Nataliia Tymofieieva/iStock via Getty Images

The pandemic has hit childcare and early education service provider Bright Horizons Family Solutions Inc. (NYSE:BFAM) particularly hard, but recent signs indicate a return to organic revenue growth and margin resilience ahead. BFAM’s revenue trends should be supported by tuition rate increases and a return to pre-COVID full-service childcare center occupancy rates by 2023, while EBITDA margins look set to continue expanding on the back of operating leverage and cost efficiencies. Plus, BFAM has an impressive M&A track record, so future tuck-ins should help it capitalize on greenfield opportunities within employer-sponsored childcare and adjacent services.

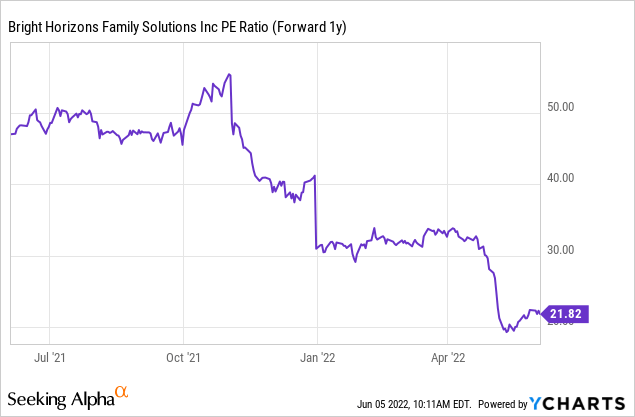

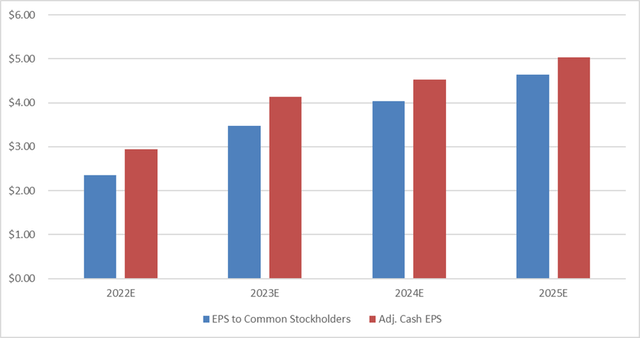

Relative to the post-IPO valuation range and the double-digit medium-term earnings growth potential, the current ~22x fwd P/E screens favorably. As BFAM regains its momentum post-COVID and returns to its historical financial algorithm in the coming quarters, I see a clear re-rating path for the stock.

A Sticky Business Model Hitting The COVID Road Bump

The BFAM business model is built around multi-year employer sponsorship contracts, with employers typically funding the development and operational costs of full-service childcare centers through operating subsidies. Thus, the BFAM model benefits from low capital intensity and covered facility maintenance, as well as a ‘sticky’ customer base. The latter is key – at >95% retention, BFAM has the leeway to focus more on quality of service than price, granting it the pricing power to protect margins through the cycles.

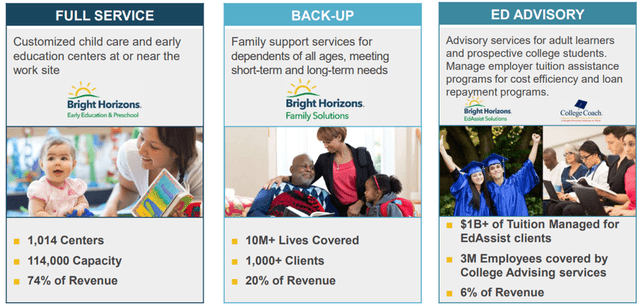

In addition to full-service centers, BFAM also provides access to a backup care network and educational advisory support, making it an essential part of the daycare provider value chain.

That said, the pandemic has taken a toll on the business, and the shift toward remote working/’work-from-home’ has led to concerns about a structural shift in the BFAM model. Compounding investor concerns was the lack of price increases in 2020 (pre-pandemic pricing generally ran at +4%).

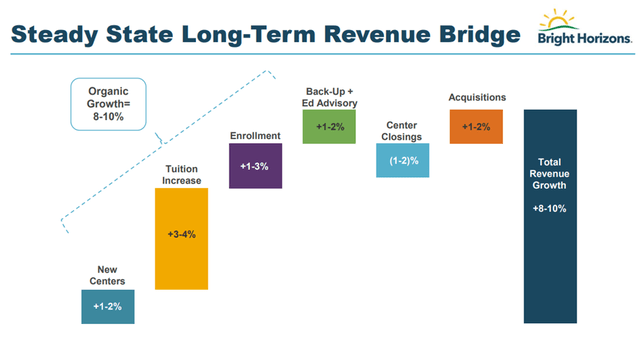

There are recovery signs emerging, though, as 2021 pricing ran at 4-4.5%, with 2022 set for a 5-6% increase. While this year’s 5-6% price increase will likely not fully offset the effects of inflation (mainly labor, which comprises ~70% of daycare costs), the post-pandemic return to the office could allow for a more significant step up in pricing. BFAM likely will hold off on pricing more aggressively to get enrollment in for now, but as things settle down over time, I see ample room to offset the labor cost headwinds.

