Luke Sharrett/Getty Images News

Tobacco, cigarettes, and nicotine giant, British American Tobacco (NYSE:BTI) has had a terrible five years on the stock market. This has occurred despite improving underlying economics, and a strengthening competitive advantage over its rivals. The industry has been marred by health concerns, but there is a case that investment can help drive change, and in the case of British American Tobacco, will reward a company that is doing the right things.

Terrible Stock Market Performance

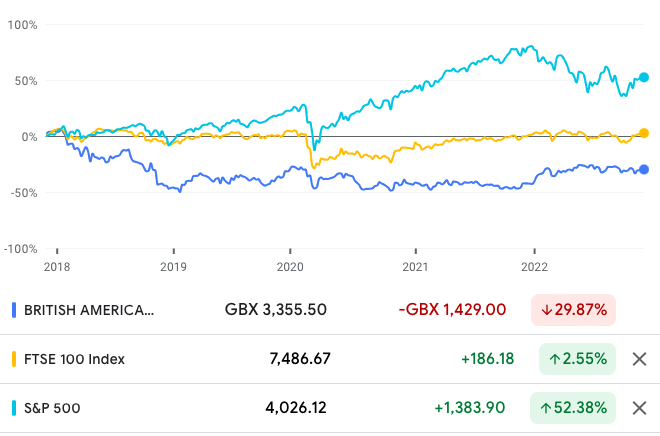

In the last five years, British American Tobacco has delivered uninspiring returns for its shareholders. In that time, the company’s share price has declined 29.87%, compared to a modest rise of 2.55% for the FTSE 100, and a tantalizing 52.38% for the S&P 500.

Source: Google Finance

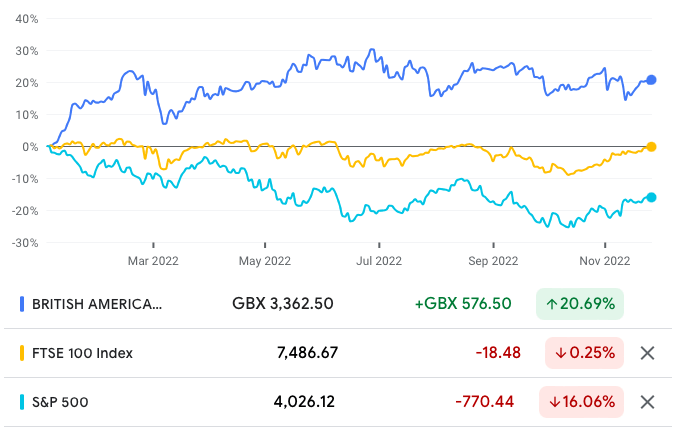

Yet, 2022 has taught us that as the demand for a stock rises, its future returns decline, and in that vein, many sectors and industries that had suffered in the last few years have thrived in this. In the year-to-date, British American is up 20.69%, while the FTSE 100 has declined 0.25%, and the S&P 500 has slumped 16.06%.

Source: Google Finance

The company’s financial performance throughout the period has been strong, despite the stock market’s perception of it.

