imaginima

Recommendation

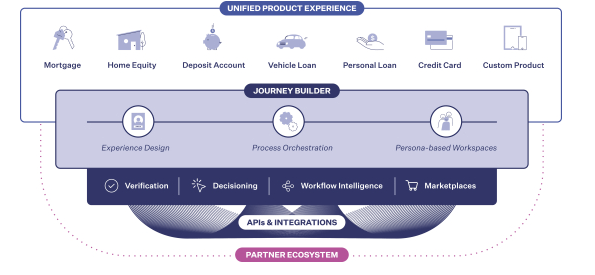

I believe the selloff is unwarranted, and the current share price for Blend Labs (NYSE:BLND) presents a good upside. BLND is a white-label software platform for delivering digital banking services to end users. The platform simplifies complicated origination procedures and automates processes, allowing financial institutions to offer easy and convenient digital services to customers. BLND also unites a partner ecosystem of service providers, making it easier for customers to find the solutions they need.

Business

Blend is a white-label software platform for delivering digital banking services to end users.

Demand for digitization increasing

Due to the COVID-19 pandemic, there has been an increase in demand for data-driven, individualized, and digital services from customers. This has led to a shift away from brick-and-mortar banking institutions towards online and mobile options. The popularity of mobile banking apps among Millennials and Gen Z indicates that mobile services will continue to be significant in the future. (Note that another a good indicator is the increasing number of digital banking start-ups). In order to retain customers and generate more revenue, financial services companies must provide easy-to-use digital customer journeys that incorporate these features.

My impression is that this change has made the financial sector more competitive. Traditional banks are losing customers to fintechs, digital banks, and other disruptors who are launching digital-first offerings. For traditional financial services companies to keep and expand their market share, they need to put money into products and services that are easy for customers to use, are driven by technology, and leave them feeling satisfied. Therefore, financial services firms are looking for strategic alliances to better manage customer experiences in the face of threats such as shifting interest rates and evolving regulations.

BLND platform fits the bill

To facilitate the delivery of any banking product throughout the entire customer lifecycle, BLND has created a flexible cloud-based software platform for financial services companies. In addition, the software developed by BLND streamlines the complex origination processes that necessitate the use of third-party resources such as technology, data, and service providers. BLND’s clients are able to save time and money on software development by avoiding the need to build their own custom solutions from the ground up thanks to the company’s automation of these processes and pre-built integrations. Since the financial services sector is currently undergoing a digital transformation, BLND is in a favorable position to reap the benefits of this trend.

S-1

The platform wasn’t merely crafted to meet those requirements mentioned above. BLND also unites a sizable ecosystem. To achieve this, BLND coordinates the efforts of these organizations to provide effective solutions to problems. In my opinion, this is crucial for efficiency and economy. The fact is that BLND doesn’t have the resources to satisfy everyone’s requirements, and some customers will always prefer to stick with standalone programs. By making the system more accessible, BLND prevents any interruptions to the flow of business for its customers.

To add to this, the BLND-backed banks act as a valuable distribution channel, putting the products and services of BLND’s ecosystem partners in front of a large number of prospective buyers who are in the research phase of the purchasing process. To receive a large volume of consumer traffic at no additional acquisition costs, BLND’s software powers the customer journeys of financial services companies across multiple channels. Increasing the number of service providers in the BLND ecosystem to better serve the needs of BLND users is a priority as more and more financial institutions sign on as BLND customers.

In this way, consumers have more ways to cut costs, businesses in the financial sector become more efficient, and BLND partners expand their reach. In my opinion, the network effect created by this win-win-win model will lead to a steady growth of the BLND TAM.

Proven track record in providing mission-critical solutions

As the underlying consumers demand faultless execution, I think a proven track record is crucial here. Therefore, it would benefit BLND’s image to have a proven track record and an established clientele.

BLND has a proven track record of delivering products securely, at scale, and in a manner that meets the demanding needs of hundreds of financial services firms, including more than 30 of the top 100 financial services firms in the US by AUM. Another positive aspect of BLDN is that once its solutions are implemented, they become entrenched in business workflow process and intertwined with back-office systems, making them next to impossible to replace. As a result, BLND is in a great position to cross-sell customers on related products and services. The sheer number and variety of BLND’s customers yield a wealth of data and valuable insights that are used to enhance the software platform and better meet the needs of both existing and prospective customers.

Huge growth opportunities ahead

In my opinion, there is a large market for BLND in the US and elsewhere. Attracting new customers and fortifying relationships with existing ones are the cornerstones of the BLND revenue model, which allows it to grow in tandem with transaction volume. I also think there is a huge unrealized potential for BLND to expand its product offerings to the financial services companies it already assists. For instance, while BLND offers a variety of software options, the vast majority of its clientele uses only a couple of these products or marketplaces.

Competition is super intense though

Some of BLND’s main rivals include companies that specialize in individual parts of the solution, suppliers of back-office software with unique digital features, and companies that have developed their own solutions. I anticipate that as the TAM expands, both new entrants and existing players will invest more time and money into creating and promoting products that compete with BLND.

In my opinion, BLND stands out from the crowd thanks to the depth of its product offerings, the adaptability of its platform, the size of its ecosystem, and the diversity of its clientele. Furthermore, as BLND expands, the network effect should assist in putting it ahead of the competition.

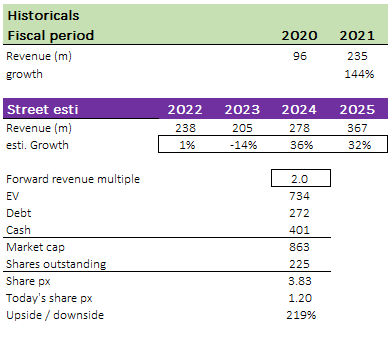

Valuation and model

According to my model, BLND is undervalued. The upside could be massive, depending on what multiple you believe BLND should trade at. Due to the current poor macroeconomic environment, I expect BLND’s revenue to fall precipitously in FY23. As we enter a recovery and growth environment, revenue should recover and grow aggressively in FY24. I believe investors are pricing in BLND based on the short-term outlook for FY23, resulting in a massive sell-off.

BLND is currently trading at 1x forward revenue. I want to emphasize that this is near its all-time low, and any mean reversion would represent a massive upside. As growth accelerates, I expect BLND to trade back to 2x revenue in FY24, making the stock worth 219% more.

Author’s own calculations

Risk

Bad macro climate

Blend’s financial results will continue to be affected by fluctuations in the macroeconomic environment and the broader effects on the volumes of existing home sales. Blend generates the vast majority of its income from fees on mortgage and refinance transactions closed on the platform as well as premiums on title transactions necessary for home loans. Negative macroeconomic trends that affect the demand for housing or the supply of currently available housing could, therefore, reduce the number of annual transactions completed on the platform.

In addition, consumers may become less willing and able to spend and borrow money if interest rates continue to rise. Customers’ ability to generate volume, and thus the number of transactions conducted through the BLND, may be negatively impacted by higher interest rates, as these rates typically translate into higher loan rates charged to consumers.

Summary

In my opinion, the current price of BLND is below its true worth. The BLND platform streamlines and automates origination processes by integrating with third-party tools, data, and services. Customers can avoid investing in costly in-house software development and save both time and money as a result. BLND’s software and service providers work together to form a cohesive ecosystem that increases the company’s reach and makes it more convenient for customers. In the face of interest rate fluctuations and ever-changing regulatory requirements, BLND’s clients benefit from the company’s effective solutions, which allow them to manage customer experiences with greater agility.

Be the first to comment