ajaykampani/E+ via Getty Images

Investment thesis

Back in October 2021, Brinker International, Inc. (NYSE:EAT) unveiled its long-term growth plan to invest in technology and grow its virtual brands.

The growth of the virtual brands is fuelled by a shift in people’s preference for getting the food delivered at home and rapid growth in the ghost kitchen concept (a set-up to prepare delivery-only meals).

The company owns two virtual brands – It’s Just Wings and Maggiano’s Italian Classics – having a TAM of $6.5 billion and $7 billion respectively. These virtual brands enable the company to efficiently use the additional space in the company-owned restaurant kitchen to prepare and fulfill online orders from virtual brands. This, in turn, aids the company to generate incremental revenues and improve margins without any significant capex. Beyond leveraging its existing asset base of 1000 plus kitchens, the company is also planning to open ghost kitchens in the newer as well as existing market. Additionally, the company is diversifying into other third-party partners to deliver orders related to virtual brands. The company has also tagged all its Chili’s across the country as “It’s Just Wings” locations in order to increase its (It’s Just Wings) brand awareness. It has also developed a transaction widget together with Google to allow people to order food directly from Google maps. As a result of these initiatives, the company expects to generate ~$300 million to ~$400 million in annual revenue from virtual brands in the next 2-3 years. Given the expansion of virtual brands combined with management’s commitment to open 2-3 new restaurants on average every month moving into fiscal 2023, the future outlook of the company looks promising.

Moreover, the fully implemented service model should enable the company to enhance the customer experience as well as attract new customers to the restaurant. Besides, it should also aid the company in smoothening out the restaurant operations along with bringing down the staff turnover numbers and saving some cost on the training front.

Although the long-term growth story remains intact, the macro-headwinds related to the interest rate hikes and supply chain disruptions should weigh on the company’s capability of generating incremental revenue and improving margins. In May 2022, the CPI index rose 8.6%. Increasing inflation along with interest rates hike can negatively impact the customer’s demand for dining out or ordering food online. Additionally, as noted by the management, the beef and chicken prices, which constitute a significant portion of food costs, have been rising due to supply chain constraints more than inflation. The worsening of the supply chain could lead to a further rise in prices of chicken and beef, hence impacting operating margins. However, I believe, with the stock trading at just 8.15x FY22 earnings, these concerns are already getting priced in at the current levels. Moreover, these concerns are mostly short-term in nature while the longer-term growth story is very attractive. Hence, I believe the stock is a good buy at the current levels.

Last Quarter Earnings

Brinker International, Inc. posted the Q3 results with revenue of ~$980.4 million beating the consensus estimate of ~$979.77 million and growing ~18.34% Y/Y. Same-store sales increased ~13.5% Y/Y while adjusted EPS increased ~17.95% to $0.92 versus the consensus estimate of $1.02. The company’s restaurant expenses as a % of sales increased 169 basis points to ~87.81% primarily due to 180 basis points increase in Chili’s restaurant expenses as a percent of sales. These increases were partially offset by sales leverage for Maggiano and favorable menu pricing for both Chili’s and Maggiano’s. Net income for the fourth quarter increased ~13.73% to ~$41.4 million from ~$36.4 million in the same quarter last year.

Long-term growth initiatives

During the last Investor Day held in October 2021, the company unveiled its long-term growth strategy to invest in technology and grow its virtual brands.

We expect the company’s delivery business to continue growing in the near to medium term. According to management, the meal delivery market grew by 20% Y/Y in 2021. Besides, the concept of ghost kitchens is also rapidly growing. According to Statista, the ghost kitchen market size is expected to grow from $43.1 billion in 2019 to $71.4 billion by 2027 (or ~65% growth). These trends are the main reasons fuelling the idea of virtual brands.

As of now, the company’s owns two virtual brands – It’s Just Wings and Maggiano’s Italian Classics having a TAM of $6.5 billion and $7 billion respectively. These virtual brands enable the company to utilize the additional spaces in the company-owned restaurant kitchen in order to prepare and fulfill orders relative to virtual brands without having to make any significant investments. The company is looking forward to leveraging its large base of 1,000-plus kitchens to support the growth of its virtual brand strategy, thereby improving sales and operating margins. Beyond capitalizing on its existing asset base, the company is also testing ghost kitchens in new markets.

