The United Kingdom has been heavily impacted by the COVID-19 pandemic and the Invesco CurrencyShares British Pound ETF (NYSEARCA: FXB) has fallen by nearly 5% since the first half of March 2020. While many nations continue to be held under strict lockdown rules, businesses have suffered and annual forecasts for regional exports are likely to see major revisions over the next few weeks. Of course, these revisions will almost certainly indicate the potential for economic weakness in a number of different areas and this should keep downside pressure focused squarely on FXB for the next several months.

Source: ETFdb

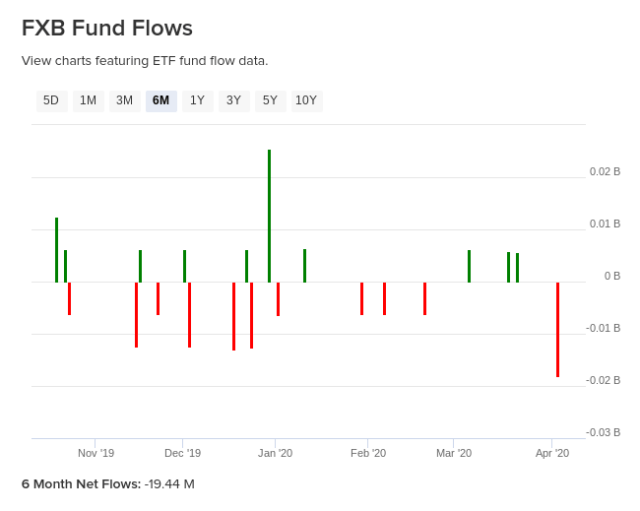

In viewing FXB’s recent declines from a medium-term perspective, we can see that outflow activities have reached extreme levels and figures that have been compiled over the last three months indicate negative trends have grown to -$19.25 million. This puts significant pressure on the market’s prior bullish arguments which suggested that pound-denominated assets could benefit as a potential safe haven if bearish trends emerged in global stock markets. Clearly, this has not been the case and this helps explain why the flow trends in FXB have dropped deeply into negative territory. Similar results are visible when we assess activity in FXB over the last six months, so the same types of arguments can be made even if we are working on an extended time horizon:

Source: ETFdb

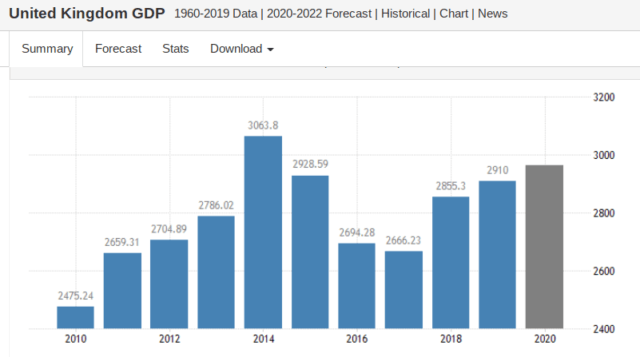

More importantly, the broadest economic data releases have suggested a slowdown in total output levels. GDP growth did move higher in 2019 but the pace of the advancement suggested vulnerabilities even before the dramatic outbreak of the COVID-19 pandemic:

Source: Trading Economics

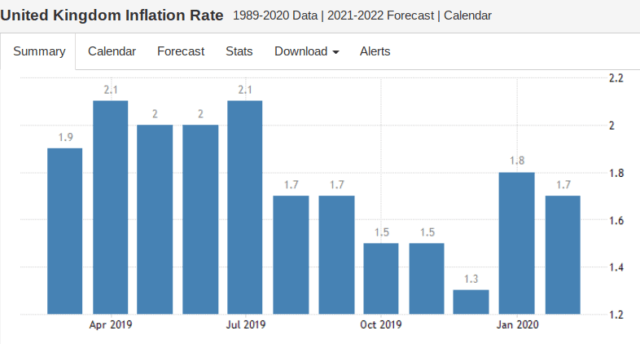

Given the macro weaknesses that are seen in the current market environment, bullish investors would likely need to see evidence of consumer inflation before there could be any real hope of seeing a sustainable rebound in FXB. However, the U.K. consumer inflation report from February 2020 (which was before most of the destruction caused by the pandemic) showed that price pressures slowed to an annualized rate of just 1.7%. But this is not a consumer price inflation level that is likely to spook the Bank of England (BoE) or suggest a need throughout the market that changes in interest rates must be used as a countermeasure.

Source: Trading Economics

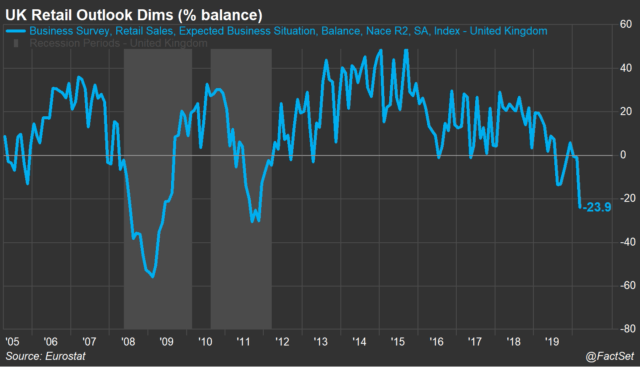

Going forward, this could be the primary area to watch because it would seem that the only supportive element for a bullish case might rest in the retail shopping uncertainties that clearly exist. However, we might need to see a surge above 3% before central bank countermeasures would be appropriate and trends in retail sentiment show this that type of event has become highly unlikely. Sentiment surveys in the U.K. have also fallen deeply into negative territory (at -23.9), which is the lowest level since 2011:

Source: FactSet

Of course, this recalls the events of the Great Financial Crisis. But, in the chart above, we can see that markets could actually fall much further before we enter into “crisis” territory. Unfortunately, the market scenarios that were visible during the 2008-2009 period ultimately led to massive declines in FXB (which extended far beyond the initial “crisis” period):

Source: Tradingview

Given this historical context (and its sharp deviations from what is being seeing currently), it seems unlikely that FXB has completed its next series of declines within the broader market downturn. Since market investors have not been drawn into the possibility of safe haven protection in FXB, it is unreasonable to expect that a substantial bullish reversal lies ahead. Indications of new economic weaknesses should keep downside pressure focused squarely on FXB for the next several months, and bullish investors would be best served to wait for better opportunities in the future.

Thank you for reading.

Now, it’s time to make your voice heard. Reader interaction is the most important part of the investment learning process! Comments are highly encouraged. We look forward to reading your viewpoints.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment