Pyrosky

Investment Thesis

Booking Holdings Inc. (NASDAQ:BKNG) is a top player in the online travel reservations and restaurant bookings segment. It is working on expanding its share of consumers’ travel wallets by focusing on air tickets, in addition to accommodation booking. The company posted strong results in the latest quarter.

The travel industry is recovering fast, and it is expected to continue recovering in the coming months. The stock compares well with its peers in terms of margins and valuation.

Business Overview

Booking Holdings is in the business of online travel reservations and restaurant bookings. It offers these services through six brands – Booking.com, Priceline, agoda, Rentalcars.com, Kayak, and OpenTable. Over the past several years, most of the growth in the company has been due to accommodation reservation business of its most significant brand, Booking.com. This is because it has over 2.5 million properties on its website as of June 2022. These include 400,000 hotels, motels, and resorts as well as roughly 2.1 million alternative accommodation properties including homes, apartments, and other unique places to stay.

Booking Holdings earns its income from two sources. First, agency revenue and commissions earned on accommodation, rental car, and airline reservation services. Here, the company does not facilitate payments from the travelers for the services provided.

Second, the company facilitates payments from travelers to book accommodation, rental car, and airline reservation. Revenue (called merchant revenue) is derived from these transactions and includes travel reservation commissions in connection with merchant reservation services, credit card processing rebates, customer processing fees, and ancillary fees.

Tourism is back

Travel restrictions in certain parts of Europe and Asia and the Russia-Ukraine war impacted Booking Holdings recently. On the positive side, World Tourism Organization notes in its recent report that, “As of 22 July, 62 destinations (of which 39 in Europe) had no COVID-19 related restrictions in place and an increasing number of destinations in Asia have started to ease theirs.” With travel restrictions getting relaxed around the world, travelers will have an increased appetite for Booking Holdings’ services.

The report further notes that:

“international tourism saw a strong rebound in the first five months of 2022, with almost 250 million international arrivals recorded. This compares to 77 million arrivals from January to May 2021 and means that the sector has recovered almost half (46%) of pre-pandemic 2019 levels.”

Likewise, data from industry benchmarking firm STR suggests that global occupancy rates rose to 66% in June this year, up from 43% in January.

Overall, the restrictions are easing worldwide, travel is back, and the sector is on its way to a speedy recovery.

Trying to capture a greater share of the consumer’s wallet

Booking Holdings has started focusing on the airplane ticketing service recently. Online airline ticketing is a low margin business. However, management believes this segment can help the company achieve higher sales. That’s because travelers who book an airline ticket will also likely search for an accommodation at the destination, thereby resulting in additional revenue and a better customer experience. The company is aiming to provide a more seamless travel experience, including both transportation and accommodation booking.

The management believes it still has enough room for increasing the company’s share in the total travel spend by customers on average. It is aiming to achieve this objective with the “connected trip” vision. This will also increase customer loyalty as the company increases the options and services on its website and app.

Strong performance

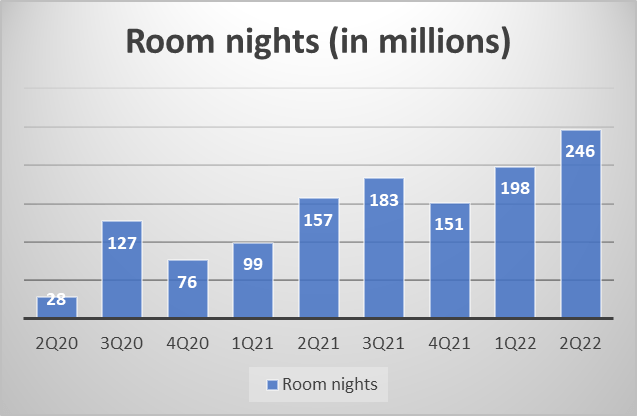

In the second quarter, Booking Holdings’ room nights sold increased from 157 million in 2Q21 to 246 million, reaching to its highest level in the last two years.

Booking Holdings

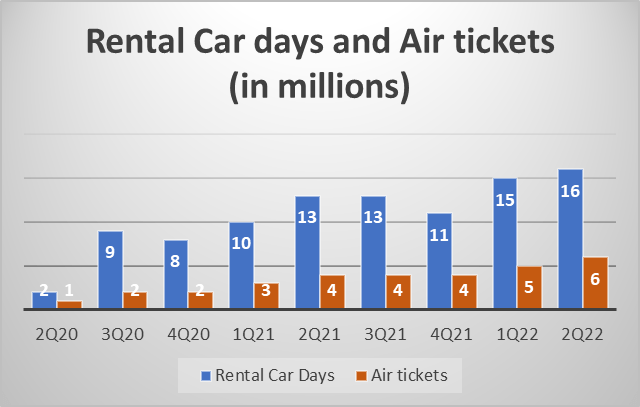

Likewise, rental car days and air tickets sold have been the highest since 2Q20.

