cagkansayin/iStock via Getty Images

The PIMCO Active Bond Exchange-Traded Fund (NYSEARCA:BOND) is an actively-managed, leveraged, diversified bond fund. BOND’s investment managers consistently select bonds with above-average yields and returns, but without materially higher risk or volatility. BOND’s diversified, high-quality holdings, above-average 3.0% yield, and above-average returns, make the fund a buy.

BOND’s high-quality holdings are particularly appropriate for more risk-averse income investors and retirees. More aggressive, yield-seeking investors should consider higher-yielding alternatives. PIMCO has a suite of fantastic high-yield CEFs, all of which yield significantly more than BOND, but are significantly riskier as well. Of these, the PIMCO Dynamic Income Opportunities Fund (PDO) is looking particularly cheap, with a 9.7% discount to NAV.

BOND – Basics

- Sponsor: PIMCO

- Dividend Yield: 2.99%

- Expense Ratio: 0.55%

- Total Returns CAGR (Inception): 2.96%

BOND – Investment Thesis

BOND’s investment thesis is quite simple, and rests on the fund’s diversified, high-quality holdings, above-average yield, and above-average returns. These combine to create a strong, high-quality fund, appropriate for more conservative income investors and retirees. Let’s have a look at each of these points.

Diversified High-Quality Holdings

BOND is an actively-managed bond fund, administered by PIMCO, the most successful and well-known fixed-income investment managers in the world. In Seeking Alpha retirement circles, PIMCO is best-known for its assortment of high-yield leveraged CEFs, but the company does have other different offerings, including BOND.

BOND itself invests in a diversified portfolio of bonds, focusing on high-quality securities like treasuries, investment-grade corporate bonds, and mortgage-backed securities. BOND also invests in some riskier bonds, including high-yield corporate bonds, but in much lower quantities.

As mentioned previously, BOND is an actively-managed fund, so asset allocations and security selection are both somewhat dependent on the fund’s investment management team. From what I’ve seen, the fund is currently somewhat underweight treasuries, likely due to concerns about rising interest rates. Treasuries have underperformed these past few months, so being underweight said asset class seems to have been the right call, so far at least.

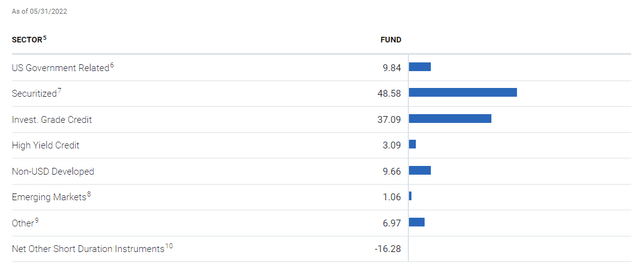

Asset allocations and credit weights are as follows.

BOND Corporate Website BOND Corporate Website

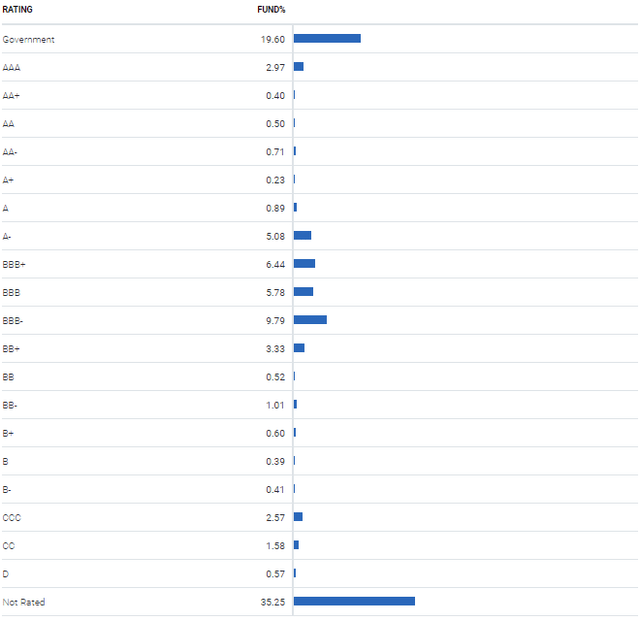

BOND’s diversified, high-quality holdings significantly reduce portfolio risk, volatility, and losses during downturns. As an example, the fund suffered losses of 1.0% during 1Q2020, the onset of the coronavirus pandemic. Losses were extremely low, as expected. Losses were significantly lower than those experienced by most broad-based equity indexes, and somewhere between those of broad-based bond indexes and investment-grade corporate bond indexes.