Virtual brands TAM (Brinker International’s 2021 Investor day)

DoorDash (DASH) has been an important piece in increasing brand awareness and serving as a sales channel for virtual brands so far. However, now, the company is also diversifying into other third-party delivery partners. To strengthen the presence of its virtual brands, EAT has tagged all its Chili’s across the country as It’s Just Wings locations. Now when someone searches in Google in the mapping section, he/she finds a physical location for It’s Just Wings which helps in the search engine optimization area. It has also built a transaction widget together with Google that allows people to order from It’s Just Wings directly on Google Maps.

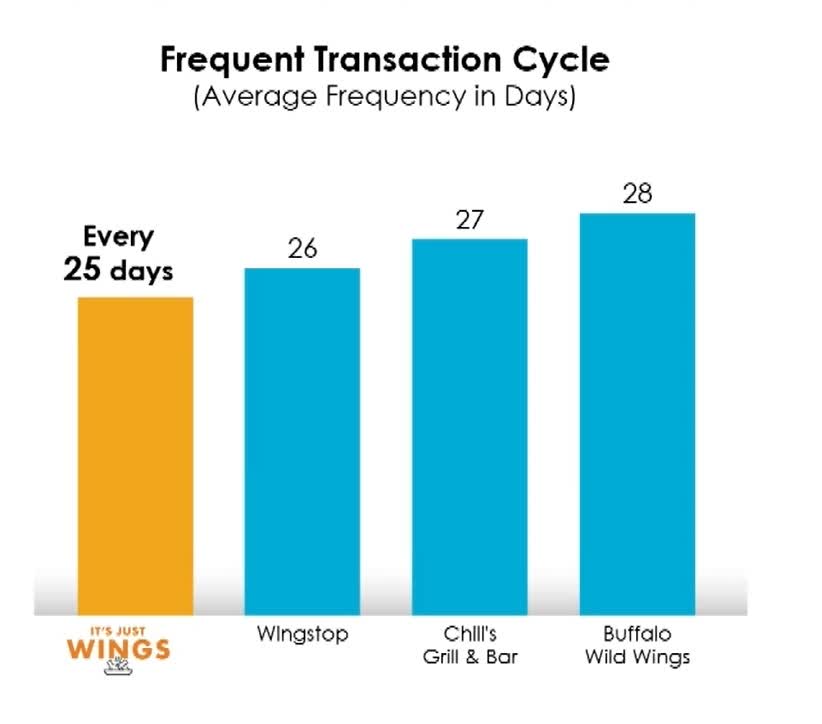

Looking at the frequency transaction data, the next transaction by a customer, who previously ordered from It’s Just Wings, usually occurs in ~25 days. This is better than other leading restaurant players like Wingstop (WING) and Buffalo Wild Wings. Also, It’s Just Wings generated ~$170+ million in US system-wide sales in the first year. This is reflective of the fact that the company has well-executed its virtual brand growth strategy so far. In the next 2-3 years, the company expects to generate ~$300 million to ~$400 million in annual revenue from virtual brands.

Frequent transaction cycle (Brinker International’s 2021 Investor day)

Management also expects to open 2 to 3 new restaurants every month moving into fiscal 2023. Given the expansion of virtual brands combined with management’s commitment to open 24-36 new restaurants in FY23, the future outlook of the company looks promising.

Additionally, the fully implemented service model should help to enhance customer experience along with improving operational efficiencies. This new model enables the servers to take orders using handheld devices and quite often even before the servers leave the table, the drinks are served. The new system creates an improved order flow to the kitchen which prevents stacking food orders, and flooding the kitchen all at once, thereby, improving efficiency. The new model simplifies the work process for the restaurant staff and helps the company to retain them to stay for longer periods. As a result, staff turnover numbers are likely to decrease which should aid the company in saving some costs on training new recruits.

The company is also leveraging robotics technology to reduce its dependency on the human workforce and complete a particular task in a more efficient way. Moving forward with this initiative, the company introduced its robot Rita, which functions as a food runner, in additional 50 restaurants in the recent quarter.

The company is also looking to upgrade the kitchen for the first time in close to 10 years. It has been testing some new equipment to deliver better products in a more efficient way and support high volumes.

As a result of these long-term growth strategies, I expect, the company should be able to generate incremental revenues while improving margins in the coming future.

Valuation and conclusion

The stock price is trading at ~8.15 times the fiscal 2022 consensus EPS estimate versus its 5-year average adjusted P/E (FWD) of ~13.64x. The company’s long-term strategy to invest in technology and expand its virtual brands looks promising. However, a potential negative impact of interest rate hikes and supply chain woes are causing investors to be cautious. I believe most of the negatives are already getting priced in at the current valuations and long-term investors can consider buying the stock.

Be the first to comment