cofotoisme

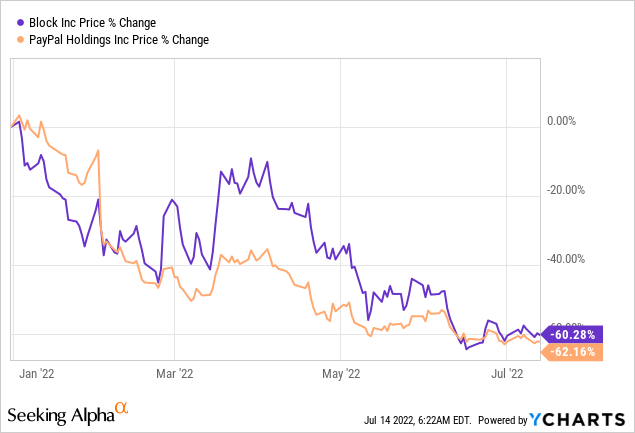

Shares of Block, Inc. (NYSE:SQ), the digital payments company most known for its popular Cash App, have declined 60% this year while shares of rival company PayPal Holdings (PYPL) have seen a decline of 62%. Since PayPal reduced guidance last quarter and macroeconomic headwinds are increasing, Block may see a deteriorating short-term business outlook in FY 2022. While the Cash App is very profitable for Block and the Buy Now, Pay Later (“BNPL”) business represents an attractive growth opportunity longer term, the market currently does not hold a favorable view of FinTechs. Since revenue estimates are declining, risks continue to increase!

Cash App is Block’s crown jewel

Block’s hottest and most successful product is the Cash App. It has seen accelerating adoption by customers, in part due to the government handing out generous stimulus checks during the COVID-19 pandemic, and the app has consistently ranked as the most popular finance app on the App Store.

Block’s Cash App has turned into a significant driver of business growth, and products like the Cash App Card now have more than 15M active users. The Cash App has also become a gross profit driver at Block in recent years.

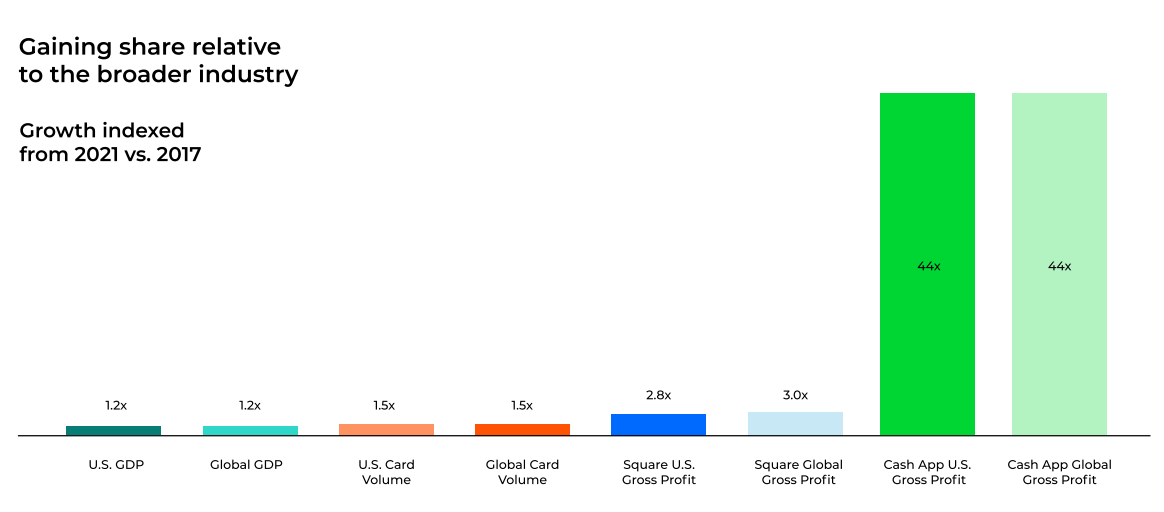

Due to accelerating customer adoption during the pandemic and increasing strategic investments in the Cash App ecosystem, Block’s Cash App gross profits have soared since FY 2017.