As should be clear from the above, BOND is a generally safe, high-quality fund, which should almost certainly experience few, if any, losses during any future downturn or recession.

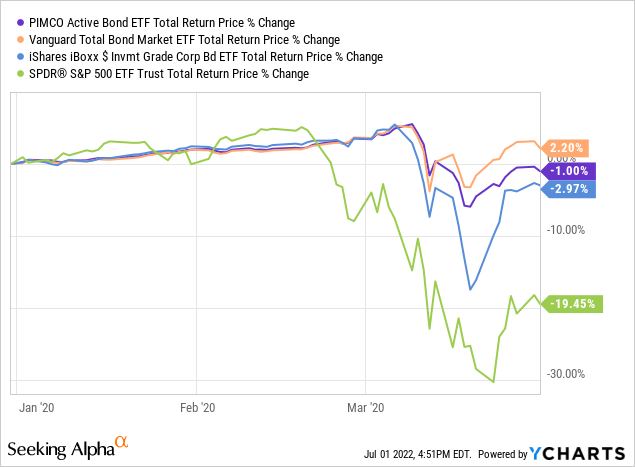

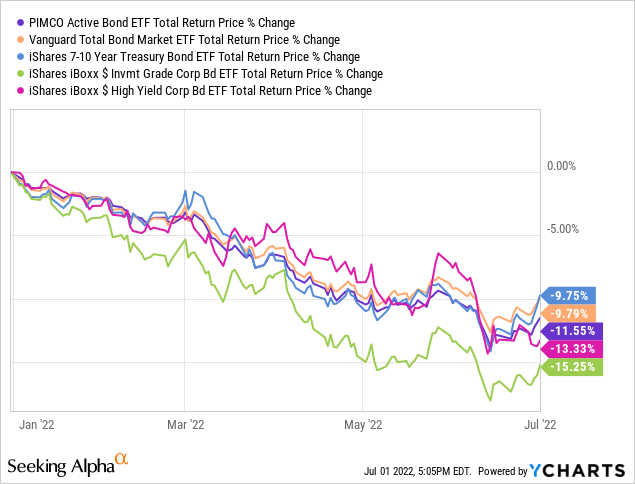

BOND’s underlying holdings sport an average duration of 6.2 years, indicating moderate/average interest rate risk. Expect, well, moderate/average losses when interest rates rise, as has been the case YTD. BOND’s losses are in the middle of its peers, quite literally so.

BOND’s average duration and interest rate risk is not a negative per se, it is an important fact for investors to consider. Other bond funds attempt to reduce interest rate risk, to reduce losses during periods of rising interest rates. BOND mostly does not do this, so investors looking for low-duration funds should look elsewhere.

As an aside, BOND is a leveraged fund, sporting a 1.52x leverage ratio. Leverage almost always increases portfolio risk, volatility, and losses during downturns, but the situation seems somewhat different for BOND. From what I’ve seen, some of the fund’s leverage is canceled out by short positions, and some is used for swaps and other derivatives which might not necessarily increase potential risks. BOND’s leverage has not led to increased losses during prior downturns, and it might not lead to increased losses during future downturns either. As such, I do not think that BOND’s leverage detracts from the overall quality and safety of its holdings: the fund remains a safe choice, appropriate for more conservative income investors and retirees.

