Sundry Photography

When I was an electrical engineering undergrad in the late 90s/early 2000s, Broadcom Inc. (NASDAQ:AVGO) was known as a leading edge semiconductor company, especially in wired and wireless networking equipment, one of the hottest areas in the early 2000s.

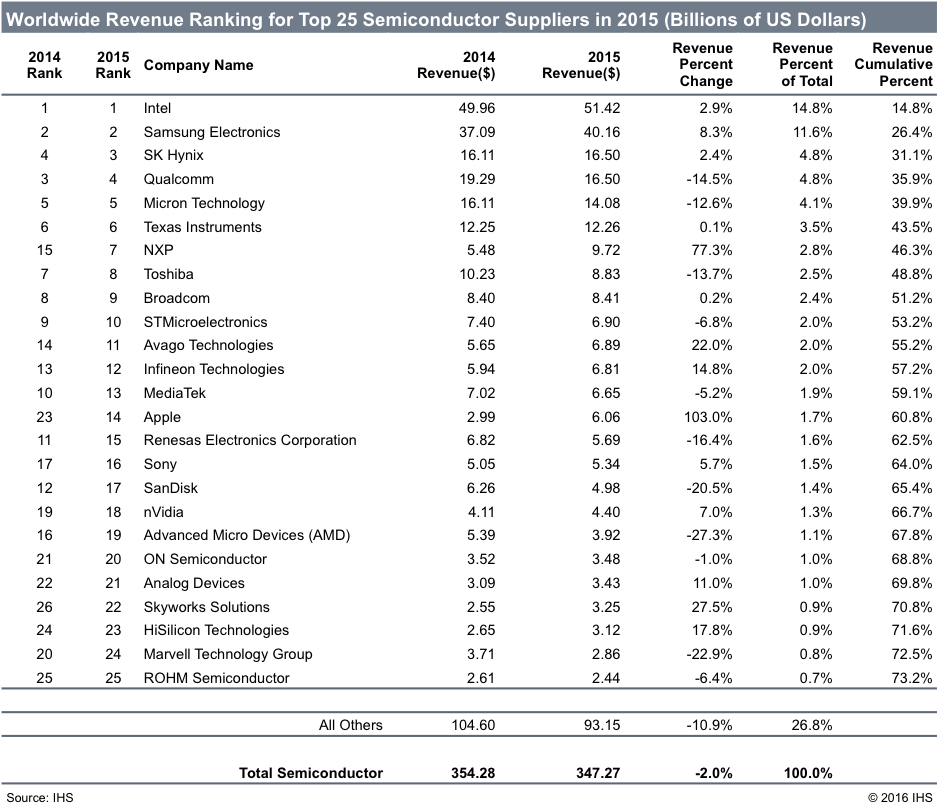

I lost track of the company after switching careers and it wasn’t until 2016, when Avago acquired Broadcom, that I took another look at the company. At the time of the acquisition, Broadcom was one of the top 10 largest semiconductor companies in the world by revenues, while the acquirer, Avago, was #11, but quickly growing (Figure 1).

Figure 1 – Top semiconductor companies by revenue, 2015 (IHS)

Who was Avago, I wondered? I had never heard of the company while I was an undergrad student.

Avago Applies Private Equity Model In Public Markets

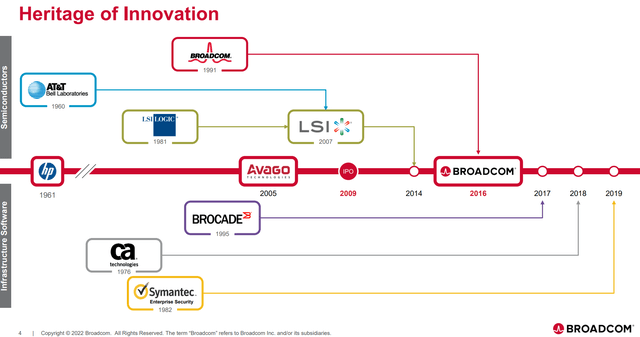

Avago was the private equity-backed spinout of Hewlett Packard’s semiconductor business (“Agilent’s Semiconductor Products Group”) that IPO’d in 2009. Applying a private equity business model to the semiconductor industry, Avago rolled up semiconductor businesses, culminating with the 2016 merger with Broadcom (Figure 2). The company retained Broadcom’s name post merger.

