nycshooter

By The Valuentum Team

The Boeing Company (NYSE:BA) was once a darling of a stock in the 2010s. The company had an enviable balance sheet, and its reputation was practically flawless, albeit not perfect. At the time, we were looking at Boeing’s shares as fortress-like, and we were huge fans of its commercial aircraft backlog, which it retains.

However, the black marks associated with its 737 MAX, all but highlighted on DOWNFALL: The Case Against Boeing, have in part made dabbling in shares of the aerospace giant a difficult proposition. Furthermore, concerns over global economic growth in Europe and China coupled with worries about the health of the U.S. consumer, as outlined in Valuentum President’s Brian Nelson’s latest video, where he expects a huge market “flush,” should give investors pause, especially in the context of Boeing’s weakened and battered balance sheet.

With that bearish backdrop clearly stated, Boeing is benefiting immensely from recovering passenger air travel demand while the outlook for defense spending in Western countries is quite robust due to rising geopolitical tensions. Boeing’s order backlog is steadily recovering, though its financial strength remains lackluster as the firm has been dealing with several crises in recent years. Not only was the 737 MAX grounded in March 2019, the negative headlines haven’t disappeared, and its 787 aircraft is now dealing with immense regulatory scrutiny. In August, Boeing restarted its deliveries of its 787 aircraft (the first since May 2021), alleviating in part major headwinds to its financial performance. All things considered, however, we think Boeing’s fundamentals and struggling financials coupled with the stock market’s bearish backdrop make it “uninvestable” for some time yet.

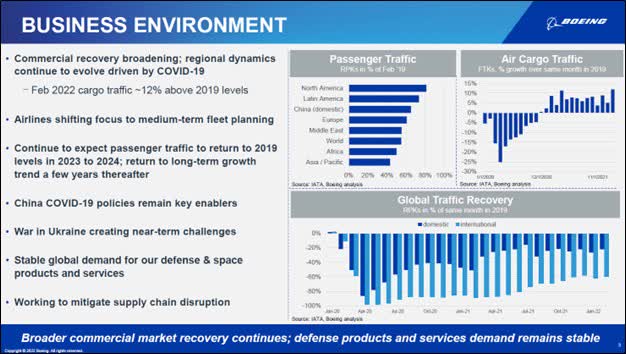

Image Shown: Passenger air travel activity is steadily recovering from the pandemic and air cargo traffic remains robust, supporting Boeing’s longer term outlook. (Image Source: Boeing – First Quarter of 2022 IR Earnings Presentation)

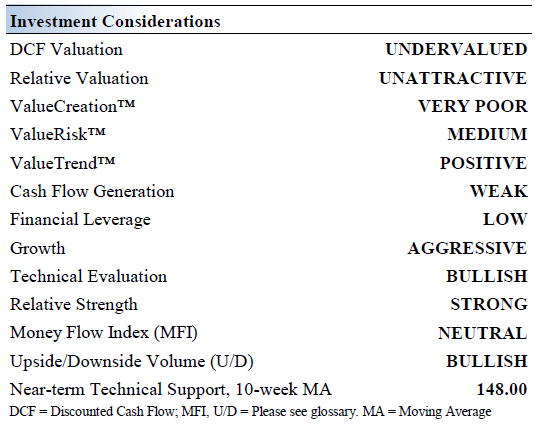

Boeing’s Key Investment Considerations

Image Source: Valuentum

Boeing is the largest manufacturer of commercial jetliners and military aircraft combined. Boeing also makes rotorcraft, electronic and defense systems, missiles, satellites, launch vehicles and advanced information and communication systems. The firm is a major service provider to NASA.

The aerospace giant had been benefiting from a benign operating environment until COVID-19 and 737 MAX troubles derailed progress. Boeing suspended its dividend and tapped debt markets in 2020 to ride out the storm, though significant headwinds remain.