Strong Financial Performance

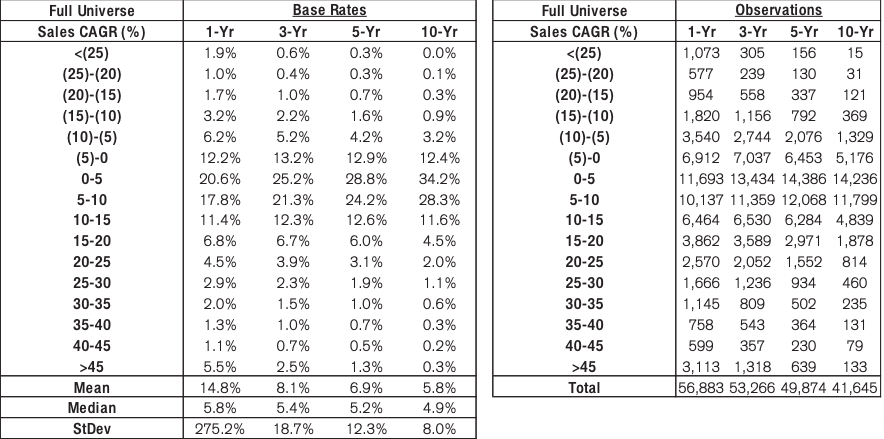

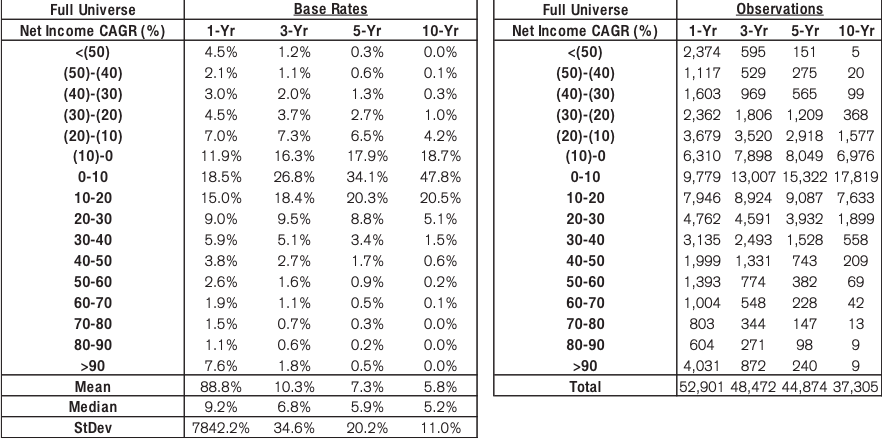

Revenue grew from £20.292 billion in 2017, to £25.684 billion in 2021, for a 5-year revenue compound annual growth rate (CAGR) of 4.83%. According to Credit Suisse’s (CS) The Base Rate Book, 28.8% of businesses achieved a similar rate of growth over a 5-year period, between 1950 and 2015.

Source: Credit Suisse

In the first half of the year, the company earned revenues of £12.869 billion. The company expects to grow 2022 revenues by 2-4% compared to last year.

The company’s gross profitability grew from 0.11 in 2017 to 0.15 in 2021. This remains well short of the 0.33 threshold that Robert Novy-Marx’s research shows marks out an attractive stock.

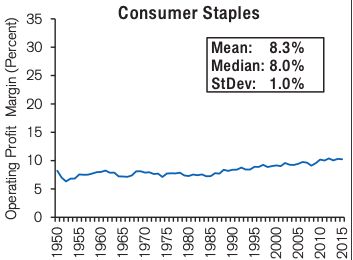

Operating profit grew from £6.476 billion in 2017 to £10.234 billion in 2021. In the first half of the year, operating profit declined 25% from the same period last year, to £3.678 billion. Operating margin grew from 31.9% in 2017 to 39.8% in 2021. In the 1950 to 2015 period, consumer staples had an average operating margin of 8.3%, and a median operating margin of 8%. In recent decades operating margins across consumer staples have risen. In the first half of the year, operating margin declined 11.7 ppts to 28.6%.

Source: Credit Suisse

British American Tobacco’s profits have declined from £37.704 billion in 2017, to £6.974 billion in 2021, for a 5-year earnings CAGR of -28.65%. This gives us a base rate of 2.7% of firms.

Source/ Credit Suisse

However, the company’s 2017 earnings were exceptional. In 2016, for example, the company earned profits of £4.839 billion. 2017’s profits were inflated due to changes in the reporting of RAI, which the company acquired, resulting in a gain of £23.288 billion from the disposal of RAI as an associate. The underlying trend is actually one of growth. Without those accounting changes, profits before taxes in 2017 would be £6.303 billion in 2017, compared to £9.163 billion in 2021. So we could think of a “shadow” 5-year earnings CAGR of about 7.77%, for a base rate of 34.1%.

