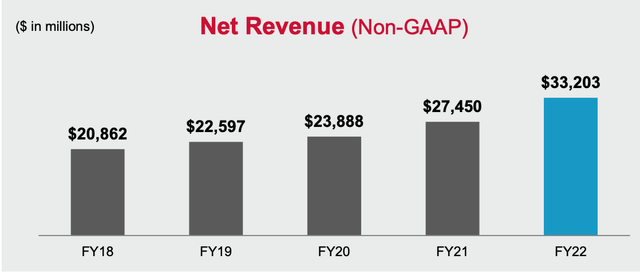

Broadcom reported solid financial results for the fourth quarter of fiscal year 2022. Revenue was $8.9 billion which beat analyst estimates by $29.26 million and increased by 21% year over year. This was driven by rapid semiconductor revenue growth of 26% year over year to $7.1 billion. In addition, infrastructure software revenue grew by 4% year over year to $1.8 billion. The aforementioned acquisition of VMWare is expected to increase the software portion of Broadcom’s revenue substantially. This will increase margins and stability thanks to diversification. For the full year of the fiscal year 2022, Revenue was $33.2 billion which increased by a rapid 21% year over year.

Back to the fourth quarter results specifically, the company noted strong performance across its hyperscaler and enterprise customers.

Networking revenue contributed to 35% of the total, after hitting a record $2.5 billion, up a solid 30% year-on-year. The company noted strong growth it its “Tomahawk 4” which is the “world’s highest bandwidth” switch chip for Artificial Intelligence [AI] and Machine Learning [ML] workloads. This product is popular for hyperscaler data centers which aim to increase the number of AI applications on offer. Broadcom is poised to benefit from the growth in the AI industry. This market is forecasted to grow at a rapid 20.1% compounded annual growth rate and be worth $1.39 trillion by 2029.

Storage connectivity revenue also hit record levels, at $1.2 billion up a blistering 50% year-over-year. This was driven by strong demand for the “MegaRAID” and storage adapters by enterprise customers.

Broadband revenue contributed to 15% of semiconductor revenue and reached a solid $1 billion up 20% year over year. This was driven by the adoption of its Wi-Fi 6 solutions primarily. Wireless network revenue was $2.1 billion which increased by 13% year over year and contributed to 29% of the total.

Revenue by segment (Broadcom FY22 report)

The company reported annualized bookings of $357 million which included a substantial $101 million in cross-selling opportunities. As mentioned prior the acquisition of VMware should boost cross-selling substantially. Broadcom reported consolidated renewal rates of over 120% which confirms customers are staying with the product and spending more via upsells.

Profitability, Margins, and Cash Flow

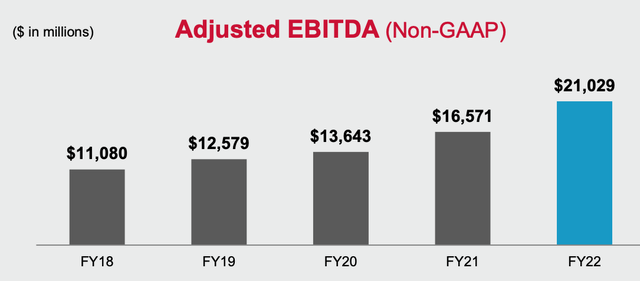

Broadcom reported earnings per share of $7.83 which beat analyst estimates by $0.34. Operating expenses were $1.2 billion which increased by 3% year over year. This wasn’t too bad given the high inflation environment which is causing rising costs in many sectors. In addition, the increase was primarily driven by an increase in R&D which I believe is positive for such an innovative technology company. Adjusted EBITDA was $5.7 billion or a solid 64% of revenue. However, this metric does exclude $129 million of depreciation.

Broadcom reported Free Cash Flow of $4.5 billion which was an outstanding 50% of revenue. The company has a solid balance sheet with $12.4 billion of cash and equivalents. Broadcom does have high gross debt of $39.5 billion, but just $440 million is short-term debt which is positive.

