gece33

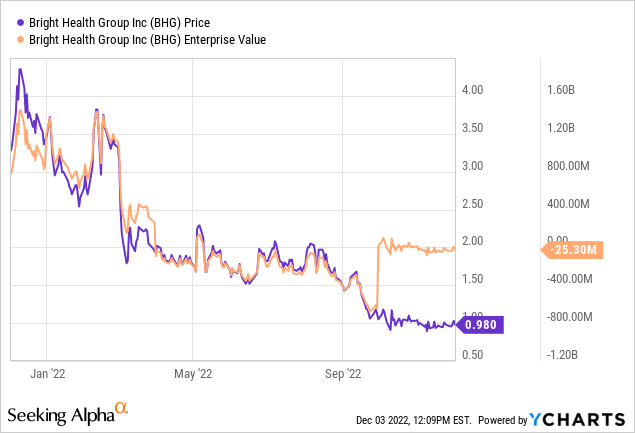

Fast-growing health insurer Bright Health’s (NYSE:BHG) continued expansion into higher-growth business lines appears to be paying off. Of note, NeueHealth member growth was higher again in its latest quarterly report, while a positive cash position and progress on medical cost management also bode well for the near-term outlook. That said, broader uncertainties related to the wind-down of the insurance business remain, and with BHG yet to meaningfully lower costs, I have difficulty underwriting the company’s profitability targets. Instead, BHG could require another dilutive capital raise down the line. Net, the BHG model has long-term potential, but the near-term challenges from cost inflation and heightened competition justify a below-average valuation multiple, in my view.

Good Cost Management Drives a Solid Quarter

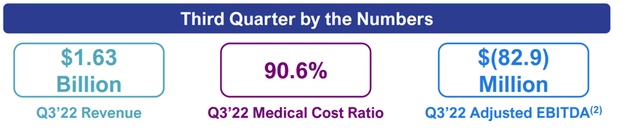

Adj EBITDA came in better than expectations on lower costs, led by a decline in the total Medical Loss Ratio (MLR) to 90.6%. While the better MLR did include a +110 bps benefit from a risk adjustment true-up, the significantly lower operating expense ratio at 18.2% (well below the 26.2% in Q2 2022) was commendable given the inflationary headwinds from COVID costs (140bps) and Direct Contracting (100bps). The good news is that COVID remains in line with internal expectations and could become a tailwind in the coming quarters, given the pricing actions taken. Utilization was also broadly in-line, with management citing no signs of pent-up demand thus far.

Bright Health

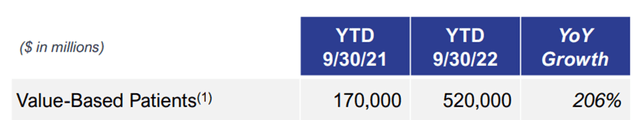

In a shift from prior years, when higher growth came with elevated disenrollment numbers, BHG posted good membership growth and better disenrollment as well. To recap, total membership reached 1.15m (vs. 1.09m in Q2 2022), comprising commercial at 1.025m members (+71% YoY) and Medicare Advantage membership of 125k (+14% YoY). Some of the increase was likely down to Individual and Family Plan adds, though, which should moderate over the course of the year. Meanwhile, BHG’s care delivery platform NeueHealth also saw strong growth at +206% YoY growth in value-based patients to 520k – this bodes well for its pending exit from internal health plans (where it currently derives half of its revenue).

Bright Health

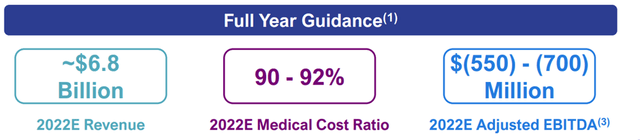

Guidance Revised Lower

Despite the favorable quarterly results, the implied Q4 guidance numbers look to be worse than expected. To recap, BHG has revised its full-year guidance lower, with revenue now at ~$6.8bn (vs. $ 6.8bn – $7.1bn prior). While the MLR range has been narrowed to 90%-92% (vs. 90%-94% prior), the adj EBITDA loss range was still revised downward to -$500m to -$700m (down from -$500m to -$800m prior). Overall membership is set to come in at a strong >1m (up from the ~1m guide previously), though primarily driven by NeueHealth’s value-based patient base guide at >500k (up from 450k-500k prior).

Bright Health

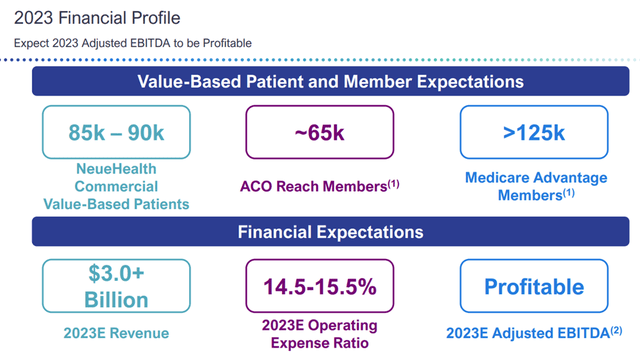

Despite the lower FY22 guide, BHG reiterated its adj EBITDA profitability target for FY23, with NeueHealth emerging as the key growth driver at a ~40% total revenue contribution (with 100% from external payors). While the company’s strategic focus on the NeueHealth provider business will be key, achieving this won’t be easy. Currently, >50% of NeueHealth’s revenue is from internal health plans, so getting to a full exit by FY23 and subsequently recapturing a significant amount of those lives as they shift to other managed care organizations (MCOs) is a tall order. From here, all eyes will be on the execution – the outcome of BHG’s contracting efforts with large payors will be key to recapturing former NeueHealth members.

Bright Health

Liquidity Outlook Remains Challenging

With the company still in loss-making territory, BHG’s liquidity position worsened to ~$2.8bn in total cash and investments in Q3 (down from $3.1bn in Q2 2022). More worryingly, management disclosed that its $350m credit facility was fully drawn, including the ~$46m committed to NeueHealth through participation in the CMS Direct Contracting Program. Of note, this comes on the heels of a recent ~$175m capital raise and ~$250m of regulated capital release from previously announced business exits. Given that BHG is also entering a challenging period and remains a long way from generating profitability, the company could be due for another dilutive capital raise sooner rather than later.

In the meantime, BHG’s recent exits from the Health Insurance Exchange (HIX) and the regional FL/TX/MA businesses are slated to be key drivers of the company achieving EBITDA profitability in FY23. Even with the negative mix shift impact post-exit, the company is expecting to see more YoY improvements in the MLR, boosting the bottom line. While a more capital-efficient model represents a potentially more sustainable shift away from price competition, winding down the insurance business carries significant execution risk. Thus, pending clarity on the outcome of this pivot, I continue to see the risk of near-term capital raises as elevated.

Near-Term Uncertainty Clouds the Growth Potential

BHG’s improved cost trend in its latest quarter will be well received by investors, highlighting that management’s efforts to streamline the overall cost structure are paying off. With growth also largely intact for its Medicare Advantage and NeueHealth businesses, the company appears to be on track to achieve its adj EBITDA positive target in FY23. That said, there remain hurdles to overcome – for one, the NeueHealth pivot away from serving large internal commercial businesses means more cost structure adjustments are still needed. Plus, the downward revision to the near-term guidance (despite a quarterly beat) signals fundamental challenges ahead, along with the full drawdown of the revolver. With any execution mishaps potentially resulting in another dilutive capital raise, the risk/reward seems unfavorable here.

Be the first to comment