There is an inverse relationship between asset growth and future returns, which academics call the “asset growth effect”, so it is important to observe that British American Tobacco has reduced its asset base from £141.038 billion in 2017 to £137.365 billion, at a 5-year total assets CAGR of -0.53%.

In 2017, the company generated £5.23 billion in free cash flow (FCF), compared to £7.4 billion in 2021. Over the next five years, the company expects to generate some £40 billion in FCF. In the first half of this year, the company generated FCF of £2.277 billion, compared to £1.28 billion for the same period last year.

British American Tobacco generated returns on invested capital (ROIC) of 70.1% in 2017 – for the reasons given for the inflated profits for the year – declining to 23% in 2021.

Over the last five years, financial results have been strong, suffering largely across the last year. The question for investors is what the secular expectations for the company should be.

Growing Revulsion at the Industry

Warren Buffett once said of the tobacco industry, “Don’t tell me about the economics – I know they’re great. You make a product for a penny, you sell it for a dollar, and you sell it to addicts. And it has tremendous brand loyalty.” His remarks show an appreciation for the obviously strong economics of the industry, coupled with a now widespread revulsion at the industry.

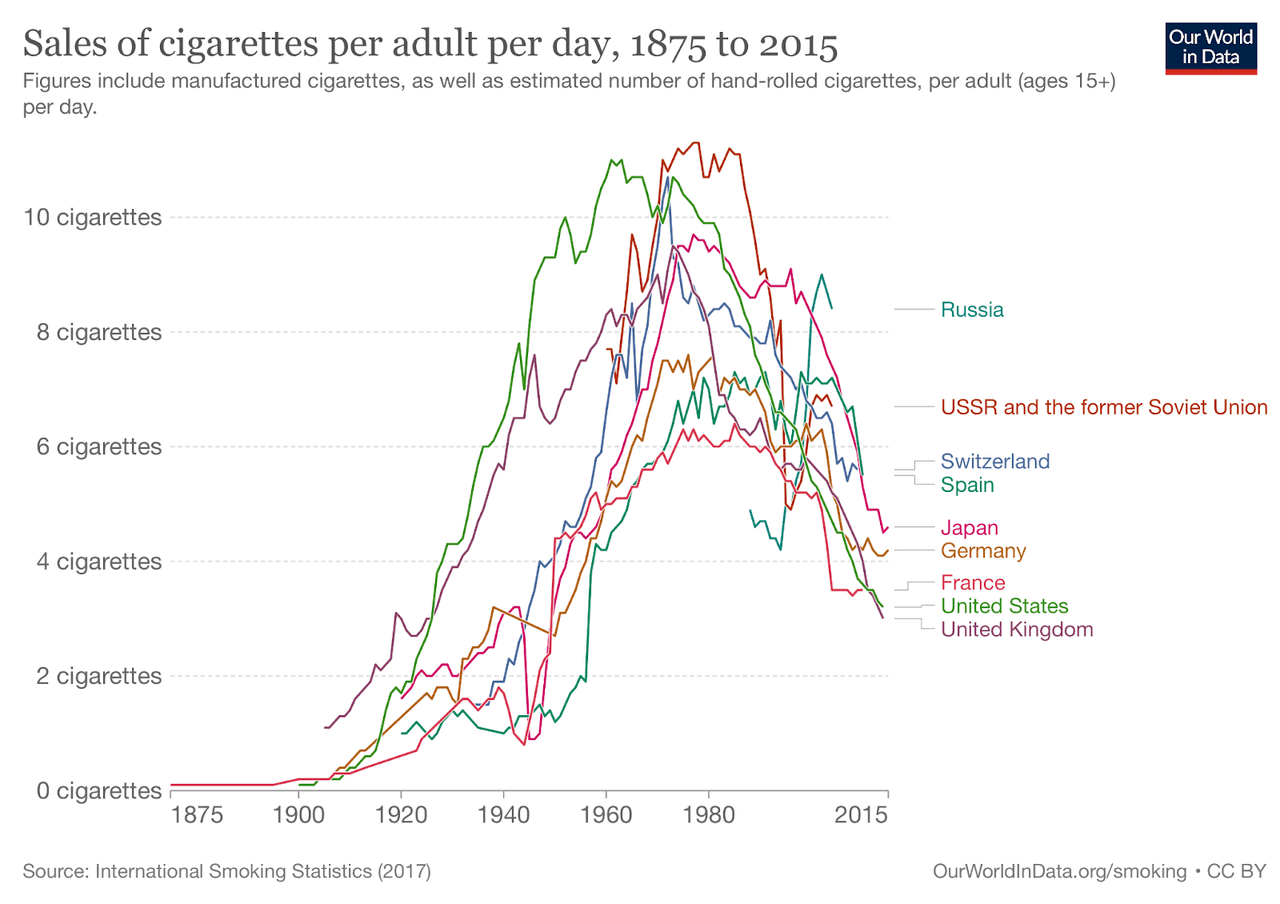

It is inarguable that the industry faces challenging headwinds. According to Our World in Data, sales of cigarettes per adult per day peaked in 1963 in the United States, and between that time and the early 1970s, across the advanced economies. As awareness of the health risks associated with smoking have risen, coupled with tax disincentives, sales have plummeted.

