Joe Raedle/Getty Images News

Investment Thesis

My first thought when Square changed its name to Block (NYSE:SQ)?

“Well, that’s a dumb name”

My second thought?

“Oh dear… they’re going to start focusing on blockchain and bitcoin aren’t they?”

It would appear that these thoughts were warranted (well, at least the second one was – the first is still up for debate) as Block has increased the focus on its bitcoin-related offerings. I think this has spooked the market and investors who don’t want to invest in yet another bitcoin proxy such as Coinbase (COIN).

However, Block has two powerful ecosystems, and the company’s core business has been continuing to execute throughout a difficult two years. When we peel back the news about Afterpay and name changes and bitcoin, we’re left with a high-quality business that still has plenty of room to grow.

But does this make Block a good investment right now? I put it through my framework to try and find out.

Business Overview

Block’s mission is ‘to enable economic empowerment’, and it looks to achieve this through the ecosystem it has built to primarily serve individuals and SMBs (small and medium-sized businesses). The company was founded as Square in 2009, which is also the name of its original product for businesses, but the company was renamed to Block in 2021 to highlight that this company was more than just its Square ecosystem.

Block has two main ecosystems – Square and Cash App – but it also has additional offerings that are being highlighted more and more following the name change.

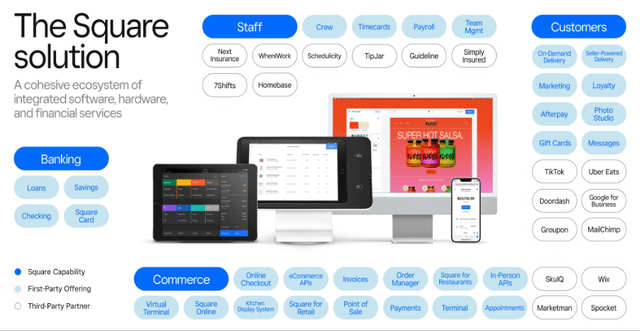

Square offers a cohesive commerce ecosystem designed for SMBs that helps sellers start, run, and grow a business. In an industry that has historically been fragmented and specialised, Square enables SMBs to do everything on one platform – whether that’s PoS (point-of-sale) solutions, payroll solutions, appointments, business banking, customer relationship management, ecommerce solutions and many more – businesses can use Square to do it all. Plus, it’s possible to integrate Square onto websites such as Wix (WIX), into third-party applications such as Quickbooks, or into a seller’s specialized PoS such as in the SoFi (SOFI) Stadium.

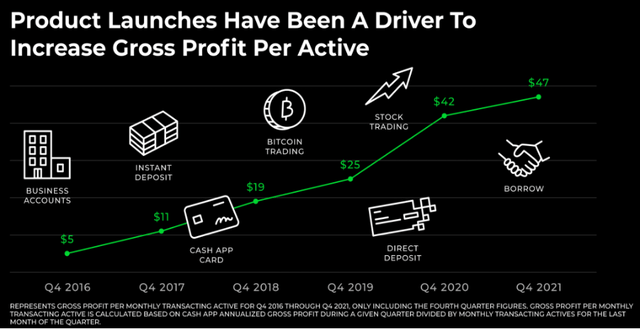

Cash App is an ecosystem of financial products and services to help individuals manage their money. Originally a mobile application from which individuals could send money to one another, it has since expanded its offerings to include direct deposits, debit cards, a free tax-filing solution, the ability to buy and sell both stocks and bitcoin, and many more. As individuals get more embedded into Cash App, the amount of gross profit brought in by Block has increased rapidly – from an average of $5 per active user in Q4’16 to $47 per active user in Q4’21.

I’ll quickly summarize some of the additional solutions rolled out or acquired by Block in the last few years:

- TIDAL: Block acquired an 86.8% stake in TIDAL during Q2’21. TIDAL is a global music, podcast, and video streaming service with a focus on ensuring equitable compensation for artists as well as tiered pricing based on delivering high-quality audio.

- TBD: launched in Q3’21 with a mission ‘to build an open developer platform to make it easier for individuals and businesses to access bitcoin and other blockchain technologies without having to go through an institution’.

- Spiral: an independent team solely focused on open source bitcoin work.

- Afterpay: acquired in Q1’22, Afterpay is a global BNPL (buy now, pay later) platform.

