Leon Neal

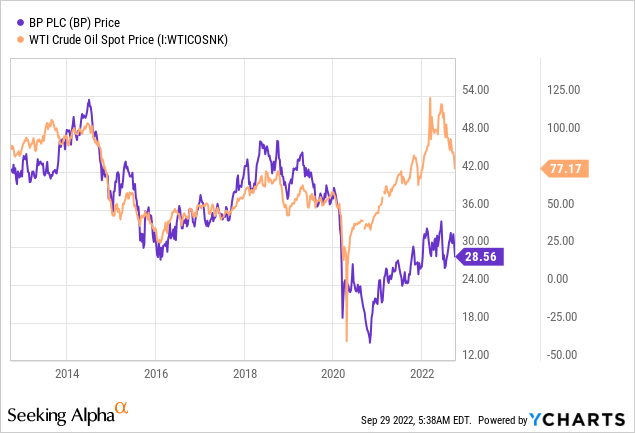

In recent days, stocks have skidded due to fears over persistently high inflation as well as higher interest rates. The sell-off, which has also led to a draw-down in petroleum prices, has created an opportunity to buy into BP (NYSE:BP) at a discounted valuation while investors can secure a very high (but also sustainable) dividend. Although there are risks to petroleum prices, BP has a very attractive risk profile right now and I believe shares have a lot of recovery potential from here!

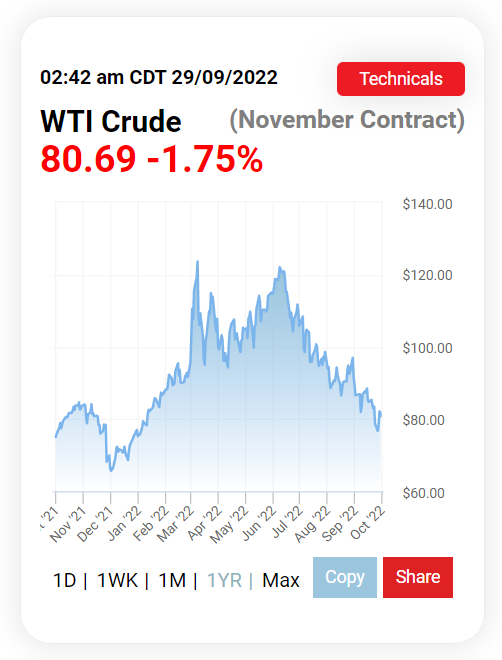

Petroleum prices are dropping

Oil prices have skidded lately due to growing economic concerns and the possibility of a more hawkish Fed. With concerns of slowing economic growth lingering over the market, petroleum prices have dropped to just ~$80 per barrel… which is the lowest price since January 2022.

Oilprice.com

The price of BP’s stock and the price of petroleum are not perfectly correlated, but there is definitely a positive relationship that investors can exploit. The tendency is for rising petroleum prices to pull up BP’s share price while falling market prices for petroleum prices result in selling pressure and a lower share price for BP. Over a long period of time, this relationship has held true.

Nord Stream 2 pipeline sabotage creates new energy supply uncertainty

Despite the lower pricing of petroleum products in the last two months, I believe the current market situation actually speaks for an investment in BP as demand for petroleum still remains high and the economy, at least so far, is not in a recession. Given the already strained energy supply situation in Europe and sanctions on the Russian energy sector, the setup currently favors higher petroleum and natural gas prices… especially if Europe were to experience a hard and cold winter.

This week’s sabotage act affecting the Nord Stream 2 pipeline further calls into question the safety of Europe’s energy infrastructure and could lead to higher petroleum and gas prices going forward. Since the market hates nothing more than supply uncertainty, investors and petroleum companies may see significantly higher energy prices heading into the winter months.