Boeing’s commercial aerospace backlog of unfulfilled deliveries offers it some visibility and recent orders indicate the firm may finally be turning the corner after years of missteps and regulatory problems stymied its growth story. The company was working to build a $50 billion services division, though COVID-19 has delayed those efforts.

The U.S. FAA cleared the 737 MAX to return to the skies in November 2020, as did EU regulators in January 2021, followed by Chinese regulators in December 2021. Now Boeing is working hard to resume the pace of deliveries of its 787 Dreamliner planes. Boeing’s outlook is improving, but we’re still very, very cautious on shares.

That said, the company has aggressively cut costs in recent years to offset headwinds created by COVID-19 and regulatory hurdles. The firm’s cost savings programs involve rationalizing its manufacturing footprint and shrinking its headcount across the board. This will help, but its reputation may be damaged for some time given the 737 MAX disasters.

Boeing’s Financial Health

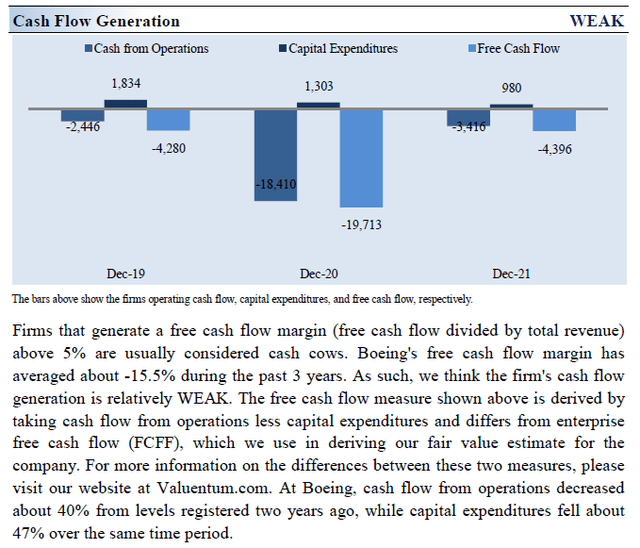

Boeing exited March 2022 with a massive net debt load of ~$45.5 billion (inclusive of short-term debt) after generating negative free cash flows in each year from 2019-2021. The company also generated negative free cash flows during the first quarter of 2022. Large working capital builds due to its inability to deliver certain aircraft, a product of its lackluster operational execution and regulatory intervention, is largely why Boeing has had difficulties generating positive free cash flows in recent years.

In March 2020, Boeing suspended its dividend as it contended with a rapidly deteriorating outlook for aircraft demand in the wake of the early days of the pandemic and large working capital builds due to the grounding of its 737 MAX aircraft (which wasn’t cleared to fly again in the US by the Federal Aviation Administration until late 2020). Back in April 2019, Boeing suspended its share buyback program. As an aside, Boeing suspended its operations in Russia (it is no longer offering services, parts, and support to Russian airlines) and also is no longer buying titanium from Russia.

