The Good Brigade/DigitalVision via Getty Images

Investment Thesis

The value of US pharma Bristol Myers Squibb’s (BMY) stock has decreased by -2% over the past 12 months after building some real momentum last year, reaching a price of $69 by late August, the share price fell back to $54 in mid-December, but has recovered to $65 at the time of writing.

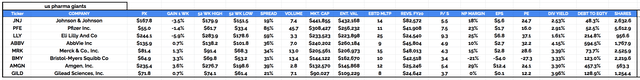

The pharma currently has a market cap of $144bn, making it the sixth-largest of what could loosely be termed the “Big 8” US pharma firms.

major US Pharmas compared.

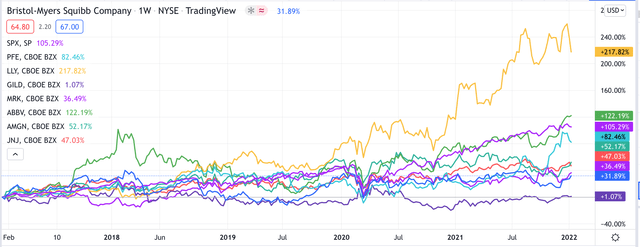

Pharmas have made for steady, if unspectacular, investments over the past five years, as shown below:

share price growth of major US Pharmas compared

All eight of the pharma on my list pay a dividend, with Bristol Myers’ paying $0.54 per share per quarter – or $2.16 per annum – and yielding 3.33%, putting it in the middle of the pack.

Although Bristol Myers’ share price may not have budged much over the past five years – up 32%, compared to the S&P 500’s ~103% gain over the same period, and nowhere near sector leader Eli Lilly’s (LLY) >200% gain – much has changed at the company, and arguably, the Pharma has never been better positioned for success as it is in 2022.

When acquiring Celgene in a $74bn deal back in 2019, Bristol Myers’ management team showed that they were prepared to take a few steps back – taking on substantial levels of debt and inheriting two best-selling drugs in Revlimid (>$12bn per annum in 2020) and Pomalyst (>$3bn per annum) that were close to their patent expiration dates – in order to make a major step forward.

That’s because, besides the $15bn per annum revenue stream from Revlimid/Pomalyst, approved for blood cancers and multiple myeloma respectively, Bristol Myers’ inherited a very valuable collection of pipeline assets, which management has adroitly guided towards commercialisation.

Reblozyl is now approved for treatment of adult patients with beta thalassemia who require regular red blood cell (RBC) transfusions and certain types of patients with anaemia caused by a group of bone marrow disorders called myelodysplastic syndromes (“MDS”), a potentially explosive market which could see the drug achieve peak sales of $2 – $4bn.

Inrebic – a JAK2 inhibitor approved for treatment of Myelofibrosis and Polycythemia Vera – is seen as a $400m peak seller while Zeposia, in autoimmune conditions including Multiple Sclerosis (“MS”), where it’s already approved, and potentially Crohn’s Disease (“CD”) and Ulcerative Colitis (“UC”) in which it’s in late stage trials, as a $3bn opportunity.

The final 2 Celgene legacy assets that BMY believes can be the difference makers that ensure the company’s revenues grow even as its other drugs face loss of exclusivity (“LOE”) and falling sales are Breyanzi and Abecma.

Breyanzi is a CAR-T therapy approved for treatment of large B-cell lymphoma, with a list price of $410k and peak sales estimate of ~$3bn, and Ide-Cel/Abecma is now approved for treatment of patients with relapsed or refractory Multiple Myeloma, with a list price of $419,500 and peak sales expectation of ~$1bn.

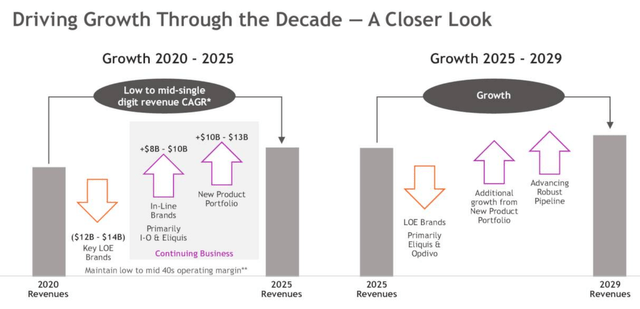

Bristol Myers Squibb targets growth in 2020s

As we can see above, Bristol Myers’ management has been quite explicit when it comes to showing how the company can continue to grow revenues – initially by low- to mid-single digits, and perhaps a little faster in the second half of the decade – even as it loses an estimated $12 – $14bn in revenues from assets that will go off patent.

