JJ Gouin/iStock via Getty Images

Inflation Has Just Created A Unique Investment Opportunity

Just about 16 months ago, in early March of 2021, we wrote an article on Seeking Alpha alerting investors to what we saw as the precursor of what could become another commodity Supercycle.

Nobody seemed to care. Things are very different today in that just about everyone is deeply concerned about inflation, including The Federal Reserve Board.

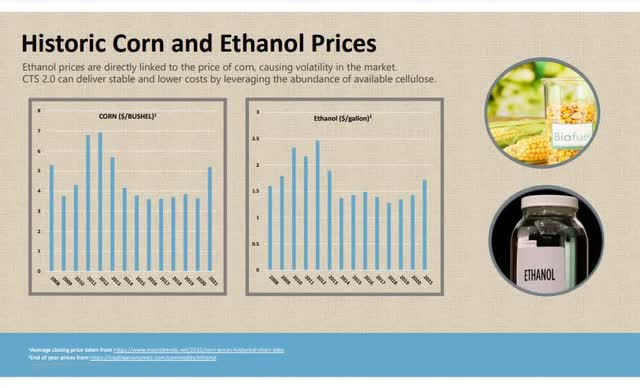

This article reinforces our belief that corn-ethanol producers will continue to suffer from rising commodity prices. We believe that if this inflationary cycle becomes secular in nature, ethanol producers will have to adapt and adopt to new feedstocks and technologies that offer a lower cost of production, higher overall margins and more generous subsidies from the U.S. government.

We have hitched our wagon, so to speak, to a micro-cap company with a patented disruptive technology that could provide an attractive alternative to corn-based ethanol and biofuels.

That company is called Blue Biofuels (OTCPK:BIOF) and because of our bullish view on the company’s future we have a sizable position in the common shares.

Blue Biofuel’s disruptive technology could very well change the economics of ethanol production in the future.

First, let’s start with a couple of premises:

- By their own admission, both Federal Reserve Chairman Jerome Powell and U.S. Treasury Secretary Janet Yellen have been wrong in their assessment of inflationary forces in the U.S. economy. They no longer believe that this inflationary trend is “transitory”. We believe that we are in the early stages of another “Commodity Supercycle” and that it could become secular (long-term in nature, with an indefinite duration).

- The long-term trend in the energy consumption appears to be leaning towards alternative energy, and biofuels, for powering many of our common modes of transportation, including cars, trucks, and airplanes.

- While certainly open to debate, evidence seems to point to fossil-fuels being at the forefront of a number of climate and environmental issues, including pollution caused by carbon emissions from cars and trucks, destruction of the ozone layer thereby destroying the natural protection from the sun’s harmful UV rays, the dangers of extracting oil from shale, along with drilling for oil in areas where such activities could destroy the natural ecosystem and potentially release environmental pollutants into the air and water.

- There are a number of federal programs that provide grants and financial assistance to advance the development of new, green technologies, that over time will replace our country’s dependence on carbon-based energy.

Corn-Based Ethanol Dominance & Disruption

Some of you may have already read a few of our Seeking Alpha articles on Blue Biofuels.

Before reading any further, we recommend that readers spend a few minutes perusing two of our past articles on this promising micro-cap company and their CTS 2.0 patented technology.

In particular, we would point readers to these two articles:

This article is somewhat more relevant than our prior ones, simply because the inflationary forces that we saw coming are now front and center and clearly in focus.

Today, in the United States there are approximately 195 ethanol plants in production. Of those 195 plants, there are 3 using waste stream as their feedstock of choice, 13 of them are using milo, also known as sorghum, as their primary feedstock and 2 are categorized as using other (not identified) feedstock.

The majority of ethanol plants, 177 in all, are using corn as their primary feedstock to produce sugars, that will eventually be converted into ethanol.

There is not a single ethanol producer in the United States that is currently using cellulosic biomass as their feedstock of choice.

Cracking The Code of Cellulosic Recalcitrance

Up until now, there has not been an easy was to breakdown cellulosic material into usable components, without a great deal of difficulty and high costs.

Cellulose is said to be recalcitrant, meaning that it is hard to breakdown in an economic manner. For this reason, ethanol producers have shied away from using cellulosic biomass in producing sugars for conversion to ethanol.