Source: Our World in Data

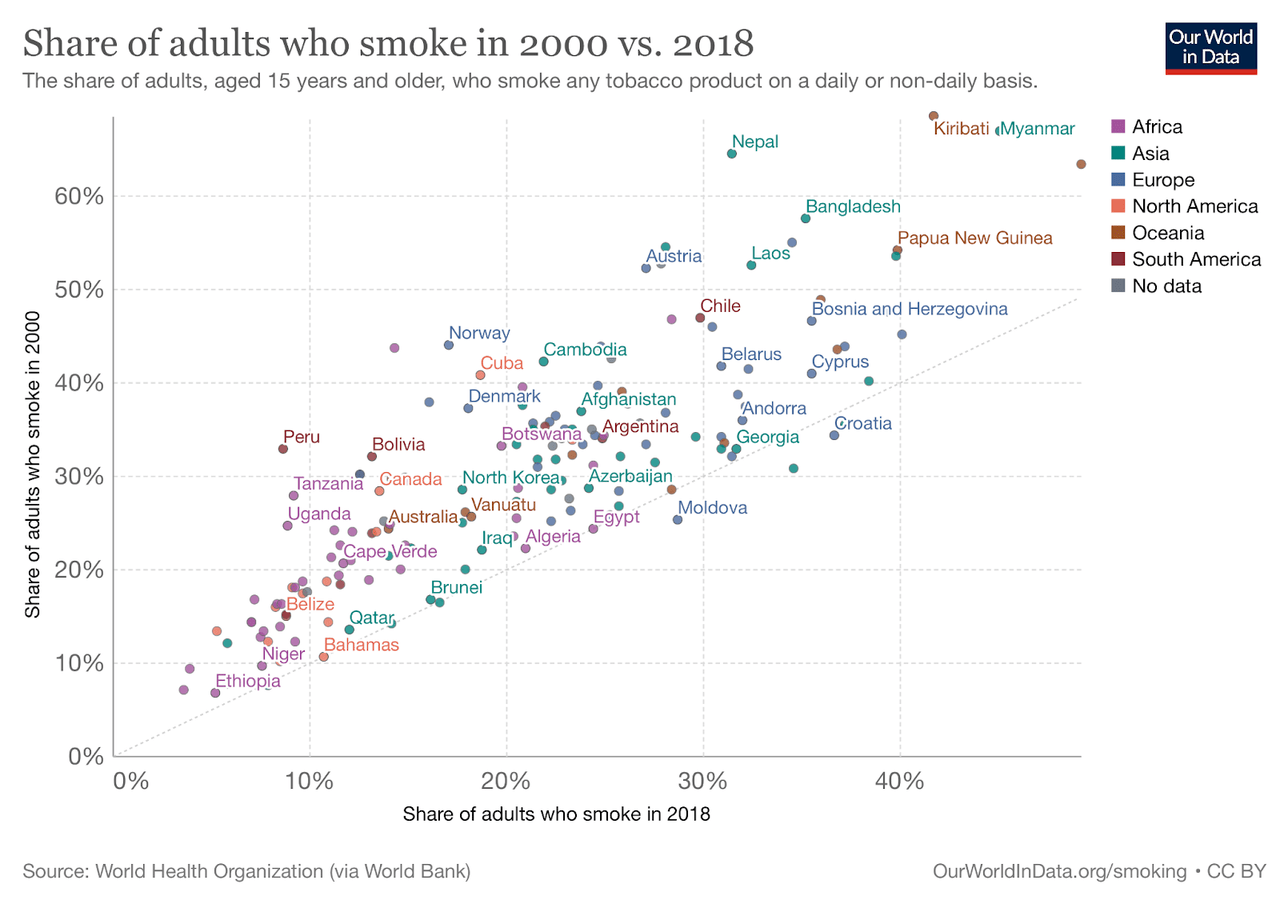

An analysis of the share of adults who smoke in 2000 versus 2018, shows how quickly the market is collapsing across the world.

Source: Our World in Data

This has led to a very obvious doomsday narrative around the industry, with investors fleeing the industry. Valuations have become depressed, especially in an era of easy money in which growth has been the mantra of many investors. In addition, the rise of environmental, social, and governance (ESG) investing has added to a growing revulsion at the industry. As an example, Tobacco Free Portfolios advises investors to exclude tobacco from their portfolios, and embrace “tobacco-free finance”. Stopping Tobacco Organizations and Products (STOP) supports the Global Tobacco Industry Interference Index, an index which has a similar exclusionary approach.

The anti-tobacco sentiment which has rightly engulfed the world, has pushed the industry to make some commitment to “smokeless tobacco”, with British American Tobacco investing heavily in next generation products (NGPs) made from vapor and tobacco heating products (THPs). This “new category” has enjoyed a 3-year revenue CAGR of 32%, between 2018 and 2021, to over £2 billion. the number of adult consumers of non-combustible products has grown to 18 million, at a 3-year CAGR of 31%. Non-combustible revenue is now 12% of group revenue.