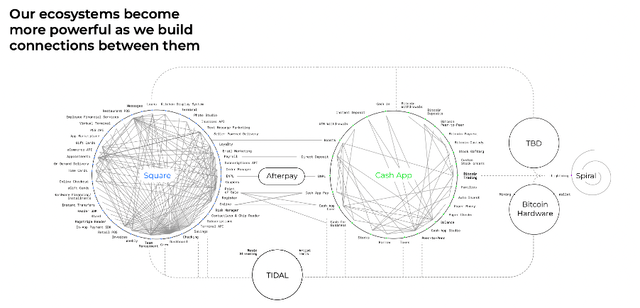

If this all seems a bit random, Block released a very useful graphic that clearly shows how these work together cohesively (note: sarcasm doesn’t always translate via text).

All kidding aside, at least there is a vision to keep an ecosystem-first model that has served Block so well in the past. The bitcoin and TIDAL businesses are, let’s face it, quite random at the minute – but this graphic does show how Afterpay can be used to further connect the Square and the Cash App ecosystems.

There’s quite a lot going on here. I think it is becoming clearer that the choice of Block as a corporate name is a nod to the blockchain and the company’s future bitcoin ambitions – CEO Dorsey is a big bitcoin believer. As it stands, the TIDAL and bitcoin-related side of Block are not contributing much to the company, so throughout this analysis, I will focus predominantly on its Square and Cash App ecosystems, with a bit of Afterpay thrown in.

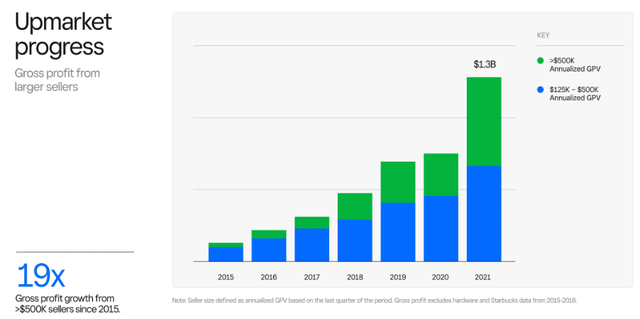

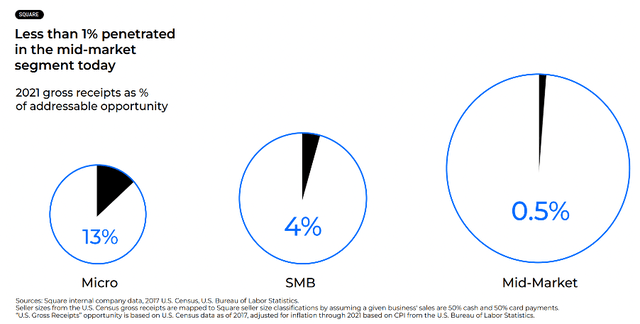

I want to quickly touch on Square’s journey upmarket, as it is looking to grow outside of its original SMB offering and reach larger businesses. The company has done this with a fair amount of success, as gross profit from sellers with over $500k in GPV (gross payment volume) increased 19x from 2015 through to 2021. The total gross profit of $1.3 billion in 2021 from sellers with over $125k in GPV represented an impressive ~56% of Square’s total gross profit, so it’s clear that the move upmarket is paying off.

Economic Moats

With every business, I look to see if there are any durable competitive advantages (aka economic moats) that will help the company continue to thrive whilst protecting itself from competition.