In our opinion, the CTS 2.0 (Cellulose-To-Sugar) technology being developed by Blue Biofuels, Inc. (offers a better alternative to traditional corn feedstocks to produce near zero-carbon biofuels including Cellulosic Ethanol, Cellulosic Jet Fuel, Cellulosic Gasoline and Cellulosic Diesel, because their unique process has cracked the code for finding a low-cost, simple and efficient way to convert cellulosic biomass into sugars.

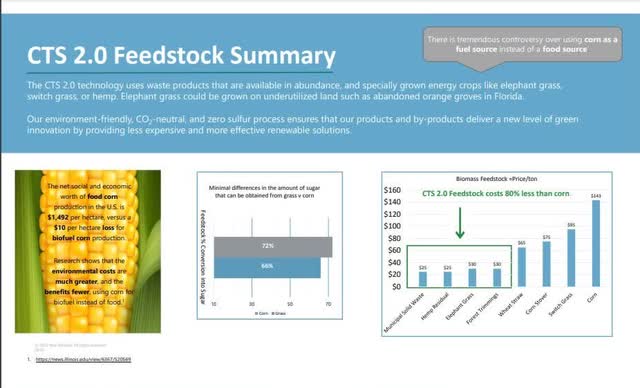

Some of the benefits of CTS 2.0 versus corn include much lower feedstock costs, lower overall planting, hydration, and pesticide control costs, and a conversion process with much greater simplicity and efficiency.

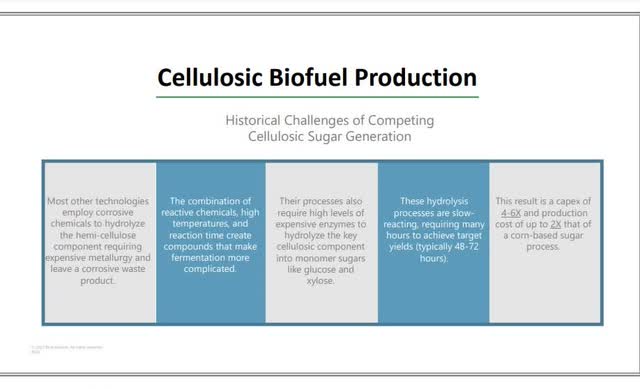

Challenges To Cellulosic Biofuel Production (Blue Biofuels Corporate Presentation)

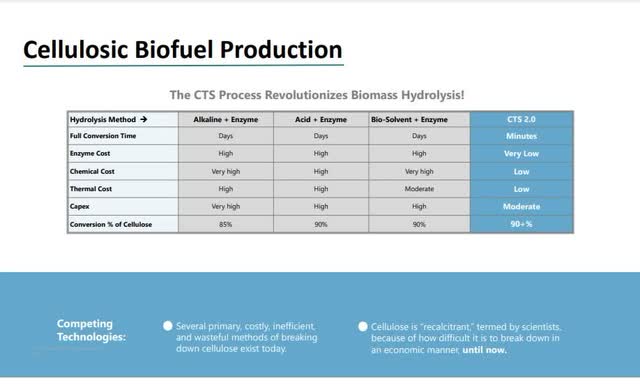

The Blue Biofuels CTS 2.0 process uses no caustic chemicals or costly enzymes. It does not rely on energy intensive high heat methods of sugar extraction, nor does it take as long as other cellulosic methods to create sizable levels of output. The process has over a 99% plus rate of conversion of biomass to sugar and enjoys higher RIN credits from the EPA.

Comparing Methods of Biomass Hydrolysis (Blue Biofuels Corporate Presentation)

Most importantly, the use of cellulosic biomass, which includes a wide variety of plant-based material such as forestry waste, agricultural by-products and waste, yard waste, wood chips, tree bark, branches and leaves, the cellulosic portion of municipal solid waste, the stalks and residual plant material, called “stover” from harvested corn crops, as well as perennial grasses which include switch grass, elephant grass and king grass means not being subjected to the vagaries of highly volatile corn prices.

Correlation of Corn Prices With Ethanol Prices (Blue Biofuels Corporate Presentation)

The company is already working with the USDA (U.S. Department of Agriculture) to optimize the use of king grass as a feedstock to produce cellulosic biofuels.

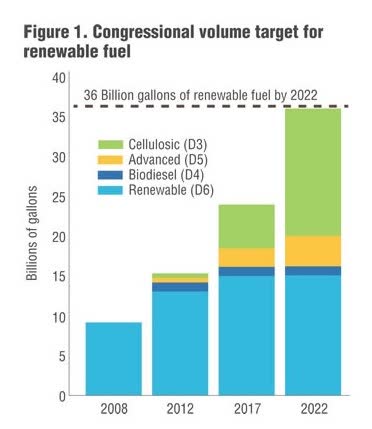

Comparing Costs of Various Types of Feedstock (Blue Biofuels Corporate Presentation) Congressional Targets For Renewable Fuel (Biocycle)

RIN Credits: The EPA’s Icing on the Cake

One example, which shows the resolve to transition away from traditional carbon-based sources for U.S. energy requirements is the EPA’s adoption of what are called RIN (Renewable Identification Numbers) credits for ethanol producers. Without getting too deep in the weeds on this subject, let’s just say that the U.S. government, through its 2005/2007 RFS (Renewable Fuel Standard) program has been providing monetary incentives to the ethanol industry to produce large volumes of ethanol for blending into gasoline.

We like to think of RIN credits as a way to improve the overall profit margin for ethanol producers, since the amount of the government credit is added to the total amount received for a gallon of ethanol sold.

The EPA adjusts the renewable fuel mandate each year. The US EPA renewable fuel standard (RFS) mandates the blending of renewable fuel into fossil fuels sold, or companies pay a fine. Cellulosic ethanol is the smallest category (D3) and has mandated volume of 510 MM gal for 2020, 620 MM for 2021, and 770 MM gallons for 2022. With an original goal of 15 billion+ gal/year in 2022, the D3 mandate will grow with the ability to supply cellulosic ethanol

Source: Blue Biofuels Corporate Presentation 6-20-2022

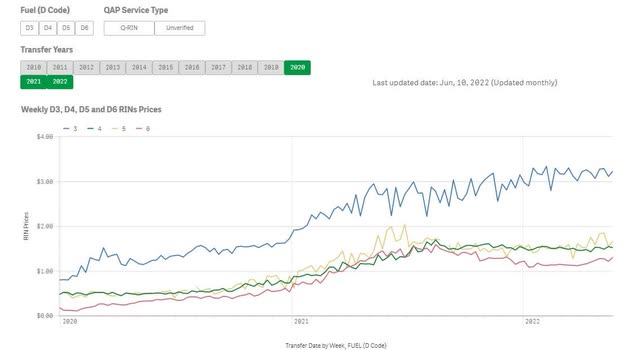

The EPA (Environmental Protection Agency) currently identifies four major categories of RIN credits; D3, D4, D5 and D6.

- Cellulosic Biofuel (D3): Produced from cellulose, hemicellulose, or lignin and must meet a 60 percent lifecycle GHG reduction.

- Advanced Biofuel (D5): Produced from a non-corn starch, renewable biomass and must meet a 50 percent lifecycle GHG reduction.

- Biodiesel (D4): Must be biomass-based diesel and meet a 50 percent lifecycle GHG reduction.

- Corn-Based Ethanol (D6): Ethanol derived from corn starch and must meet a 20 percent lifecycle GHG reduction.

Source: Biocycle.net

Here are the current RIN credits and their values as of June 10, 2022

Graph of 3 Years of RIN Pricing 2020-2022 (EPA)

As you can see the RIN credit for Cellulosic Ethanol is the highest dollar amount at a price of $3.50, yet most ethanol producers that use corn as feedstock fall into the D6 category established by the EPA.

Currently, cellulosic ethanol gets a D3 RIN credit, worth $2.76/gallon, in addition to the market price, resulting in potential total revenue of around $4.92/gallon for Blue Biofuels.

Potential Market Size For Cellulosic Biofuels

As energy prices continue their torrid pace of increasing, many in Washington, D.C. are looking for ways to ease the higher cost burden of on consumers.

One of the steps that the Biden administration has taken, is to increase the amount of ethanol that is blended with gasoline.

Whereas before, the maximum percentage of ethanol that could be contained in a gallon of gasoline was 10%, that has now been increased to 15%.

One area that is getting a lot of attention is SAF’s (Sustainable Aviation Fuel).

