British Pound (GBP) Price Outlook

- UK employment picked up for the fifth consecutive month.

- GBP/USD nearing a fresh multi-year high.

The latest UK jobs data release showed employment picking up and the unemployment rate falling, beating market expectations. According to the Office for National Statistics (ONS), the jobs market is showing some early signs of recovery, with the number of payroll employees increasing for the fifth consecutive month, although the number ‘remains 772,000 below pre-coronavirus pandemic levels’.

Ahead this week, the latest inflation report on Wednesday with the Markit PMIs (May) rounding off the week on Friday. For all market-moving economic data and events see the real-time DailyFX calendar.

A combination of Sterling strength, driven by stronger data, the next stage of the re-opening of the UK economy and the success of the UK vaccination program, and a weak US dollar have pushed GBP/USD ever higher. Cable currently trades just under 1.4200 with a fresh multi-year high around 40 pips above here. There seems little in the way to prevent GBP/USD from hitting this target at the moment with the latest CoT report showing US dollar short positions increasing, while Sterling long positions grew.

US Dollar Selling Persists, CAD Bulls Largest Since Late-2019 – CoT Report

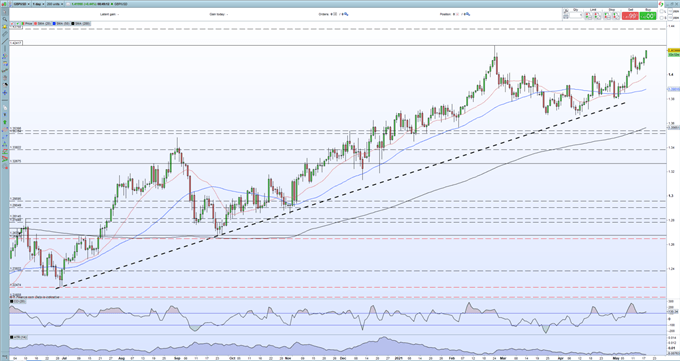

The daily GBP/USD chart continues to suggest higher prices with all three moving averages in a positive formation, while the bullish trendline remains unchallenged. Volatility in the pair remains low and this argues that the recent grind higher will continue, leaving the February 24 high at risk. Traders should be aware of the FOMC minutes, released on Wednesday, where the Fed’s thoughts on inflation will be closely watched. Any hawkish hint by the Fed may cap further GBP/USD upside.

GBP/USD Daily Price Chart (June 2020 – May 18, 2021)

Retail trader data show 37.27% of traders are net-long with the ratio of traders short to long at 1.68 to 1. We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBP/USD prices may continue to rise.Positioning is more net-short than yesterday but less net-short from last week. The combination of current sentiment and recent changes gives us a further mixed GBP/USD trading bias.

Traders of all levels and abilities will find something to help them make more informed decisions in the new and improved DailyFX Trading Education Centre

What is your view on Sterling– bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

Be the first to comment