porcorex

The stock market can be thought of as being a giant casino in the short-run, but that’s not the way that I see it. I believe a more apt description of the market is of the notion that it’s a wealth transfer vehicle from the impatient to the patient.

Of course, holding a falling stock such as Blackstone Mortgage (NYSE:BXMT) takes both fortitude and conviction, but I believe it’s one in which investors will be rewarded. This article highlights why BXMT is a bargain basement buy with a very high yield.

Why BXMT?

Blackstone Mortgage Trust is an industry giant in the commercial mortgage REIT space, generating senior loans collateralized by real estate in North America, Europe, and Australia. It’s externally managed by Blackstone (BX), one of the largest asset managers in the world, with over $200 billion worth of real estate assets under management. This affiliation benefits BXMT in that it provides it with a deal pipeline and line of sight that it would not otherwise have as a standalone company.

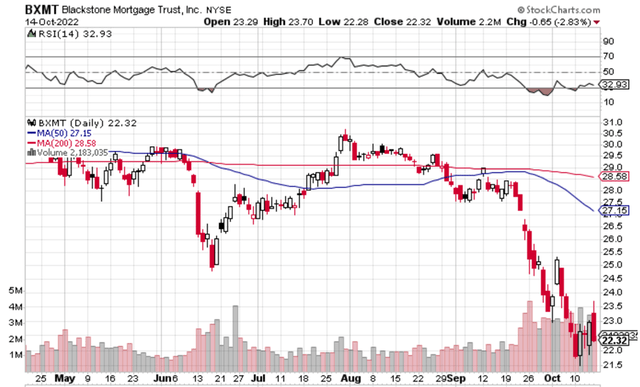

Starting off with the stock’s technical performance, BXMT has gotten very cheap as of late, falling from the $30-level from as recently as August to just $22.32 at present. As shown below, BXMT now sits very well below its 200- and 50-day moving averages of $28.58 and $27.15, respectively, and carries an RSI score of 33, indicating that it’s close to being in oversold territory.

BXMT Stock Technicals (StockCharts)

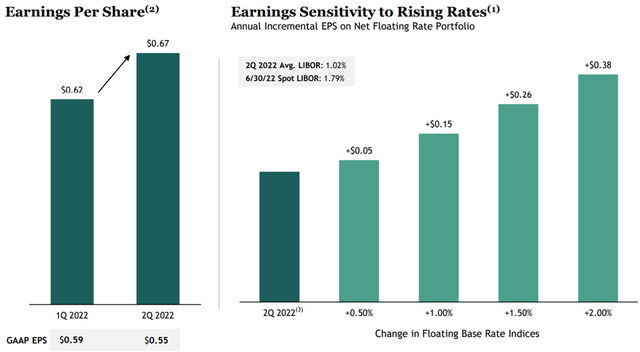

It appears that the market is throwing out everything it perceives as being risky at fire-sale prices. It’s precisely during these times that one needs to remain level-headed. This is considering the fact that BXMT saw 100% interest collection and 99.9% of its portfolio is floating rate, which makes it positively correlated with rising rates in an inflationary environment. This means that BXMT is in immediate position to benefit from rising rates. As shown below, management expects to see between $0.10 and $0.12 in EPS accretion with every 50-basis point increase in the LIBOR rate.

BXMT Interest Rate Sensitivity (Investor Presentation)

Moreover, BXMT has a simplistic structure of senior loans with a weighted average 64% loan-to-value ratio. This means that borrowers have significant skin in the game and that underlying properties in loan default would need to see a significant loss in value before BXMT begins to incur losses.

Also encouraging, management appears to be de-risking the portfolio further, as loan originations in its last reported quarter carried an average 59% LTV ratio. It’s also greatly reduced its loans to office properties from over 50% last year to 41% at present. Notably, its office properties are generally of high quality in nature with legal protections to ensure timely interest payments.

Meanwhile, BXMT carries a healthy balance sheet with $1.5 billion in liquidity, and a long-dated maturity schedule, with only $220 million of debt maturities before 2026. Having said that, BXMT does carry more leverage than its peers, with a long-term debt to capital ratio of 80%, compared to 72% for Starwood Property Trust (STWD), and 56% for Ares Commercial Real Estate (ACRE). Ideally, I’d like to see BXMT’s leverage ratio trend down to closer to that of its peers.

Nonetheless, BXMT pays a very attractive 11% dividend yield that’s well covered by a 92% payout ratio. I also find it to be rather cheap at the current price of $22.32 with a price-to-book value of just 0.83x. As shown below, this is well below BXMT’s historical norms over the past 5 years, and is back to its lows during 2020.

BXMT Price to Book (Seeking Alpha)

Investor Takeaway

In conclusion, I believe BXMT stock is a very attractive buy at the current price. The market has overreacted to the selloff in risk assets and has priced in a worst-case scenario. BXMT has a conservative investment portfolio, solid income growth prospects, and a very attractive 11% dividend yield. As such, I believe this is a stock that’s well worth adding to income portfolios at this time.

Be the first to comment