Drew Angerer/Getty Images News

Thesis

We updated investors in our previous article on Block, Inc. (NYSE:SQ) that we had anticipated its pullback to be supported above its June lows. However, the market had other ideas, as SQ went on further to re-test its lows, but has been consolidating since September.

We noted that SQ’s recovery momentum has weakened since our previous article. However, the selling downside has also subsided recently, with a slight bearish bias as Block heads into its upcoming Q3 earnings release on November 3.

With the recent developments, we believe it’s critical to apprise investors of whether the current levels are still attractive for SQ as a speculative buy.

Our analysis suggests that industry analysts have continued to revise forward estimates for SQ and its industry peers through September. Hence, it’s arguable whether the revisions are sufficient for SQ, given its more significant exposure to small and medium-sized businesses.

Notwithstanding, management’s commentary at a September conference seems optimistic on the merchant and consumer side. Interestingly, Block expects a better performance in H2, which could help lift its revenue and adjusted EBITDA growth metrics.

We also observed that Bitcoin’s price action has continued to consolidate. Therefore, the impact on Bitcoin’s QoQ revenue growth metrics should be less significant than in previous quarters. Furthermore, Bitcoin has a much lower gross margin than Block’s corporate average. As such, we don’t expect it to have a marked impact on the expected improvement of its profitability metrics through H2’22.

Hence, we view SQ constructively at the current levels, even though it still trades at a significant premium against its peers. However, given the opportunity for substantial operating leverage gains, we deduce that SQ could grow into its valuations at these levels if CEO Jack Dorsey & team can execute accordingly.

We reiterate our Speculative Buy rating on SQ but cut our medium-term price target to $85 to reflect lower target multiples (representing an implied upside of 52%).

Block Needs To Execute Well For Its Q3 Release

SQ has fallen 40% from its August highs to its current levels as the market rejected further upside, given the Fed’s increasingly hawkish stance. Hence, SQ has underperformed the market since its August highs as investors parse the impact of weaker consumer discretionary spending, worsened by the record high inflation rates.

We believe the de-rating is justified, as the market needed to de-risk SQ’s execution risks. However, management highlighted its confidence in a September conference of executing well in H2’22. CFO Amrita Ahuja articulated:

We’ve seen resilience in our ecosystems. For Square, excluding Afterpay, on a 3-year CAGR basis, we expect to see gross profit that’s in line in August with what we saw in July and Q2. For Cash App, what we shared in early August was that we expect the year-over-year growth rates to improve in the back half of the year relative to what we saw in the first half of the year. And what we saw in August was also consistent with what we shared there. (Goldman Sachs Communacopia + Technology Conference 2022)

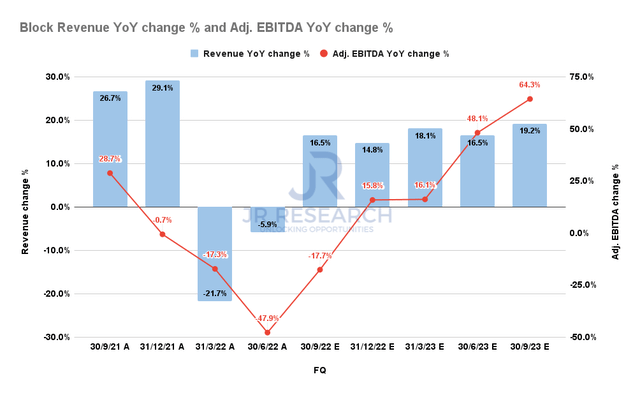

Block Revenue change % and Adjusted EBITDA change % consensus estimates (S&P Cap IQ)

As such, the consensus estimates (bullish) expect Block’s revenue decline to have reached a nadir in Q2. Therefore, Block is projected to deliver revenue growth of 16.5% in FQ3. However, Block’s adjusted EBITDA growth is still expected to decline by 17.7%, an improvement from Q2’s 47.9% decline.

Hence, it implies that if Block can execute accordingly, we could have seen the worst in its operating performance in Q2, despite the economy moving into a recession moving ahead.

Therefore, we deduce that the recent de-rating from its August highs is necessary to cut some slack on management’s execution through the cycle.

We will know in early November whether management is up to the mark.

Is SQ Stock A Buy, Sell, Or Hold?

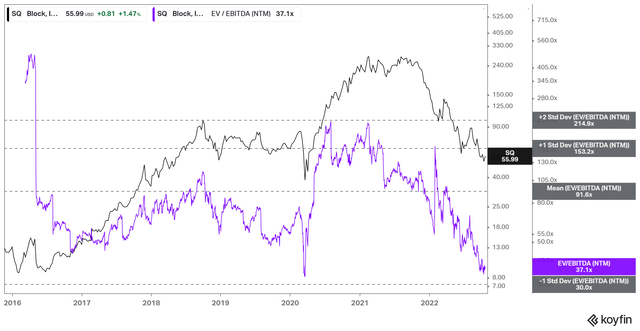

SQ NTM EBITDA multiples valuation trend (koyfin)

With the recent de-rating from its August highs, SQ’s NTM EBITDA multiple of 37.1x has collapsed close to levels last seen in its March 2020 COVID lows.

Despite that, SQ still traded at a premium against its peers’ median EBITDA multiple of 10.4x. Therefore, the market is still placing emphasis on SQ to execute well, despite the battering over the past year.

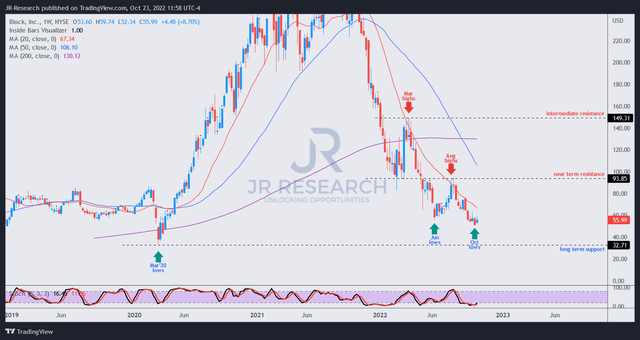

SQ price chart (weekly) (TradingView)

As seen above, SQ’s pullback from its August highs re-tested its June lows, which we had anticipated to hold. However, we have yet to observe a bullish reversal to support that thesis.

Hence, SQ remains in a downtrend bias, even though we gleaned that near-term downside volatility has likely subsided. Therefore, the setup for SQ heading into its Q3 earnings release is relatively well-balanced.

However, we are still bullish at these levels, as SQ’s reward-to-risk profile is attractive if management can execute well through FY23.

We reiterate our Speculative Buy rating, with a medium-term PT of $85.

Be the first to comment