hapabapa/iStock Editorial via Getty Images

Introduction

My thesis is that Block (NYSE:SQ) is very helpful for society but their valuation is tricky. As a personal anecdote, I found Square Seller to be extremely helpful on a recent skiing trip. Getting food and drinks at Mammoth Brewing Company was done with a QR code menu/shopping cart and a Square checkout that confirmed my identity with a verification code such that I didn’t have to re-enter credit card details. This is similar to the way in which QR codes are used in China with Tencent (OTCPK:TCEHY) and Alipay which is partially owned by Alibaba (BABA). I think Block is one of the companies that will benefit as we continue moving to this type of model in the future.

Great Company

In the same way that Shopify (SHOP) started by helping small and underserved online merchants before moving up market, Square Seller started by servicing a base of micro merchants which are those with annual payment volume of less than $125,000. Block is one of the few companies that has been able to fend off Amazon (AMZN). Block co-founder Jim McKelvey explains that Block’s innovation stack allowed them to come out on top when Amazon tried to enter their space with a lower price.

Former CFO Sarah Friar used to talk about the fact that sellers could onboard in 5 minutes or less by using transparent pricing in the app store. She noted that data science and machine learning let Square Seller skip credit checks and accept 95% of sellers. At the March 2016 Morgan Stanley Technology, Media & Telecom Conference, she explained that Square Seller does much more than just processing:

Well, first and foremost most of those folks are talking about as payment processors, they’re only doing one thing in the value chain. So as a merchant, you still have to go get a payment processor, get a terminal provider, you have to get a point of sale (“POS”) provider, you have to get an analytics provider and so they leave the merchant to stitch together everything to do commerce. Square thinks about it because we do everything for you.

At the May 2016 JPMorgan Technology, Media and Telecom Conference, CEO Jack Dorsey talked about the innovation from the prior 7 years starting with the initial idea of enabling merchants to make sales by accepting credit cards:

So we made a little piece of hardware that allowed you to plug it into the headphone jack of a phone, and that enabled a seller to start swiping cards. And we made it so that you could go to the app store, you could download Square, and we would send you free hardware. You could actually purchase it in the Apple Store. And you had everything you needed to actually start and to run your business.

CEO Dorsey went on to explain that Square Seller has always kept up with the preferred payment methods of the time, going from magstripe cards to more secure payments with Europay, Mastercard and Visa (“EMV”) chip cards and near field communication (“NFC”). Once they were satisfied with processing, CEO Dorsey talked about building point-of-sale (“POS”), Square Capital and Square Payroll. Former CFO Friar chimed in at the same JPMorgan conference, noting that Square Loan which was then Square Capital helps merchants who are underserved by legacy banks. She noted that the average Square Capital loan size at the time was just $6,000 to $10,000 which is much smaller than the loan amounts legacy banks like to use.

In the May 2017 Investor Day Webcast, CEO Dorsey pointed out that legacy payment providers are built on COBOL and they don’t use the newest tech. He said Square Seller won by focusing on speed:

That’s where I think we’ve really won, is that we focused multiple times around just making it faster for sellers to get in, #1. So under 2 minutes to sign up, to start accepting credit cards, which was a 2-week process before us. The 2.75%, one rate instead of digging through this byzantine maze of a rate table which took hours and accountants for a seller to really demystify. Demanding that our funds would be accessible to sellers the next business day and then making that even better by enabling them to go instant as well.

In the 2Q18 call, CEO Dorsey emphasized the ways in which Square Seller makes it easy for both small and large restaurants to conduct business:

60% of Square for Restaurants sellers have self-onboarded, and this is rather unusual in the industry. Typically, restaurants go to the point-of-sale provider, and they need help to set everything up. That includes their table map, all the menus, basically all the operations that they need to focus on to run their restaurant. They actually need a third-party to help them out. So the ability for a restaurant to take that on and self-onboard and do all their menus, do all their table layout with our software is pretty awesome because it creates efficiencies. And the other great thing is that our restaurant seller average annualized GPV is over $650,000. So these are not small.

