Lobro78

Introduction

In my previous article, I pointed out that the new iPhone 14 sales would likely disappoint before the release of the new iPhone back in August. The reasoning behind this argument came from the likely pressure Apple (NASDAQ:AAPL) will experience from the currency risks and the weak demand from a potential increase in iPhone 14 prices. Today, even after Apple restrained from raising iPhone prices in key markets including the U.S. and China, I believe Apple’s iPhone sales will disappoint throughout 2022 and into 2023 due to worsening currency risks, which leads to a conclusion that Apple’s valuation is too expensive today. Further, I believe innovation in Apple’s iPhone 14 will not be enough for Apple to retain its strong growth levels justifying the current valuation; therefore, I continue to rate Apple as a sell.

Worsening Currency Risks

The global economy is experiencing a strong dollar, and the valuation of the USD is continuing to strengthen relative to other currencies around the world. The impact of such a phenomenon results in significantly stronger prices of iPhones for consumers whose currencies have been weakened against the dollar, likely dampening the demand. Because iPhones are sold around the world, the impact of a strong USD will have a profound negative effect on Apple.

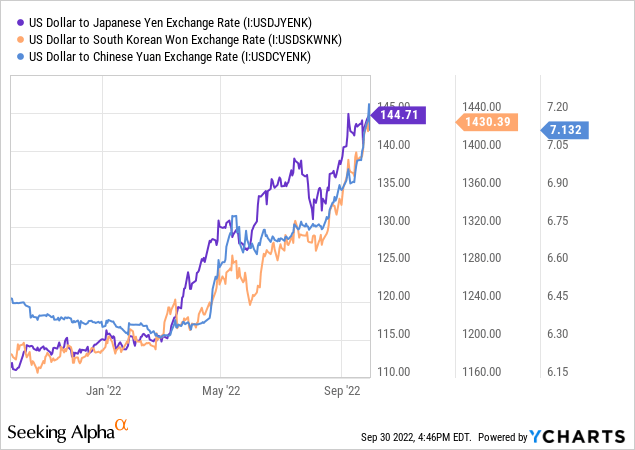

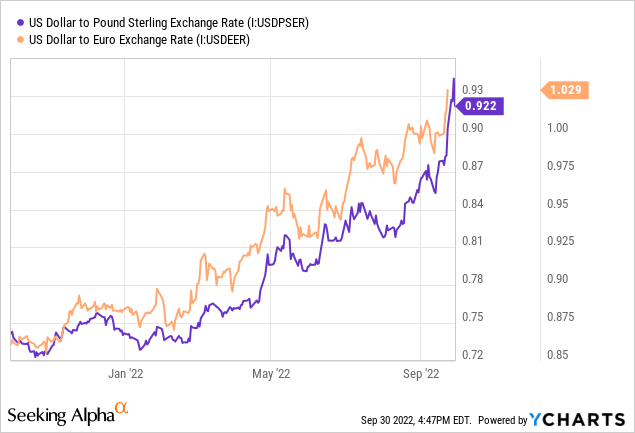

The below charts show the weakening Japanese Yen, British Pound, Euro, South Korean Won, and Chinese Yuan against the dollar.

[Chart created by Author using YCharts]

[Chart created by Author using YCharts]

As the charts above show, the USD has been strengthening, forcing Apple to raise prices in foreign markets despite global recession worries.

In South Korea and Japan, iPhone prices grew by 15% and 21%, respectively while iPhone prices in the UK and Europe increased by 16% and 13%, respectively. These increased prices for an iPhone, a consumer discretionary good, come at a time when the global economy is slowing and consumers face pressure from high inflation along with future uncertainties. Therefore, I continue to estimate global iPhone demand to be lackluster.

To further support my speculation or prediction, there has been a report explaining that Apple is scrapping plans to boost production of the new iPhone beyond analyst estimates on demand concerns. The article says that “Bloomberg said suppliers have been told to pull back from efforts to ramp up assembly.” This news comes a mere week after there has been a report that new iPhone demand continues to be stronger than expected. The dramatic change within a month shows the fast-changing markets due to the currency risks. Therefore, I believe the timing of these reports shows support for my predictions of the potential for iPhone demand to continuously worsen throughout 2022 on increasing currency risks as it is unfolding today.