Booking Holdings

The growth in these metrics gets reflected in the company’s revenue growth. Total revenue nearly doubled to $4,294 million in 2Q22 as against $2,160 million in 2Q21. This was contributed by an increase of 73% in agency revenue, 165% increase in merchant revenue, and 43% increase in advertising and other revenue.

Meanwhile, total operating expenses grew at a slower pace of 49%. Total operating expense for 2Q22 stood at $3,294 million as against $2,216 million in 2Q21. This resulted in the company posting an operating profit of $1,000 million in the latest quarter as against an operating loss of $56 million in the same quarter last year.

Risks

- The company competes with various online and traditional travel and restaurant reservation services worldwide. Along with that, players such as Google (GOOG, GOOGL) are also entering the travel booking space. Google today offers various services such as Google Flights, Google Hotel Ads, Book on Google, and Google Travel. These services are directly or indirectly competing with the company’s services. This is one potential competitive threat to all online travel portals, including Booking Holdings’ brands.

- Booking Holdings’ management sees an increasing demand for alternative accommodation properties. Consumers are demanding more properties in this space, perhaps due to the unique experiences they provide. However, having alternative properties impacts the company’s profit margins as these come with increased costs, such as an increase in customer service cost. It seems having alternative accommodation properties, with each property having its own uniqueness, is a positive trend for the customers, but might hurt the company’s profitability going forward. One reason for this might be that hotels typically have more standardized offerings making it less costly for online travel portals like Booking.com to verify them.

