Adene Sanchez

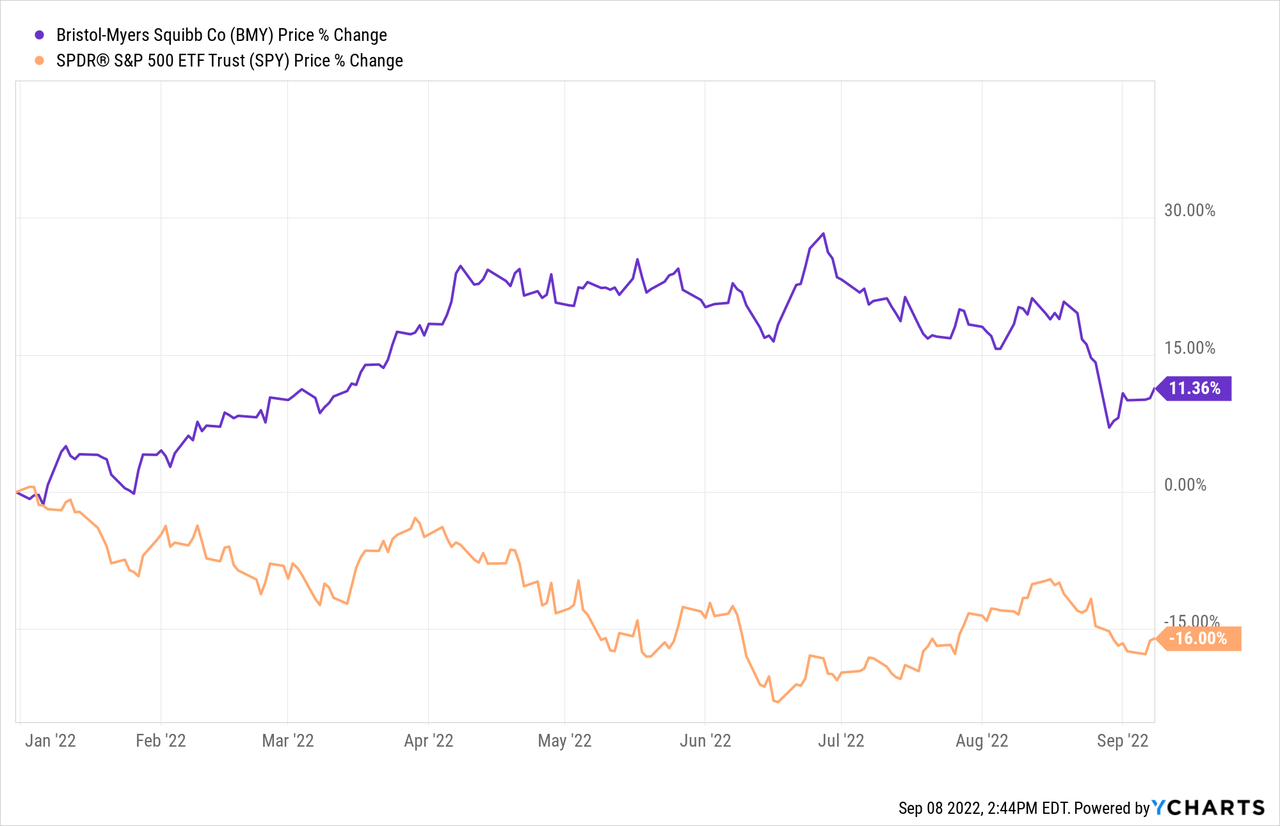

Bristol Myers Squibb (NYSE:BMY) was definitely a great stock to own in the last months. It needed two years for investors and a rising demand for safer heavens to notice this pharmaceutical company. While the S&P 500 (SPX) is still in bear market terrain, shares of Bristol Myers Squibb continued its strong momentum which it had built up in November 2021.

Since the low the stock rose nearly 50% until June which is impressive for such a large pharma stock especially in this macro environment. As shown in the chart below, Bristol Myers had a strong negative correlation to the S&P500 which makes it a strong addition in a usual portfolio to reduce volatility.

But there is also shown, that the stock showed some signs of weakness in the last weeks related to some financial news and pipeline updates. Investors might be concerned if it is time to sell their profits or if it is just a little overreaction. I will therefore put the news of the last few weeks into a fundamental context below.

Pipeline Updates

Since my last update on Bristol Myers Squibb in February, there have been several developments to watch in the pipeline. Progress in this area is currently particularly important for the company to offset the declining sales of Revlimid, Abraxane and soon Pomalyst. A long-term plan for this was drawn up some time ago, but the necessary approvals must also be obtained.

For example, the approval of the combination of Nivolumab and Relatlimab to treat advanced melanoma was important. It is sold under the name Opdualag and already laid a convincing result for the start with a start of $58 million in the 2nd quarter. Management expects Opdualag to reach a sales peak of $4 billion. Therefore, the initial registration of the product in the U.S. market is an important milestone, but some registration extensions are needed in the coming years to realize the sales potential.

Another important milestone going forward was the approval of Mavacamten, which was given the product name Camzyos. This was important because it was the main reason for Bristol Myers Squibb to acquire MyoKardia for $13 billion at the end of 2020. Accordingly, the failure of the compound in Phase 3 would have been a disaster for the company and confidence in further M&A transactions.

Camzyos is thus the only approved compound on the market that specifically targets the cause of hypertrophic obstructive cardiomyopathy. Here, too, the company anticipates a combined sales potential of $4 billion, including some approval extensions.