Block

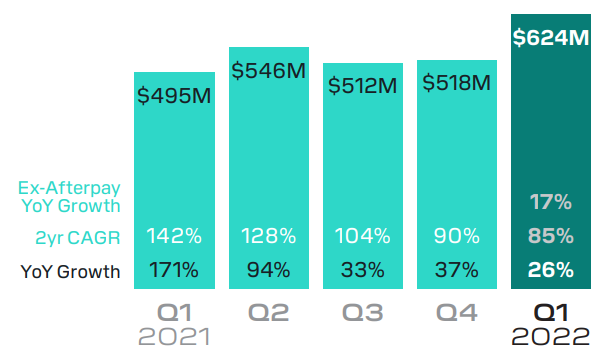

In Q1’22, Block’s Cash App achieved gross profits of $624M, showing 26% year-over-year growth, or 17% growth after excluding gross profit contributions from Block’s Buy Now, Pay Later business Afterpay.

Block

Block acquired Afterpay to make a strategic investment in the rapidly growing Buy Now, Pay Later industry and to develop the Cash App ecosystem. The acquisition of Afterpay was completed in January 2022. The inclusion of Afterpay services in the Cash App means that customers can manage their installment payments directly within the app and customers can also use the app to scan for merchants that offer Buy Now, Pay Later services, creating a win-win-win situation for buyers, merchants and Block.

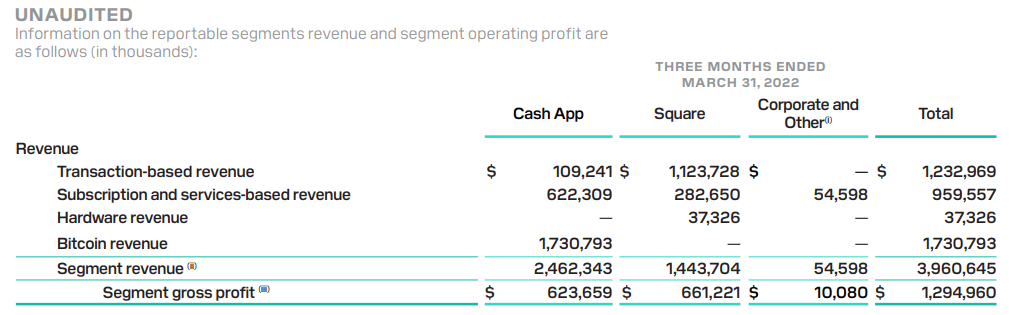

The Cash App generated 48% of all gross profits in Q1’22 and segment gross profits are about on the same level as gross profits from all of Block’s other products and services, including the sale of point-of-sale software and hardware. These products and services are represented in the Square segment which generated $661.2M in gross profits in Q1’22 (51% gross profit share).

Block

Despite Cash App success, economic headwinds are growing

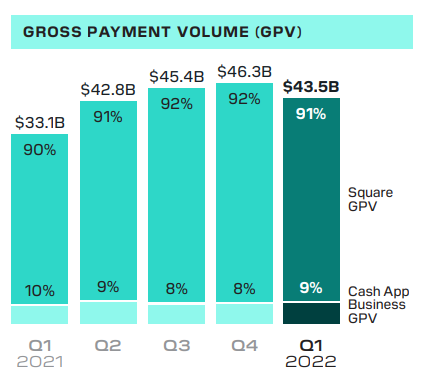

Despite the hugely successful Cash App, there are reasons to be concerned about the decline in Block’s gross payment volume. The gross payment volume reflects the total dollar value of transactions that are being processed by Block. In the first quarter, Block processed $43.5B in gross payment volume, showing 31% year-over-year growth. However, gross payment volume saw a sequential decline of 6%, largely because of a lower dollar amount processed within Square. Block’s gross payment volume within the Cash App increased 1 PP quarter over quarter to 9% and the inclusion of Afterpay could drive further growth in Block’s Cash App gross payment volume going forward.

