dpproductions/iStock via Getty Images

Many homebuilders and building related stocks have had a rough start to 2022. There have been a couple problems, including rising interest rates leading to a spike in mortgage rates. While it might not be a 2.5% or 3% mortgage rate, mortgage rates near 5% are still below the real rate of inflation. However, many are predicting that the real estate market is going to pull back and lead to further pain for homebuilders and supplier stocks like Builders FirstSource (BLDR) and BlueLinx Holdings (NYSE:BXC).

While some are predicting a recession in the next couple years, I don’t think it will look like the 2008 Financial Crisis created by real estate speculation and banks getting out of control. This led to a decade of underbuilding and materials suppliers appear poised for solid returns. I wrote an article on Builders First Source a couple months ago and I’m bullish on BlueLinx for many of the same reasons. Both are materially undervalued, and I will be writing up BlueLinx today as an option for investors that are focused primarily on buying good companies at attractive valuations.

Investment Thesis

BlueLinx Holdings operates in the eastern half of the United States producing a mix of residential and commercial building products, from lumber and plywood to siding, trim, and insulation. The company has seen impressive revenue growth in the last couple years and has also been able to improve their margins. The valuation is extremely cheap, even if the EPS numbers decline in the next couple years, returns could be impressive even if the multiple expands to 6x or 7x earnings. Investors that understand the macroeconomic environment and still think the risk/reward profile is favorable might consider taking a position in BlueLinx.

The Business

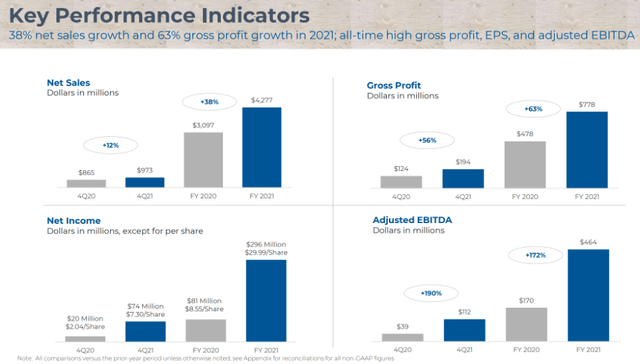

BlueLinx has grown revenue at a rapid rate in the last couple years as demand increased for their products. They had $4.3B in revenue for 2021 after $3.1B in 2020. I’m not sure if the revenue will continue to grow in 2022, but I doubt it will drop to the pre-lockdown levels. This dramatic increase in revenue has led to a huge boost in profitability and the increased bottom line.

Sales & Net Income (bluelinxco.com)

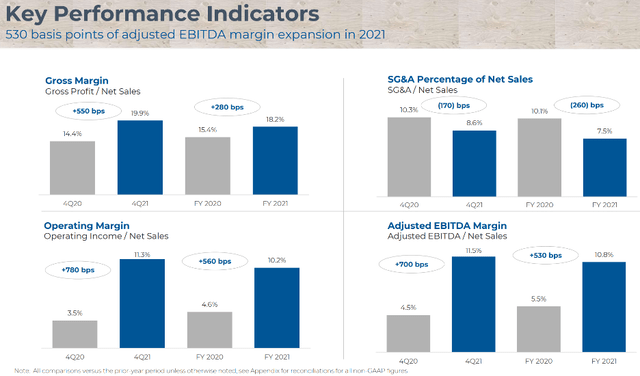

BlueLinx relies on a mix of specialty and structural products. Over the last two years, their product mix has been approximately 60% specialty and 40% structural products. The margins on the specialty products are slightly better, but the company has been able to improve their overall margin profile as well. Gross and operating margins have increased, and the SG&A percentage has decreased significantly.

Margin Improvement (bluelinxco.com)

Investors might be hesitant to buy a company like BlueLinx if it appears like we are going to be headed into a recession. However, when you look at the revenue and the earnings and compare it to the market cap, BlueLinx appears to be materially undervalued and provides a wide margin of safety.

Valuation

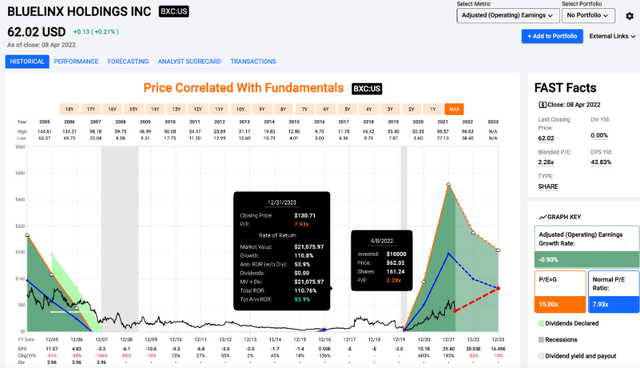

Shares of BlueLinx have sold off by more than 30% in the last month. BLDR has dropped nearly 20%, and many of the homebuilders have also sold off to start 2022. Part of it is the news cycle of increased mortgage rates, increasing chance of recession, and other potential problems that could impact BlueLinx’s business. However, I still think the risk/reward profile is skewed to the upside. Shares currently trade at 2.3x earnings, which is extremely cheap. Just because shares are cheap doesn’t mean the share price is going to turn around overnight, but if you have a 12-month time horizon (or longer), I think the share price could be significantly higher than it is today.

Price/Earnings (fastgraphs.com)

To be perfectly clear, BlueLinx is a stock just over $60 that had almost $30 in EPS for 2021. Even if earnings decline to $20 or even $10 per share, I still think the potential for multiple expansion means that shares have significant upside. If EPS sticks around $30 per share, I think BlueLinx is easily a $100 stock and probably significantly more than that. If the company continues to earn money at this rate, cash will start to build up on the balance sheet and the debt will continue to decrease. Eventually the market will realize just how cheap the stock is.

The company has a small repurchase program in place for $25M (approximately 4% of the $602M market cap), but I think more buybacks could be in store depending on what management decides to do. I mentioned the company to my dad (who owns shares of BLDR) and he came to the same conclusion that BlueLinx is too cheap to ignore. He said that he wouldn’t be surprised to see the company get acquired or taken private, especially at the current valuation.

Conclusion

Over the last couple years, I have had to look harder and harder to find companies trading at attractive valuations. BlueLinx is one of those companies. There aren’t many companies that had profits in 2021 ($296M) that equal about half of the current market cap ($602M). There are potential issues with the economic picture, but I still think the risk/reward is skewed to the upside due to the cheap valuation. Even if EPS declines, I still think shares of BlueLinx are a buy and I will be looking to start a position in the coming months.

Be the first to comment