BalkansCat

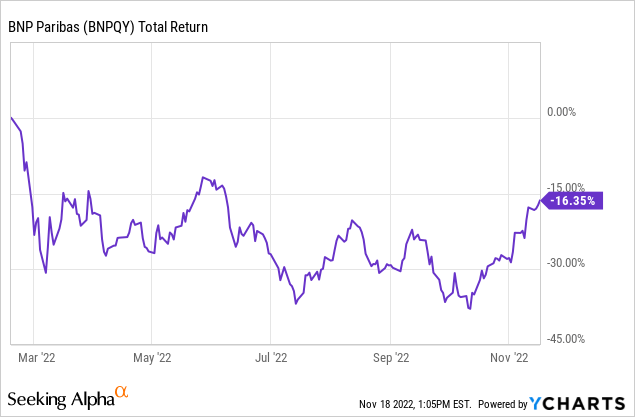

Including dividends, BNP Paribas (OTCQX:OTCQX:BNPQY)(OTCQX:OTCQX:BNPQF) shares have shed around 12% of their value in euro terms since I last covered the bank in mid-February, with the ADRs slightly underperforming that due to the dollar’s strength.

That unfortunately timed piece came just a week before the Russian invasion of Ukraine, and with the conflict being the catalyst for a sharp downtick in Europe’s economic outlook it’s not surprising that the continent’s largest bank has struggled.

While the backdrop for credit quality may well be deteriorating, BNP has so far reported strong results for the year. Revenue is up, cost rises are lagging top line growth, and asset quality is holding up very well all things considered – a good combination for net income growth. It also gets the bank off to a strong start in terms of meeting management’s 2021-2025 strategic goals.

In total return terms, the year-to-date share price fall basically takes us back to where we were when I first covered the bank in Q3 2021. In the meantime, tangible book value per share is up, meaning the shares have undergone a significant de-rating over that period. Granted, uncertainty has also increased since then, but with management appearing pretty upbeat on credit quality I’m inclined to think the stock once again offers compelling value. Buy.

Solid Year-To-Date Results

Results for 2022 to-date have been strong, with BNP reporting good numbers across its three operating divisions: Corporate & Institutional Banking (“CIB”), Commercial, Personal Banking & Services (“CPBS”) and Investment & Protection Services (“IPS”).

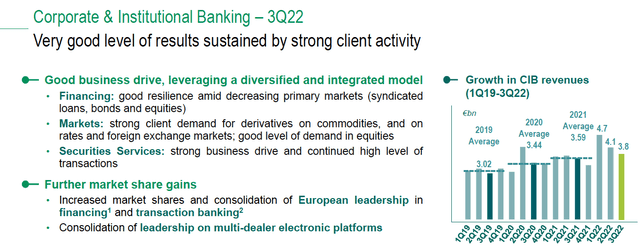

CIB: Revenues of €12.6B were up 10% at constant exchange rates versus the first nine months of 2021, with market volatility helping to boost trading in Fixed Income, Currencies and Commodities as well as in equities and its prime brokerage offering, particularly at the start of the year. Higher transaction volumes, higher interest rates and new mandates also helped offset the impact of market falls on assets under custody and administration in its Securities Services segment.

CPBS: Revenues of €21.3B were up 7.6% at constant exchange rates versus 9M21, helped by the impact of high single-digit loan growth on net interest income (“NII”). Divisional pre-provision operating profit (“PPOP”) was up over 16% to €7.8B, helped by positive jaws, while lower provisioning expenses juiced pre-tax income even further, which at €6.5B was up almost 30% versus 9M21.

IPS: Revenues of just over €5B were up 3.5% versus the year-ago period, helped by strong NII growth at Wealth Management.

All told, 9M22 group revenue of €38.3B was 6.9% higher on the year-ago period at constant exchange rates, with PPOP up 9.2% at constant exchange rates to over €13B. Net income was up 12% year-on-year to €8.05B, while tangible book value per share stood at €79.30 at the end of Q3, up from €76.80 at the end of Q3 2021.

The Outlook

BNP Paribas isn’t going to be the most interest-rate sensitive bank in the region on account of its revenue mix (higher fee income due to the investment bank) and some specific factors (e.g. French regulations on loan repricing). At last disclosure management had a 50bps parallel shift in the yield curve only moving revenue by €127m in year one. Investors looking for purer plays on rising rates would do better with the likes of NatWest (NWG) or, in the eurozone, the Irish banks in my view.

Nevertheless BNP will still see some positive impact now that the ECB is hiking, with management pointing to around €2B in extra income out to 2025 as a result of higher interest rates. That should help offset an eventual normalization in investment banking revenues (CIB revenue declined again sequentially in Q3 to €3.8B).

Image Source: BNP Paribas Q3 2022 Results Presentation

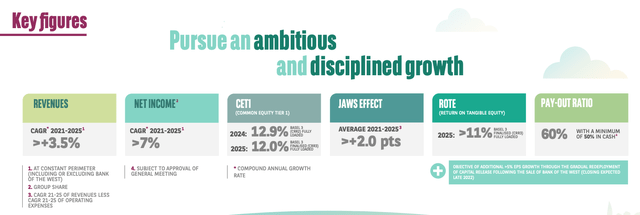

With that, the bank still looks like its in a good position with respect to its 2021-2025 strategic goals. To recap, those goals include 3.5% annualized top line growth, 7% annualized net income growth, and an annual return on tangible equity (“ROTE”) of at least 11% by the end of that period. Results to-date put it well on the path to achieving this.

Image Source: BNP Paribas 2025 Strategic Plan Infographic

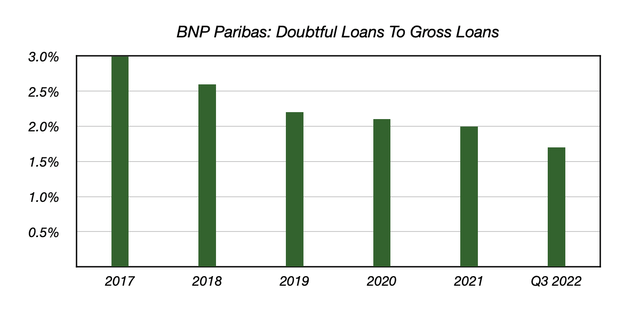

Credit quality is perhaps the most interesting part of the equation right now. The European economic outlook has worsened since I last covered the bank, yet asset quality metrics are still holding up very well. Cost of risk was 39bps in Q3, and that included 8bps from mortgage-relief legislation in Poland, with underlying cost of risk still solidly below the 2017-2019 average. That helped the bank post an 11.4% ROTE in Q3.

Data Source: BNP Paribas Annual Reports and Q3 Results Release

Doubtful loans also remain relatively low, standing at 1.7% of total loans in Q3 versus 2% at the start of the year. They remain comfortably below the 2017-2019 average of circa 2.6%.

Shares Appear Cheap

BNP Paribas shares trade for €53.25 apiece as I type, putting them below 0.7x tangible book value per share. Previously, I have called for a fair value here in the 0.9-1.0x tangible book value per share region, and notwithstanding the economic uncertainty I don’t see any reason to change that based on recent results. Indeed, management was very confident on credit quality in response to analyst queries during the Q3 earnings call:

I was going to say read my lips, but this is video, so listen to my lips. We basically anticipate 40 basis points every year until 2025.

Lars Machenil, CFO

That gives me confidence that BNP will at least get close to its ROTE targets over the next few years, and with that implying 34% upside to fair value at the low end, these shares look cheap. Buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment