Scott Eisen

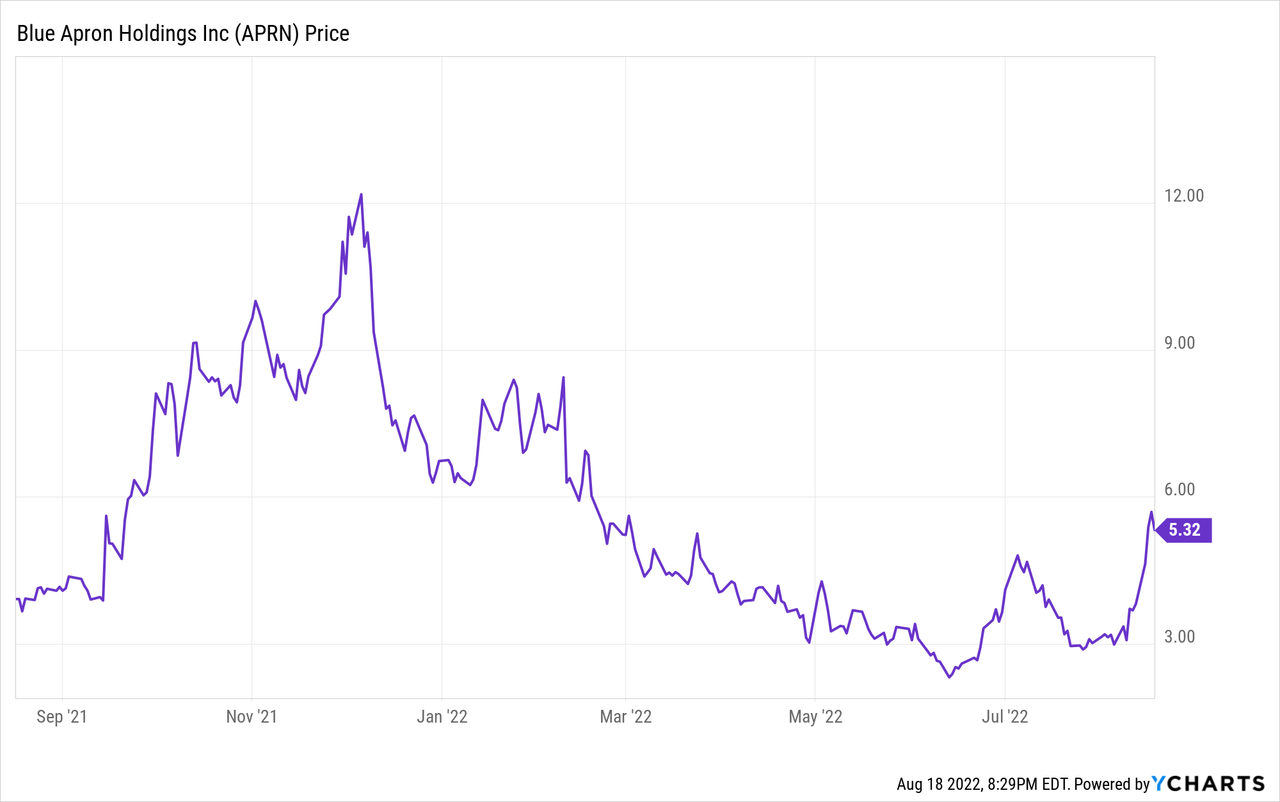

A lot of beaten-down tech stocks have gotten nice rebounds over the past month, but I would be loath to trust every rebound rally as genuine and supported by fundamentals. In particular, I’m very wary of Blue Apron’s (NYSE:APRN) recent rise from the dead. This embattled meal-kit vendor has struggled post-pandemic to retain customers while also dealing with severe cost inflation, putting it at a very difficult crossroads.

Year to date, Blue Apron has lost only 20% of its share price after its recent rebound. Recent rebound action has been volatile, and a short squeeze is one of the driving factors here. I think, however, this stock carries incredible risk, and it won’t be long until a continued string of disappointing results pushes Blue Apron back down.

I remain bearish on Blue Apron after parsing through the company’s latest updates. I continue to think Blue Apron’s business model has proven itself unsustainable, and no amount of financing can course-correct this company for the long run.

Due to volatility, I’m leery of taking any outright short positions against this stock, even buying puts on it – my preferred approach is to stay on the sidelines. Certainly, avoid buying this stock, however, thinking that this rally has further steam.

Financing only extends lifeline, but doesn’t solve current issues

Blue Apron’s recent uptrend is driven primarily by an expanded financing agreement with RJB Partners.

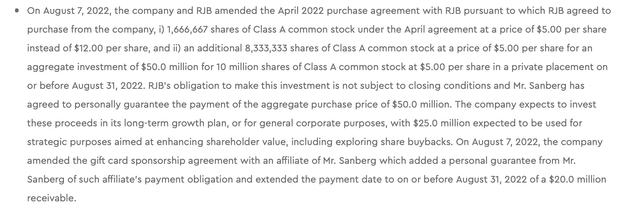

The net of the story here – in early April, the company signed an agreement with RJB for an equity investment at $12 per share. Due to share price compression, RJB negotiated the purchase price down to $5 per share. However, in August, Blue Apron managed to get RJB to expand the investment commitment to $50 million.

Blue Apron financing details (Blue Apron Q2 earnings release)

Now, let’s put aside the dilutive impact of this for a moment. This capital is essential to Blue Apron. At the end of Q2, Blue Apron had only $54.0 million of cash left on its balance sheet (alongside $63.0 million of debt, however).

But while this $50 million injection pushes out Blue Apron’s “expiration date”, it hasn’t bought the company that much of a lifeline. The company intends to spend $25 million of the investment on strategic growth initiatives and the rest on general corporate purposes (in other words, we should expect spending to increase).

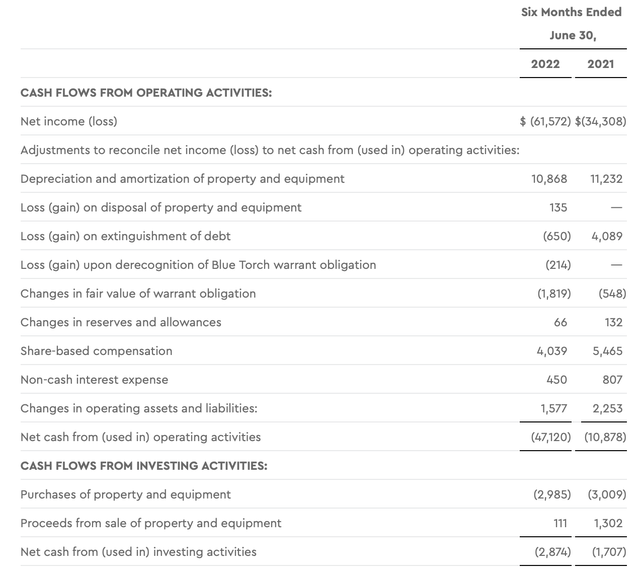

Meanwhile, already through the first six months of FY22, Blue Apron has burned through -$50.1 million of free cash flow:

Blue Apron cash flow (Blue Apron Q2 earnings release)

In other words, it may not be long at all before Blue Apron has to raise capital again. This is a band-aid solution only. As long as no structural improvements are being made in Blue Apron’s business model, a temporary liquidity injection won’t save it.

Q2 trends continue to sour

To illustrate the point of how Blue Apron’s fundamentals continue to show a number of red flags, let’s now go through Blue Apron’s latest Q2 highlights. The company reported earnings in mid August, and as usual the news wasn’t good.

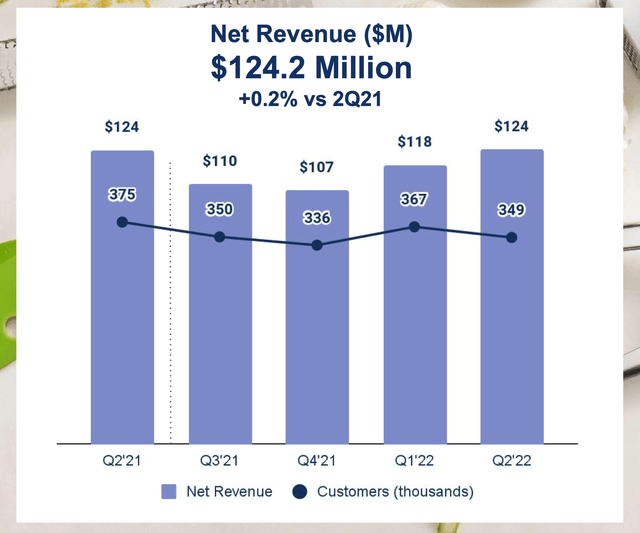

Blue Apron Q2 results (Blue Apron Q2 earnings deck)

In Q2, as shown in the chart above, Blue Apron managed flat y/y revenue at $124.2 million – but the saving grace here was a $10 million, one-time enterprise deal. Outside of this deal, Blue Apron’s revenue would still have declined roughly -8% y/y, in-line with last quarter’s decline. Note as well that this deal did not help Blue Apron meet Wall Street’s expectations of $125.0 million for the quarter.

