AvigatorPhotographer/iStock via Getty Images

I have covered Borr Drilling (NYSE:BORR) previously, so investors should view this as an update to my earlier article on the company.

In recent weeks, shares of premium jackup rig pure play Borr Drilling (“Borr”) have delivered outstanding returns thus outperforming industry peers by a wide margin.

Even after Tuesday’s setback, shares have more than doubled since late February fueled by rising oil prices as a result of Russia’s invasion of Ukraine and a recent $400 million court win over Petrobras (PBR).

Borr inherited the lawsuit from its acquisition of Paragon Offshore (“Paragon”) in 2018. In short, Paragon is seeking compensation for the early termination of two drillship contracts in 2015 as also outlined in the company’s 2017 annual report on form 10-K:

Petrobras has contested the term of each of our drilling contracts for the Paragon DPDS2 and the Paragon DPDS3 in connection with the length of prior shipyard projects relating to these rigs and released the Paragon DPDS2 effective September 29, 2015. Under our interpretation of the contract, the Paragon DPDS3 was scheduled to work until August 2017. However, in accordance with Petrobras’ interpretation of the contract, the Paragon DPDS3 was released in August 2016. Both rigs are currently stacked in a shipyard in Puerto Rico and Paragon is winding down its operational presence in Brazil. Backlog related to this dispute is not included in our reported backlog as of December 31, 2016. Paragon will vigorously pursue all legal remedies available to us under these contracts.

While Paragon prevailing against the state-owned energy giant in a Brazilian court is certainly noteworthy, Petrobras has already stated its intent to appeal the decision, so there won’t be a major payment day for the notoriously cash-strapped Borr Drilling anytime soon.

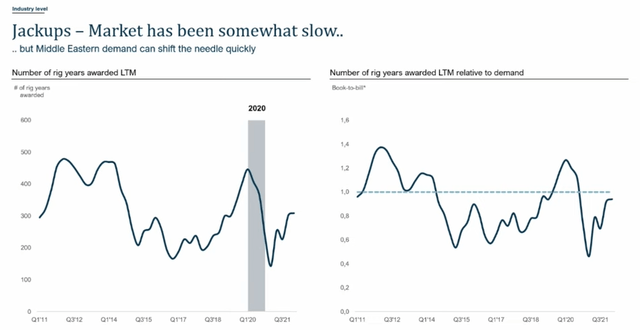

While I remain very bullish on the offshore drilling industry as a whole, recovery in the jackup market has been lagging:

Pareto Securities

That said, Borr recently managed to secure long-term maiden contracts in the Middle East for two additional premium jackup rigs thus increasing its contracted fleet to 20 rigs out of a total of 23 delivered rigs:

The contracts have a firm duration of 3 years plus options each and are expected to commence in the second half of 2022.

According to management, Borr remains on track to have all available rigs committed and under contract by the end of the year.

The company has another five newbuild rigs scheduled for delivery next year.

For 2022, management expects adjusted EBITDA to increase from a paltry $38 million last year to a range of $115 to $140 million but cash flows will be pressured by elevated rig activation costs.

To deal with these anticipated near-term cash outflows, Borr Drilling has raised approximately $35 million in gross proceeds from an oversubscribed equity offering and selling new shares into the open market under its $40 million at-the-market (“ATM”) program since the beginning of the year.

In contrast to U.S.-exchange listed competitors Valaris (VAL) and Noble Corporation (NE), Borr has avoided a bankruptcy filing by extending debt maturities and delaying installment payments for newbuild rigs.

In addition, the company has committed to refinance $935 million in near-term debt maturities by June 30:

The Company has agreed to enter into negotiations with the lenders of the Facilities and certain holders of the 3.875% Senior Unsecured Convertible Bonds due 2023 (the “Convertible Bonds”) and use its best efforts to reach a binding agreement on a refinancing of the Facilities and the Convertible Bonds by 31 March 2022 and complete such refinancing by 30 June 2022, providing the Company with a complete long-term financing solution.

To be perfectly clear, Borr’s net debt position of approximately $1.9 billion represents a strategic disadvantage relative to restructured competitors with little or no net debt like Valaris and Noble Corporation as the company needs higher dayrates to generate cash flow.

According to Esgian Rig Analytics (“Esgian”), dayrates for premium jackup rigs have been stuck in the $70,000 to $80,000 range for the past couple of quarters with near-term improvements still unlikely:

The jackup segment remains oversupplied and is less consolidated than the floater market, leading to more competition and slower dayrate growth. Although scrapping activity has been healthy there are more stranded assets that will enter the market in the future. More scrapping will be needed to absorb these incoming rigs.

Also, there are still several distressed owners that are now controlled by creditors who are liquidating the assets. This has a negative effect on values as these assets are available at discounted prices. Additional units remain for sale and are expected to be sold at lower values.

That said, Esgian expects the jackup market to improve going forward:

However, the rig market is changing. The oil price is now above $90, and Esgian Rig Analytics expects the jackup market to develop further into 2022. Demand is expected to grow, and competitive utilisation could increase close to 85%. The remaining distressed assets are also expected to be sold this year and afterwards jackup owners are likely to hold out for higher prices. If this is realised both dayrates and values will again start to move upwards.

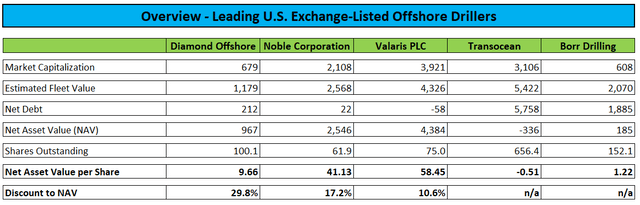

From a valuation perspective, Borr Drilling trades at a massive premium to estimated net asset value (“NAV”) while restructured competitors continue to change hands at a discount:

Company SEC-Filings, Esgian Rig Analytics

Please keep in mind that estimated fleet values have not been adjusted for contract backlog which makes floater pure play Transocean (RIG) appear much worse than it really is.

Considering the muted-near term outlook for the jackup market, ongoing liquidity challenges, strategic disadvantages compared with restructured peers and the requirement to address substantial near-term debt maturities, Borr Drilling appears to be overvalued relative to peers.

Given this issue, the recent utilization of the company’s ATM program shouldn’t be viewed as a surprise:

Borr Drilling Limited (OSE, NYSE: BORR) has during the month of March 2022, issued 1,521,944 new common shares at the New York Stock Exchange under the At-The-Market program announced on July 6, 2021, at an average price of $3.431 per share. Following such issuance, Borr Drilling has an issued share capital of $15,207,345.20 divided into 152,073,452 common shares with a par value of $0.10 per share.

Bottom Line

Borr Drilling’s recent outperformance is unlikely to persist given the company’s apparent overvaluation relative to peers.

While the surprise lawsuit win in Brazil and the announcement of new long-term contracts in the Middle East have been major positives, the jackup market will require more time for rig owners to regain pricing power.

Last month, the company has started to utilize its $40 million ATM program and with the stock price now even higher, I firmly expect Borr to have sold additional shares into the open market over the past couple of sessions.

At this point, investors looking for exposure to the offshore drilling industry should rather consider an investment in restructured peers Diamond Offshore (DO), Noble Corporation and Valaris as these companies not only trade at a large discount to Borr Drilling but also operate drillships in current industry hot spots like the U.S. Gulf of Mexico and South America.

Besides Borr Drilling, the most aggressive industry bet remains Transocean due its very high leverage and large fleet of stacked drillships which provides decent optionality in case of a full-blown, near-term industry recovery.

Be the first to comment