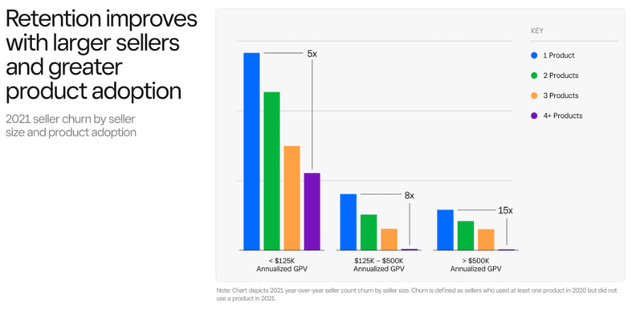

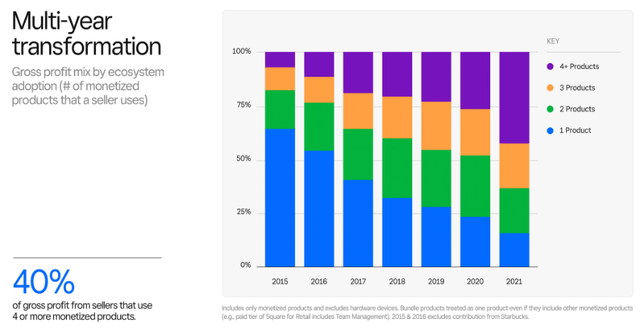

The first clear economic moat possessed by Block is switching costs, and we can see this in both the Square and the Cash App ecosystems. Starting with Square, I highlighted that the purpose of this ecosystem was to move away from the fragmented world of specialized offerings for SMBs towards a single cohesive offering. This also means that sellers who do decide to use Square can use it for a whole host of offerings. Every additional solution taken up embeds Square even further into a business, and therefore makes it even more onerous to switch from. As per the below chart, it is clear that more solutions taken up leads to lower churn – and similarly, Square’s push upmarket has also reduced churn.

Even more promising is the amount of gross profit driven by customers with 4+ products, and this clearly shows more that customers are adopting Square’s additional solutions, and in doing so they are bringing in substantially more value for Block.

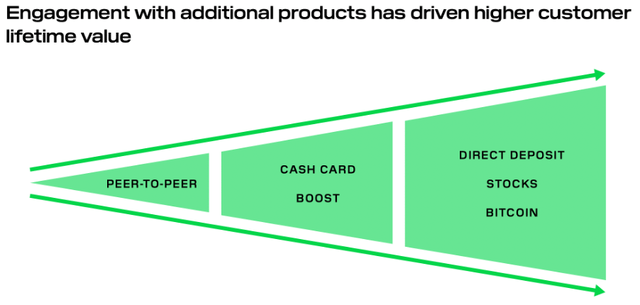

Cash App also benefits from switching costs in a very similar way – Block has been able to successfully offer more and more solutions to Cash App users, and as these have been adopted the switching costs have increased. There aren’t really any switching costs with a P2P (peer-to-peer) money transfer system for individuals, but once customers integrate banking, investments, taxes etc. it becomes a lot more difficult to use anything other than Cash App to manage your finances (plus, why would you want to?).

Block Q4’21 Investor Presentation

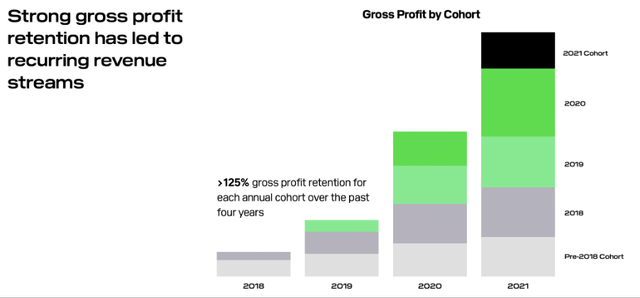

The company has continually expanded the gross profit by cohort through these additional offerings – and a gross profit retention rate above 125% over the past four years demonstrate these switching costs in practice.

Block Q4’21 Investor Presentation

Another moat that I see with Cash App is its network effect, primarily due to its original purpose as a P2P payment solution. Any Cash App user is likely to encourage a friend to join Cash App in order to facilitate a payment transfer between the two, so that friend would join Cash App, and then they would encourage their friends to join – it’s very similar to the network effect that Facebook had. I personally don’t believe this is a strong network effect, since I believe that there are plenty of other ways to transfer money between individuals, but it has certainly helped Cash App to grow up to this point.

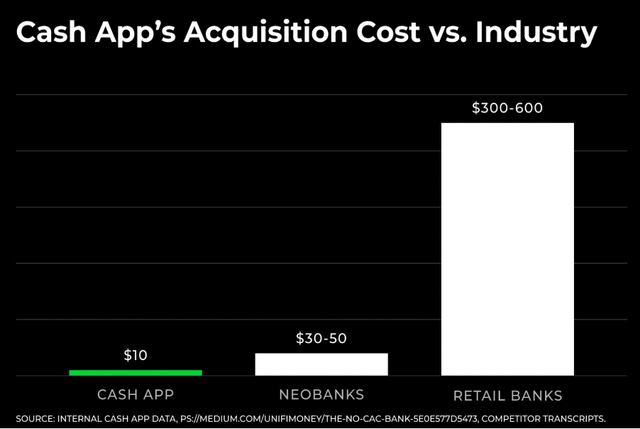

The final economic moat that I will give Block credit for is its Brand, and this is across Square, Cash App, and even Afterpay. All of these are leading, instantly recognizable names in their respective industries, but perhaps the strongest brand of the three belongs to Cash App. It has been the top finance app in US app stores for the past 5 years, and as a result the customer acquisition cost for Cash App is incredibly low when compared to its competitors.

