AndreyPopov

Consumers and retail investors are rightfully confused as to the state of the economy, as no one really knows if we are truly in a recession or a period of extended stagflation. This is reflected by recently disappointing quarterly results from the likes of Walmart (WMT) while other companies have held up well.

This brings me to Blackstone Mortgage Trust (NYSE:BXMT), which is a big player in the commercial mortgage space. BXMT just posted strong results, and in this article, I highlight why this should give investors confidence in this name, so let’s get started.

Why BXMT?

Blackstone Mortgage Trust is an industry giant in the commercial mortgage REIT space, generating senior loans collateralized by real estate in North America, Europe, and Australia. It’s externally managed by Blackstone (BX), one of the largest asset managers in the world, with over $200 billion worth of real estate assets under management. This affiliation benefits BXMT in that it provides it with a deal pipeline and line of sight that it would not otherwise have as a standalone company.

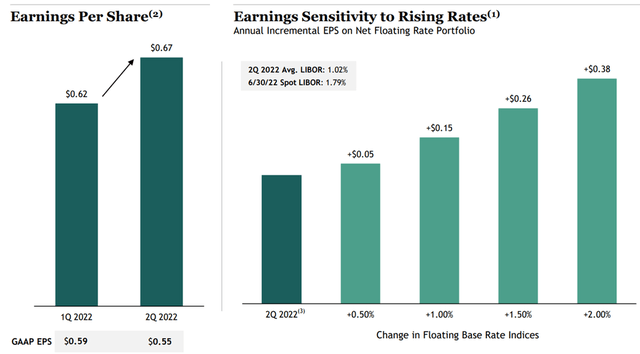

BXMT just posted strong second-quarter results, with 11% YoY growth in distributable EPS to $0.67 per share. This was driven on the back of strong originations amounting to $3.0 billion, backed by top sponsors and high-quality assets in hospitality, multifamily, industrial, and new-build office. The Q2 originations came with a safe average of 59% loan-to-value (sitting below portfolio average) with a $313 million average loan size.

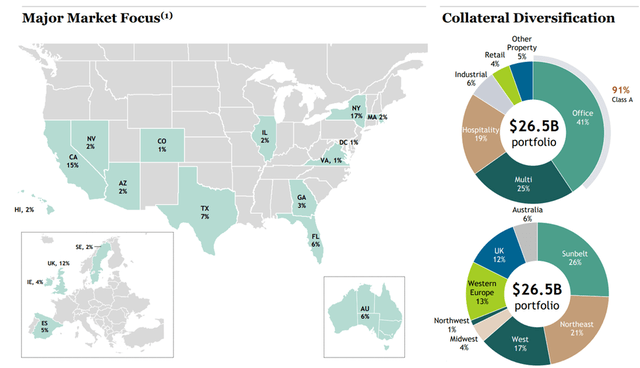

The overall portfolio also appears solid, as BXMT saw 100% interest collection, and has a 64% weighted average loan-to-value. This implies that the underlying properties would need to incur on average a 36% loss in value after a borrower default before BXMT begins to incur losses on invested principal. The $26.5 billion portfolio is diversified across 205 loans by geography, with office, multifamily, and hospitality comprising the top 3 sectors.

BXMT Portfolio Mix (Investor Presentation)

Looking forward, BXMT is well-positioned for continued rising rates, as 99.9% of its loans are floating rate. As shown below, BXTM stands to see annual EPS bumps of $0.10 to $0.12 for every 50 basis point hike in the LIBOR rate.

BXMT EPS Sensitivity (Investor Presentation)

BXMT also has plenty of dry powder to fund new loans, with $1.5 billion in liquidity. Moreover, management has highlighted plenty of greenfield opportunities due to less competition for deals, as noted during the conference call:

Turning to new investments. The market environment today has changed considerably since our last call but remains attractive for strong, well-capitalized lenders like BXMT. Capital markets dislocation has pushed CMBS originators, midsized debt funds and even many banks out of the market, clearing the field and creating a compelling competitive dynamic. Against this backdrop, we have drawn on our global platform to identify investments that fit our stringent risk and return criteria.

As always, our investing activity was supported by our strong access to asset-level financing as well as corporate capital, where we continue to execute efficiently despite significant dislocation across the market as a whole. Through our track record of credit performance and responsible borrowing, we have developed deep relationships with large banks around the world, who continue to support our business as they consolidate lending activity to their strongest clients.

Risks

Factors that could drive the share price down include a lower interest rate environment, which could pressure investment spreads, as well as increased pressure from competitors in the space, such as Ares Commercial Real Estate (ACRE). In addition, black swan economic events could place pressure on borrowers’ ability to make interest payments, and BXMT carries a BB- rated balance sheet, due to its use of leverage to increase investment returns.

Dividends and Valuation

BXMT’s strong Q2 earnings result in a respectable 92.5% dividend payout ratio. While the share price has ticked up to $31.14 on back of Q2 results, I still see value in the stock, especially considering that it yields a solid 8%. At present, BXMT carries a price-to-book ratio of 1.146x (based on book value per share of $27.17). As shown below, this sits towards the low end of BXMT’s trading range over the past 5 years, outside of the 2020 and spring 2022 timeframes.

BXMT Price-to-Book (Seeking Alpha)

Investor Takeaway

BXMT’s strong Q2 results demonstrate that it’s thriving in the current rising interest rate environment and with reduced competition. It’s seeing robust origination activity while gearing the portfolio towards ever safer loans with lower loan-to-value ratios. Given its solid dividend yield and reasonable valuation, I believe there is still value in this stock at current prices for income investors.

Be the first to comment