By 2029, BMY believes that it will have created >$25bn in new revenue streams from its current product portfolio and pipeline.

Opdivo – its highly successful immune checkpoint inhibitor (“ICI”) which made $7bn of sales in 2020 – and more recently approved Yervoy – which targets CTLA-4, a protein receptor that downregulates the immune system – are expected to add another $8-$10bn of annual sales alongside Eliquis, Bristol Myers blood-thinning treatment that is jointly marketed with Pfizer (PFE).

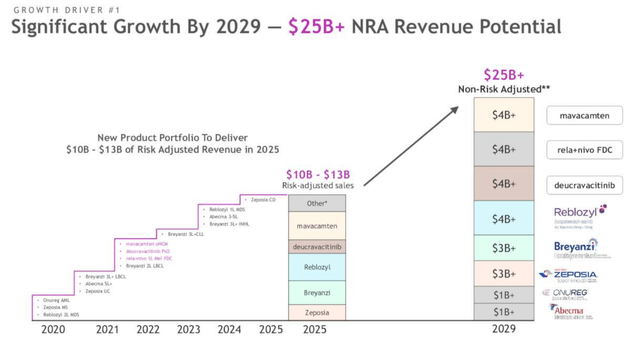

How Bristol Myers plans to drive additional revenue from portfolio and pipeline products.

As shown above, Bristol Myers appears to be very confident that its products and pipeline will succeed better than ever before this decade.

Besides the Celgene assets, the company believes it can earn ~$4bn in peak sales from Mavacamten, its cardiomyopathy therapy that faces a first approval decision by the FDA on Jan. 28 – an important date for BMY investors that ought to lift the share price, given that Mavacamten – a myosin inhibitor acquired as part of a $13bn acquisition of MyoKardia last year – appears to be well-tolerated and displaying statistically significant efficacy in trials.

Relatlimab – another drug targeting immune checkpoint inhibition as a LAG-3 inhibitor that can be used in combo with Opdivo – and Deucravacitinib – an orally administered Tyk2 inhibitor pushing for approval in Psoriasis, with a decision date in September – are also both viewed as ~$4bn selling assets by BMY.

The charts produced by BMY management that “go up and to the right” – outlining a pattern of steady growth and portfolio regeneration – will certainly put smiles on the faces of its investors, but can they be relied upon?

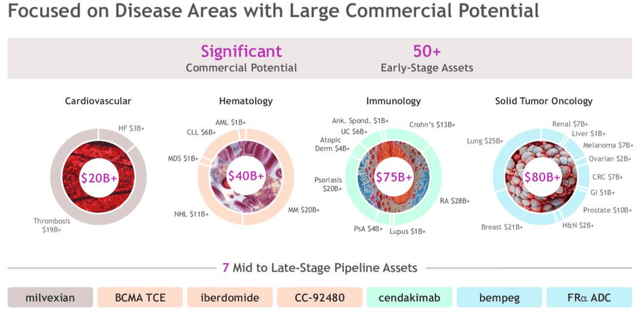

Although it should be noted that the peak sales opportunities highlighted above are speculative in nature – given the level of competition from other major pharmas that all of these drugs face – the pharma’s presence in four major markets, as shown below, with the corresponding earnings opportunities – makes Bristol Myers look well balanced, and ready to contest at the top level in multiple therapeutic areas for years to come.

Bristol has a strong presence in 4 key markets

Is it all good news looking ahead for Bristol Myers’ investors? As discussed, BMY has tended to target mainstream markets, and although it has led to success for the company, arguably, the pharma does not stand out in any particular field like, say, AbbVie does in auto-immune thanks to its $20bn selling Humira, or Eli Lilly (LLY) in diabetes, or formerly Gilead (GILD) in HIV, or more recently, Pfizer in mRNA.

