Stephen Brashear

Share prices of Boeing (NYSE:BA) surged following the company’s monthly update on orders and deliveries. While I believe that monthly orders and deliveries should not be isolated events that cause significant changes in share price appreciation or depreciation, the surge in Boeing’s share price is an undeniable sign that Wall Street was in awe with what the jet maker presented.

In this report, I will have a look at the orders, deliveries, cancellations and other book adjustments for the month of June. For this I use the TAF Boeing Orders and Deliveries monitor developed by The Aerospace Forum. Each month, I provide an update on the order activity for Boeing and Airbus. I do this on a monthly basis as that’s the smallest timescale on which it’s possible to extract useful data on orders, deliveries and cancellations. Using this timescale, we’re able to more accurately detect trends and inform readers.

Boeing 737 MAX Lifts Orders

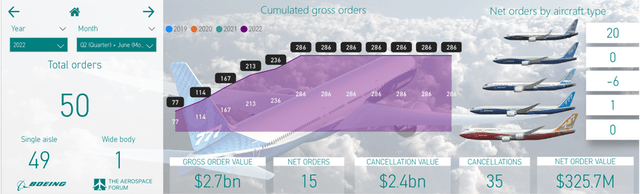

Boeing aircraft orders June 2022 (The Aerospace Forum)

During the month, Boeing received a total of 50 orders consisting of 49 single-aisle orders and one wide-body order marking a sequential increase of 27 units:

- American Airlines (AAL) ordered one Boeing 737 MAX.

- One or several unidentified customers ordered 48 Boeing 737 MAX aircraft.

- FedEx ordered one Boeing 777F.

During the month, the following changes were made to the order book:

- Avianca cancelled an order for two Boeing 787-9s.

- WestJet cancelled orders for three Boeing 787-9s.

- Norwegian Air Shuttle (OTCPK:NWARF) cancelled orders for one Boeing 787-9.

- Norwegian Air Shuttle cancelled orders for 28 Boeing 737 MAX Aircraft.

- Aerolineas Argentinas cancelled an order for one Boeing 737 MAX.

- Southwest Airlines (LUV) was identified as the customer for three Boeing 737 MAX aircraft.

- The Republic of Iraq was identified as the customer for 10 Boeing 737 MAX aircraft.

Boeing 787-9 in WestJet colors (WestJet)

In June, Boeing’s orders were heavily tilted toward the Boeing 737 MAX which should not come as a surprise keeping in mind the continued delays on the wide body programs and the differences in demand recovery between single aisle focused markets and wide body focused markets. An uptick in wide body orders might come once Boeing has its programs better aligned to serve customers on a more reliable timeframe.

There were some interesting changes in the order book as Norwegian cancelled its last Dreamliner on order and cancelled orders for 28 Boeing 737 MAX aircraft bringing the order book in line with its fleet plan. Avianca and WestJet also walked away from their Dreamliner orders, likely the result of the continued delays in deliveries and a re-think of the overall fleet strategy. Interesting to note is that these cancellations were already anticipated as they were included in our tally accounting for orders that Boeing believes are unlikely to be delivered.

During the month, Boeing received 50 orders and 35 cancellations, bringing its net order tally to 15 orders valued at $325.7 million. In the same month last year, Boeing received 219 orders but had to scratch 73 orders from the books, bringing its net orders to 146 units valued at $8.3 billion. So, year-over-year, the net orders were dropped significantly but this was primarily driven by an order for 200 aircraft last year from United Airlines (UAL).

Year-to-date, Boeing received 286 orders and 100 cancellations, bringing its net orders to 186 units valued $13.9 billion. In comparison, last year, Boeing booked 599 orders and 356 cancellations, bringing its net orders to 243 units valued at $17.9 billion. The numbers show that gross order inflow has declined and cancellations have improved, resulting in a 25% decline in net orders and a similar decline in base value for the aircraft. This, however, is not necessarily a sign of weakness as the differential is driven by a single big order, and with the Farnborough Airshow kicking off later this month, things could be different by the end of July.

Boeing also updated its ASC606 adjustments tally, which is a tally in which Boeing lumps orders that have a purchase agreement but also several other check boxes that need to be ticked in order to count the aircraft orders to the backlog or not. During the month, we saw the tally decrease by 83 units. This was primarily driven by the orders from Norwegian turning into cancellations but also 50 orders from the same carrier now being considered as likely to be delivered meaning that they were added back to the backlog.

If all ASC 606 adjustments result in cancellations, which definitely is not always the case, Boeing would have to scratch an additional 867 aircraft from its books.

