HABesen/iStock via Getty Images

Introduction

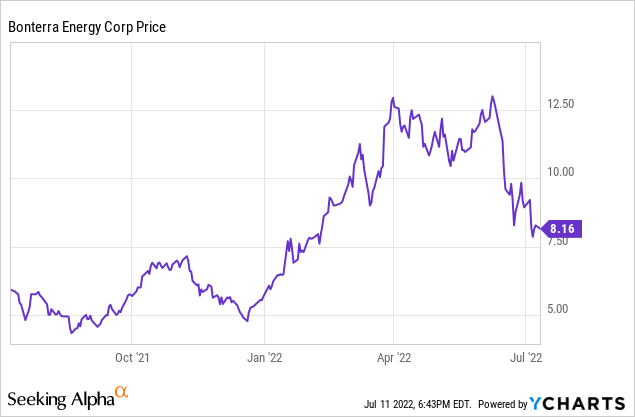

In December of last year, I turned bullish on Bonterra Energy (OTCPK:BNEFF) as the stronger oil and gas prices boded well for the future of the company whose share price was held back due to the high net debt level on the balance sheet. Just a few months later, the share price had indeed doubled and I moved to a ‘hold’ but as the share price has now dropped by in excess of 30% on the fear of seeing a lower oil and gas price due to the potential recession, I’m getting very interested again. I think the Q2 results will be excellent thanks to the high oil and gas price and this will reduce the net debt faster than I expected.

I would recommend to trade in Bonterra stock on the Toronto Stock Exchange where Bonterra Energy is trading with BNE as its ticker symbol. The average daily volume on the TSX comes in at around 200,000 shares per day, clearly making it the most liquid listing for this company. The current market capitalization is approximately C$300M after the recent share price decrease.

The cash flow makes the net debt evaporate very fast

Before discussing the anticipated Q2 results, we should perhaps take one step back and have a look at the Q1 results as that will make it easier to extrapolate the anticipated results for both Q2 and the rest of the year.

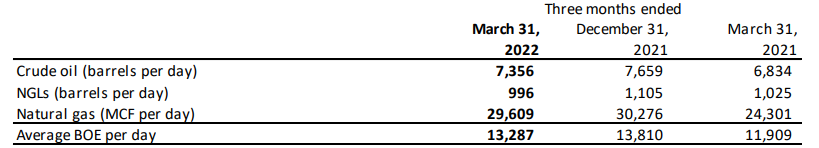

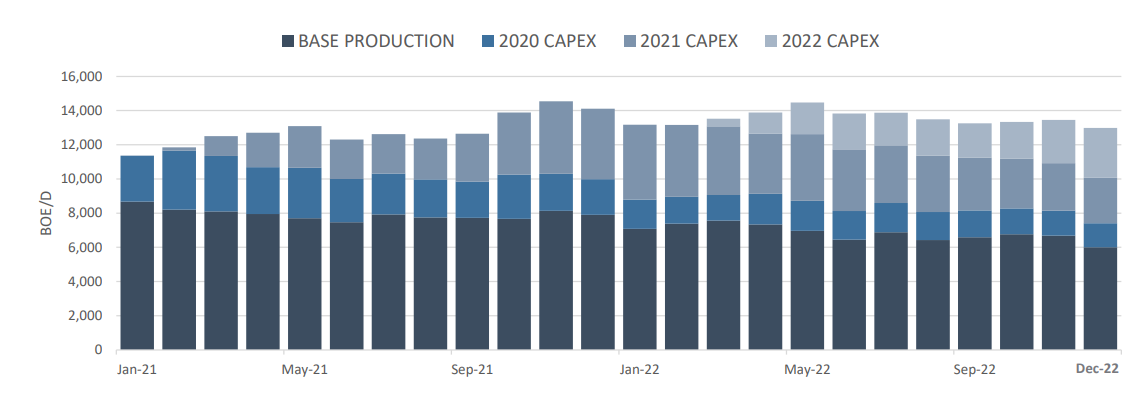

In the first quarter, Bonterra reported a total production rate of just over 13,200 barrels of oil-equivalent per day. Approximately 55% of the oil-equivalent production rate consisted of oil with NGLs making up about 5% and 40% of the oil-equivalent production rate coming from natural gas. That will be an important factor for the second quarter results as the average natural gas price in the second quarter will likely be 25-30% higher than the C$4.80 received in the first quarter.