Pfizer’s share price has gained by 40% across the past six months as firstly it has recorded $36bn in sales from its mRNA COVID vaccine co-developed with BioNTech (BNTX) – which received 50% of all revenues – and more recently, its development of Paxlovid, the antiviral COVID therapy that may reduce risk of hospitalization by >80%.

Eli Lilly’s share price has gained 30% in the last year thanks to a flagship Alzheimer’s program (which may or may not make it through a rolling NDA process) and it could be argued that Bristol Myers’ lack of a flagship asset or program has been responsible for a lack of share price gains.

Bristol Myers has made numerous big bets on drugs that it hopes can bring $25bn in new revenues to the company – which is an exciting challenge, but not one that seems to have grabbed investors’ attention and seen the investment floodgates open.

BMY generates very impressive cash flow, however – management estimates it will bring in $45 – $50bn between 2022 – 2024 – while recently upsizing a share buyback program by 45% and promising to buy back $6.4bn of shares.

That has helped boost the share price in the past few weeks, but even this may not be sufficient to generate the sort of value appreciation that shareholders have been patiently waiting for.

In my view, Bristol Myers’ best hope of finally earning the valuation its cash flow deserves (in previous notes I have argued for a share price target of $100) would be to attain a genuinely leading position in a genuinely progressive area of drug development – and in 2022, I believe that could be in cell therapy.

Why the Century Partnership Matters

Century Therapeutics (IPSC) is an $819m market cap biotech that completed a >$200m IPO in July this year, and a cell therapy specialist, with its own manufacturing facility, ~160 employees, a small portfolio of discovery stage drug candidates, and post-IPO, >$400m of cash.

Some of that cash has been received from Bristol Myers which wasted no time striking a deal with the company “to develop and commercialize up to four induced pluripotent stem cell (IPSC)-derived, engineered natural killer cell (iNK) and/or T cell (IT) programs for hematologic malignancies and solid tumors,” according to a press release.

Bristol’s two approvals for cell therapies last year – Abecma and Breyanzi – catapulted the pharma into the heart of the cell therapy industry, where there’s little competition in commercial markets currently, despite the enormous promise of this field of research.

In the cell therapy space, only Gilead Sciences’ (GILD) Yescarta and Tecartus – approved for various types of B-cell lymphoma and mantle cell lymphoma (“MCL”), respectively, and Novartis’ Kymriah have really made an impact on cancer markets of any kind, generating peak sales of just over $500m, $120m, and $444m in the first 9 months of 2021.

That’s a poor return for such a promising therapy – after all, Gilead paid $12bn to acquire Kite Therapeutics, a CAR-T cell therapy specialist, in 2017, while Kymriah was first approved in 2017. However, Bristol Myers may be coming to the market with Breyanzi and Abecma at just the right time, and with a better safety and efficacy record, that could trigger new approvals and open up lucrative new markets.

In June, Bristol Myers published data from trials of Breyanzi in second line B-cell lymphoma, showing how it had outperformed a physician’s standard of care choice in terms of event-free survival, complete response rate and progression-free survival.

Breyanzi is far from perfect – it comes with a Black Box warning from the FDA for Cytokine Release Syndrome – a potentially deadly side effect of cell therapy use – but a win against a standard of care therapy could signify that cell therapy is here to stay, and meanwhile, demand for Abecma has apparently been very strong, with bespoke manufacturing the only thing holding the drugs’s sales back, management claims.

It seems as though, with Abecma and Breyanzi, and now with its Century partnership, leadership in the cell therapy market beckons for Bristol Myers, and if cell therapies can succeed in earlier stage treatment settings, this ought to prove to be a highly lucrative business to be in.