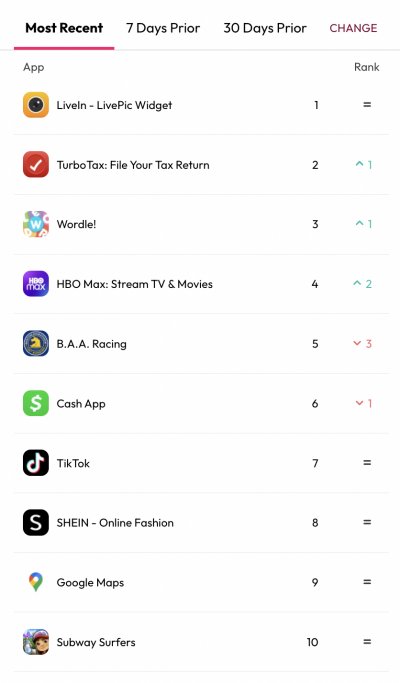

At the May 2019 JPMorgan Global Technology, Media and Communications Conference, CEO Dorsey talks about the way Cash App acts as a customer acquisition tool. Other payroll providers focus on the employer but Block focuses on the employees by putting them in control of how they get their money. Employees can get instant access to their paycheck with Cash App. We see at data.ai that Cash App is consistently in the top 10:

Cash App Popularity (data.ai)

Block recently completed their acquisition of Afterpay which will help merchants give consumers more flexibility with buy now, pay later (“BNPL”) options at checkout.

Tricky Valuation

There is a tremendous opportunity for international growth; for 2021, $17.1 billion of the $17.7 billion total revenue came from the U.S.

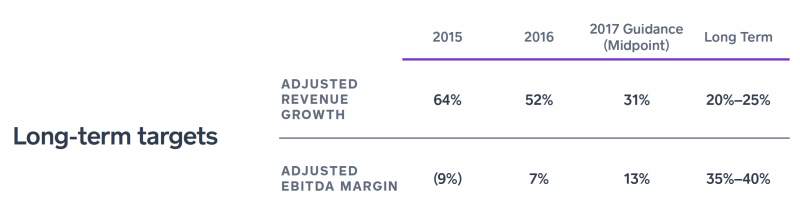

We need to have an idea of long-term margins in order to put together a valuation range. Page 165 of the 2017 Investor Day shows an adjusted EBITDA margin of 35% to 40% as a long-term target:

Long-term adjusted EBITDA margins (2017 Investor Day)

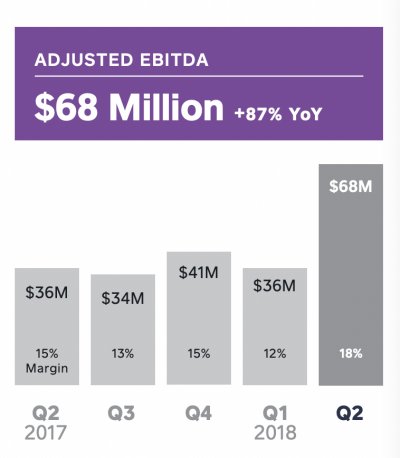

This was back before Cash App was a meaningful part of the business and eventually management stopped showing the adjusted EBITDA margin consistently in the shareholder letters. The last time I saw it displayed prominently was in the 2Q18 letter when the bulk of the business was still on the Square Seller side:

Adjusted EBITDA (2Q18 letter)

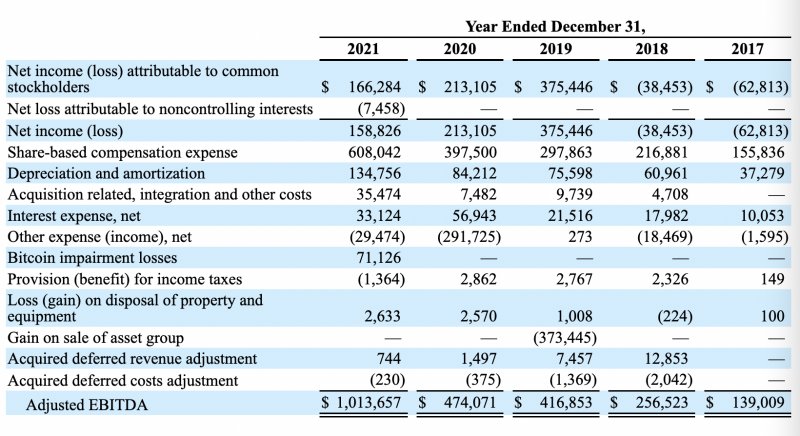

Block’s adjusted EBITDA ignores stock-based compensation (“SBC”) so this margin is misleading. The letters to shareholders continually focus on adjusted EBITDA and this is a facile way of looking at the economics seeing as stock-based compensation is a real and ongoing expense. Here is the adjusted EBITDA table in the 2021 10-K:

Adjusted EBITDA breakdown (2021 10-K)

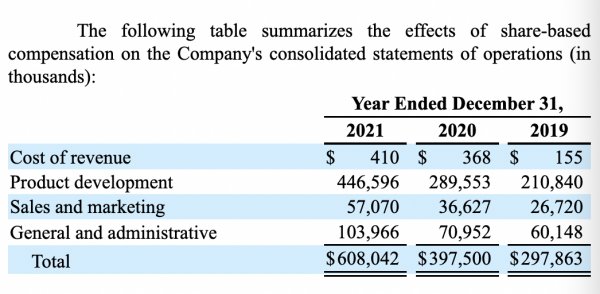

The adjusted EBITDA numbers don’t look nearly as good when we put stock-based compensation back in place. For example, the $1,014 million adjusted EBITDA for 2021 becomes just $406 million when we consider the weight of the $608 million stock-based compensation. The $135 million for 2021 depreciation and amortization is a real economic expense too. Sometimes EBITDA is useful for real estate companies with aggressive depreciation or with serial acquirers when accounting amortization isn’t the same as economic amortization but that isn’t the case here. I don’t understand why management focuses on adjusted EBITDA; it doesn’t make sense.

