martin-dm/E+ via Getty Images

Booking Holdings Inc. (NASDAQ:BKNG) released its Q3 2022 earnings report on November 2, and it was a success, as analysts’ estimates were widely beaten. EPS of $49.55 and revenues of $5.93 billion were expected, while actual results were $53.03 and $6.10 billion, respectively. The tourism industry is still resilient, and since the release of the quarterly report, Booking has gained over the next two weeks about 13%, reaching a price per share just over $2000. Because of this rise, I do not believe that Booking is still so undervalued, which is why, compared to my previous article in early October, my rating is a hold.

Focus on Q3 2022

Overall, we can call the last quarterly as one of the best ever for Booking. Travel continues to be a priority for people who, despite the current economic slowdown, still decide to travel. The only negative aspect concerned the foreign exchange losses due to the super-dollar. However, over the last few days the euro has returned above parity, so I would not exclude the possibility that in the next quarterly report this negative effect will be less relevant.

Booking’s management also appeared very pleased with the results achieved. Here are the words of CEO Glenn Fogel:

I am encouraged by the strong results we are reporting today, including the highest amount of quarterly revenue and Adjusted EBITDA ever for our company. We saw an improvement in room night trends as we moved through the quarter and accommodation ADR growth continued to be strong. Despite the rising concern around the macroeconomic environment, we are encouraged by the slight improvement in room night growth we have seen in October and by the level of bookings for travel in early 2023.

These statements also show some positivity for the future, at least until early 2023.

Quarterly highlights now follow.

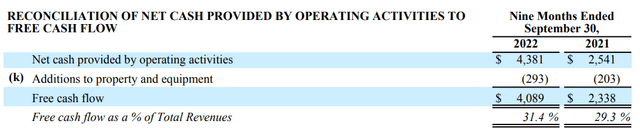

As a first aspect, we can see that 9M 2022 generated much higher free cash flow than 9M 2021. In addition, the free cash flow margin increased further to 31.40%. Basically, for every $100 in revenue Booking generates $31.40 in free cash flow, which is outstanding. It is not common to find companies leading an industry and with such high margins.

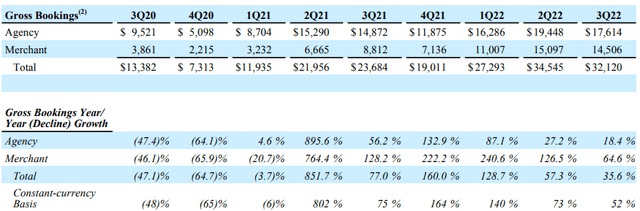

Gross Bookings increased by $8.43 billion compared to Q3 2021, driven mainly by the Merchant component. These figures reflect the business model shift that Booking is gradually adopting, moving from an Agency to a Merchant model. The latter, guarantees a greater temporary inflow of cash as well as additional forms of revenue. I recommend reading this article if you want to know more.

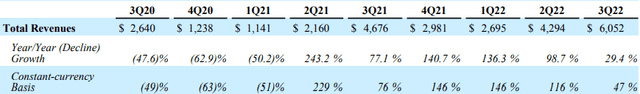

Regarding revenues, there was a 29.40% increase compared to Q3 2021. In just 3 months, revenues reached $6.05 billion, an unprecedented achievement. Moreover, it should be considered that if the exchange rate had remained the same the growth would have been 47%. This company has made a great recovery from the difficulties caused by the pandemic.

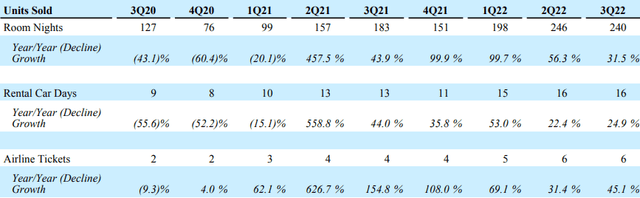

Finally, double-digit improvements also include room nights, rental car days, and airline tickets.

How much is Booking worth?

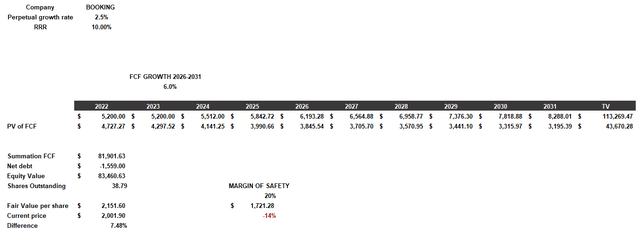

Q3 2022 was very positive overall, but this does not mean that Booking is a buy. To understand what the fair value of Booking, is I will use a discounted cash flow (“DCF”) formula, and it will be constructed as follows:

- RRR has been selected through the calculation of WACC and will be 10%.

- The cost of equity (10%) includes a beta of 1.26, a country market risk premium of 4.20%, a risk-free rate of 4.25%, and additional risks of 0.50%. Since Booking has negative net debt, I preferred not to consider the cost of debt.

- The free cash entered in 2022 is my estimate based on previously analyzed data. We saw how in 9M 2022 free cash flow was $4 billion and I assumed an additional $1.20 billion for Q4 2022. In 2023 I have included the same figure, as I think it is unlikely that Booking will continue to grow: I expect a difficult 2023. From 2024 onward I have assumed moderate growth of 6%. The perpetual growth rate will be 2.50%.

- The source of net debt and shares outstanding is TIKR Terminal.

Based on my assumptions, the fair value of Booking is $2151 per share. Therefore, a slightly higher value than it is today. On paper, the company appears to be undervalued, however, I do not believe there is such a margin of safety to start building a position.

In my previous article on Booking, my rating was a buy, as the stock was trading around $1800 per share, so there was a slight margin of safety that as of today is no longer there. I value this company, but would not be surprised to see it trading at $1800 or less again in the coming months given the current market volatility.

Obviously, for those with a positive long-term view, buying it at $1800 or $2000 is almost irrelevant, and they might already be thinking of building their position now. After all, we are talking about a company that has a free cash flow margin above 30%, negative net debt, and is an industry leader. Personally, I have made an initial buy around $1800 and will average down if it reaches $1400-$1500.

Be the first to comment