CHUNYIP WONG/E+ via Getty Images

Boston Properties (NYSE:BXP) is the largest publicly traded developer, owner, and manager of Class A office properties in the US. It has ~201 properties, it is part of the S&P 500 index, and it is rated top 5% by sustainalytics of sustainable corporations. The company has long-leases, with a weighted average of ~7.8 years, which should give the company enough time to readjust to any potential demand impact from the work from home trend that significantly accelerated due to the pandemic.

Boston Properties reported a decent set of numbers in Q4, with funds from operations of $1.55 per share, ~13% higher than the $1.37 reported one year earlier. The company also reaffirmed its full-year FY22 FFO guidance of a range of $7.30-7.45 per diluted share. Unfortunately that means that current multiples are approaching 20x forward FFO, which we consider expensive, especially given the challenges the company will face in the coming years with softer office demand from the work-from-home trend.

Financials

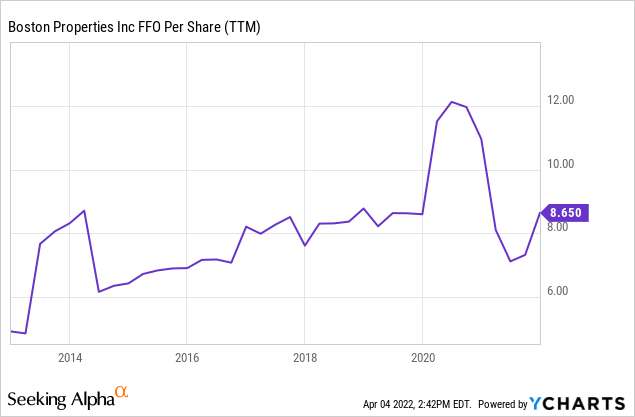

Looking at the historical FFO per share we can see that they were mostly trending higher until the pandemic hit, which has a material adverse effect on the company despite the long-term leases. Part of the impact was due to variable earnings streams such as parking, as well as a small percentage of the properties being retail and hotels.

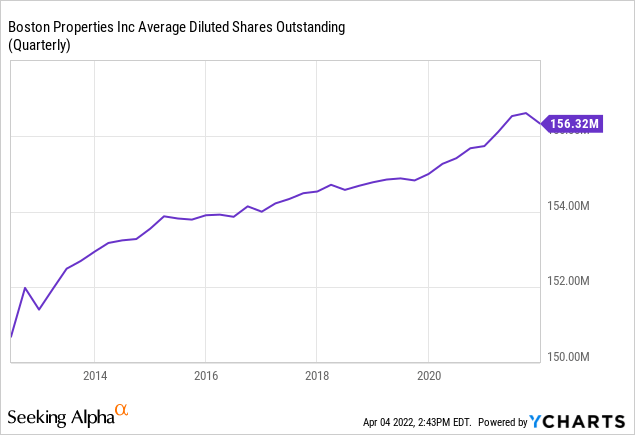

One thing we noticed is that the company has done a good job of growing without diluting shareholders too much. For example, shares outstanding are barely about ~2 million higher than 5 years ago. For a REIT this is quite the accomplishment, and it reflects Boston Properties strategy of financing developments and acquisitions from the sale of mature assets. We much prefer this strategy to a strategy of constantly issuing new shares to finance growth and the development of high-quality properties from the ground up. These developments are usually significantly pre-leased and are projected to deliver a stabilized cash yield of more than 8%.

The current market cap rate of comparable quality office buildings is ~4% to 5%. The company is well-positioned to benefit from its strong development pipeline of 3.4 million square feet and $2.5 billion of investment that is already 59% leased, and that is projected to add approximately $190 million to NOI over the next three years.

Boston Properties has been expanding in the very attractive life-sciences sub-sector, which is more shielded from work from home trends and tends to command higher rents due to the need to have complex buildings with labs and usually located in life sciences/technology clusters. Unfortunately this still represents a relatively small percentage of BXP’s share of rental obligations at ~6.3%.

Boston Properties Investor Presentation

Balance Sheet

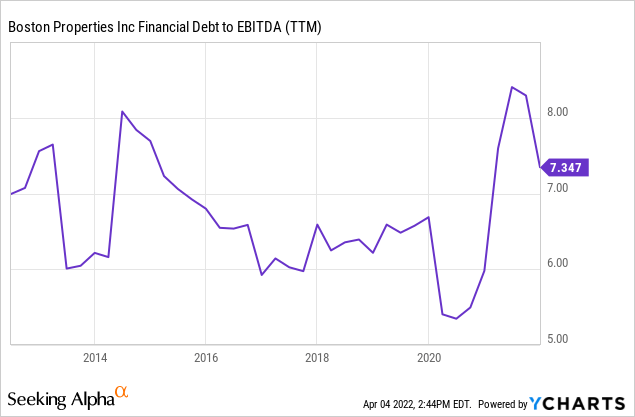

Boston Properties’ balance sheet is strong, even if its debt to EBITDA ratio did reach concerning levels during the depths of the Covid crisis. At that time this ratio exceeded 8x, but has since recovered to a less concerning ~7.3x as EBITDA has recovered.