Outlook

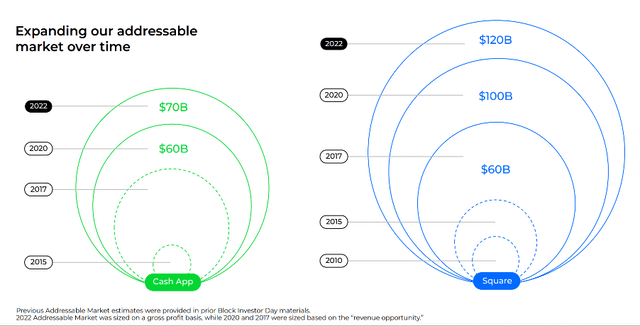

As the number of solutions offered by Block continues to expand, so does its Total Addressable Market. In fact, the company’s latest TAM across both its Cash App and Square ecosystems was $190 billion on a gross profit basis – this is compared to its 2020 TAM of $160 billion, which was sized based on the revenue opportunity, so in reality, the TAM has grown by more than just $30 billion over that period.

Block’s gross profit in 2021 was $4,419m and represented ~2.3% of its latest TAM – so despite being a leading name across both industries, there is still a lot of growth potential for Block. The company believes it can achieve this in multiple ways, specifically by continuing to move further upmarket with Square, rolling out more solutions on Cash App, expanding geographically across both ecosystems.

Management

When it comes to fast-paced, innovative companies, I always aim to find founder-led businesses where inside ownership is high, and we have this in Block thanks to Co-Founder, Chairman & CEO (officially Block Head…) Jack Dorsey – who you may also know as the co-founder of Twitter (TWTR). Block’s Board of Directors also includes the other co-founder Jim McKelvey, as well as former TIDAL owner Shawn Carter (better known a JAY-Z).

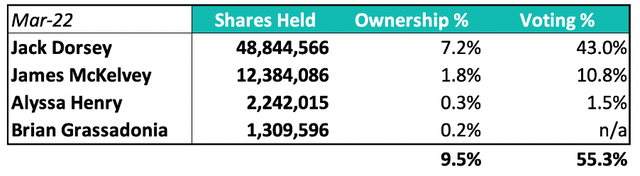

I want to invest in companies where leadership has skin-in-the-game, and we get this with Block primarily through Jack Dorsey’s 7.2% ownership. Co-founder James McKelvey still owns 1.8% of all shares, and he and Dorsey have a combined voting power above 50%.

What is also impressive is the ownership levels of executives – normally this is negligible, but Square Lead Alyssa Henry and Cash App Lead Brian Grassadonia own 0.3% and 0.2% of shares respectively. That may not sound like much, but at Block’s current market cap of $37.1 billion, their shareholding is worth $122m and $71m respectively, so they have a lot of skin in the game compared to most C-Suite executives.

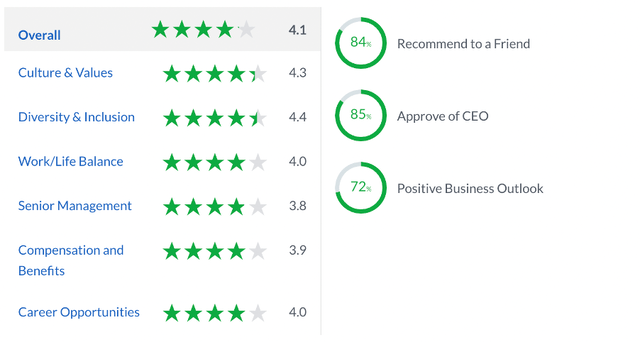

I also like to take a quick look on Glassdoor to get an idea about the culture of a company, and Block gets some great scores from the 1,049 reviews left by employees. Any score over 4.0 is impressive, and Block achieves this in a lot of categories. In fact, most scores are around that 4.0 mark, with the highest scores coming in Culture & Values and Diversity & Inclusion. Whilst a somewhat controversial figure, I have always got the impression that CEO, sorry Block Head, Jack Dorsey does try to do right by people – and the scores for these culture-related aspects speak to that.

