dpproductions

Investment Thesis

BlueLinx (NYSE:BXC) reported Q3 results that were arguably better than expected. Yes, revenues came in in-line with expectations. And yes, there are all the reasons to flock away from anything pertaining to homebuilding. Indeed, it’s not difficult to find evidence to validate the idea that investing in homebuilders is not the place to be.

That being said, for investors that have the mental bandwidth to look under the prevailing narrative, I believe there’s a lot to be compelled about here.

What’s Happening Right Now?

On the one hand, there’s the widely held view that the housing market has rolled over, as interest rates continue to climb. There’s plenty of data confirming that point of view. That’s the macro view.

On the other hand, there’s the micro view. And that is of a company that is surprisingly delivering very strong results, given where expectations are.

Revenue Growth Rates Tick Along

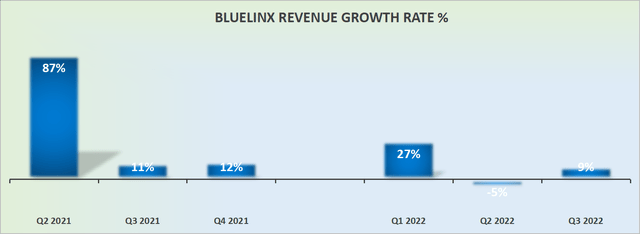

Anyone that is closely following the lumber market, may perhaps be a bit surprised to see that despite all the turbulence in the past several months, BXC still reporting high single digit revenue growth in Q3 2022.

Of course, the question that now looms large is where do we go from this point? And that’s where things get really tricky. Investors have all the reasons in the world not to be interested in investing in lumber distributors.

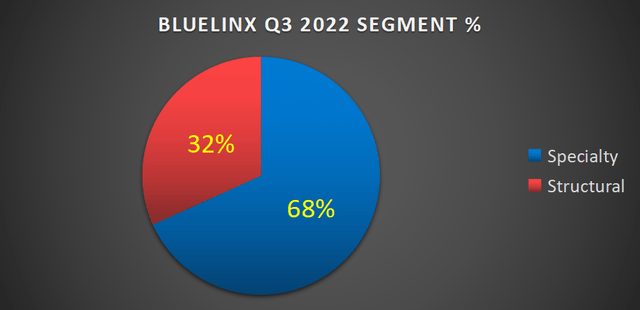

What impresses me about BXC’s new management team is that it has continued to grow its Specialty products business. Recall, BXC’s Specialty products business is the higher margin business.

And that side of the business was up 13% y/y. So, not only is the Specialty side of the business growing significantly faster than the Structural products business, which saw less than 2% y/y growth, but this side of the business also saw gross margins of 21% in Q3.

First Rule of Commodity Investing!

Before going any further, let’s keep in mind that this is a lumber commodity company. Consequently, the most important consideration to keep in mind here is its balance sheet.

If the balance sheet is strong, with ample flexibility, it will be able to survive this expected downturn with ease, and may even take market share. Accordingly, as it stood at the end of Q3, BXC has a net debt position of $343 million.

That not only means that net debt is down approximately $150 million in the past twelve months, which is pretty impressive, but it also shows that BXC’s net leverage now stands at 0.7x.

What’s more, keep in mind that its debt isn’t due until 2029. So, whatever we may think about BXC, even if one is bearish, the core of the bearish investment thesis will not find much traction on its balance sheet. The balance sheet is rock solid.

Profitability Profile Remains Strong

Again, just using that net debt figure of $343 million as a reference point, for Q3, free cash flow was $130 million. Put another way, nearly a third of that net debt can be covered in just the free cash flow that BXC made this quarter. In a single quarter!

Given the seasonality of the business, plus the macro environment, if we assume that BXC’s free cash flow reaches $30 million, that would imply that in 2022, BXC will report $250 million for free cash flow.

For a business with a clean balance sheet, and a market cap of $650 million, I believe this is cheap enough. Don’t you?

BXC Stock Valuation — 5x EPS? How to Think About This

We know that Q4 isn’t BXC’s strongest quarter. Indeed, that’s not where the bulk of its profitability is made. However, if we roughly assume that Q4 ends up making approximately 50% of the EPS that BXC made in Q4 of last year, that would see BXC report $3.65 of EPS this year. Or thereabouts, call it $3 just to err on the side of caution.

That would mean that 2022 EPS would be around $30.82. That puts the stock right now priced at 2x this year’s free cash flow.

But then, as we look ahead to 2023, let’s assume that earnings are slashed down by 50%. That would imply that in 2023, EPS would be around $15.

Note, my figure of $15 is even smaller than analysts’ EPS of $16.27. But I use it to get us thinking.

The Bottom Line

BlueLinx is an extremely cheap homebuilding supplier. From many perspectives, the stock has a wide margin of safety.

I argue that BlueLinx is batting way above its valuation, as its crown jewel, its Specialty products business continues to deliver very attractive margins.

I believe that paying approximately 5x next year’s EPS is a more than attractive valuation.

That would mean that if the property market remains in the doldrums, BXC is priced at 5x depressed earnings. I believe that most market participants would be inclined to believe that’s cheap.

Be the first to comment