A sequential decline in gross payment volume in the second quarter, however, could indicate the beginning of a slowdown in Block’s revenue and gross profit growth… which could lead to another down-leg for Block’s shares.

Block

Block’s valuation could come under more pressure due to cyclical retail spending adjustments

It is an easy thing to say that Block’s valuation factor could come under pressure after a 60% year-to-date decline in pricing has already occurred. But a downturn in the economy would seriously affect companies like Block, which increasingly depend on the adoption of BNPL services and retail spending.

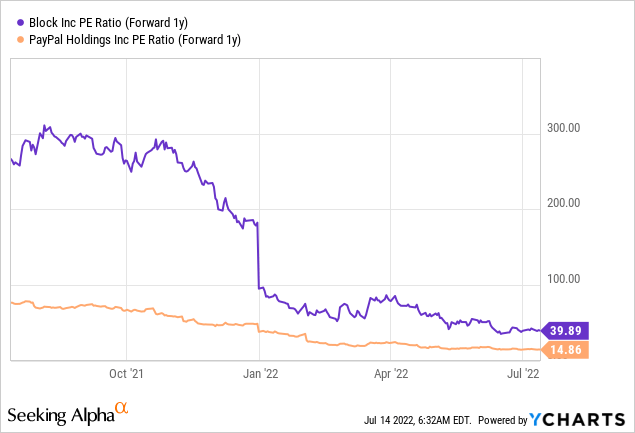

Block is expected to generate revenues of $21.2B in FY 2023, implying a year-over-year topline growth rate of 20%, and EPS of $1.61. Both Block’s and PayPal’s price-to-earnings ratios have decreased materially in FY 2022, but Block may be considered expensive, relative to PayPal, with a P/E ratio of 40 X. Because of the much better valuation and setup, I prefer PayPal over Square.

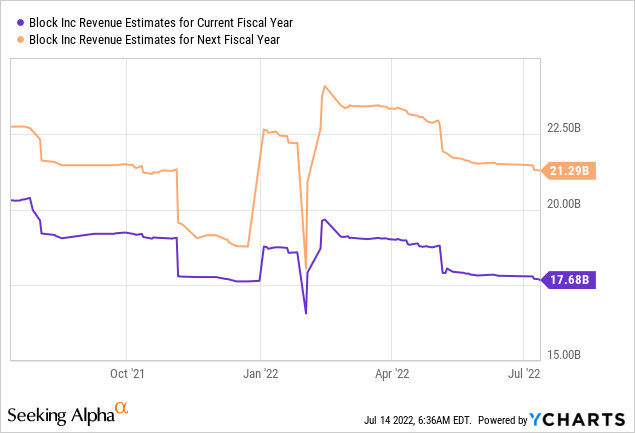

Block’s revenue estimates have started to decline due to growing concerns about the firm’s post-pandemic growth rates. The decline in estimates could mark the beginning of a longer trend, especially if consumers cut back on discretionary spending this year.

Risks with Block

Block’s biggest risk is a sequential decrease in gross payment volume and, related to this, a slowdown in the firm’s revenue and gross profit growth. The economy appears to be slouching towards a recession right now, and it could expose Block to further declines in gross payment volume. The result of this would likely be a deteriorating outlook for revenue and EPS growth which would add new pressure on Block’s valuation multiplier.

Final thoughts

Shares of Block have declined 60% this year, but the firm may be set for even more pain in the short term. While the Cash App is a money-maker for Block, the digital payments company may face additional (gross payment volume) headwinds in FY 2022 if market conditions continue to deteriorate. Although Block has a much more attractive valuation compared to last year, I believe headwinds for the company are set to grow!

Be the first to comment