Above-Average Yield

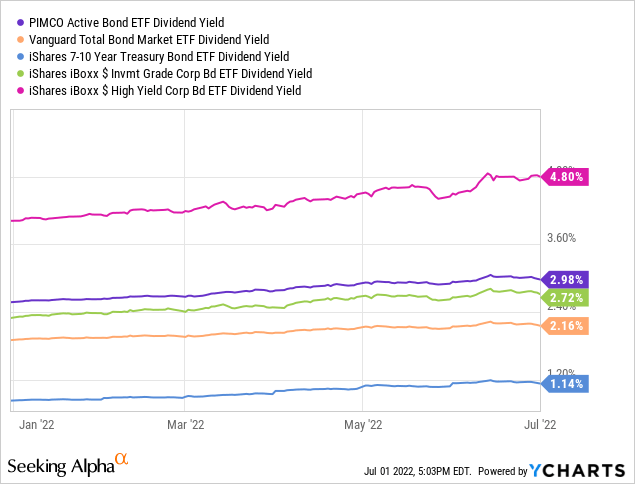

BOND currently yields 3.0%. Although the fund’s yield is not particularly high on an absolute basis, it is higher than that of its closest peers, broad-based bond indexes, and investment-grade corporate bond indexes. BOND’s yield is quite good for a diversified, high-quality bond fund, a benefit for the fund and its shareholders. The fund does yield quite a bit less than high-yield corporate bond funds, but these are materially riskier funds too.

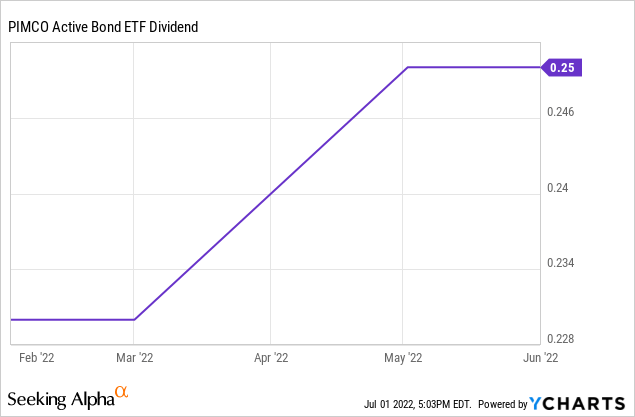

BOND’s dividend will likely see some growth in the coming months, as the Federal Reserve is hiking rates to combat rising inflation. BOND’s dividend has already increased twice in the past few months, and is up 8.7% YTD. Further growth is likely, as the fund sports a 30-day SEC yield, a short-term yield metric, of 3.8%, and a yield to maturity, a forwards-based measure of expected returns, of 5.7%.

BOND’s 3.0% yield is somewhat above-average for a diversified, high-quality bond fund, and will likely see strong, consistent growth in the coming months, benefitting the fund and its shareholders.

Above-Average Returns

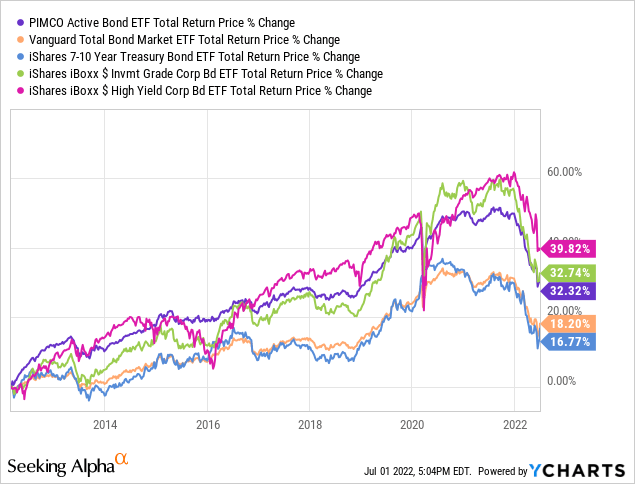

BOND’s above-average dividend yield generally results in above-average return for shareholders, at least relative to the fund’s level of risk. BOND has achieved annual returns of about 2.9% since inception, vastly outpacing treasuries and bonds in general, matching the performance of investment-grade corporate bonds, but underperforming relative to the high-yield corporate bonds.

BOND’s returns are above-average for a fund of its type and level of risk. As an example, the fund outperformed relative to investment-grade corporate bonds during 1Q2020, a recession, and YTD, a period of rising interest rates.

In simple terms, BOND provides investors with the returns of an investment-grade corporate bond fund, the level of risk of a diversified bond fund, and a higher yield than both, a solid combination. In general terms, the fund is superior to most comparable alternatives on most metrics, although not significantly so. It is a good fund, and better than the index, but nothing too spectacular.

Conclusion

BOND’s diversified, high-quality holdings, above-average 3.0% yield, and above-average returns, make the fund a buy.

Be the first to comment