Bonterra Investor Relations

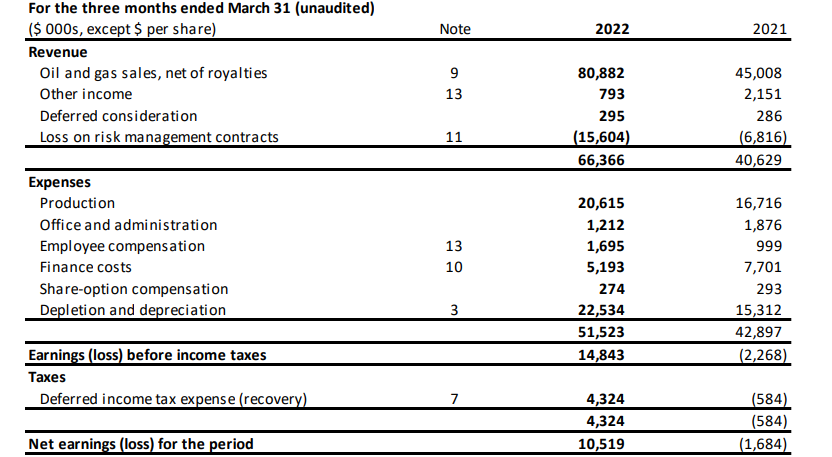

The total revenue in the first quarter came in at almost C$81M, after taking the royalty payments into account. The reported net revenue was C$66.4M as the company also recorded just under C$16M in realized and unrealized hedging losses on its hedge portfolio.

Bonterra Investor Relations

Due to the hedging losses, the pre-tax income was just under C$15M with a net income of C$10.5M which translates into approximately C$0.30 per share. On an annualized basis, this means Bonterra was generating about C$1.20 in earnings based on an average WTI price of US$95 per barrel and an AECO natural gas price of C$4.80, and both are the approximate current prices. And keep in mind the pre-tax income was actually slashed in half by hedging losses. This means I’m expecting much more from the cash flow statements as those only include the realized hedge losses.

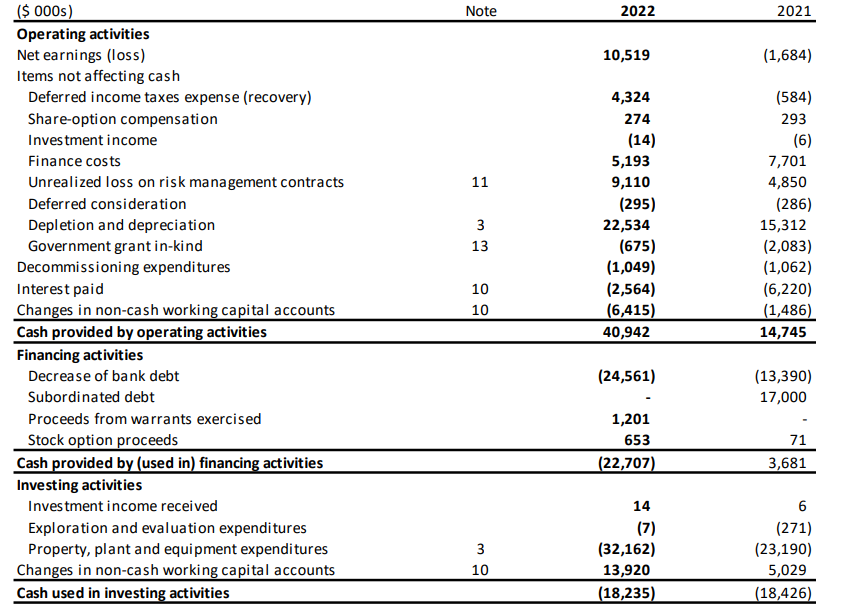

And indeed, as you can see below, approximately 60% of the recorded hedging losses were unrealized and this puts everything in a whole different perspective. We see the reported operating cash flow was approximately C$41M including a C$6.4M investment in the working capital position. Excluding this WC investment, the operating cash flow would have been C$47.3M. This includes the deferral of C$4.3M in taxes (as the balance sheet contains a massive accumulated deficit of in excess of C$400M, Bonterra won’t have to pay taxes for quite a while) as well as just over C$1M in deferred interest payments.

Bonterra Investor Relations

So if we would use C$46M in operating cash flow and subsequently deduct the C$32M in capex as shown above, you may be disappointed in the free cash flow result of just C$14M on an adjusted basis. However, Bonterra’s full-year capex guidance is just C$70M which means the company spent almost half of its full-year guidance in just the first quarter. This means that the normalized capex on a quarterly basis is just around C$18M which results in an underlying free cash flow result of C$28M. There are currently just under 36M shares outstanding which means the adjusted free cash flow was approximately C$0.78/share in the first quarter, and this still includes about C$6M in hedging losses.

The average production rate for the entire year will increase to 13,500 boe/day which means the average production rate in Q2-4 will exceed 13,600 boe/day which should further boost the operating cash flow. In fact, the Q2 production rate will likely be around 14,000 boe/day and the timing couldn’t have been better as this will have allowed Bonterra to take optimal advantage of the strong oil and gas prices.

Bonterra Investor Relations

But even if the oil and gas prices decrease, Bonterra should be fine. At an average oil price of US$75 WTI and an AECO natural gas price of C$3.50M, the operating cash flow on an annual basis should be around C$170M with a free cash flow result of close to C$100M for the year.

