Sundry Photography

Investment Thesis

There are so many things that do not look to be going in the right direction for Boston Scientific (NYSE:BSX). On top of an unjustifiable current valuation, there are other issues such as pending legal cases, high currency exposure, and high debt. The market is also overreacting to recent news including news last week that Boston Scientific would acquire Apollo Endosurgery (APEN). While this is a move to expand their portfolio, it does not warrant the jump in stock price that occurred. In this article, I will discuss all of these and why I believe that Boston Scientific is a hold.

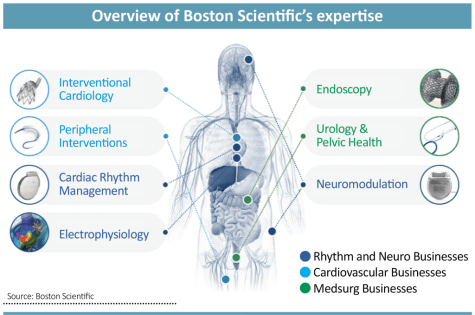

Company Overview

Boston Scientific is an international medical device company that develops and manufactures a number of products in the lines of cardiovascular, neuro, and others. Its continued research and development has led to an extensive network of products that it sells to companies all over the world. The CEO of the company is Mike Mahoney and has been at the helm since 2011. Mahoney has 25 years of professional experience and is well experienced in the medical device industry specifically. The company is headquartered in Marlborough, Massachusetts.

Overview of Areas Where BSX Operates (Boston Scientific Investor Relations)

Why Boston Scientific is Overvalued

Debt Load

One of the biggest issues that I see in BSX is the debt that the company currently holds. Right now, Boston Scientific has over $8.5 billion in debt despite having EBITDA last year of $2.5 billion. Debt for the company has grown since 2019 and there have been no real efforts from the management team to lower that in any significant capacity. This debt problem is especially concerning given the uncertain macroeconomic environment that we are in and will be in for a while.

Exposure to Foreign Currency

Last year, Boston Scientific had approximately 48% of their sales come from outside the United States. While that is not always a bad thing to diversify geographic revenue streams, it is a problem when the foreign exchange market is unfavorable to US companies like it has been recently. Since there is so much exposure to foreign markets, the company is very sensitive to exchange rates and it can have a negative effect on the company’s top and bottom lines.

Poor Efficiency Metrics

Another area of concern for BSX long-term is the poor efficiency metrics. I believe that poor efficiency will dampen any growth that the company sees in the future. Pretty much every efficiency metric that you look at, BSX is severely below its peers. The company has a return on invested capital of 3.6%, a return on capital equity of 4%, and a return on assets of 4.3%. Investors should be very concerned by this because it is destroying investor capital. Be wary of efficiency for BSX

Overreaction to Recent News

Last week, Boston Scientific announced that they would acquire Apollo Endosurgery for $615 million. While this is a move to expand their endoscopy segment, I believe that the market overreacted to the news. This news has fueled a short term price increase that I do not think is justified. While I don’t think it is a big issue, it is another consideration for why the stock price is overvalued right now.

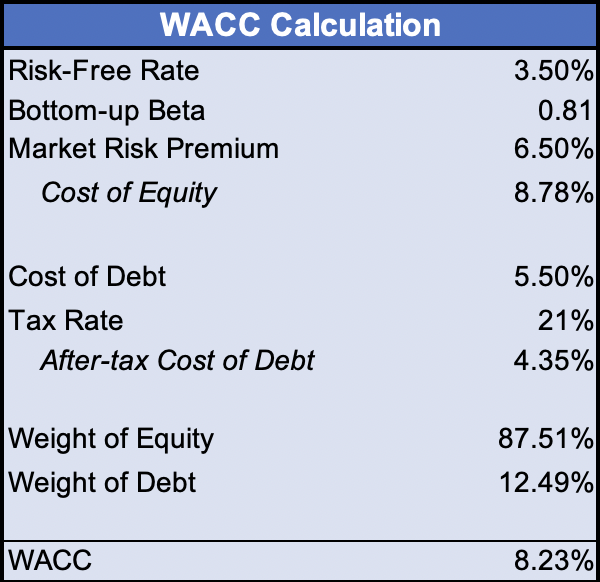

DCF Valuation

I decided to value BSX two different ways with the first way being a discounted cash flow model using free cash flow to the firm. I will discuss my relative valuation later. For the free cash flow to the firm model I arrived at a WACC of 8.23%. This was calculated by using a bottom-up beta instead of the published five year beta in order to take into account its peers and industry risk. I used a risk free rate of 3.50 which reflects the recent 10 year treasury. For cost of debt, I looked at the company’s capital structure and current issuing and arrived at a weighted interest rate of 5.5%. Lastly, I decided to use an equity risk premium of 6.5%. Below is my calculation for WACC.

