andreswd

Investment Thesis

Box, Inc. (NYSE:BOX) is a leading cloud services provider based out of Redwood City, United States. In this thesis, I will be analyzing BOX’s third-quarter FY23 results and its future growth prospects. I will also be analyzing its valuation at current price levels. I think BOX experienced solid revenue growth and substantial profit margin expansion, but it is currently overvalued. Even its solid growth and improving margins don’t justify its high valuation, however, and I would recommend that investors hold the stock for now.

Company Overview

BOX is a cloud-native service provider helping companies manage their entire content journey through one integrated platform. This cloud content management platform helps clients access, manage, and share data remotely through multiple devices. With its software-as-a-service (SaaS) platform, the clients can collaborate on content internally as well as externally. BOX currently serves around 67% of the Fortune 500 companies, providing these companies with an integrated platform to access and exchange data. BOX has partnered with multiple companies to build a partner ecosystem that enables its clients to integrate services provided by other companies like Apple (AAPL), Zoom (ZM), Adobe (ADBE), and IBM (IBM). This gives its clients access to these brands without leaving the BOX interface. BOX currently provides cloud content solutions in 25 different languages across 70 countries worldwide.

Q3 FY23 Results

BOX recently posted third-quarter results, beating the market EPS estimates by 4.5%. The revenues were in line with expectations. The company experienced strong demand for cloud services, which resulted in significant revenue growth. I believe the company did a good job in limiting operating expenses, which resulted in improved profit margins for the company.

BOX reported a total revenue of $250 million, up 11.7% compared to $224 million in the same quarter last year. As per my analysis, the overall improved demand for cloud services in the industry led to this increase. This is reflected in the 12% y-o-y billings increase from $231 million in Q3 FY22 to $258 million. I believe the company did well in limiting the cost of revenue to $64.5 million compared to $63 million in the same quarter last year. The company reported an operating income of $13.4 million compared to a loss of $11 million in the corresponding quarter. I believe this increase was primarily due to increased billing coupled with restricted operating expenses. Despite the inflationary headwinds, the company managed to limit its expenses, which reflects that its cost-cutting initiatives paid off. BOX reported diluted EPS of $0.03 compared to a loss per share of $0.12 in the same quarter last year. The company also reported deferred revenues of $467 million, up 9% y-o-y, which provides the company with a strong order book.

Overall, the company reported a strong quarter with gross and net profit margin expansion. The gross margin for the third quarter stood at 74.5% compared to 71.7% in the same quarter last year. The company reported positive operating and net profit margins for the quarter. I think the improved expenditure proved to be a highlight for the quarter, resulting in improved margins for the company. BOX provided a solid FY23 outlook with revenues estimated to be in the range of $990-$992 million, representing a 12% y-o-y growth and non-GAAP EPS in the range of $1.16-$1.17. I think the company should be able to achieve these targets given the strong performance in the recent quarter and solid order backlog.

Key Risk Factor

Highly Competitive Industry: BOX operates in a highly competitive industry with a low barrier to entry. The cloud services market is consistently growing, but so is the competition. BOX faces competition from some major players with significantly higher resources. In the cloud content management market, BOX faces competition from companies like Microsoft (MSFT) and Open Text, and in the file sync segment, it faces competition from Google (GOOGL) (GOOG) and Dropbox (DBX). Severe competition with major players in the market could affect the company’s profit margins in the future as it might have to provide significant discounts and invest heavily in advertising to gain and maintain its market share. I think investors should consider this risk before investing in BOX.

Quant Rating and Valuation

Seeking Alpha

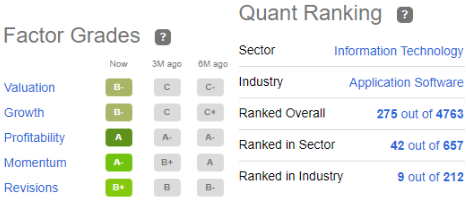

BOX is ranked 9th out of the 212 companies in the application software industry as per the Quant rankings, which reflects that there are better investment opportunities in the market. BOX has a B- grade for valuation, which clearly reflects that the company is overvalued at current price levels compared to its peers. However, the company has seen improvement in terms of profitability and momentum, with an A and A- grade, respectively. I believe the company is witnessing improved profitability and growth, but the real cause of concern is the valuation.

BOX is trading at a share price of $31.2, a YTD increase of 18%. It has a market cap of $4.32 billion. BOX is trading at a forward non-GAAP P/E multiple of 26.7x compared to the industry standard of 19.5x with the FY23 EPS estimates of $1.17. This clearly reflects that the company is overvalued at current price levels. Even if we consider PEG ratio analysis, which is a better valuation method for growth companies, we realize that BOX is currently trading at a forward non-GAAP PEG multiple of 1.3x. Generally, a PEG multiple below 1x is considered adequate for growth companies, and it represents that a company is undervalued. BOX is overvalued on multiple parameters, despite considering its solid growth rate. I believe that BOX is not an ideal buy at current price levels, and I would not recommend that investors buy any shares currently.

Conclusion

BOX posted a solid third quarter with strong revenue growth and expanding profit margins. The company is experiencing strong consumer demand and has a strong backlog to support revenues in the coming quarters. However, the most important factor here is its valuation. I believe the company is highly overvalued at current price levels, and even its revenue and earnings growth don’t justify the current valuation. I think there isn’t much upside potential in the stock price from current levels. After considering these factors, I assign a hold rating for BOX.

Be the first to comment