Emerging Signs Of A Broad-Based Recovery

Management’s tone on BFAM’s latest quarterly call should reinforce confidence in the recovery path – the updated 2022 revenue growth guidance remains resilient at 17-22% amid centers reopening, and utilization also improving sequentially to 55%-65%. The utilization numbers are particularly impressive given the inflationary headwinds on the staffing front, with actions on wages and retention programs starting to pay off.

By segment, the 2022 guidance for full-service revenue growth stands at 15-20% amid headwinds from FX at the non-US operations and a wind-down in subsidies, while backup care revenue growth is targeted to hit 10%-20% amid lingering Omicron headwinds. Even with margins down modestly YoY on the ongoing lack of provider availability, the 25%-35% margin target in 2022 indicates operating leverage is beginning to kick in.

Still, the severe impact of the pandemic and the closure of many offices throughout BFAM’s operating regions cannot be ignored. Thus, I would not underwrite a full recovery to pre-pandemic levels until 2023 or so in the core full-service center business. In the meantime, the company’s educational segment looks set to be the growth engine – in the U.S., BFAM has expanded its partnerships with employer clients via backup care family support, featuring the addition of elder care and virtual tutoring, among others.

The international footprint extension is also progressing well, as BFAM further strengthens its competitive position in the UK and builds out a platform for further international expansion across the Netherlands and India. Successful expansion should clear the path toward the 8-10% long-term sales growth target, supplemented by 3-4% pts from pricing and 1-3% pts from enrollment.

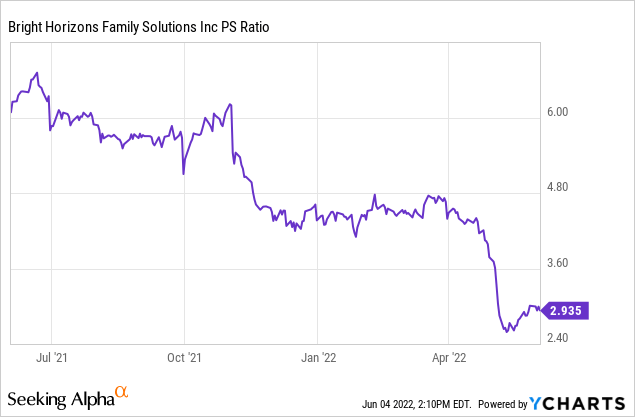

Acquisition Spree Continues With Only About Children

Having acquired ~400 childcare centers across the U.S., the UK, and the Netherlands over the last decade, BFAM has announced yet another tuck-in with Only About Children (OAC), a childcare and early education provider in Australia. BFAM will pay $319.5m in total, of which ~$213m will be paid upfront, with the remaining ~$106.5m to be paid eighteen months post-close. The financials look strong at first glance – Only About Children operates 75 centers with $140m of revenue and high-single-digit margins – in line with BFAM’s full-service margin profile pre-pandemic. Relative to the purchase price, BFAM paid an implied ~2x sales multiple on 2021 numbers, which compares favorably to BFAM stock at ~3x trailing sales. The transaction is guided to close in Q3 2022.

BFAM management has been open about its interest in penetrating the Australian childcare market for years now, so the acquisition will come as no surprise to investors. Strategically, I think the deal makes a lot of sense as part of a ‘land-and-expand’ strategy – demand is strong in the region, and the childcare provider market is highly fragmented. Plus, early childcare education in Australia benefits from a generous level of government support (mainly subsidies), making OAC a more compelling large-scale opportunity relative to more tuck-ins in the U,S., for instance. As one of the high-quality, premium providers in Australia, the addition of OAC provides a strong foothold, granting BFAM an even playing field to compete with incumbent providers such as Goodstart and G8 Education (OTCPK:GEDUF).

Positioned for a Post-COVID Re-Rating

Pandemic-driven headwinds have weighed on BFAM’s near-term fundamentals, but the medium-term growth trajectory and secular tailwinds remain intact, in my view. With another strong quarter in Q1 2022 as well, all signs point to BFAM’s fundamentals reverting higher to (and beyond) historical levels once the fallout from the COVID pandemic has fully abated. M&A also stands to be a key source of upside for the company, particularly given its history of successfully executing on tuck-in acquisitions.

Coupled with further growth in higher-margin backup services and the ongoing expansion in education services, I see a clear double-digit earnings growth runway for the company over the long run. The stock is currently on offer at a P/E well below its post-IPO range, thus, offering investors a compelling opportunity to invest in the BFAM growth story at a reasonable multiple.

Source: Author, Company Filings

Be the first to comment