djordje zivaljevic/E+ via Getty Images

Introduction

Whilst the international tobacco giant, British American Tobacco (NYSE:BTI) has sustained their dividends throughout the recent years, their growth has remained low and rather lackluster, which explains their high 6.90% yield. Thankfully when digging under the surface, this actually stands to improve within the medium-term given the hidden value in deleveraging, which could boost their dividends by 30% within the next five years.

Executive Summary & Ratings

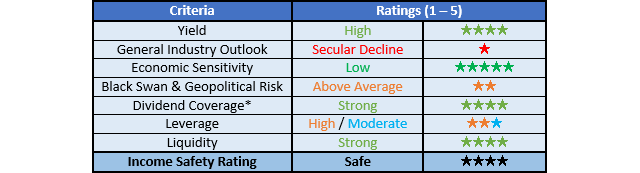

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing dividend coverage through earnings per share cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

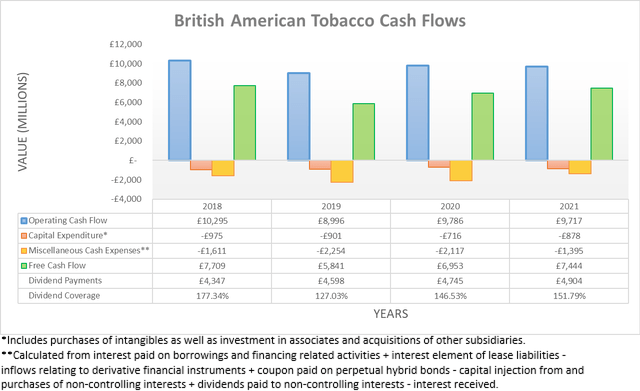

It would not be surprising for new investors to wonder why those focused on income often revere tobacco companies given the secular decline that tobacco demand faces in the long-term. The answer lies under the surface when looking at their strong and resilient cash flow performance that produces consistent free cash flow thanks to the inelastic nature of tobacco demand that allows price hikes to offset volume losses, whilst also defying economic conditions. Even though foreign currency exchange rates buffer their British Pound denominated earnings across the years, throughout 2018-2021 they have always covered their dividend payments with average coverage at a strong 150.68%, which leaves scope to fund significantly higher dividends in the future even without any earnings growth.

Their strong dividend coverage also provides scope for deleveraging in the meantime, as during 2021 they produced £2.54b of excess free cash flow after dividend payments, which as subsequently discussed, could boost their dividends significantly in the medium-term. Despite being a global company that operates in many countries and continents, thankfully they should not be significantly derailed by the tragic Russia-Ukraine war given their relatively low financial exposure, as per the quote included below.

“We now expect constant currency Group revenue growth of 2% to 4% and Mid-Single Figure constant currency adjusted diluted EPS growth. In 2021, Ukraine and Russia accounted for 3% of Group revenue and a slightly lower proportion of adjusted profit from operations.”

-British American Tobacco 11th March 2022 Announcement.

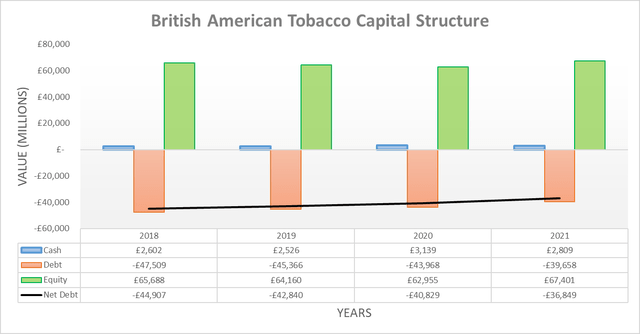

Following their acquisition of Reynolds American almost five years ago, their net debt swelled and even by 2018 it was still a massive £44.907b, which created concerns for investors since very large acquisitions can often backfire. Thanks to their strong and resilient cash flow performance, they provided an example of how to successfully integrate two large companies whilst still rewarding their shareholders by avoiding dividend reductions with their net debt now falling to £36.849b by the end of 2021. Even though this remains formidable on the surface, their circa £2.5b per annum of excess free cash flow after dividend payments should see it continue trending lower. In fact, after another five years this would aggregate to a very impressive circa £12.5b and reduce their net debt by approximately one-third to a less formidable £24.35b, thereby revolutionizing their financial position.