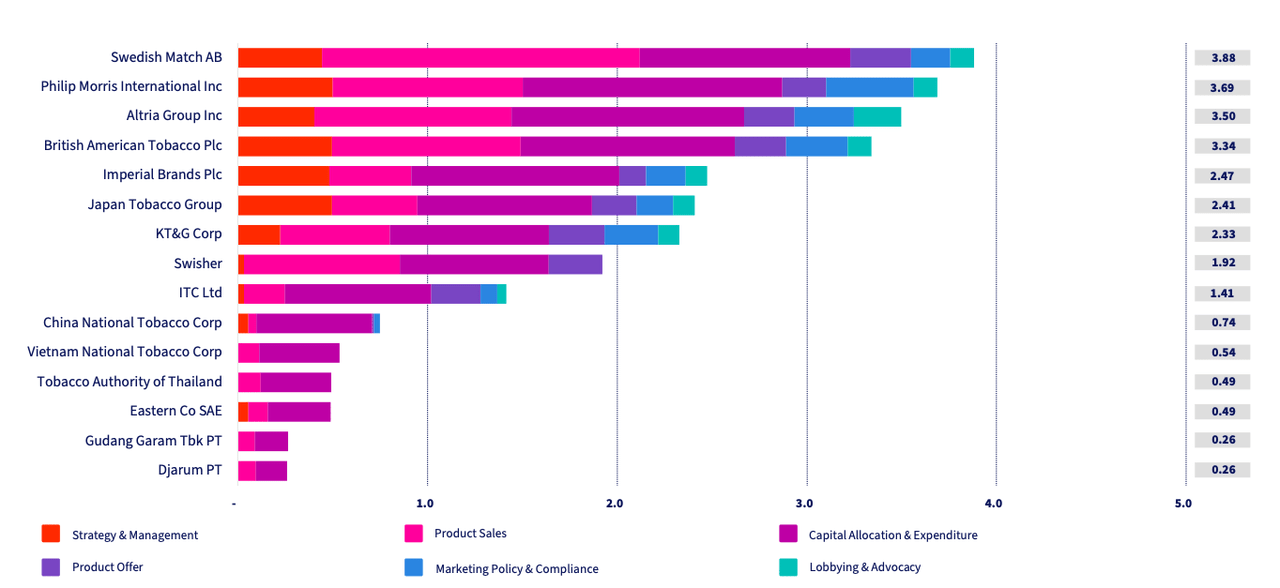

Tobacco Transformation Index was created to highlight the progress made by tobacco firms toward becoming “smokeless tobacco” firms. The index’ framework was developed by the Sustainability Accounting Standards Board and other ESG methodologies used in different sectors. Results are obtained by measuring progress overall, and in terms of strategy and management, product sales, capital allocation, product offer, marketing, and lobbying and advocacy. According to the 2022 ranking, British American Tobacco had the 4th-best overall results, out of the 15 tobacco firms across the world that produce 92% of the world’s cigarettes. The industry is still well behind its goals, with only Swedish Match AB, the Altria Group Inc. (MO), Philip Morris International Inc. (PM), and British American Tobacco being the only firms with a score out of 5 that is greater than 3. Nevertheless, capital allocation toward smokeless tobacco has risen across the board.

Source: Tobacco Transformation Index

Russell Investments believe that, as a result of the factors we have stated, the typical U.S. investor is underweight tobacco, with 50% to 70% of investors completely avoiding tobacco between 2003 and 2018. Globally, 50% to 75% of investors are underweight tobacco, with 36% to 62% completely excluding it. Yet, while investors have shied from the industry, of the of the 65 to 74 industry groups covered in the Russell 1000 and MSCI World Indexes, tobacco enjoyed the second to the third-highest returning industry in some periods, as well as the second to third-lowest performing in others, averaging out to the 11th or 12th best-performing industry under coverage. While tobacco is not essential to abnormal positive results, it has not performed badly despite a narrative of failure.

Impact Investing Matters

While exclusionary policies make sense, they are not the only way of engaging with ESG issues. Impact investing, by which investors seek transformation through engagement, is a legitimate and possibly more powerful way of achieving industry transformation.

Impact investing is made even more possible because tools such as the Tobacco Transformation Index are more accessible than they were in the past, and ESG pressure has forced firms to be more transparent about their ESG activities. Impact investors therefore have the information they need to judge a tobacco firm’s actions and to push for change. Therefore, investors should invest in so-called “dirty” industries if they have ESG goals, and seek to transform the industry from within.

Investors will be rewarded in investing in British American Tobacco, because capital will increasingly shift from those firms that are performing poorly from an ESG perspective, toward those that are doing well. British American Tobacco will gain a competitive advantage because of its initiatives in smokeless tobacco. As Larry Fink, the chairman and CEO of BlackRock, said in his 2020 Letter to CEOs:

Over time, companies and countries that do not respond to stakeholders and address sustainability risks will encounter growing skepticism from the markets, and in turn, a higher cost of capital. Companies and countries that champion transparency and demonstrate their responsiveness to stakeholders, by contrast, will attract investment more effectively, including higher-quality, more patient capital.