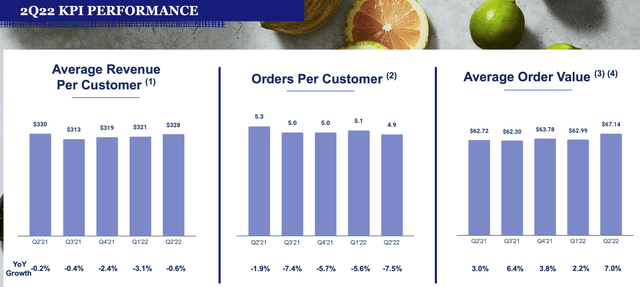

Also, as shown above, Blue Apron continued to bleed customers, down to 349k at the end of Q2 (down -7% y/y). And, as shown in the chart below: average revenue per customer is down, as order frequency also continued to tank to 4.9 orders per customer in the period:

Blue Apron customer metrics (Blue Apron Q2 earnings deck)

The company has increased pricing slightly to offset inflationary pressures. This could be driving the customer churn, though the company chose to also attribute weakness to seasonal travel. Per CEO Linda Findlay’s remarks on the Q2 earnings call:

Similar to many other companies, we saw seasonal and macroeconomic pressures on purchasing patterns due to concerns over the inflationary environment. I would note that we have some subscribers who chose not to order during the quarter for budgetary and travel reasons and therefore, are not included in our customer count for the second quarter.

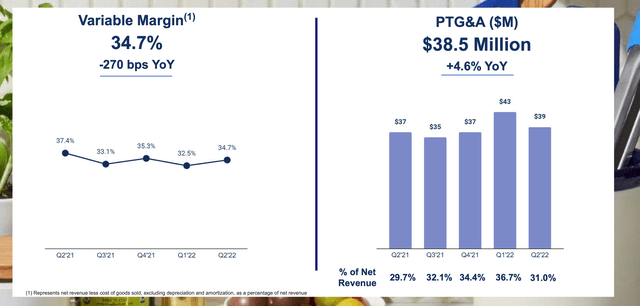

These price increases, however, were not enough to offset higher packaging costs and a continued rise in logistics fulfillment rates. Variable margin declined -270bps y/y to 34.7%.

Blue Apron variable margin (Blue Apron Q2 earnings deck)

Part of the problem here may be Blue Apron’s menu expansion. In Q2, the company had 62 options on its menu – more than 3x the number of menu options in the pre-pandemic period. Expanding menu choice may be a great strategy for a growing company that is trying to widen its customer appeal, but in Blue Apron’s case it may be causing dis-economies of scale.

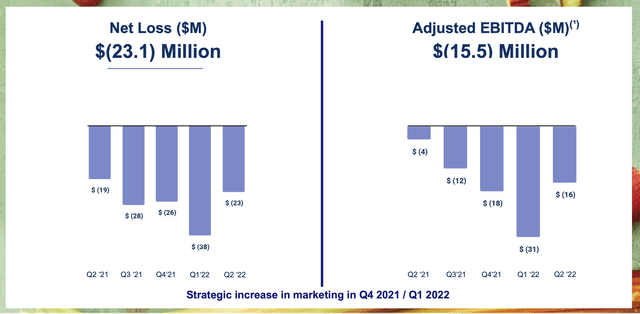

And with corporate overhead spend also rising 5% y/y, Blue Apron’s losses continued to grow. Adjusted EBITDA loss in the quarter was -$15.5 million, representing a -12% margin – roughly quadrupling last year’s loss of -$3.5 million at a -3% margin.

Blue Apron loss profile (Blue Apron Q2 earnings deck)

Key takeaways

There’s a long list of things I need to see before I change my tune on Blue Apron: customer growth, revenue growth, opex control, and improving gross/variable margins. A one-time injection of equity capital may delay Blue Apron’s troubles, but it’s not a permanent fix to a business that has struggled for viability for such a long time. Continue to watch out for this stock and stay on the sidelines.

Be the first to comment