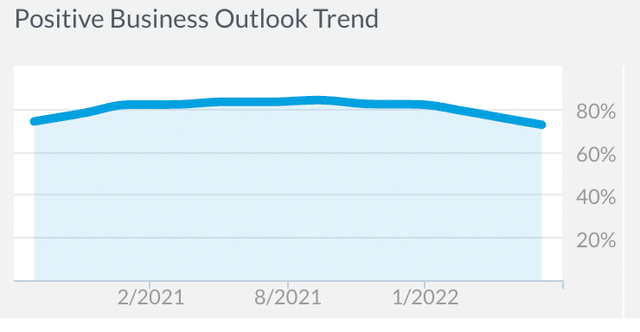

It’s worth noting that the CEO approval rating, whilst still strong, has fallen since the name change from Square to Block & the change of his role from CEO to Block Head. Only a small point, but perhaps there are concerns within the business about its new direction – there is a similar drop in the trend for Positive Business Outlook, moving from above 80% a year ago to just 72% in July 2022.

Financials

Block’s financials are not the most straightforward to understand, primarily due to the way it records bitcoin revenue. When customers buy bitcoin through Cash App, Block recognizes the full purchase amount as revenue (despite only taking a ~2% fee), and then offsets it in cost of sales – I personally think a more appropriate approach would be to record the ~2% as revenue (and pure gross profit), but we don’t need to get into the nitty-gritty of accounting.

Basically, if I want to own $100 worth of bitcoin on Cash App, I pay $102 in total and I receive $100 in bitcoin and pay $2 to Cash App for facilitating the transaction. Then, Cash App will record revenue of $102, cost of sales of $100, and gross profit of $2 – this skews the financials massively by lowering gross profit margins and inflating revenues, especially since over $10 billion worth of bitcoin was purchased via Cash App in 2021.

As a result, Block often focuses solely on gross profit in its shareholder letter, but I don’t necessarily like this either – I want to see both top line revenue growth AND gross margin expansion, but just looking at gross profit doesn’t tell me about these two individual aspects. So, I’ve created an adjusted revenue figure which accounts for bitcoin in what I believe to be the most appropriate way; it only recognizes the ~2% fee charged. With that out of the way, we can see Block’s financials below.

Revenue growth was lumpy in 2020, primarily because the SMBs that Square traditionally serves were hit hardest by the pandemic and the lockdowns that ensued. This is where the resilience of Block’s business model showed, as Cash App growth took off in 2020 and through to 2021 – not only keeping revenue growth alive, but also boosting gross profit margins substantially due to the higher margin nature of Cash App. All in all, Block has successfully achieved an adjusted revenue CAGR of 36% from 2018 through to 2021.

I have to say that I’m not a massive fan of Block’s balance sheet; they do just about have more cash, cash equivalents, and short-term investments than they do debt, but things have got worse in Q1’22 following the Afterpay acquisition. Block now has a whopping $12.4 billion in goodwill on its balance sheet relating to the premium paid for Afterpay – this will stay on Block’s balance sheet indefinitely, unless it is revalued downwards in which case it will be gradually written off. Basically, goodwill on a balance sheet is almost never a good thing.

On the plus side, both operating and free cash flows are strong, and have been positive for a long time. This makes me feel a bit more comfortable with Block’s average balance sheet, as the company is clearly bringing in enough money to sustain its own operations.

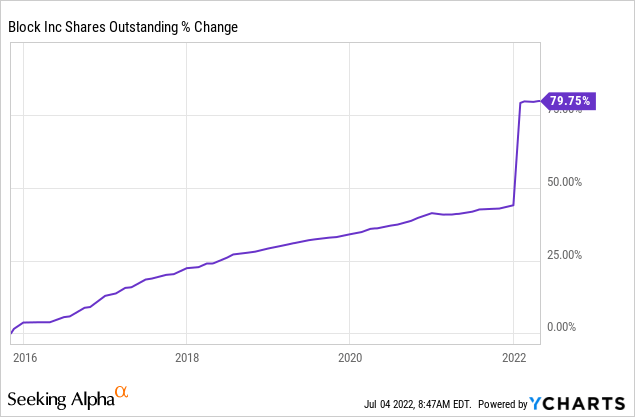

I should also highlight that this company has a record of shareholder dilution, and that has only been exacerbated by its recent Afterpay acquisition – shares outstanding have now increased by 80% since Block first came public in 2015.