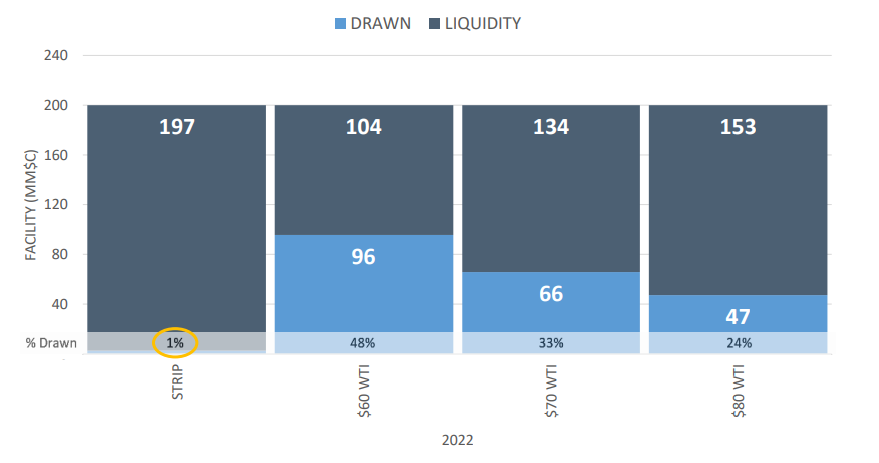

This will dramatically reduce the net debt which stood at C$235M as of the end of March. Since the end of the first quarter, the company has successfully renegotiated its bank debt deal. The borrowing base was confirmed at C$165M (C$138M drawn down as of the end of March) but with the borrowers forcing a monthly step-down of C$10M in the borrowing limit until C$115M, which will be reached in November.

This shouldn’t be an issue at all. I expect the company to generate in excess of C$50M in free cash flow in Q2 and Q4 which means the bank debt level will likely decrease to less than C$90M by the end of September and less than C$70M by the time the step-down to C$115M will be completed. And I’m quite conservative as the company expects to have just C$47M of bank debt by the end of this year, using an average WTI oil price of $80 for the May-December period. Given the average price north of $110/barrel in the first two months of this eight month period, the average oil price should be just $70/barrel from now on to make Bonterra miss this guidance. So I am very comfortable with the company’s projections and expect Bonterra to end the year with a bank debt between C$10 and C$50M.

Bonterra Investor Relations

That also means Bonterra can already work towards repaying the C$47M subordinated loan from the Business Development Bank of Canada (maturing in November 2024). Additionally, there’s a C$59M unsecured debenture outstanding with a 9% coupon, maturing in October 2025. However, the company can choose to repay this 9% debenture without any penalties in October 2024. So this year, the focus will understandably be on the bank debt, but from 2023 on, I expect Bonterra to make progress towards repaying the other debt.

As part of this debenture financing, there are still about 2.85M warrants outstanding (down from 3.15M as of March 31st) with an exercise price of C$7.75/share. While this would increase the share count to 39M shares, it would also bring in almost C$22M in cash should these warrants be exercised. Subsequent to the end of Q1, 300,000 warrants were exercised which will have boosted the cash position by almost C$2.5M and this will be visible in the Q2 update.

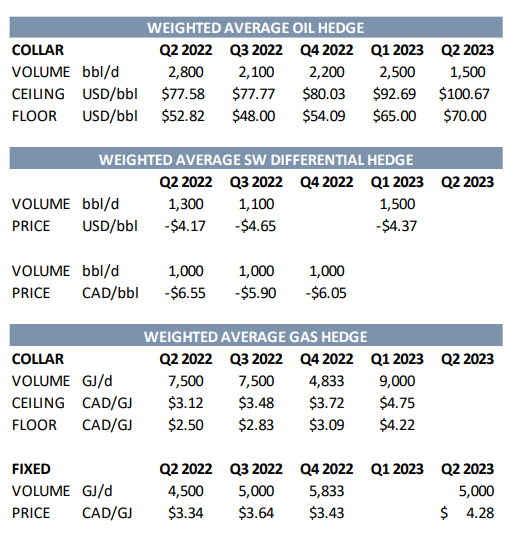

I expect a lot from the Q2 report despite having hedged about 2,800 barrels of oil per day at US$77.6 and 12,000 GJ of natural gas at an average price of around C$3.20.

Bonterra Investor Relations

Investment thesis

I think the market is quite harsh for Bonterra Energy as the company is taking the prudent approach of rapidly repaying debt. I expect to see a much stronger balance sheet at the end of Q2 and don’t foresee any issues with the agreed step-down level of the bank debt as Bonterra will likely already meet the November ceiling of C$115M.

The very strong prices in 2022 will provide Bonterra with the unique opportunity to rapidly reduce its net debt. I expect the net debt position at the end of this year to be less than C$150M and that’s a more than acceptable level to head into 2023. At a WTI oil price of US$75/barrel and C$3.75 AECO, I expect Bonterra to generate approximately C$155M in operating cash flow in 2023 and assuming a C$70M capex to keep the production stable, the free cash flow result of C$85M divided over approximately 36 million shares means the free cash flow per share will likely come in around C$2.40/share. That makes the current share price of just around C$8 very interesting and I may look into initiating a long position as the current production profile is underpinned by 2P reserves for almost 20 additional years.

Be the first to comment