Mihajlo Maricic/iStock via Getty Images

Global bond yields continue to soar. Some are even venturing out of negative yield territory. Imagine that. Domestic investors are none too pleased as evidenced by fund flow data. Just as yield to maturities have perhaps regained some luster, negative price momentum has ruled the day (as it so often does). As a result, money has left bonds and mildly entered stocks. It all adds to what has been a wild start to the year.

Risk Turns Off

Don’t get too bullish on equities, though. While there was a snapback off the mid-March lows among global stocks, selling has re-entered the picture among both large and small caps. Moreover, US and overseas stocks have endured bearish price action, down about 2%, despite April being a usually positive month for risky assets.

A Bond Exodus

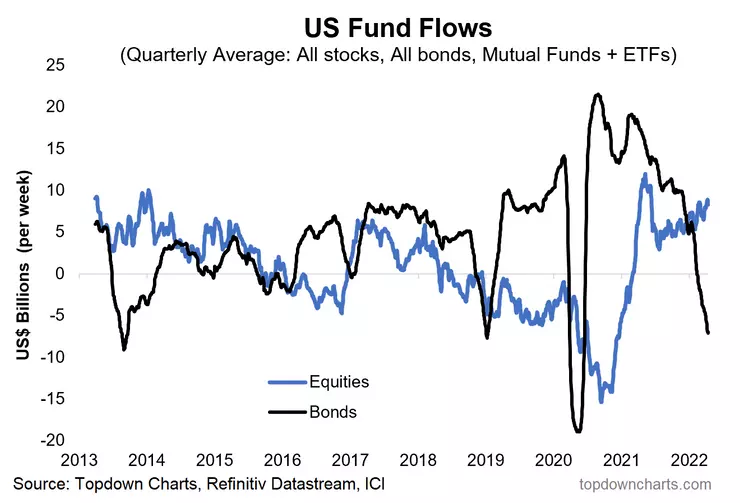

Our featured chart highlights how money has been moving over recent quarters. Following a “sell everything” mindset during the Covid panic more than two years ago, investors scooped up bonds first, then stocks. Of course, central banks around the world were part of that buying pool in Q2 2020. For equities, it was not until early 2021 (when enormous fiscal support hit the checking accounts of Americans) that cash came into US equities.

Featured Chart: Money Jumps Ship from Fixed Income

Topdown Charts, Refinitiv Datastream

Historic Losses YTD

As fiscal support rolls off, Americans still have about $2 trillion of excess savings, so we continue to see positive equity flows (that includes single issues, mutual funds, and ETFs). Investors are heeding the common narrative that stocks are not the worst place to be during inflationary times—at least for now. Meanwhile, the fixed-income space has been a rout.

So far in 2022, the US aggregate bond market is down a whopping 8%, including dividends, while so-called high-grade corporates are down nearly 12%. The iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) sports an effective yield to maturity near 4%, close to the highest level since the GFC.

When Will Investors Buy the Bond Dip? No Signs Yet.

A lot of ink has been spilled about 2022 shaping up to be among the worst years on record across a variety of bond niches, so that could portend a further exodus from fixed-income investments. The question is: When will investors dip their toe into what could be relatively decent yields compared to stocks?

More Selling to Go?

Our weekly Global Cross Asset Market Monitor highlights key happenings in the latest bond yield breakout. Across the world, rates have surged to 7-year highs. If emerging markets are a good analog at the moment, there is still room to run, maybe upwards of 50 basis points on average across the developed market.

Bottom Line:

Extreme pessimism abounds in fixed income. Developed market yields are up enormously this year amid inflationary fears and central banks that are steadfastly hawkish. There is no historical analog to the current environment, so it’s hard to confidently call a bottom anytime soon. Investors are skittish (to put it mildly) as evidenced by major bond outflows.

Be the first to comment