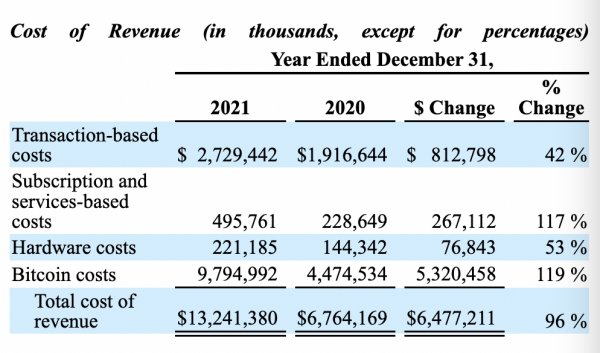

Despite the fact that we don’t have a direct use for the adjusted EBITDA numbers, they can be indirectly helpful if we make assumptions for stock-based compensation and depreciation/amortization. Looking at 2021, the payments business has a 44% gross margin [[$4.8 billion – $2.7 billion]/$4.8 billion] and the subscription business has an 81% gross margin [[$2.7 billion – $0.5 billion]/$2.7 billion]. I don’t see a detailed breakdown between Cash App and Square Seller beyond the gross margin level in the 2021 10-K but the 3Q19 letter says the following:

Our Seller ecosystem has achieved strong profitability with an expected Adjusted EBITDA margin of nearly 30% for full year 2019. Given this profitability and our 3- to 4- quarter payback period, we are increasing our investment in go-to-market initiatives to drive continued growth.

