Pavlo Sukharchuk/iStock via Getty Images

I don’t exactly consider myself an athletic person. But with the exceptions of chess (yes, moving the pieces across the board is technically a physical activity) and golf, bowling has got to be my favorite physical activity. It’s competitive, relaxing, exciting, cheap, and serene, all wrapped into one. When it comes to investing opportunities, it’s always great to be able to mix what you enjoy with making money. And for investors who are fans of bowling, the opportunity to do so involves the purchase of shares of Bowlero (NYSE:BOWL), a $2.07 billion owner of bowling entertainment centers. In recent years, the company has done quite well to grow itself. But the big question is whether or not recent performance will be permanent or just a passing fad. If the former, shares are priced low enough to offer investors some rather attractive upside from here.

A strike or a gutter ball?

According to the management team at Bowlero, the company is the largest operator of bowling centers on the planet. Its origins began humbly, starting with a single location back in New York City in 1997. Fast forward to today, and the company has grown into an owner and operator of 325 different centers. In the US alone, where the company has a majority of its locations, an estimated 26 million people (prior to the pandemic) enjoy this activity every year.

Although bowling may seem generic and straightforward, it’s important to note that the company engages in a number of activities. The company prides itself in pioneering in-center gaming. And also utilizes apps and other technologies to bring gaming into its centers and beyond them. Naturally, the company sells food and beverage products. But it also engages in the production and sale of all of the content used for the Professional Bowlers Association.

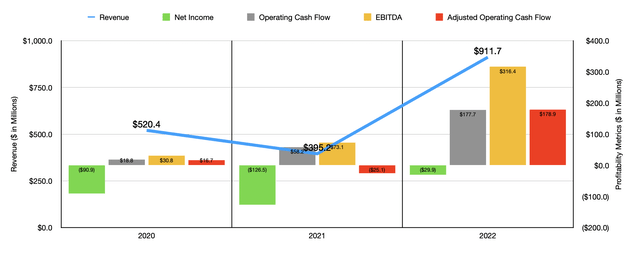

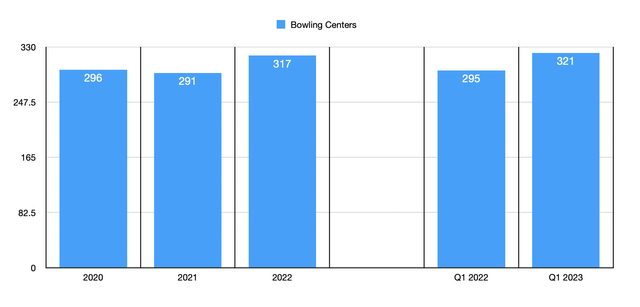

From an operating perspective, the history for the company has been a bit mixed. In 2020, for instance, the firm generated $520.4 million in revenue. Sales then plunged to $395.2 million in 2021 in response to the COVID-19 pandemic. But then, in 2022, the picture changed, with sales rebounding and hitting an all-time high of $911.7 million. Some of this increase has undoubtedly been driven by a rise in the number of locations. By the end of 2021, the company had 291 centers in its portfolio. This number jumped to 317 by the end of its 2022 fiscal year. Although the increase caused by new centers, many of which were acquired, undoubtedly added to the company’s top line, most of the revenue improvement actually came from growth in same-store sales. From 2021 to 2022, this growth totaled 120%. And of course, the company also benefited that year to the tune of $14.9 million from an extra week of sales compared to the year prior.

Although the general revenue trajectory for the company has been positive, the firm is still generating sizable net losses from year to year. In 2020, the business generated a loss of $90.9 million. This worsened to $126.5 million in 2021 because of the plunge in revenue. But in 2022, the picture did improve markedly, with a net loss of $29.9 million for the year. Fortunately, there are other profitability metrics that we can rely on. Operating cash flow, for instance, rose over the past three years, improving from $18.8 million to $177.7 million. And over that same window of time, EBITDA also expanded, rising from $30.8 million to $316.4 million.