Here again, policies are being put in place, by the Biden Administration, to advance the development of these new biofuels. Some of the initiatives that are a priority, in reaching a goal of producing three billion gallons of SAF by 2030, while at the same time, reducing aviation emissions by 20% are:

- A new Sustainable Aviation Fuel Grand Challenge to inspire the dramatic increase in the production of sustainable aviation fuels to at least 3 billion gallons per year by 2030.

- New and ongoing funding opportunities to support sustainable aviation fuel projects and fuel producers totaling up to $4.3 billion.

- An increase in R&D activities to demonstrate new technologies that can achieve at least a 30% improvement in aircraft fuel efficiency.

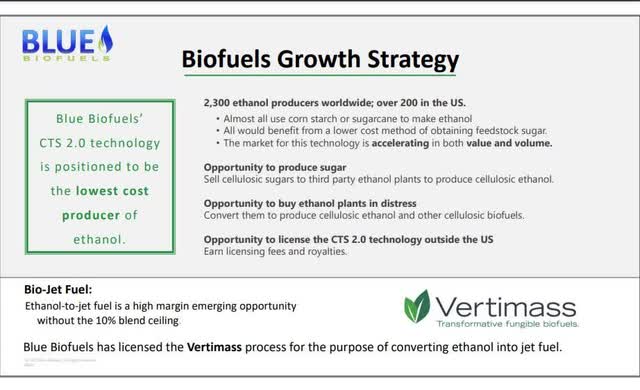

Blue Biofuels has specifically targeted Sustainable Aviation Fuels as one of its priorities and is consider one of the primary markets where the company expects to be selling cellulosic biofuels.

The Blue Biofuels Growth Strategy (Blue Biofuels Corporate Presentation)

To this end, Blue Biofuels has partnered with a company called Vertimass to convert their ethanol production into jet fuel.

So, you may say, all well and good, but what is the TAM (Total Addressable Market) for these biofuels.

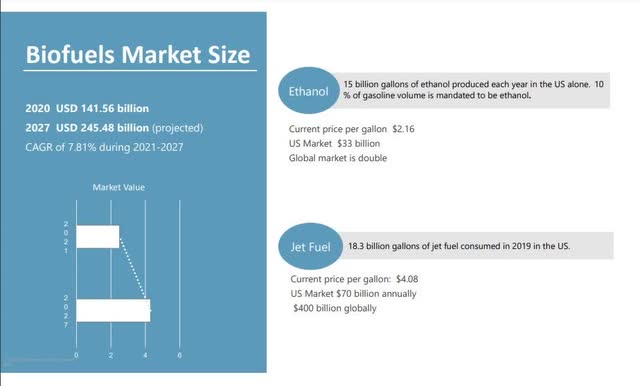

Total Addressable Market (TAM) For Biofuels (Blue Biofuels Corporate Presentation)

Looking at the above graphic, the market size for biofuels in 2027 is projected to be around $245.48 billion and is expected to have an overall CAGR (Compound Annual Growth Rate) of approximately 7.81% per year.

Jet fuel or SAF’s currently represent a $70 billion industry in the U.S. and $400 billion globally.

In a 256-page report, the sustainable aviation fuel market is projected to grow from USD 219 million in 2021 to USD 15,716 million by 2030, at a CAGR of 60.8% during the forecast period.

BIOF Comes With Many Risks

We see tremendous potential for Blue Biofuels and its revolutionary CTS 2.0 process. However, this investment opportunity has significant risks.

The most obvious risk is that the company cannot bring its CTS 2.0 technology to a commercial size level to produce the required economies of scale that would create an investable growth story.

The second risk that we see ahead, for this company, is the amount of capital that will be necessary to reach an adequate level of commercialization.

There are a number of options available to the company, although there can be no assurance that they will be successful with any of them.

Blue Biofuels Financing Options (Blue Biofuels Corporate Presentation)

In addition to the two obvious risks mentioned above, other risks unique to micro-cap stocks include the additional risks beyond those of higher classes of securities including, but not limited to trading outside of a listed exchange, potential liquidity issues, dealing with penny-stock rules, lack of margin eligibility, a possible absence of transparency regarding BBBO quotes, a limited number of Market Makers willing to provide depth to the order book, potential issues regarding financing activities, inadequate capital to execute on the company’s business plan, going concern caveats, and the potential inability to compete with larger companies due to limited financial and personnel resources. Please invest responsibly.