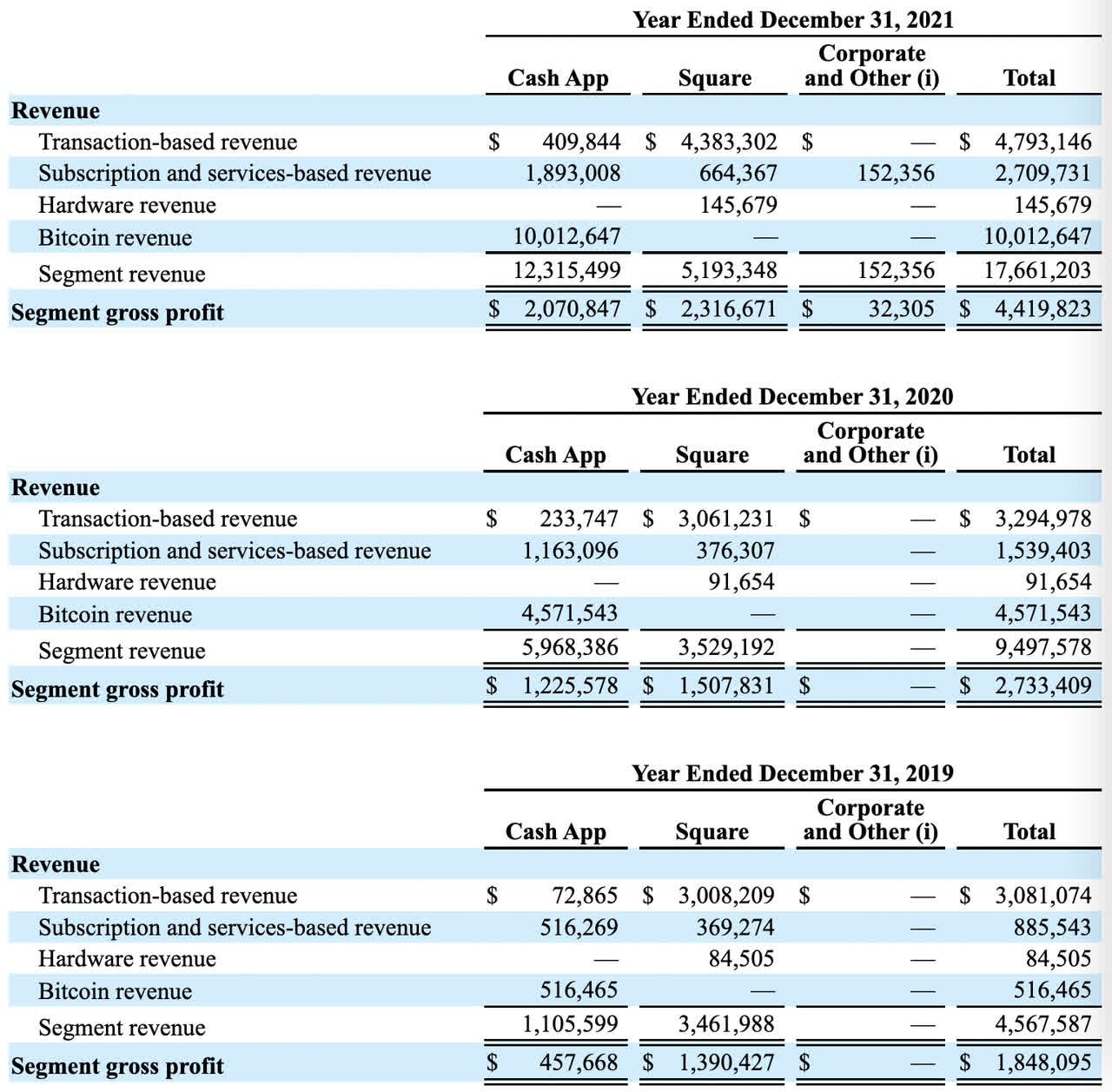

Looking at gross profit from the last 3 years and then trying to think about what it will be like 5 years from now can be helpful for a valuation framework. Once the gross profit levels are estimated, it makes sense to estimate owner earnings with some long-term margin assumptions. Cash App gross profit has skyrocketed from $458 million in 2019 to $1,226 million in 2020 and all the way up to $2,071 million in 2021. Square Seller gross profit growth has been more modest, going from $1,390 million in 2019 to $1,508 million in 2020 and $2,317 million in 2021:

Gross profit breakdown (2021 10-K)

Per GAAP requirements, Bitcoin revenue is reported on a gross level and the massive Bitcoin revenue figure above is not as meaningful as one might expect because the cost of Bitcoin revenue is large as well. Looking at 2021 for example, Bitcoin revenue was $10 billion but the Bitcoin cost of revenue was $9.8 billion for a spread of just $0.2 billion:

Bitcoin cost of revenue (2021 10-K)

Though not a direct driver with respect to gross profit, Bitcoin creates utility that drives engagement as noted by CFO Amrita Ahuja at the November 2019 Citi Conference:

And we’ve seen within the Cash App ecosystem self-reinforcement on that, where the introduction of Bitcoin, as an example, is not a huge monetization driver in and of itself, but it becomes an engagement driver. And engagement is the rising tide that lifts all boats. Bitcoin users are twice as likely to have and use their Cash Card as non-Bitcoin users, which is not necessarily intuitive, but when you see the strength of the ecosystem, these products reinforce each other and create daily utility, which makes the Cash App top of mind for our customers, which then creates an overall monetization stream across Cash App. Today, we have half a dozen revenue streams within Cash App, which enables us to reinvest back into the products.

Per the 10-K, hardly any of the stock-based compensation is on the cost of revenue; it is almost entirely on the gross profit:

SBC breakdown (2021 10-K)

Stock-based compensation as a percentage of gross profit was 16.1% [$297.7 million/$1,848.1 million], 14.5% [$397.1 million/$2,733.4 million] and 13.7% [$607.6 million/$4,419.8 million] for 2019, 2020 and 2021, respectively. I’m optimistic that it can get down to 10% of gross profit eventually.

Overall gross profit growth was 61.7% from 2020 to 2021 and the segment breakdown was 69% growth for Cash App and 54% growth for Square Seller. If gross profit can continue growing at a prodigious level then one can make the argument that today’s valuation should be based on a prodigious earnings multiple as well. If Block wasn’t managing the company for growth then I believe the income statement expense lines would be substantially lower such that roughly 20% to 25% of gross profit would make its way down to net earnings. Based on the 2021 gross profit of $4.4 billion, this translates to about $1 billion of steady-state net earnings. Today’s enterprise value is fairly close to the market cap of $62.5 billion based on 580 million shares outstanding [518,361,474 Class A + 61,696,578 Class B] as of February 18th and the April 21st market price of $107.71 per share. In effect, this is kind of like a P/E ratio of 63 and if we can expect 50% growth then it is sort of like a PEG ratio of a little more than 1 and a quarter. It’s hard to say if Mr. Market is right about today’s valuation. Block investors should watch the upcoming Investor Day on May 18th to see how well management spells out specifics for future economics. The 5-year growth rate of gross profit is very important as is the long-term net profit margin including the impact from stock-based compensation.

Be the first to comment