Figure 2 – Avago/Broadcom major acquisitions (AVGO investor presentation)

The basic model for Avago/Broadcom was to acquire a business, improve margins, pay off debt, and repeat. However, the model reached physical/competitive constraints in 2017 when its proposed acquisition of Qualcomm Incorporated (QCOM) was blocked for national security concerns. Around the same time, the company was also being investigated by the FTC and the European Commission for anti-competitive practices.

As the roll-up strategy in semiconductors became more difficult, Broadcom switched gears and started acquiring infrastructure software businesses, such as CA Technologies in 2018 and Symantec in 2019. Recently, Broadcom announced its most ambitious acquisition to date, the $69 billion (cash, stock, and debt) pending acquisition of VMWare.

VMWare Acquisition

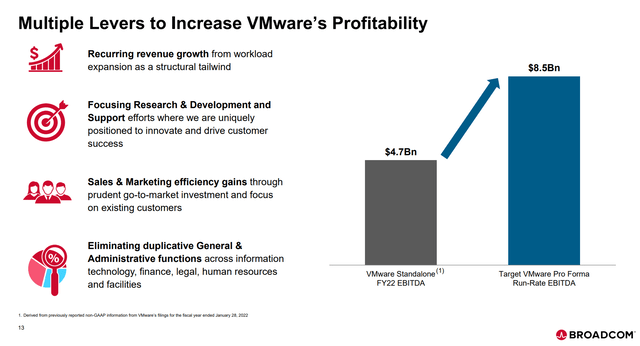

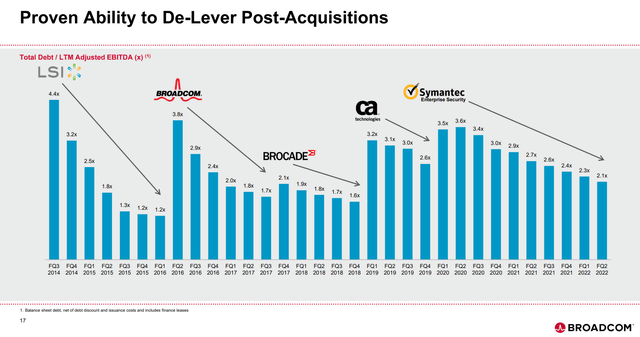

The main premise behind the VMWare acquisition is a repeat of the same PE model – acquire a mature cash-flowing business, improve margins (Figure 3), and pay off debt (Figure 4).

Figure 3 – Rationale for VMWare acquisition (AVGO investor presentation) Figure 4 – AVGO deleveraging ability (AVGO investor presentation)

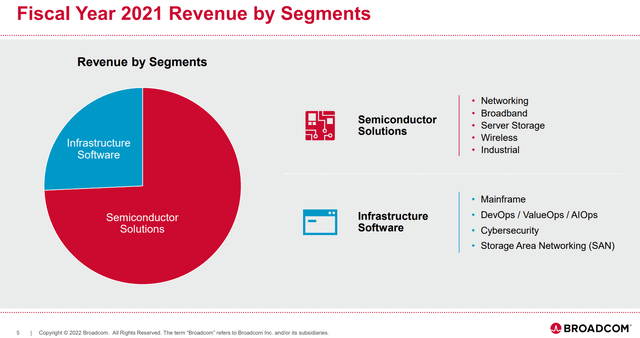

With pro-forma revenues over $40 billion, the addition of VMWare should bring Broadcom’s revenue split closer to 50/50 between semiconductor solutions and infrastructure software, compared to 2021 (Figure 5).