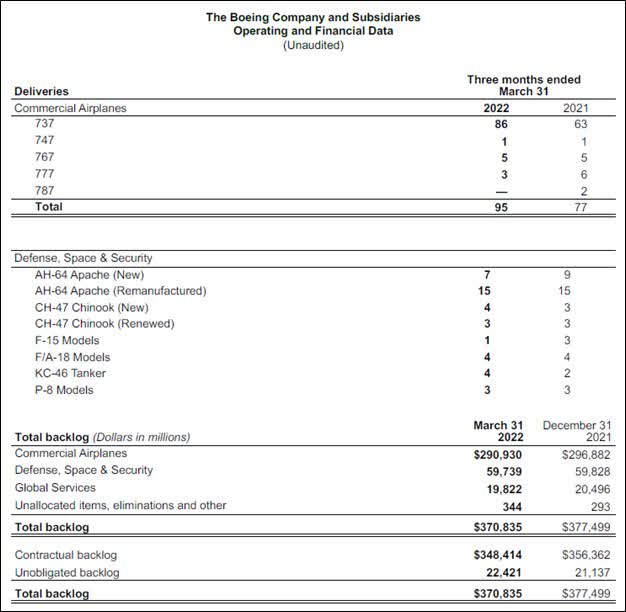

One of the few things working in Boeing’s favor is its strong order backlog, which stood at $370.8 billion at the end of March 2022. That covered ~4,200 commercial aircraft with a backlog worth $290.3 billion, followed by a $57.7 billion backlog relating to national defense needs (defense, space, and security) along with a sizable services backlog. Boeing delivered 95 aircraft in the first quarter of 2022, up from 77 aircraft in the same period in 2021. Deliveries of Boeing’s national security offerings remained robust in the first quarter of 2022 and was broadly flat, in unit terms, versus the same period last year.

The company’s backlog declined modestly (down $6.6 billion) from the end of December 2021 to the end of March 2022, primarily due to Boeing picking up the pace of its deliveries, though its backlog still remained enormous. At the end of December 2020, Boeing’s backlog stood at $363.4 billion (covering ~4,000 commercial aircraft along with sizable defense, services, and other offerings), indicating its order book has more or less resumed its growth trajectory over the past several quarters.

Image Shown: Boeing’s total backlog remains enormous and its commercial aircraft deliveries are steadily picking up the pace. (Image Source: Boeing – First Quarter of 2022 Earnings Press Release)

Boeing’s Economic Profit Analysis

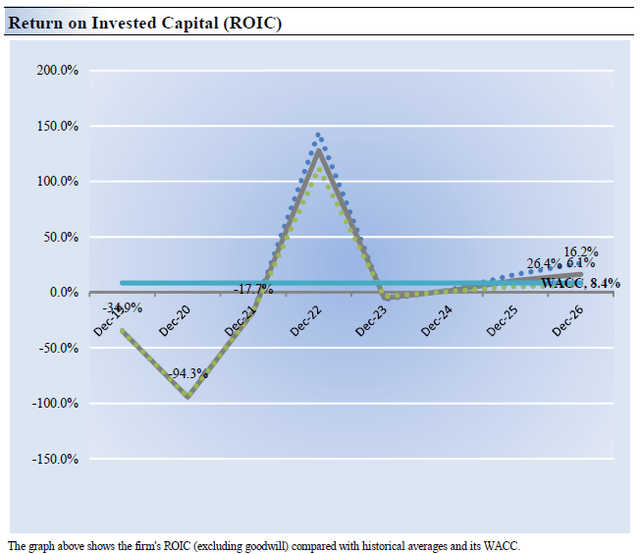

The best measure of a company’s ability to create value for shareholders is expressed by comparing its return on invested capital with its weighted average cost of capital. The gap or difference between ROIC and WACC is called the firm’s economic profit spread. Boeing’s 3-year historical return on invested capital (without goodwill) has been negative, clearly well below the estimate of its cost of capital of 8.4%.

As such, we assign Boeing a ValueCreation rating of VERY POOR. In the chart below, we show the probable path of ROIC in the years ahead based on the estimated volatility of key drivers behind the measure. The solid grey line reflects the most likely outcome, in our opinion, and represents the scenario that results in our fair value estimate. As shown, things aren’t looking great for Boeing as it relates to economic profit creation, and we expect conditions to remain difficult for the company in this department for some time yet.

Boeing’s Cash Flow Valuation Analysis

Though we are bearish on shares, more generally, we do think they are cheap, but only for investors with a very long time horizon. It may take years for Boeing to come to reflect our estimate of intrinsic value, given the sentiment surrounding the name at the moment.