Advanced Valuation

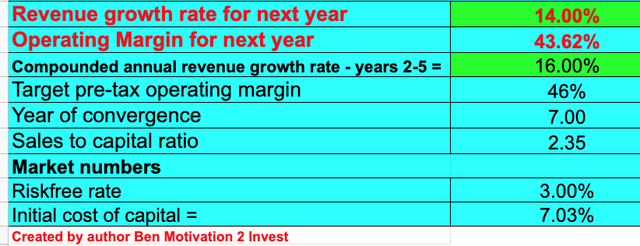

In order to value Broadcom I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted 14% revenue growth for next year and 16% revenue growth over the next 2 to 5. This is aligned with analyst estimates (Yahoo Finance data) and very conservative given the company has grown at a prior growth rate of 21%.

Broadcom stock valuation 1 (created by author Ben at Motivation 2 Invest)

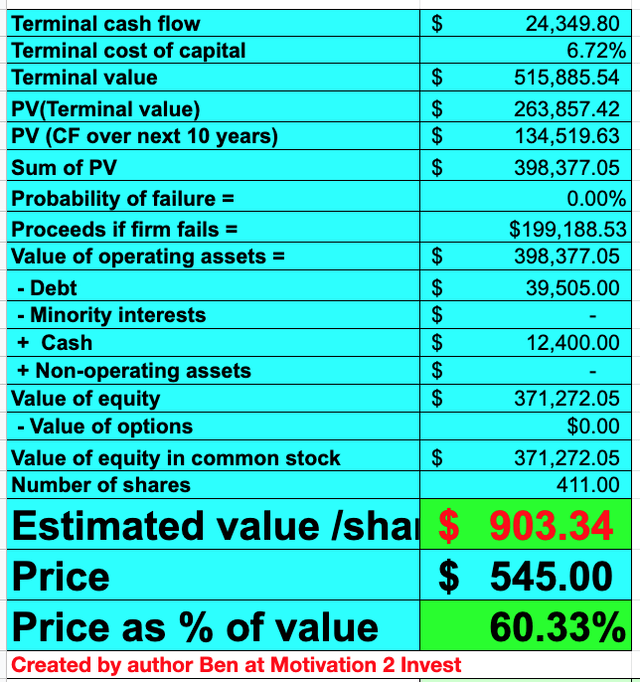

To increase the accuracy of the valuation, I have capitalized R&D expenses which has lifted its operating margin. In addition, I have forecasted its operating margin to expand as the business focuses more on software solutions and increasing its cross-sell opportunities.

Broadcom stock valuation 2 (created by author Ben at Motivation 2 invest)

Given these factors I get a fair value of $903 per share, the stock is trading at $545 per share at the time of writing and thus is ~40% undervalued.

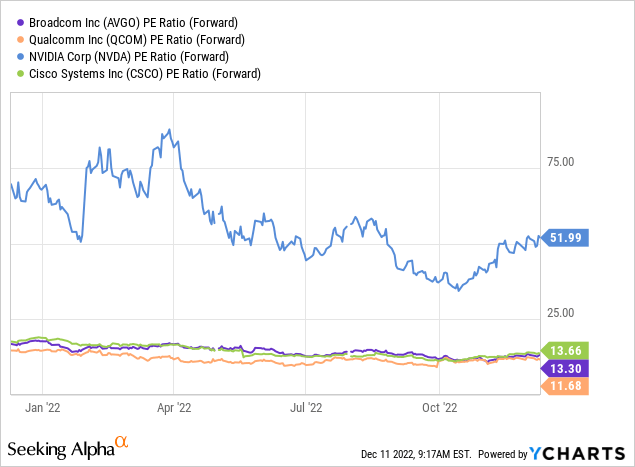

As an extra datapoint, Broadcom trades at a P/E ratio = 18, which is 45% cheaper than its 5 year average. Relative to industry peers, Broadcom trades at a mid-range P/E ratio.

Risks

Electronics demand/Recession

We are currently going through a downturn in semiconductor and electronics demand, after a major boom in 2020. Management has been proactive and has been disciplined with its shipping strong backlog only when its end customers need it. There is also the risk that the VMWare acquisition is blocked by EU lawmakers which would likely mean hefty costs for the pleasure.

Final Thoughts

Broadcom is an innovative semiconductor solutions provider which has continued to pioneer many new technologies. The company has reported strong growth and management is bullish moving forward despite the macroeconomic environment. Broadcom is undervalued intrinsically and thus it could be a great long-term investment.

Be the first to comment