Central Bank Watch Overview:

- Both the Bank of England and European Central Bank are slow walking their fight against high inflation pressures.

- Rates markets are pricing in a 25-bps rate hike by the BOE in May, while the ECB is expected to raise rates by 10-bps in July.

- Retail trader positioning suggests EUR/USD rates have a bearish bias, while GBP/USD rates have a mixed outlook.

Balancing Growth and Inflation

In this edition of Central Bank Watch, we’ll cover the two major central banks in Europe: the Bank of England and the European Central Bank. Both central banks continue to monitor the impact of the Russian invasion of Ukraine on liquidity in financial markets (thanks to the sanctions), and in turn have slowed their approach to addressing multi-decade highs in inflation pressures in the Eurozone and UK. Neither central bank appears to have much ‘teeth’ behind their respective policies at present time, leaving both the British Pound and the Euro at a disadvantage.

For more information on central banks, please visit the DailyFX Central Bank Release Calendar.

BOE Hike Odds Remain Relatively Soft

Among developed economies, the UK is perhaps the worst positioned to deal with the dual threat of high inflation and low growth, effectively stagflation. A lack of aggressive forward guidance by the Bank of England is exacerbating the problem, insofar as markets don’t really believe the BOE will do what’s necessary to curb high price pressures, which are at a 30-year high. Of course, this perception comes downstream from comments made by BOE Chief Economist Huw Pill in February, when he said that he wanted to avoid “taking unusually large policy steps may validate a market narrative that Bank policy is either foot-to-the-floor on the accelerator or foot-to-the-floor with the brake.”

Bank of England Interest Rate Expectations (April 19, 2022) (Table 1)

Accordingly, rates markets don’t seem to buy the idea that the BOE will act aggressively on inflation anytime soon – leaving the British Pound at a relative disadvantage while so many other major central banks have embarked upon and signaled that they will hike rates rapidly over the coming months. UK overnight index swaps (OIS) are discounting a 129% chance of a 25-bps rate hike in May (a 100% chance of a 25-bps hike and a 29% chance of a 50-bps hike). Rates markets are still pricing in a 25-bps rate hike at every meeting for the rest of 2022; while that seems aggressive, it’s actually a slower pace than where pricing was back in February, prior to the Russian invasion of Ukraine.

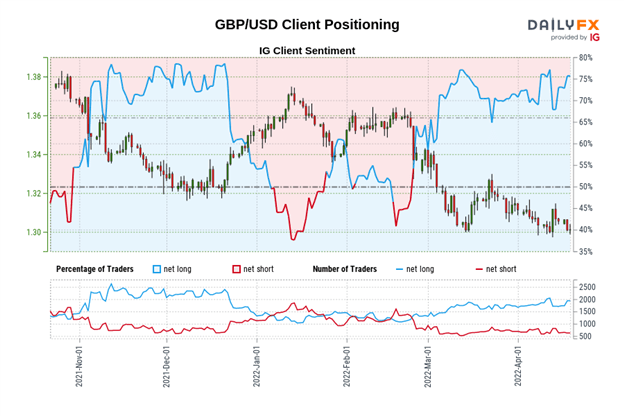

IG Client Sentiment Index: GBP/USD Rate Forecast (April 19, 2022) (Chart 1)

GBP/USD: Retail trader data shows 75.25% of traders are net-long with the ratio of traders long to short at 3.04 to 1. The number of traders net-long is 7.23% higher than yesterday and 3.99% lower from last week, while the number of traders net-short is 0.92% lower than yesterday and 3.42% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBP/USD prices may continue to fall.

Positioning is more net-long than yesterday but less net-long from last week. The combination of current sentiment and recent changes gives us a further mixed GBP/USD trading bias.

Disconnect Persists Between ECB, Market Odds

As the European Central Bank outlined last week, an end to stimulus efforts in 3Q’22 remains the most likely course of action, which leaves the Euro at a disadvantage in the near-term: while other major central banks are raising rates to try and curb price pressures, the ECB will not. Rates markets continue to price in July for the first ECB rate hike, but that seems likely to disappoint, given the fact that the ECB doesn’t want to raise rates prior to ending asset purchases.

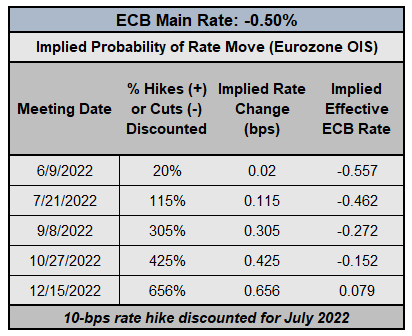

EUROPEAN CENTRAL BANK INTEREST RATE EXPECTATIONS (April 19, 2022) (TABLE 2)

Eurozone OIS are discounting a 10-bps rate hike in July (115% chance), which seems too high. €STR, which replaced EONIA, is priced for 60-bps of hikes through the end of 2022 – again, far too high. If the ECB doesn’t raise rates before ending asset purchases – which it has suggested is the plan of action – the juxtaposition between the ECB and other major central banks will continue to grow, weighing on the Euro.

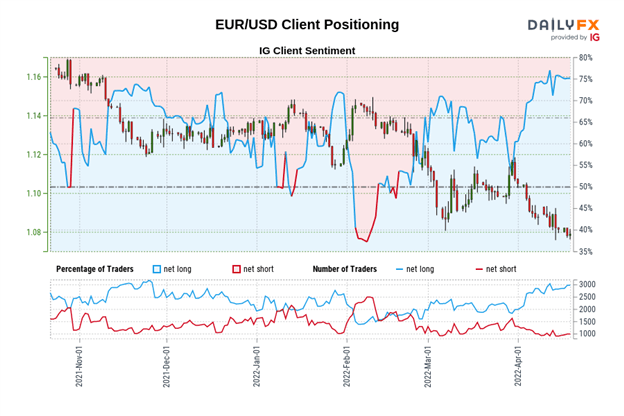

IG Client Sentiment Index: EUR/USD Rate Forecast (April 19, 2022) (Chart 2)

EUR/USD: Retail trader data shows 72.85% of traders are net-long with the ratio of traders long to short at 2.68 to 1. The number of traders net-long is 1.32% higher than yesterday and 0.55% lower from last week, while the number of traders net-short is 0.09% lower than yesterday and 3.12% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/USD prices may continue to fall.

Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

— Written by Christopher Vecchio, CFA, Senior Strategist

Be the first to comment