Inflation Is At The Forefront Of Our BIOF Thesis

A primary basis for our investment thesis for Blue Biofuels rests in how one views the unfolding problem of inflation in the U.S economy. Here is our viewpoint; expressed below.

The growing secular inflationary forces (it’s not just transitory and it may not be cyclical) and the false assumption that they would be manageable, to the degree that the FED would be able to engineer a soft landing, are simply out of touch how we see all this playing out over the next 6-12 months.

Between the Federal Reserve and the Federal Government, the massive amounts of money that were put into the economy, through programs such as Quantitative Easing, along with the trillions of dollars in various stimulus packages, couldn’t help but create the untenable situation that we find ourselves in now.

All one had to do was look at the charts of slowly rising commodity prices, over the past few years, to see what was coming. Those slowly rising prices of many commodities have picked up speed and are now wreaking havoc as they work their way through the system.

10-year Chart CRB Commodity Index 2012-2022 (Trading Economics)

The CRB Index increased 71.36 points or 28.89% since the beginning of 2022, according to trading on a contract for difference that tracks the benchmark market for this commodity.

Source: Trading Economics

This has resulted in major price increases in many areas of consumer spending including food, shelter, energy, transportation costs (moving goods and a vital number of component parts across land and sea) new and used automobile costs, along with the raw materials used to build new homes and apartments.

The primary reason for the price increases in all the above is from the massive liquidity that was created in the banking system. All that newly printed money had to go somewhere and with interest rates at or near zero much of it found its way into the more speculative asset classes such as real estate, stocks, bonds, and cryptocurrencies.

The classic definition of inflation is “too much money chasing too few goods”.

This statement mirrors the situation that we currently find ourselves in. Just take a look at real estate prices. There are an overabundance of buyers, flush with cash, chasing a limited supply of new and used homes on the market.

It was fun while it lasted, but now it’s time to pay the piper for the failed MMT (Modern Monetary Theory) experiment, that could go down as one of the costliest mistakes ever made by the members of The Federal Reserve Board.

What we will be witnessing in the coming months, and perhaps years, will be inflation on steroids. The prescription that the FED doled out in years past to produce a broad economic recovery, now could become the medicine that ultimately winds up killing the patient.

You can only kick the can down the road for so long. At some point, you must pick up the can and face the reality that you cannot suspend the laws of economics any more than you can suspend the laws of gravity.

Attempting to engineer an economic cycle, through monetary policy, is dangerous, simply because you are not letting the natural forces of economic expansion and contraction play out over the course of time.

Now the Federal Reserve is left with the prospect of having to financially engineer a soft landing for the economy. We say good luck with that.

The FED, once again, finds itself in a position where they are using their monetary toolbox to manipulate and maneuver around the natural progression of events associated with the economic cycle.

Summary and Conclusions

As we mentioned at the beginning of this article, we targeted Blue Biofuels as an exceptional micro-cap idea in January of 2021.

Since then, a great deal of progress has been made; some of which took longer than expected due to the impact of Covid-19 on supply chains and the subsequent restriction to access the component parts for the optimization of the CTS 2.0 reactor.

Overall, each prototype has shown considerable progress towards building a commercial scale reactor. In fact, BIOF management has stated publicly that the prototypes exceeded their expectations.

In fact, the 4th generation prototype’s output was 30 times of its 3rd generation predecessor.

The company has built a moat around its IP (Intellectual Property) portfolio with multiple patents on their proprietary CTS 2.0 process.

Blue Biofuels Intellectual Property Protection (Blue Biofuels Corporate Presentation)

The company continues to forge ahead with its plans for a commercial unit to be ready by the between the summer of 2023 and year end (12-18 months).

At the current price, we look at the shares as being the equivalent to a LEAP, or a long term option on a company.

Anyone considering an investment in BIOF shares should be prepared to hold the shares for a period of at least 3-5 years.

Remember, micro-cap stocks are extremely risky and should only be purchased in speculative accounts, with funds that an investor can afford to lose up to 100% of the investment.

Good luck to everyone and remember to perform your own due diligence before making any investment.

Be the first to comment