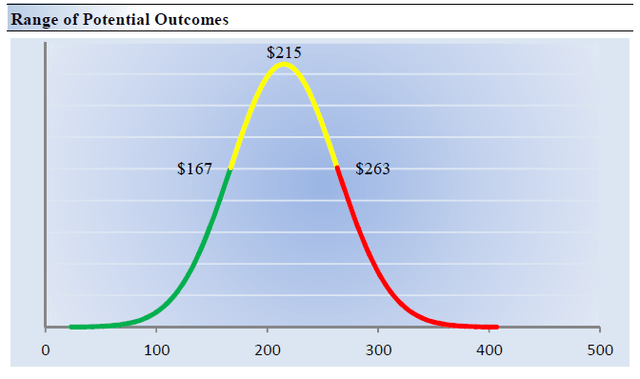

On the basis of our enterprise valuation process, our fair value estimate for Boeing is $215 per share with a fair value estimate range of $167-$263. The margin of safety around our fair value estimate is driven by the firm’s MEDIUM ValueRisk rating, which is derived from an evaluation of the historical volatility of key valuation drivers and a future assessment of them.

Our near-term operating forecasts, including revenue and earnings, do not differ much from consensus estimates or management guidance. Our model reflects a compound annual revenue growth rate of 15.4% during the next five years, a pace that is higher than the firm’s 3-year historical compound annual growth rate of -14.9%.

Our valuation model reflects a 5-year projected average operating margin of 6%, which is above Boeing’s trailing 3-year average. Beyond year 5, we assume free cash flow will grow at an annual rate of 2.2% for the next 15 years and 3% in perpetuity. For Boeing, we use a 8.4% weighted average cost of capital to discount future free cash flows.

Boeing’s Margin of Safety Analysis

Our discounted cash flow process values each firm on the basis of the present value of all future free cash flows. Although we estimate Boeing’s fair value at about $215 per share, every company has a range of probable fair values that’s created by the uncertainty of key valuation drivers (like future revenue or earnings, for example). After all, if the future were known with certainty, we wouldn’t see much volatility in the markets as stocks would trade precisely at their known fair values.

Our ValueRisk rating sets the margin of safety or the fair value range we assign to each stock. In the graph above, we show this probable range of fair values for Boeing. We think the firm is attractive below $167 per share (the green line), but quite expensive above $263 per share (the red line). The prices that fall along the yellow line, which includes our fair value estimate, represent a reasonable valuation for the firm, in our opinion.

Even though we think Boeing’s shares may be cheap at present levels of ~$150, our downside fair value estimate of $167 per share indicates that there may not be that much upside–even on the basis of an enterprise valuation process that considers a margin of safety. Not only this, but investors should keep in mind the bearish backdrop for stocks in the near term. Anyone invested in Boeing likely may require a 5-10 year time horizon for the company to right the ship.

Concluding Thoughts

Boeing’s financials continue to be in bad shape, and its operations continue to be plagued by missteps. The aerospace giant exited March 2022 with a massive net debt load of ~$45.5 billion (inclusive of short-term debt) after generating negative free cash flows in each year from 2019-2021. The company also generated negative free cash flows during the first quarter of 2022. Large working capital builds due to its inability to deliver certain aircraft, a product of its lackluster operational execution and regulatory intervention, is largely why Boeing has had difficulties generating positive free cash flows in recent years.

Boeing will need to step up its aircraft production activities and ultimately its deliveries to realize meaningful economies of scale while improving its cash flow generating abilities going forward. Manufacturing hiccups remain, and management will need to improve Boeing’s operational execution in order to improve the firm’s cost structure and financial performance. Though Boeing was once a darling of a stock, there is way too much “hair” on the name today for us to grow interested, even as we note it could present a great opportunity for long term investors on the basis of our fair value estimate. As it no longer pays a dividend, too, this one might be best to put aside for most investors.

This article or report and any links within are for information purposes only and should not be considered a solicitation to buy or sell any security. Valuentum is not responsible for any errors or omissions or for results obtained from the use of this article and accepts no liability for how readers may choose to utilize the content. Assumptions, opinions, and estimates are based on our judgment as of the date of the article and are subject to change without notice.

Be the first to comment