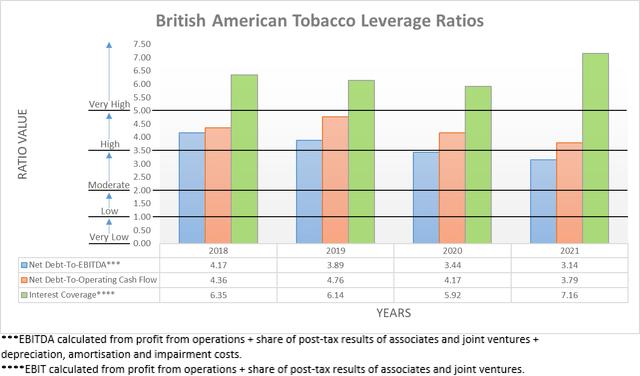

Quite unsurprisingly, their steady net debt reductions and resilient financial performance translated into their leverage steadily reducing in tandem with their net debt-to-EBITDA now down to 3.14 at the end of 2021. Apart from now residing within the moderate territory of between 2.01 and 3.50, this also marks a sizeable improvement versus their three previous results from the ends of 2020, 2019 and 2018 in particular, which at the time saw a result of 4.17. Meanwhile, their net debt-to-operating cash flow also saw improvements and whilst its result of 3.79 at the end of 2021 still remains slightly into the high territory of between 3.51 and 5.00, thankfully this is merely towards the bottom of the range and should fall into the moderate territory within the coming year as their net debt is further reduced. Regardless, this does not necessarily pose any material risks given their strong and resilient cash flow performance, especially when combined with their interest coverage of 7.16 that indicates no stress servicing their debt.

When looking ahead, their prospects to reduce their net debt by approximately one-third during the next five years stands to boost their dividend prospects in two ways, as previously hinted. The first and most direct way stems from boosting their free cash flow because despite 2021 seeing their lowest net interest expense in their recent history since at least 2018, it nevertheless was still £1.488b and thus equated to circa 30% of the cost to fund their £4.904b of dividend payments. If they reduce their net debt by approximately one-third, it should theoretically see their net interest expense also decrease by one-third, thereby releasing another circa £495m that can be directed towards dividend payments and as a result, booting them by around 10%.

The second and less direct way stems from the impact on their financial position and their possible resulting capital allocation strategy. If their net debt is reduced by one-third as estimated, their leverage would tumble lower even without any earnings growth, which based upon their results for 2021 would see their net debt-to-EBITDA and net debt-to-operating cash flow sitting at 2.08 and 2.51 respectively. Since this would be approaching the low territory of between 1.01 and 2.00, it seems reasonable that management would increase the relative size of their dividends proportionally to their earnings, as there would be less requirement to retain such a significant portion of free cash flow for deleveraging. If they were to boost their £4.904b of dividend payments by 20%, they would equal £5.885b and thus still leave circa £1b of excess free cash flow against their average free cash flow of circa £7b during 2018-2021.

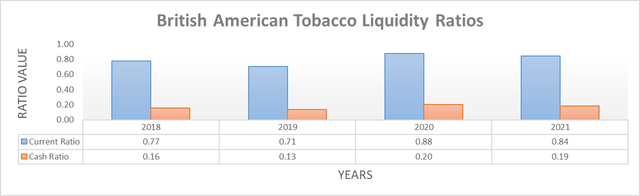

When moving onto their liquidity, thankfully their current and cash ratios ended 2021 at 0.84 and 0.19 respectively, which are broadly in line with their usual results from previous years and warrant a strong rating. Since the resilient nature of the tobacco industry provides consistent free cash flow, their liquidity should not erode materially going forwards, especially given the only minimal impact on their earnings from the Russia-Ukraine war. Unlike a small company, as a very large company with these desirable fundamentals, they should always be able to source liquidity if required to refinance debt maturities for the foreseeable future, even if central banks tighten monetary policy.

Conclusion

When combining both the avenues for deleveraging to boost their future dividends, shareholders could see their dividends 10% higher at minimum, if not even 30% higher after five years even without any future earnings growth. Whilst the prospects for circa 20% dividend growth at the midpoint may not sound too exciting, it should be remembered that they are a very large company in a very mature industry and thus as a result, I believe that a strong buy rating is appropriate as the hidden value in deleveraging stands to boost their sleepy low growth dividend in the medium-term.

Notes: Unless specified otherwise, all figures in this article were taken from British American Tobacco’s Annual Reports, all calculated figures were performed by the author.

Be the first to comment