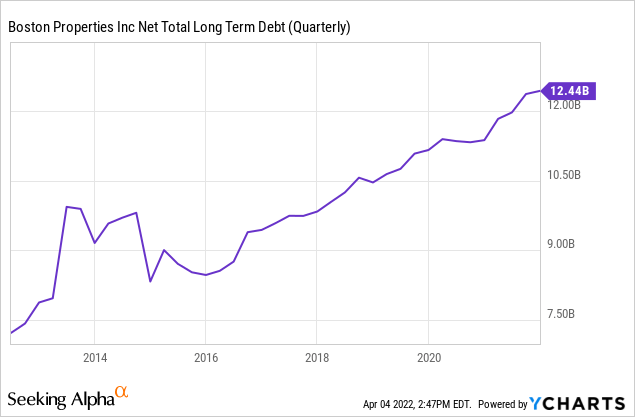

As we had previously seen, BXP does not tend to issue shares to finance developments. Instead it recycles capital from mature assets and adds debt into the mix. As the company has grown, so has its net total long-term debt. However we do not see this as too concerning as long as its financial ratios such as debt to EBITDA remain at healthy levels.

ESG

One thing to like about Boston Properties is that it pays a lot of attention to ESG matters, and that has resulted in the company being consistently ranked as an ESG leader. It is committed to achieving carbon neutral operations by 2025, and it pays attention to the health and wellness impact of its buildings on the people that work there. It is also focused on improving diversity and inclusion.

As a result, the company has an MSCI “A” rating on sustainability, it has a GRESB Green Star 5-star rating, it is part of the Dow Jones Sustainability Indices, and it is ranked in the top 5% most sustainable corporations by Sustainalytics.

Valuation

The one problem we have with BXP is the valuation, which as we will see appears to be somewhat stretched, especially if one thinks that the work from home trend will continue to have a material effect for the foreseeable future.

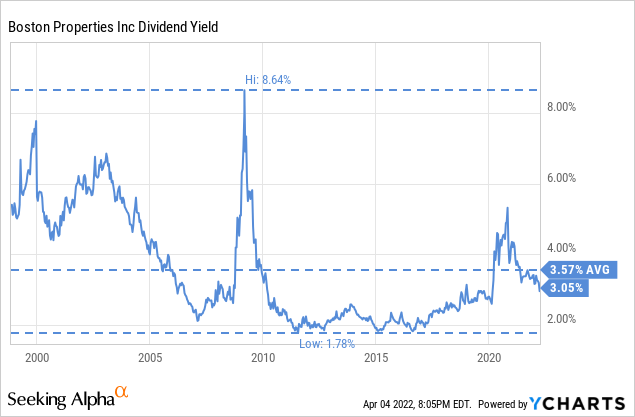

The first indicator we’ll like to point out is the dividend yield, which has averaged historically 3.57%, and currently is ~15% below at 3.05%.

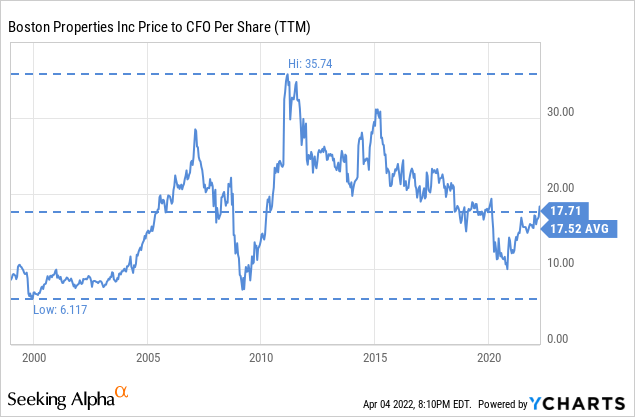

The price to cash flow from operations (CFO) is very close to its historical average. The historical average is 17.52x, and the current multiple is a little bit more expensive at 17.71x.

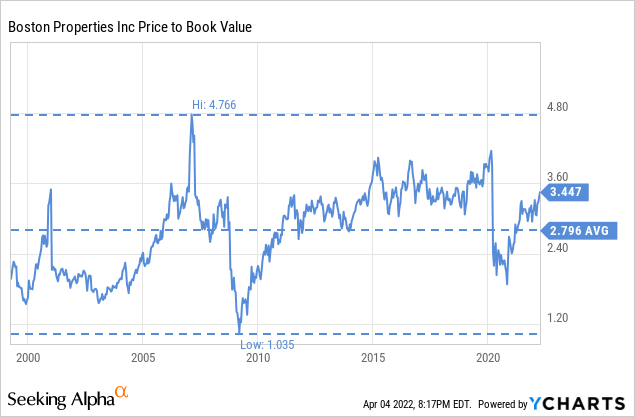

Similarly the price to book value valuation multiple points to a small degree of overvaluation, with the average at 2.79x vs. a current multiple about 23% higher at 3.4x.

None of these valuation multiples are perfect, but taken together they paint a picture of a company that is about fairly valued, maybe a little overvalued compared to its historical multiples. However, we believe the challenges the company faces today are much bigger than what it faced in the past, and we believe that once the impact of the work from home trend is factored in, one can make the case that shares are considerably overvalued. By how much depends on how big an impact this will make in occupancy, and for how long.

Conclusion

Boston Properties is a world-class REIT that has generated tremendous returns for investors. Unfortunately, shares appear overvalued at the moment, especially considering the headwinds from the work from home trend.

While we believe shares are overvalued, investors willing to accept lower returns, or believing the work from home trend will completely reverse itself, can justify a purchase at these levels. In any case, the company appears superbly managed and seems to still have some growth opportunities from project developments and the life-sciences platform.

Be the first to comment