Although industry effects drive cost of capital, managers do have some impact on their company’s cost of capital, as Fink hinted at. Jack Bowles, British American Tobacco’s CEO, has done remarkably well since taking over in 2019, to continue and drive the company’s initiatives toward smokeless tobacco. Those efforts will add to the company’s ability to get a competitive cost of capital. As Fink said later in that letter:

In the discussions BlackRock has with clients around the world, more and more of them are looking to reallocate their capital into sustainable strategies. If ten percent of global investors do so – or even five percent – we will witness massive capital shifts.

British American Tobacco is the kind of company that will be able to benefit from shifts in capital and the pursuit of more sustainable models.

As the Foundation for a Smoke-Free World said:

Tobacco Free Portfolios, funded by Cancer Research UK, The Danish Cancer Society, and other supporters aims to reduce and ultimately eliminate investment in tobacco. Investors that do not wish to own tobacco company debt and equity are certainly free to do so. However, not all investors will make this choice. As a result, the act of selling (or not buying) an investment for non-financial reasons may only create a better buying opportunity for someone else. For example, a report by Wilshire Associates, the general investment consultant for The California Public Employees’ Retirement System (CalPERS), estimates that the pension system lost $3.581 billion in investment gains by divesting from tobacco stocks during a 17-plus-year period ending June 30, 2018. Deutsche Asset Management suggests that an investor agenda for tobacco, including both divestment and engagement strategies, may emerge, since divestment on its own is unlikely to change tobacco industry practices.

In sum, impact investing to achieve a smokeless tobacco world is something that investors should think about, even as the broader narrative cements the idea that exclusionary policies are best, with the foundation noting that:

A central point of contention across the programs relates to engagement with the tobacco companies, as reflected by the interpretation of Article 5.3 of the WHO Framework Convention on Tobacco Control. The STOP Global Tobacco Industry Interference Index report states, “Article 5.3 is regarded as the backbone of the Convention and its importance cannot be over-emphasised,” and the “tobacco industry must be denormalized.” To the extent Article 5.3 is interpreted to mean boycott and ban, it has paradoxically become an impediment to change, thereby perpetuating the status quo.

A Strong Position for the Future

Success in the new era in the industry will depend on each firm’s ability to innovate to earn and conserve attractive profits. The disruption of the industry is leading to a shift toward heated tobacco. According to the foundation’s 2021 Global Nicotine Trends report, British American Tobacco has 12.3% of the cigarettes market, 7.2% of the smoking tobacco market, and 14% of the heated tobacco market (where Philip Morris dominates with 78% of the market).

What we are seeing is a “creative destruction of the cigarette”, as Jacob Grier has called it, and British American Tobacco is the only real rival to Philip Morris in heated tobacco. The market was worth $20.8 billion in 2020, and although it remains small, at 2.4% of the global nicotine market, it is growing very quickly, as British American’s new categories results show. British American’s products are sold in just 20 markets, compared to Philip Morris’ IQOS system. As the company expands to new markets, it will increasingly challenge Philip Morris. As the two firms establish a duopoly, they will earn rich returns in this new market.

Valuation

The company is trading at a relative price-earnings multiple of 14.55, compared to the S&P 500’s PE ratio of 20.94. According to Aswath Damodaran’s data, the tobacco industry has an average PE ratio of 18.79. In addition, the company enjoys a FCF yield of 13.4%, compared to 1.5% for the 2,000 largest firms in the U.S. public markets, as measured by Nex Constructs. This implies a strong future stock price performance.

Conclusion

Despite an Armageddon scenario created around the tobacco industry, British American Tobacco has positioned itself to attract and conserve attractive performance as the market shifts toward the fast-growing heated tobacco markets. The firm has already shown strong underlying economics, and as a duopoly forms in heated tobacco, its underlying economics are poised to strengthen. The company is trading at a very attractive level, and is a good long-term bet.

Be the first to comment