In China, Apple did not raise the prices of its iPhone despite the weakening Yuan due to fierce competition in the respective market. In the best-case scenario where Apple maintains strong sales in China, the company is still expected to feel pressure on revenue and margins as a result of the significantly weakened Yuan. Selling one iPhone in 2022 will not have the same revenue or profits in China compared to 2021. Further, due to the significant slowdown in the Chinese economy with its GDP growth expected to be about 2.8%, which is lower than the previous 30 years, it may be possible that sales may slow in the country despite Apple maintaining the price parity especially as China continues to uphold a stringent zero-COVID policy dampening consumer demand.

The USD has been strengthening against other currencies since the beginning of 2022, yet it has no signs of slowing as the United States Federal Reserve is committed to aggressively raising rates throughout 2022 and 2023. After the previous FOMC meeting in September, the FED has hinted that they will raise rates by 125 basis points for the remainder of 2022, which equates to another giant step, a 75 basis point increase, and one more big step, a 50 basis point increase. Further, Fed chair Jerome Powell has said that the Federal Reserve may raise rates to about 4.6 basis points by the end of 2023 destroying the hopes of a potential rate hike pause or even lowering rates in times of economic downturns in the coming months. The FED’s commitment to put inflation rates back to 2% is far stronger than its intention to keep the economic gains and maintain global currency stability. Therefore, the currency risks for Apple are expected to continue throughout 2022 pressuring iPhone sales and margins.

Innovation

I believe that innovation in the new iPhone 14 is not enough to entice consumers to switch to the new phone in times of relative economic hardships.

First, no major upgrades have been announced for the base iPhone 14 and 14 Max models. These models use the same CPU as the previous iPhone 13 models, with the same notch design. There have been upgrades in camera quality, satellite emergency contact, and eSim, but I believe these are not enough to entice consumers to switch to iPhone 14. Camera upgrades are nothing new. It has been almost an ongoing tradition. With the previous iPhone cameras already enough for normal retail users, a slight upgrade from the base 13 series to the 14 series is likely not enough. Further, satellite emergency contact and eSim is truly a new feature, but how could the majority of consumers justify switching over to a new phone because they have satellite emergency contact and do not have to use a physical sim card? The truth is, the overwhelming majority of consumers do not need an eSim and a satellite emergency contact. It is a good feature to have, but it is not necessary or enough to convince consumers to switch. The above features are a niche market. Therefore, given the current economic hardships, I strongly believe that the innovations in the base iPhone 14 models are not enough to entice consumers to buy a new phone.

On the other hand, iPhone 14 Pro series are slightly different. It received a CPU upgrade, design innovation, a pro-motion display, and all the new features in the base 14 series. iPhone 14 Pro showed design innovation by removing the notch design and adapting a dynamic island where the camera island is used as a part of the user interface software to make it feel as if it was not there. Further, the new pro-motion display allows the refresh rates to move from 1-120hz optimizing battery usage and allowing always on display. These changes were widely followed by consumer optimism, but I do not think iPhone 14 Pro series will save Apple. It is true that iPhone customers are generally more wealthy, but not all customers are. I do not believe the majority of consumers will stretch their budgets to splurge on a new iPhone with features that are cool to have but not necessary.

Valuation

Considering the macroeconomic headwinds, Apple’s valuation, in my opinion, is too expensive today. The company currently has a market capitalization of about $2.22 trillion, with a forward price-to-earnings multiple of about 22.7. The company’s historical price-to-earnings metrics from 2010 show that the company has been trading at about a 10-20 price-to-earnings ratio even while the growth prospects were brighter than today, expecting about mid-single digit growth. Further, Apple stock has a beta value of about 1.21. Because the beta value estimates the stock’s relative movement to the market, worsening macroeconomic conditions may result in greater pain for Apple stock. Therefore, I believe Apple’s valuation is still expensive.

Summary

Apple is a strong company. However, it is not recession-proof. The company faces strong macroeconomic hurdles, especially outside the U.S. The USD has been gaining significant strength compared to other currencies, forcing Apple to raise prices significantly. Further, the mature smartphone market and minimal iPhone 14 upgrade from the previous model will likely not be enough to entice consumers to switch to a new phone in current economic conditions. Therefore, I am continuing my sell rating on Apple.

Be the first to comment