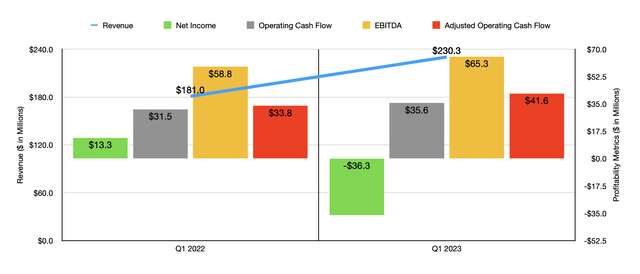

For the 2023 fiscal year, the picture has been largely positive compared to the same time last year. Revenue of $230.3 million beat out the $181 million reported in the first quarter of 2022. The company benefited on this front from the addition of 26 additional locations year over year, bringing its unit count up to 321. Organic growth with event revenue, as well as robust demand for its services in general, we’re all instrumental in pushing sales higher. On a same-store basis, sales still managed to increase by 19.9%. For those wondering whether the company can continue to grow by means of acquisition or not, I would like to point out that the business has made multiple acquisitions since the end of the first quarter.

Although revenue rose nicely in the first quarter of the year, the firm’s bottom line did worsen. The loss of $36.3 million in the first quarter was far worse than the $13.3 million profit achieved at the same time last year. On the other hand, operating cash flow still managed to increase, rising from $31.5 million to $35.6 million. And over that same window of time, EBITDA for the business expanded from $58.8 million to $65.3 million.

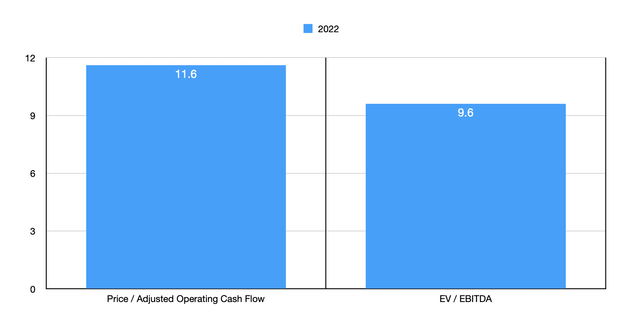

Management has not really provided any guidance for the 2023 fiscal year. In addition to that, it’s fairly early to try and forecast what the picture might look like, especially for a firm that is growing as rapidly as this. So instead, I decided to value the company using data from its 2022 fiscal year. In this case, the price to operating cash flow multiple of the firm is 11.6. Meanwhile, the EV to EBITDA multiple for the company should be 9.6. As part of my analysis, I compared the enterprise to five similar firms. On a price to operating cash flow basis, these companies ranged from a low of 5.8 to a high of 61.8. In this case, two of the five companies were cheaper than Bowlero. Using the EV to EBITDA approach, the range was from 6.2 to 4,255.7, with only one of the five companies cheaper than our prospect.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Bowlero | 11.6 | 9.6 |

| Cedar Fair (FUN) | 5.8 | 6.2 |

| Six Flags Entertainment (SIX) | 8.2 | 10.3 |

| Topgolf Callaway Brands (MODG) | 61.8 | 10.5 |

| Xponential Fitness (XPOF) | 15.4 | 4,255.7 |

| Vail Resorts (MTN) | 14.7 | 14.1 |

Takeaway

Although Bowlero has a fairly simple and easy-to-understand business model, the rapid growth of the company by means of acquisition makes it rather difficult to value. We especially don’t know what the picture might look like during difficult economic times. Although it’s hard to imagine a scenario where the picture would be worse than what the company experienced during its 2021 fiscal year. In its healthy state, the company does look to be attractively priced and continued growth leaves open the opportunity for additional cash flow that could result in shares being even cheaper. Add on top of this the fact that the stock looks relatively cheap compared to similar firms, and I do think that it makes for a decent ‘buy’ prospect at this time.

Be the first to comment