Figure 5 – AVGO 2021 revenue split (AVGO investor presentation)

Hard To Argue With Broadcom’s Business Model

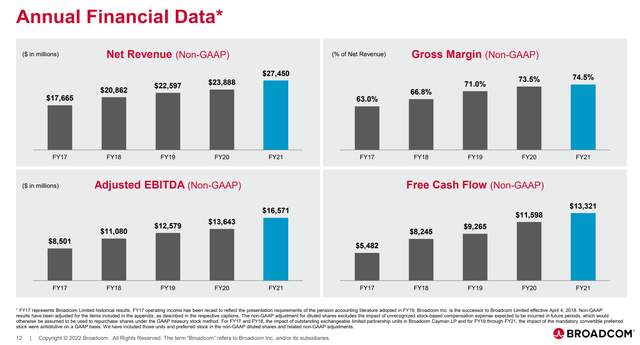

It is hard to argue against the Broadcom PE business model, as it has delivered consistent revenue growth and improving margins, while generating copious amounts of free cash flow. Free cash flow in 2021 was $13.3 billion, 80% of adjusted EBITDA and 48% of revenues (Figure 6).

Figure 6 – AVGO financial summary (AVGO investor presentation)

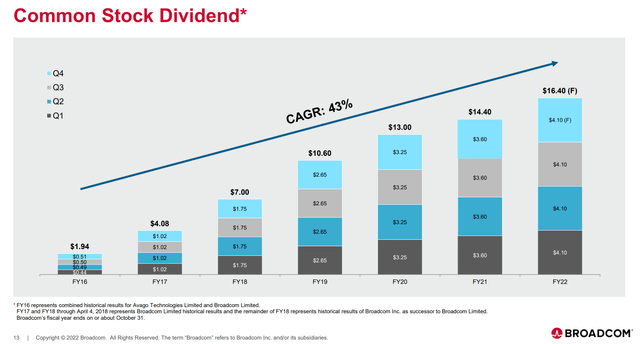

Investors have been well rewarded, as Broadcom has increased the common share dividend at a 43% CAGR to a forecasted $16.40/share, an 8.5x increase from $1.94 in 2016 (Figure 7).

Figure 7 – AVGO dividend increases (AVGO investor presentation)

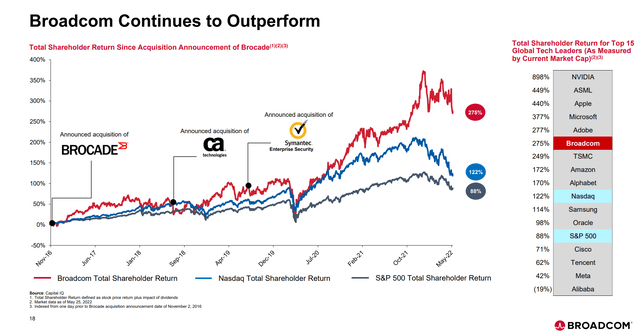

At the same time, Broadcom has delivered 275% total return since 2016, outpacing the Nasdaq Index and the S&P 500 Index, and only trailing the top performing stocks like Nvidia (NVDA), Apple (AAPL), and Microsoft (MSFT) (Figure 8).

Figure 8 – AVGO outperforms Nasdaq (AVGO investor presentation)