Calculation of WACC (My Model)

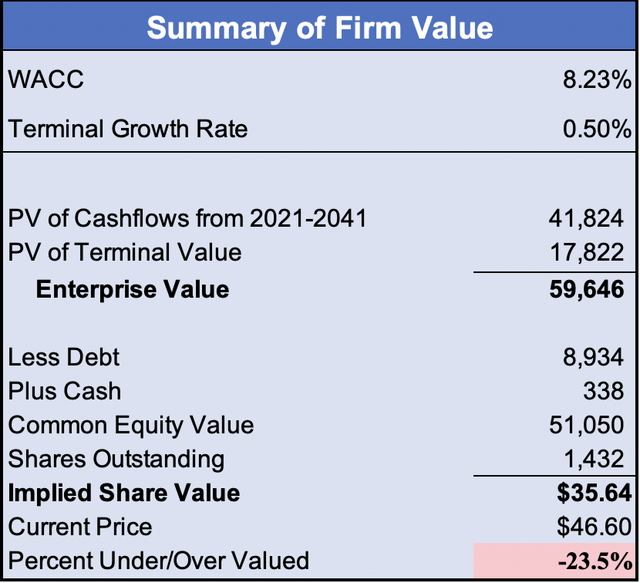

For my free cash flow to the firm model, I forecasted out 20 years because at the end of the 20 years, I believe that BSX will reach its terminal growth rate. For the 20 years, I forecasted out each item of the income statement including revenues, operating expenses, and capital expenditures. Once I have free cash flows, I discount them back using the WACC that I calculated earlier. With all of this in consideration, I arrived at an intrinsic price of $35.64, showing a 23.5% overvaluation.

Free Cash Flow to the Firm (My Model)

Relative Valuation

The second way I valued BSX is through looking at its peers and seeing where BSX ranked relative to the group. The companies that I decided to use for comparables are as follows:

- Medtronic (MDT)

- Stryker (SYK)

- Becton, Dickinson and Company (BDX)

- Baxter (BAX)

- Zimmer Biomet (ZBH)

- Edwards Lifesciences (EW)

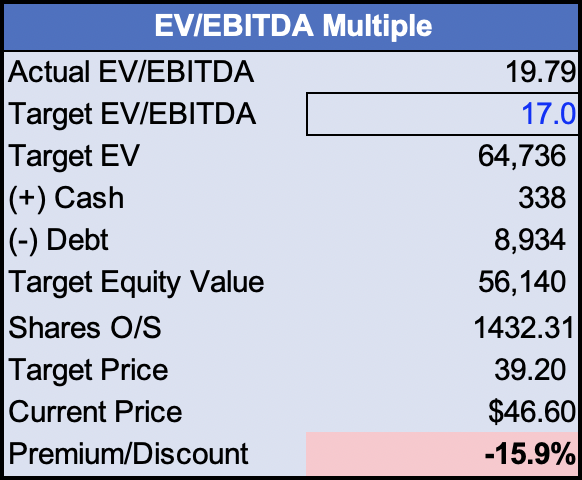

Comparable Companies (My Model)

I compared Boston Scientific to its peers using 4 categories: profitability, growth, efficiency, and risk. For profitability, BSX is middle of the road with their gross margin being above average at 69.4%, but their net income margin of 5.2% is below average. EBITDA margin of 26.3% is the median of the group. For growth, BSX has seen about a 7% growth for revenue, gross margin, and EBITDA. When comparing against its peers, that ranks about fourth in the group of 7. For efficiency, as I mentioned earlier, this is an area of concern. With a return on assets of 4.3% and a return on equity of 3.8%, both of those rank below its peers. Lastly, BSX is middle of the road when it comes to risk using beta with a beta of 0.86.

When you consider BSX ranks fourth in profitability, fourth in growth, fifth in efficiency, and fourth in risk, I think it is safe to say that the company should be valued as the fourth best company in the group. Put simply, they are not. Using next twelve months Enterprise Value to EBITDA multiple of 19.79, that would place them almost second. Looking realistically, a multiple of 17 would be more appropriate and would value BSX as the fourth best company in the group.

Relative Valuation Calculation (My Model)

Risks To My Thesis

In this article, I have discussed why I believe that Boston Scientific is overvalued. While I have strong conviction of my analysis, it is always a good idea to be wary of what would change my thesis. BSX has a diversified range of products in its portfolio and is a part of a growing industry. There could be the case that BSX does not have a price correction because the market sees that and values its products, growth, and what industry it is in. Another thing that would change the way I see this company is if they improve their efficiency metrics. I genuinely believe that if management focuses on improving those key metrics, investors will reward them handsomely. Those are two main risks that I see in my thesis.

Conclusion

Boston Scientific has solid products and the stock has performed well relative to the market in the last year. However, during my research into this company, I found many flaws in the company and my valuation shows that BSX is overvalued anywhere from 16% to 24%. I believe that a price correction is coming because of the reasons I have laid out, thus my reasoning for my rating of a hold for BSX.

Be the first to comment