Boeing 737 MAX Deliveries Surge

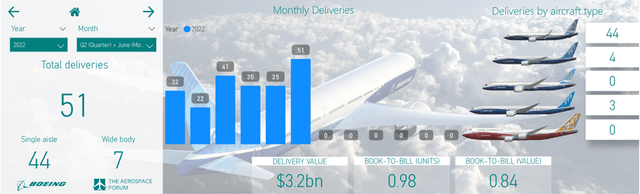

Boeing aircraft deliveries June 2022 (The Aerospace Forum)

Month-over-month Boeing’s delivery numbers improved from 35 units to 51 aircraft, valued at $3.2 billion consisting of 44 single-aisle aircraft and seven wide-body aircraft:

- Boeing delivered 44 Boeing 737s consisting of 43 Boeing 737 MAX aircraft and one Boeing P-8A.

- Boeing delivered one Boeing 767-2C used as the base aircraft for the KC-46A tanker and three Boeing 767-300Fs.

- Boeing delivered three Boeing 777-300Fs.

- There were no deliveries for the Boeing 747 program.

- There were no deliveries for the Boeing 787 program.

Over the past few months, we have seen Boeing missing even the lower bound on Boeing 737 MAX deliveries and that has been extremely disappointing. The deliveries in July, however, showed delivery numbers where I’d like to see them. Boeing has achieved a production rate of 31 aircraft per month on the Boeing 737 MAX program and that is definitely a good sign. Last month, I mentioned that Boeing would need a quarter-end surge in order to have a chance to meet airline delivery schedules. The strong uptick in deliveries is indeed what we observed and it shows the overall strain on the system. While the increase in deliveries brought Boeing to the highest delivery volume in years, I don’t believe it has been enough to meet airline delivery schedules.

An example are the deliveries for Air Canada. The airline expected three deliveries to meet its schedule, but Boeing only delivered one. While it’s certainly a positive that deliveries went up and a higher production rate has been achieved, it’s too early to say that this is the delivery volume we’re going to see in the remainder of the year as part of the uptick in deliveries is driven by June marking the end of the quarter.

Year-over-year delivery numbers increased from 45 to 51, but the value went down slightly from $3.3 billion to $3.2 billion. So, we’re seeing an uptick in deliveries, but due to the mix being less tilted toward wide body aircraft the value of the deliveries has declined a bit. Also important to consider is that as expected Boeing did not meet a comparable year-over-year growth as we saw in previous months.

Year-to-date, there have been 216 deliveries valued at $14.2 billion compared to 156 deliveries valued $12.3 billion. So, we do see a significant increase in deliveries and delivery value, but not the delivery volumes you would like to see, given that Boeing has a big pile of jets awaiting delivery. The Boeing 787 is still not back for Boeing, but we’re expecting deliveries to recommence soon. Overall, Boeing is highly dependent on the Boeing 737 MAX, but delivery volumes on that program are not satisfactory on a consistent level.

The book-to-bill ratio for the month was 0.98 and 0.84 in terms of value reflecting a heavy weight of the more valuable wide body aircraft in the delivery mix relative to the orders. For the year, we have a book-to-bill of 1.3 in terms of units and 1.5 in terms of value, driven by strong order inflow, while deliveries are mediocre at best.

Conclusion

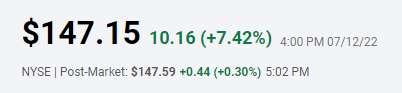

Boeing share price pop (Seeking Alpha)

Share prices of Boeing saw a nice pop following the release of the order and delivery numbers and the news that Boeing reached a production rate of 31 aircraft per month on the Boeing 737 MAX program. The increase in deliveries is nice, but we have yet to see whether that will be a sustained rate, and looking at quarter-end delivery figures history suggests that’s not the case.

I don’t quite think there was a strong reason to see Boeing’s share prices increase 7.4% in value. Indeed, there’s good news for the MAX, but we need to see some sustained form of growth and just the quarter-end delivery surge is not the proof of sustained growth that I’m looking for but apparently for Wall Street it is. I wouldn’t be surprised if we see some of that surge fade in the next trading day or days.

At the same time, this is a step process for Boeing. Recovery doesn’t happen overnight, which people who have been invested or not invested in Boeing know for the past three years. I think while the pace of recovery has been slow and probably too slow, Boeing is on the way back. Production rates back at 31 aircraft per month mean something for cash flow and the Boeing 787 delivery resumption also has significance. So, Boeing is ticking the boxes that allows itself to become more investable.

Be the first to comment