In addition, there was a successful label expansion for Breyanzi in Europe and the U.S. for Relapsed or Refractory Large B-cell Lymphoma After One Prior Therapy, as well as two additional approvals for Opdivo and some encouraging phase 2 trial results for Deucravacitinib. Thus, many major milestones have already been achieved in the first half of the year. Most recently FDA approved Sotyktu (Deucravacitinib) as an oral treatment for adults with moderate-to-severe Plague Psoriasis which is also great news. But now to the negative news.

In my last analysis, I highlighted Bempeg, among others, as a great hope for a Nex gene successor to Opdivo. Unfortunately, the phase 3 trial results were disappointing in all areas studied and the project in collaboration with Nektar (NKTR) was terminated.

The next setback had a significant impact on the share price. The company presented phase 2 trial data on blood thinner Milvexian, which was weaker than expected. According to Bristol Myers Squibb and partner Janssen, the primary objective was missed. However, there were some encouraging results and the two companies decided to move on to Phase 3.

However, the stock reacted with a significant 5% discount. The two setbacks impact the potential of the mid-term pipeline, but the key approvals and progress have been made, so I remain confident with their pipeline.

Financial Update

In February, my estimate for the fiscal year was $47.2 billion, which was within the company’s guidance of $47 billion. But already in the first quarter of 2022, management adjusted the forecast down to a level “In-Line” with 2021″. Accordingly, the new target is around $46.5 billion. This is somewhat disappointing, as management was previously extremely confident that it would be able to continue to grow even after the discontinuation of Revlimid.

The fact that this target is already being discarded in the first quarter of the generic competition, at least for 2022, somewhat squanders investor confidence. While sales of Revlimid and Abraxane were expected to reach $10.5 billion in 2021, the new estimate for Revlimid is $9-$9.5 billion, and it is highly unlikely that Abraxane will achieve sales of one billion in 2022.

Accordingly, the generic counter-widening for Revlimid appears to be somewhat stronger than anticipated. At least the outlook was not lowered again in the second quarter, which is an encouraging sign for now.

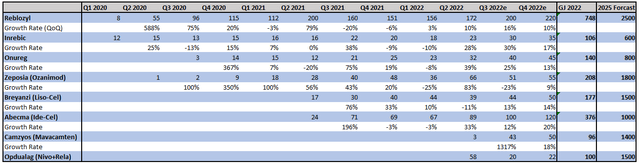

In my view, another reason for the cautious outlook is the somewhat sluggish sales development of the new product line. Here is an overview of the products approved since 2020:

Bristol Myers Squibb Quarterly Reports, Author´s Calculations

At first glance, the developments look quite appealing given the high growth rates. However, one has to take into account the low comparison bases and also the growth targets that the management has set for the products. For example, Reblozyl got off to a strong start in 2020 but has lost massive momentum since Q2 2021 at a level of $200 million.

This is somewhat surprising given that 2025 sales are expected to be $2.5 billion and, according to management, as high as $4 billion in 2029. A similar situation can be observed at Inrebic, Onureg, and Breyanzi. Positive exceptions here are only Zeposia and Abecma. Overall, sales of the new pipeline were just $450 million in the second quarter. It is up to the management to prove in the coming quarters that the $10-13 billion by 2025 forecast for these products is still realistic or whether they were too optimistic.

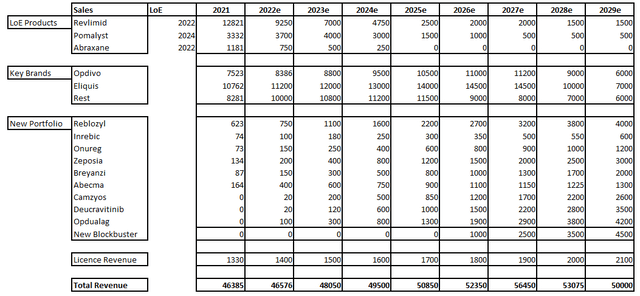

In any case, I have become a bit more cautious with my estimates in the short term as well as somewhat in the medium term. This is reflected here in my overview of the next few years:

Valuation Update

Despite the reduced estimates, Bristol Myers Squibb remains quite attractively valued. The price/sales ratio of 3.2 remains close to historical lows while the expected P/E of 9 is also far from a high valuation. A slightly better overview is provided by the discounted cash flow model. I have calculated the following assumptions.

- Sales development until 2029 as outlined above

- Average free cash flow margin of 34%.

- Shares outstanding to 2.000 million considering share buybacks

- WACC 9%

- Terminal growth rate 0%

These assumptions bring me to a fair value of $107, which represents a potential upside of 55% from current levels. This is quite attractive considering that I have made fairly conservative assumptions. In addition to the share buyback programs, we can expect substantial dividend increases in the coming years. For these reasons, I consider Bristol Myers Squibb to be very attractively valued.

Bottom Line

Bristol Myers Squibb’s stock has been one of the winners so far in a challenging year and a weak market environment. This speaks to a robust business model and a certain resilience to external factors. There have already been some milestones in the form of positive trial data and approvals, which should secure the company’s medium-term revenues.

However, there have also been two disappointments, which, together with a cautious outlook, have caused some caution among investors. Management will need to prove the sustainability of its growth strategy through 2029 in the coming quarters.

Nevertheless, the stock has already anticipated some risks and disappointments here, which is why I consider it an attractive buy, even taking into account the share buybacks and the rising dividend.

Be the first to comment