Valuation

As with all high growth, disruptive companies, valuation is tough. I believe that my approach will give me an idea about whether Block is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

Note that in this model, I have used adjusted revenue once again to only include gross profit from bitcoin transactions. I have assumed a 30% YoY revenue growth rate in 2022, helped out by the Afterpay transaction closing – note that in Q1’22, gross profit growth was +34% YoY, or +25% YoY excluding Afterpay. I do think that my assumptions for growth are conservative, and as a Block shareholder I would expect my expectations to be beaten.

I have assumed a continued improvement in free cash flow margins as Cash App growth continues & more software solutions are adopted in the Square ecosystem, plus Afterpay should also provide a boost to margins in the long run.

I’ve also assumed continued dilution of shareholders, with total shares outstanding increasing by 28% over this period.

Finally, I believe that my EV / FCF assumption of 45.9x in the mid-range scenario is appropriate if Block can continue to grow and capture this market opportunity. For context, the average EV / FCF of Block since it came public was 64x, and the average multiple of a more established business such as PayPal (PYPL) over the past three years has been 52x – although all businesses have seen multiple compressions recently, which is why I include a range of multiples in my scenarios.

Put that all together and I can see Block’s shares achieving a 20% CAGR from now through to 2026 in my mid-range scenario.

Risks

Unfortunately for investors, there are a ton of risks to be aware of when it comes to Block.

First and foremost there is substantial competition risk on both the Square and Cash App side. Square is seeing competition from similar broad players such as Shopify (SHOP), as well as more niche solutions from the likes of Toast (TOST) who specialize in restaurants. There is also competition on the Cash App side from PayPal’s Venmo and also from Zelle, as well as competition in Afterpay’s BNPL business from the likes of Affirm (AFRM) and Klarna. Clearly a lot of money has been pumped into the fintech space in recent years, and it will be interesting to see if Block is capable of fending off this competition – it has done this successfully so far, but it is something for investors to keep an eye on.

There was also the substantial $29bn acquisition of Afterpay, which used up a lot of capital and diluted shareholders. Whilst it is a useful product to add into Block’s ecosystem, it will take a lot of time to see whether or not it was a good use of capital. Furthermore, the synergies actually realised in acquisitions are generally lower than expected – trust me, I used to own Teladoc (TDOC) & saw their acquisition of Livongo burn shareholder capital & realise very limited benefits, so I have a lot of caution when it comes to large acquisitions.

I do also wonder about the potential strategic drift within this company. CEO Dorsey is a bitcoin fan, and clearly he is looking to take Block down a bitcoin route in the future. I am not a bitcoin fan, I don’t believe in it, but I do think that Dorsey has shown his ability to execute his plans thus far as CEO – so if he wants to play with his bitcoins then fine, just as long as it doesn’t start affecting the core business in a negative way.

The other cause for concern with strategic drift relates to the TIDAL acquisition. I mean I don’t even have to explain this – it’s a real push to try and justify, and I mean really justify, how a music streaming platform fits within Block’s ecosystem. Again, it is only a small part of the business, and doesn’t take away from the quality of the Square and Cash App ecosystems, but I do question some of the decisions taken by management.

Summary

Despite ending on a negative note & highlighting the risks and management concerns, I want to point out that Dorsey has built a brilliant business in Block, and shareholders have been rewarded in the long run (despite the recent big pullback). He is an eccentric character who has a habit of thinking outside the block, and I don’t mind him exploring bitcoin-related ideas even if it is not something I’m very keen on – when you invest in a company, you have to decide how much trust you personally are willing to put in management.

So in spite of these risks, I can see a lot of positives in the future for Block. They do have moats to protect them from the increasing threat of competition, and they have built out two extremely strong ecosystems that should continue to grow – and perhaps even complement each other as time goes on.

There’s been a lot going on with this business lately, but don’t let that distract you from the quality of its Square and Cash App offerings – I think it has certainly distracted the market, and as a result Block’s shares are looking quite enticing right now.

Be the first to comment