We Are/DigitalVision via Getty Images

Block (NYSE:SQ) including Facebook’s parent Meta Platforms (META) formed an odd duo in 2021 when both companies decided to change their names to broadly reflect crypto and the metaverse, the dual hypes of the time. It wasn’t quite clear then that the market for crypto would collapse less than a year later. Indeed, the zeitgeist for most of 2021 was characterized by animal spirits drunk on euphoria and a retail trading boom that saw bubbles pop up in everything from SPACs to NFTs. It truly was an era of easy money so when it ended, it did so with a bang.

To be fair to Block, its name change was also meant to reflect its greater range of businesses. This included Jay-Z’s music streaming platform TIDAL and Australian buy now, pay later firm Afterpay which was acquired in an all-stock deal for $29 billion. Fundamentally, the triumphant pivot into crypto, BNPL, and music streaming was done by Block at the peak of market sentiment. Indeed, Afterpay’s larger competitor Klarna recently completed a down round that saw its valuation cut from $45.6 billion to $6.7 billion, an 85% decline.

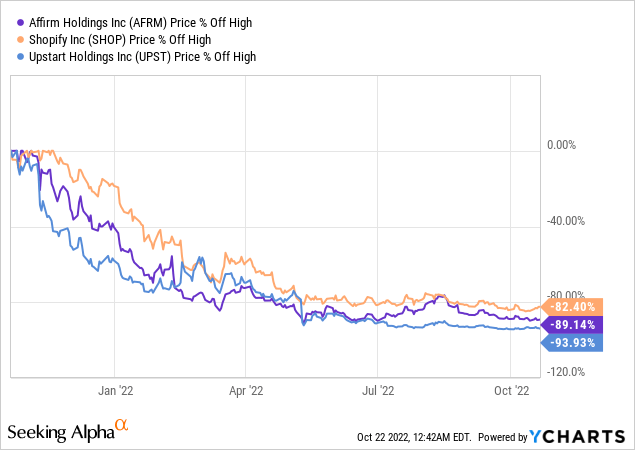

San Francisco-based BNPL competitor Affirm with its Amazon (AMZN) partnership is down 89% to $5.29 billion from its all-time highs. Block undoubtedly overpaid for Afterpay which now stands to be a liability on the back of rising interest rates and a global economy on the brink of a recession.

Large Write-Downs Are Likely Coming

A write-down happens when a company reduces the book value of an asset when its fair market value falls below the carrying book value. Hence, whilst Square’s balance sheet was in relatively decent shape as of the end of its last reported fiscal 2022 second quarter with cash and equivalents of just under $5 billion offset by total debt of $5.3 billion, the company carried goodwill of just under $12 billion. This formed 41.5% of the company’s total assets and is mainly formed from the excess from the buyout of Afterpay.

How much is Afterpay worth now? Using a blunt comparison to its peers and the broader eCommerce sector, the company would likely be currently trading on the Australian Securities Exchange at a valuation range between $2.9 billion to $5.8 billion if it was never acquired. This figure would be less if adjusted lower for the 30% premium over the market price that Block paid.

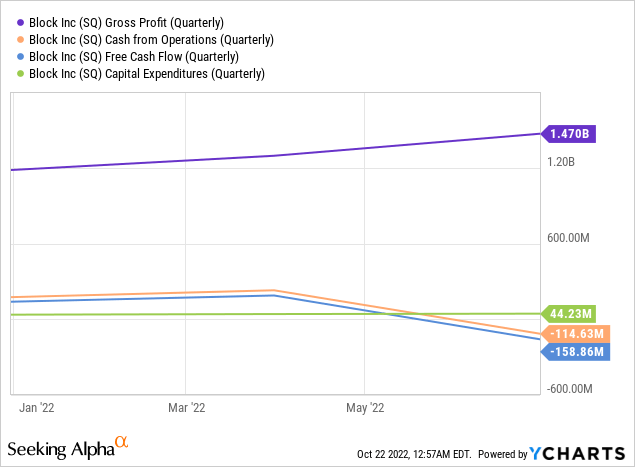

This places into view a likely impairment charge of at least 80% on current goodwill. Whilst this would be a non-cash charge, it would see shareholders’ equity realize a 57% decline to $7.3 billion. Further, when aggregated with what looks to be a deterioration in Block’s liquidity position on the back of negative cash burn from operations of $114.6 million, the impairment would become more acute.

The uncertain macro backdrop is already weighing down on Block’s common shares as the company’s underlying financial profile looks set to decline. To be clear here, BNPL is glorified subprime lending. It allows mass-market consumers to use different financing options to spread out the cost of their purchase at the point of checkout. This is an inherently high-risk endeavour against the spectre of a recession.

The current BNPL cohort were founded in the aftermath of the 2008 global financial crisis following regulations that encouraged the proliferation of non-bank lenders. They have not been tested in a recessionary environment characterized by falling real incomes, high inflation, and rising interest rates. Hence, Block might find that Afterpay’s consumer credit performance deteriorates and that it has to realize large-scale charge-offs on its portfolio if risks are not managed well. Critically, managing these risks would mean the company pulling back materially from underwriting for a currently large segment of its active customer base. This would slow BNPL growth markedly and see less of the synergies realized with the ongoing integration of Afterpay with the cash app and Square seller ecosystem. This was recently expanded to the UK and Canada.

Chasing The Hype Around And Finding Out

Block’s growth is negative with revenue for its last reported quarter coming in at $4.41 billion, a decline of 5.8% from its year-ago quarter. This came on the back of a slowdown in its low-margin bitcoin trading business which constituted 56.6% of the company’s fiscal 2021 revenue and had a less than 3 % gross profit margin during one of the most buoyant bitcoin bull markets in years. Bitcoin trading is an inherently volatile and unstable business with revenues at cryptocurrency exchange Coinbase (COIN) down 64% year-over-year for its last reported quarter.

Block looks set to realize negative gross margins on its bitcoin business this year, as the fickle retail trading that led much of the initial trading boom has dissipated with the collapse of most speculative trading phenomena seen in 2021. There could be more pain to come with most of the developed world forecast to fall into a recession next year as elevated inflation forces a newly hawkish Fed into a series of rate hikes. Block paid at the top for Afterpay. Bitcoin, its largest revenue driver, is now set to be a drag on earnings for the foreseeable future. Shares could very much fall into the $40 range on the back of this. However, the market remains volatile and upside risks remain if there is a sensed pivot of the Fed’s current hawkish stance. This is the most pertinent near-term risk for a bear position.

Be the first to comment