Pro-Forma Valuation Slightly Expensive

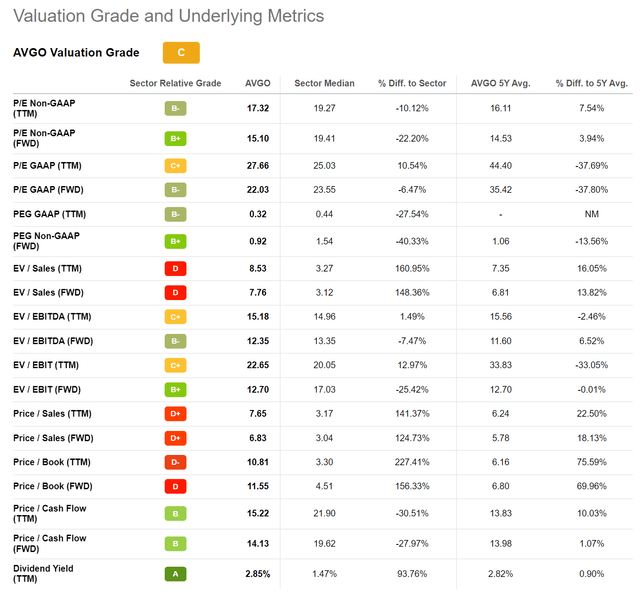

While the addition of VMWare will add more than $32 billion in debt to the balance sheet (bringing pro-forma net debt to over $62 billion), it does add almost $5 billion in EBITDA to AVGO’s $16.6 billion in Adjusted EBITDA (2021). Once synergies are realized, EBITDA could be over $25 billion. At a pro-forma Enterprise Value of over $320 billion (current $255 billion + $69 billion for VMWare), this values the resultant AVGO at roughly ~13x EV/EBITDA, assuming synergies are achieved. Pre-synergies, the pro-forma Broadcom is valued at 14.8 EV/EBITDA. This is a slight premium compared to the sector median of 13.4x (Figure 9).

Figure 9 – AVGO valuation (Seeking Alpha)

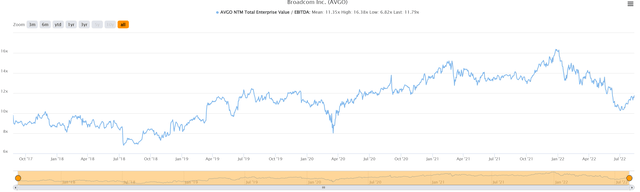

On a historical basis, 13x forward EV/EBITDA is also on the expensive side, especially as synergies have not been realized. AVGO’s multiple has traded between 8 to 16 times in the last few years, with 12x being near the peak prior to the post-COVID market euphoria (Figure 10).

Figure 10 – AVGO historical multiples (TIKR.com)

At current valuations, AVGO is slightly expensive. I would be a buyer of Broadcom if it were to trade down to 11-12x pro-forma EV/EBITDA or $420 to $470 per share (note the stock recently bottomed in June at $464/share).

Risks To Avago

The biggest risk to AVGO is the pending VMWare acquisition. While it should not attract the same level of regulatory scrutiny as the Qualcomm acquisition a few years ago as Broadcom isn’t dominant in software like it was in semiconductors, the deal is currently under regulatory review by European, American, and Chinese authorities.

Another risk is that post VMWare, the number of potential acquisition targets that move the needle for Broadcom will further dwindle, as Broadcom will be a $300 billion tech behemoth. Will AVGO make a run for IBM (IBM) or Intel (INTC) and more importantly, will regulators allow it?

Finally, Broadcom is taking on $32 billion in additional debt in the face of a global economic slowdown. With pro-forma net debt over $62 billion (~3x Net debt/EBITDA pre-synergies), this will make Avago one of the more leveraged technology companies.

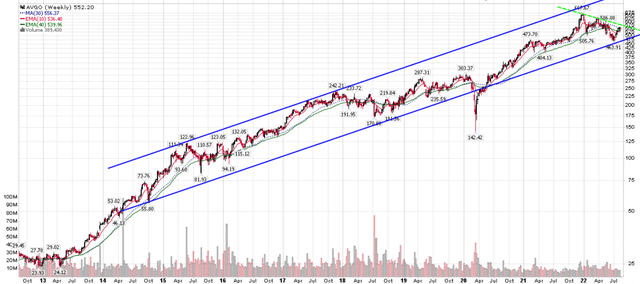

Technicals In Consolidation Pattern

Technically, Broadcom has been in a consolidation pattern since late 2021. Broadcom is in a multi-year uptrend, and recently bounced at the bottom end of the uptrend around $460/share.

Figure 11 – AVGO in multi-year uptrend (Author created with price chart from stockcharts.com)

Conclusion

Broadcom’s recently announced acquisition of VMWare appears to be the latest chapter in its PE-like business model playbook. On a pro-forma basis, the stock appears rich at current valuations. However, I would be a buyer at around 12x pro-forma EV/EBITDA, or ~$470/share, as the company, led by CEO Hock Tan, has consistently delivered shareholder value through acquisitions.

Be the first to comment