Valuation

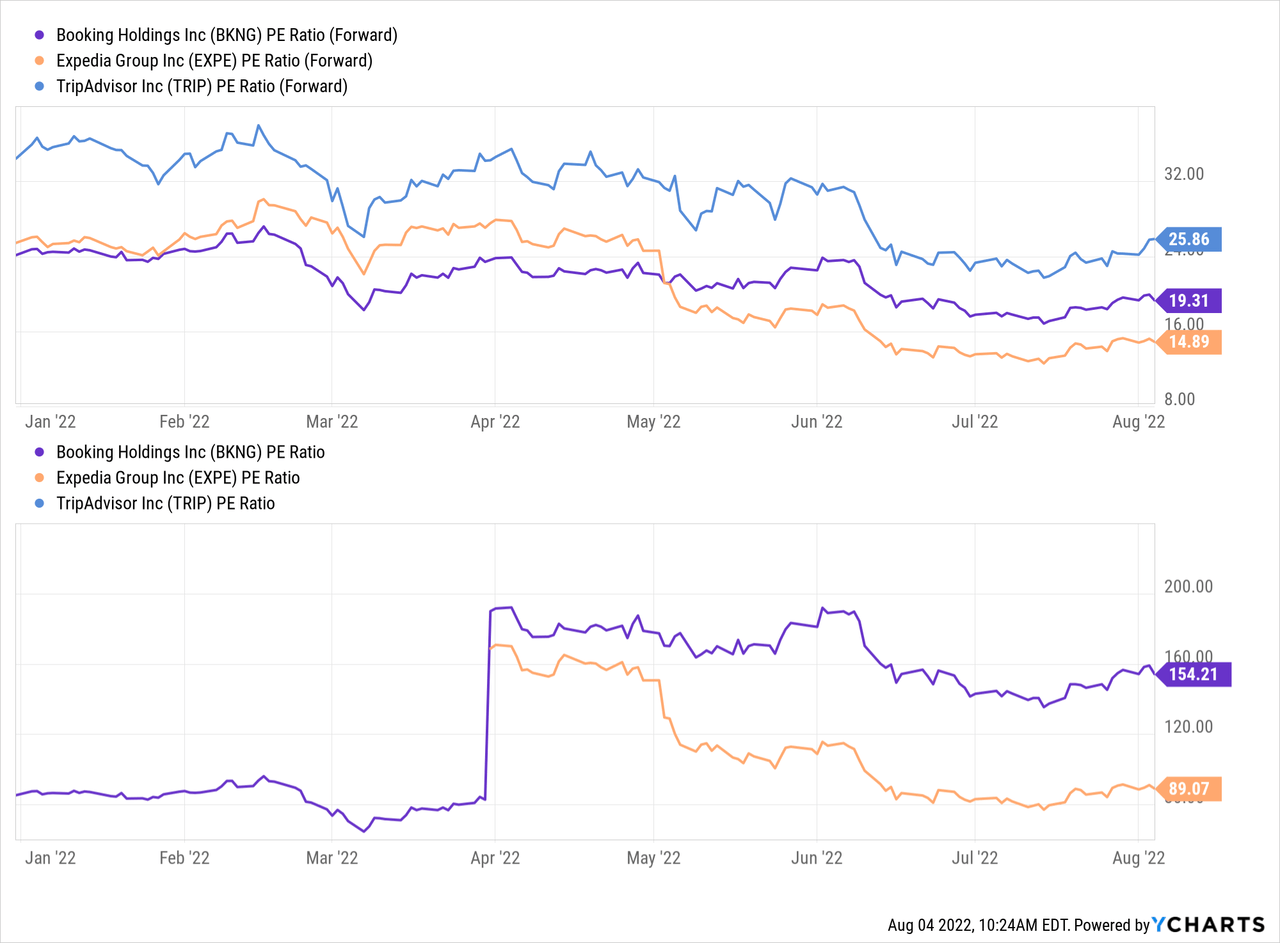

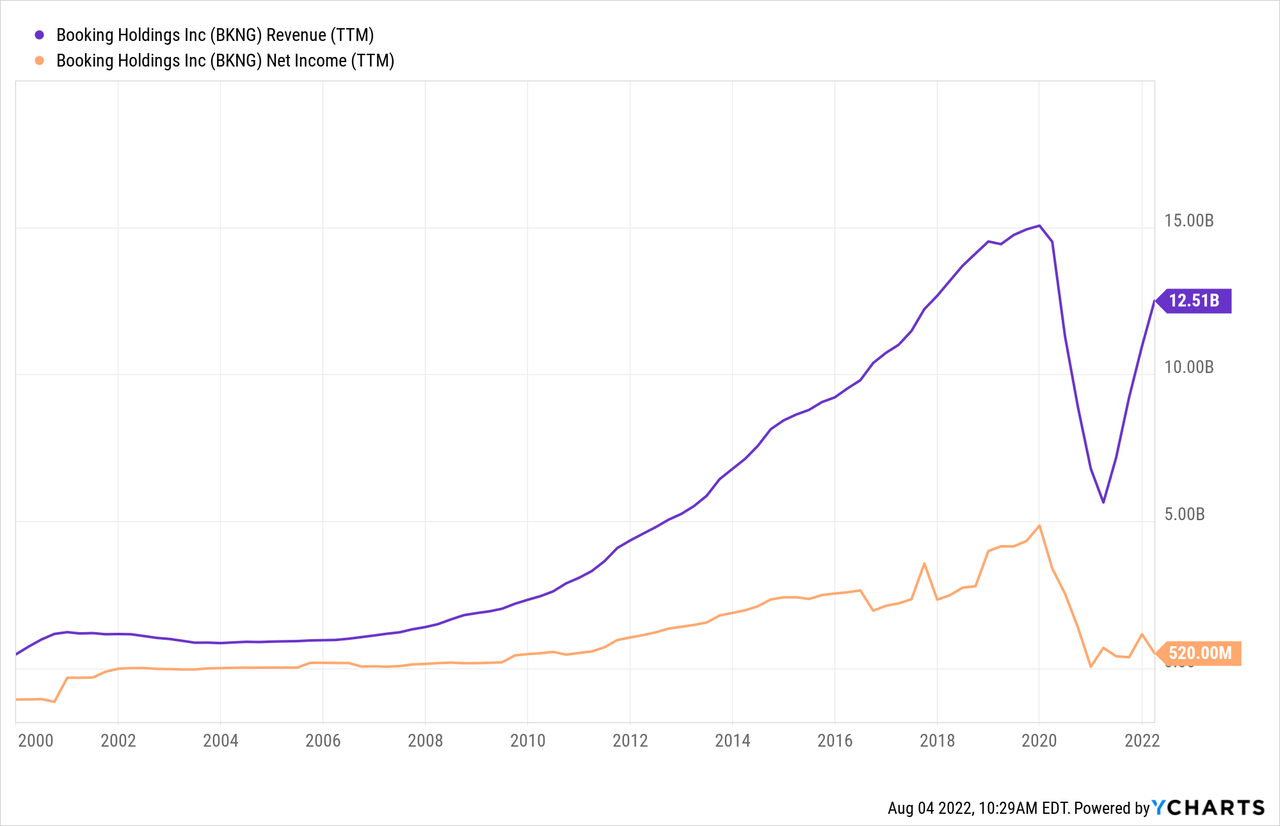

The stock is currently trading at a high P/E multiple of 159. However, this is mainly because the earnings per share reduced dramatically recently. Pandemic-induced travel restrictions affected the entire tourism industry. But the situation is now improving fast.

Although the current P/E ratio is too high, the forward P/E ratio looks reasonable. That’s because the earnings are expected to rise significantly in the coming quarters as the travel situation throughout the world gets better.