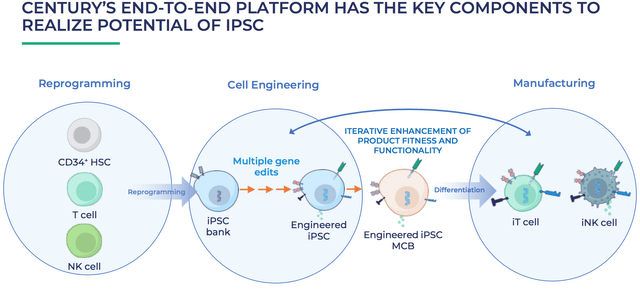

Century optimises cell therapy development process

As we can see, Century’s platform will allow Bristol Myers to take another step forward, targeting three different types of cell engineering – t-cells, natural killer (“NK”) cells, and CD34-expressing stem cells.

Century’s cells are designed to evade the “three major pathways of host rejection” i.e. the ways a patient’s body can refuse to accept the engineered cells when they are re-introduced to the body, leading to problems such as CRS of graft vs host disease – and overcoming these types of safety issue whilst making the manufacturing process safer and faster are the key ways to win in cell therapy.

$3bn in biobucks potentially on the table for Century

By the terms of its agreement with Bristol Myers, Century could earn a potential $3bn if it meets all development and commercial milestones.

Bristol Myers has so far paid $100m upfront and made a $50m equity investment into Century and will target both blood cancers and solid tumors through the partnership, with an initial focus on acute myeloid leukemia and multiple myeloma according to sources. Century will fund the discovery process, with Bristol Myers taking on the costs of clinical and commercial development.

The deal appears to be structured so that the impact of failure on either company is marginalized, although if things go well, the prospect of Bristol Myers making a bid for Century cannot be ruled out.

Century’s shares have generally performed poorly, falling from a peak of $32 in August to just over $15 at the time of writing, and with its low market cap valuation, it may not cost the pharma much more than $2bn – $3bn to take Century and its technology in-house – which when compared to Gilead’s deal with Kite, appears to make good business sense.

With its prowess in both hematological and solid tumor cancers, there ought to be much that Bristol Myers can do for Century even if does not acquire it, helping the biotech fine-tune its tech platform and allowing it to allocate R&D funds elsewhere, such as submitting Investigational New Drug (“IND”) applications for CD-19 and glioblastoma (brain cancer_ targeting assets this year and in 2023.

Conclusion – What Price Bristol Myers and Century to be the Pfizer and BioNTech of 2022?

Unfortunately, that’s an unrealistic comparison – BMY and IPSC will not even release a product in 2022, and perhaps not until the middle of this decade – but that does not mean the partnership can be overlooked.

Bristol Myers’ achievement with Abecma – outperforming a standard of care as a second-line therapy – is significant, and underlines what an important form of treatment cell therapy can become – as do the improved safety profiles being developed by the likes of Century and its platform.

Bristol Myers believes it has ~$4bn in peak sales potential from Breyanzi and Abecma, but if, like e.g. Yervoy, the cell therapies can work in combo with e.g. Opdivo, or new ones be developed, then the market potential of the pharma’s cell therapy division may be more like $10bn than $5bn going forward.

In fact, some sources believe cell therapy will be a near $50bn market by 2027, which is equivalent to the auto-immune / inflammation sector in value.

As discussed earlier, Bristol Myers has made some bold bets and forecasts about the revenue growth it can achieve across the rest of the decade, and we will find out a great deal about whether those forecasts are accurate in 2022, with Mavacamten’s PDUFA date in January, and Deucravacitinib’s in September, and with share buybacks to complete.

These types of wins ought to help Bristol Myers grow its valuation during 2022, but I feel that what the company needs to really seal the triple-digit share price that I feel the Pharma deserves is dominance in a field of its own.

That’s why I will be watching the progress of the Century deal and the sales figures from Breyanzi and Abecma as closely as anything this year when it comes to BMY.

In fact, so long as BMY shares trade below $70 I will consider continuing to build my position in the company, and so long as Century as a company is valued <$1bn, I may consider investing in this stock also – cell therapy is competitive, but Bristol Myers brings a lot to the table, and Century, although one of a large number of early-stage cell therapy biotechs, looks to have the missing pieces the Pharma will be searching for.

I’m hopeful that together, the value of Bristol Myers and Century together adds up to considerably more than the sum of their parts and will become recognized as a partnership that is front-running the future of cell therapy and its quest to penetrate mainstream treatment fields opening up potentially double-digit billion markets.

Be the first to comment