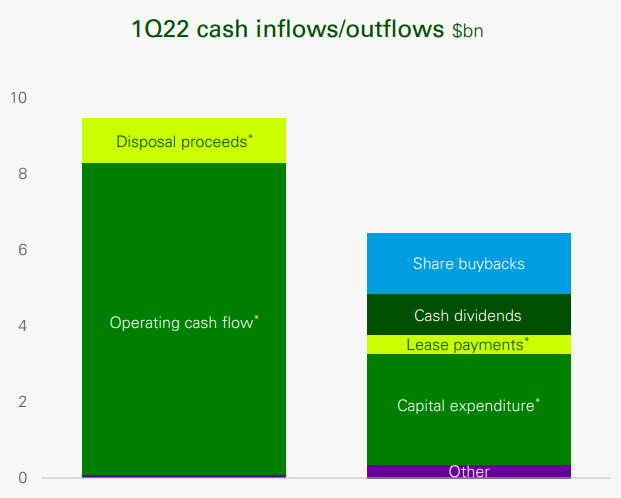

For those reasons, I believe the market could see an uptick in petroleum pricing in the near future which would not only help BP’s valuation, but also its cash flow. BP achieved $6.6 billion in surplus cash flow in the second-quarter with “surplus” referring to cash flow that exceeded the company’s basic capital needs. I estimate that BP’s third quarter cash flow is set for a 20-30% decrease relative to the second quarter, due to the drop in petroleum pricing, but the cash flow should still be more than sufficient to pay BP’s dividend.

BP: Significant Surplus Cash Flow

Share buyback

Of the $6.6B in surplus cash flow, BP has said it will use $3.5B for share buybacks and the company will likely repurchase even more shares in the fourth quarter. The announcement of a new share buyback could also create new investor interest in the stock.

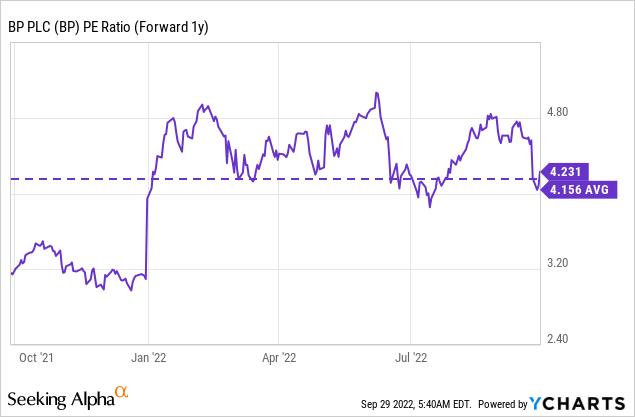

BP’s P-E ratio is a joke

Shares of BP are currently trading at a P-E ratio of 4.2X… indicating that the market believes petroleum prices (and cash flow) are going to drop off significantly in the near term. Alternatively, the market may underestimate the potential for higher petroleum prices during the winter months.

I believe the truth lies somewhere in the middle: petroleum prices have likely peaked around $130 per barrel earlier this year and BP is set to see a decline in (surplus) cash flow in Q3’22. However, BP’s shares are still cheap based off of earnings, suggesting that the market may have become (at least to some extent) too bearish on BP’s earnings prospects.

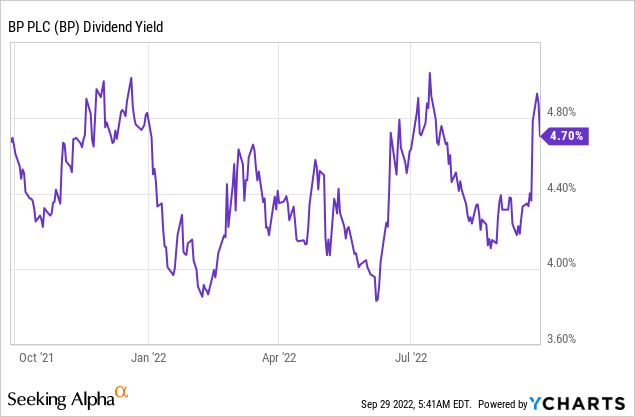

Dividend yield

One of the key reasons I bought BP again relates to BP’s high dividend yield. I am not a dividend investor, but the combination of a very low P-E ratio with a high (covered) dividend yield of 5% made BP’s shares irresistible to me.

Risks with BP

The biggest commercial risk for BP is the petroleum price which, despite the recent draw-down, still trades at considerably higher prices than last year. BP is still benefiting from this setup, obviously, but a global recession and declining petroleum demand would likely impact the firm’s valuation factor as well as cash flow prospects negatively. BP exited its investment in Russian energy company Rosneft in response to Russia invading Ukraine, so I don’t see any impairment risks for BP going forward. Weaker cash flow from BP’s productive operations as well as a lower earnings multiplier factor are the two biggest risks I see for BP right now.

Final thoughts

I believe BP’s shares have dropped too much and the current setup is actually very favorable for energy companies: with petroleum prices dropping back to $80 per barrel, and BP’s stock also declining, a new buying opportunity has been created that has led to an underpricing of BP’s earnings potential and a very attractive dividend yield of 5%. The Nord Stream 2 pipeline sabotage act may further exacerbate concerns over Europe’s energy supplies which may result in higher petroleum prices!

Be the first to comment