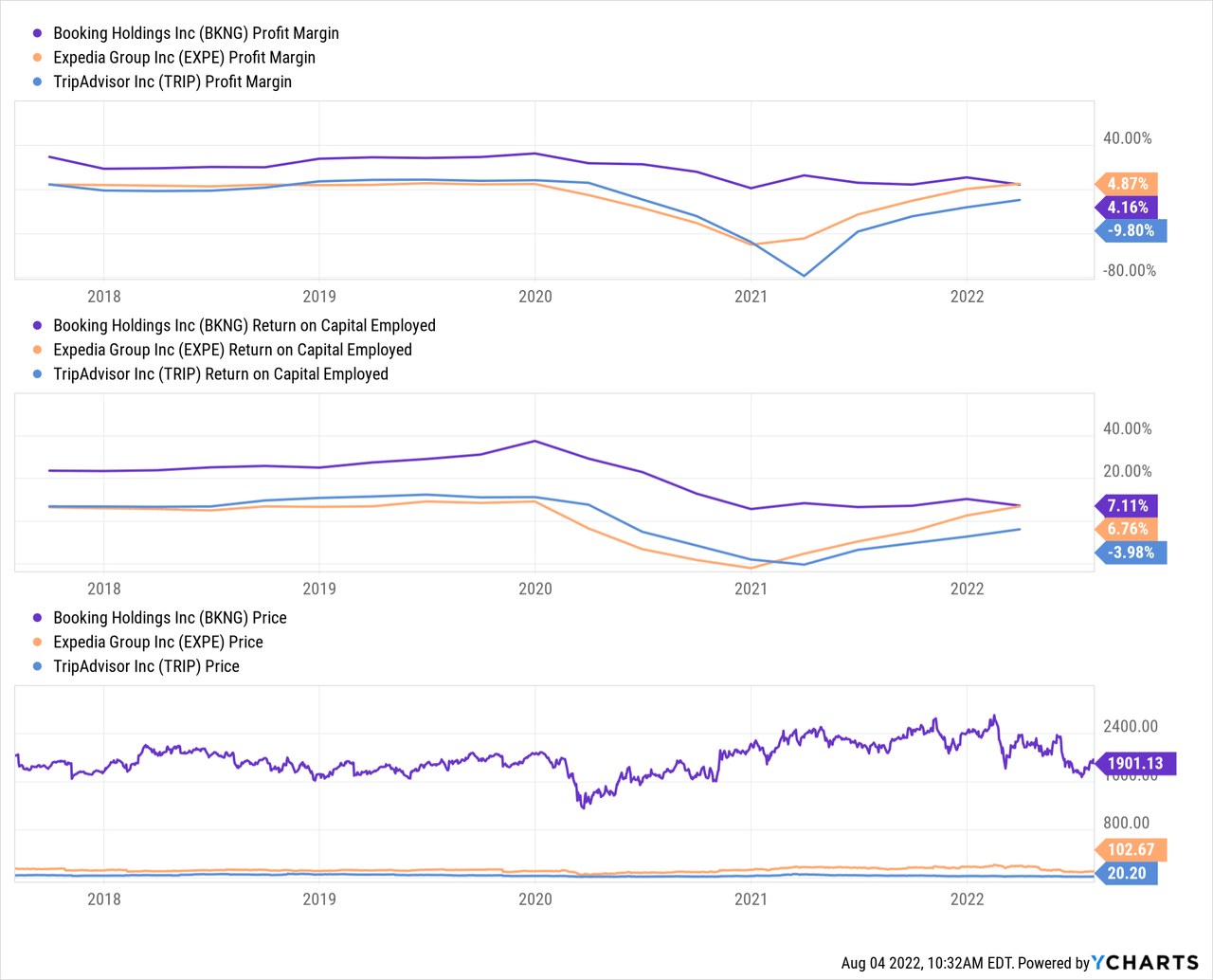

The company fares in-line with or better than its peers when it comes to profit margins and return on capital employed.

Booking Holdings has posted solid performance in the long-term. The company looks well-placed to continue doing well in future, as the industry comes back on its growth trajectory.

Seeking Alpha’s proprietary quant ratings rate the stock as “hold.” The stock is rated high on growth and profitability factors, but low on valuation.

Conclusion

Booking Holdings is a top player in its sector. It is working on expanding its share of consumers’ travel wallets by focusing on air tickets, in addition to accommodation booking. The company posted strong results in the latest quarter. Being one of the largest travel-services company in the world, Booking Holdings has good prospects of bouncing back once the overall world travel gets back on its feet. The stock compares well with its peers in terms of margins and valuation. Accumulating on the dips could be the best strategy to build a position in this top stock.

Be the first to comment