hapabapa/iStock Editorial via Getty Images

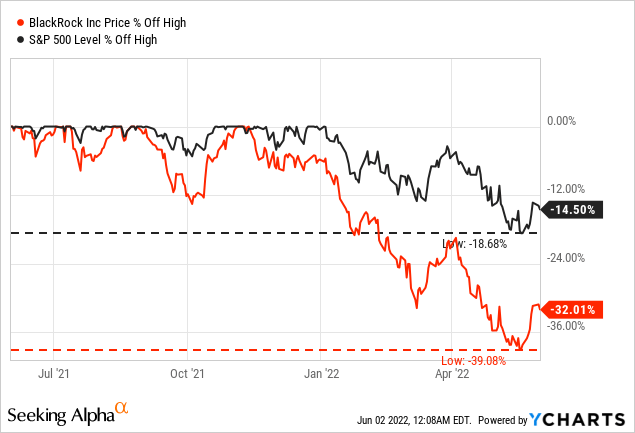

In the last few months, the U.S. stock market – represented by the S&P 500 (SPY) – almost entered a bear market. Therefore, it is not surprising that many different stocks declined rather steeply during that time. One stock, that clearly underperformed the S&P 500 in the recent past was BlackRock, Inc. (NYSE:BLK). While the S&P 500 declined “only” 19% from its previous all-time high, BlackRock declined as much as 39% during the same timeframe.

And while not every decline is necessarily creating a bargain (some stocks declined 70% or 80% in the last few months, and I would still not buy any of them), BlackRock is clearly deserving a closer look right now.

Quarterly Results

Let’s start with the solid first quarter results BlackRock reported recently. And considering the rather difficult first quarter of the U.S. stock market, it is rather surprising what growth rates BlackRock could report. Revenue increased 6.8% year-over-year, from $4,398 million in the same quarter last year to $4,699 million this quarter. Operating income increased from $1,545 million in Q1/21 to $1,764 million in Q1/22 – 14.2% YoY growth. And diluted earnings per share could grow even 20.3% from $7.77 in the same quarter last year to $9.35 this quarter.

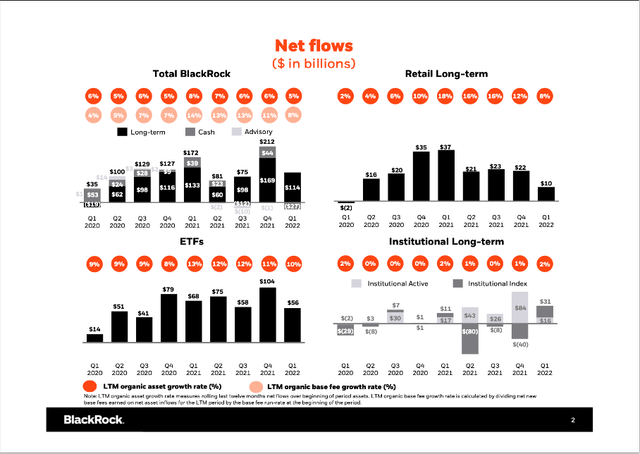

Operating margin could also improve from 35.1% one year ago to 37.5% in Q1/21. And even assets under management increased from $9,007 billion on March 31, 2021, to $9,570 billion on March 31, 2022 – an increase of 6.3%. And it is especially surprising, that BlackRock generated $114 billion in inflows during the first quarter of 2022 with positive flows across all product types (slightly offset by $27 billion in seasonal outflows). When the stock market is declining, we often see people pulling their money out of the stock market – creating challenging times for asset manager.

And the performance during the first quarter of fiscal 2022 was not great for the stock market. But we should also keep in mind, that the S&P 500 could improve again during March and closed around 4,550 at the end of March and therefore recovering most of the previous losses. The steep decline came in April (and in May). And it could very well be that BlackRock will see outflows in Q2/22 – this might also depend on the performance of the stock market during June.

Recession and Bear Market

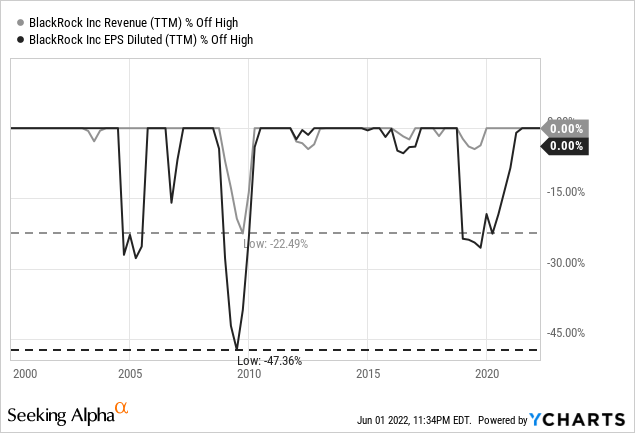

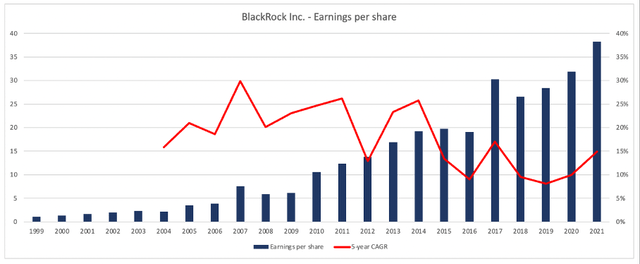

When looking at the last two decades, BlackRock was not a business that was affected hard by a recession, but BlackRock is also not recession-proof. Especially the Great Financial Crisis was a challenge for BlackRock, with revenue declining more than 20% and earnings per share declining almost 50%. However, the company performed very well during the 2020 recession as well as the recession following the Dotcom bubble.

And when looking at the performance of BlackRock, it is not so much a recession that is problematic for BlackRock, but rather the performance of the stock market. For example, after the steep correction in 2018, BlackRock saw its revenue and earnings per share decline.

In case we should have a steep bear market and recession, BlackRock’s performance might also suffer. Recently, Jamie Dimon was speaking of a hurricane that might be headed our way and hit financial markets:

It’s, we — right now it’s kind of sunny, things are doing fine, everyone thinks the Fed can handle this. That hurricane is right out there down the road coming our way. We just don’t know if it’s a minor one or Superstorm Sandy or — yes, Sandy or Andrew, or something like that. And it’s — see, you better brace yourself.

And this might be a pretty good description by Jamie Dimon. We know a hurricane with the potential for devastating consequences is out there, but we don’t know how hard and when it will hit financial markets. But we should prepare for such a scenario and identify the businesses that might be hit hard by a recession (and a bear market).

Great Business, Wide Economic Moat

Despite the fears about a recession and bear market that might have a huge negative impact on BlackRock’s business, the company also has a wide economic moat around its business. In my last article, I described the wide economic moat, which is based on the company’s brand name as well as cost advantages:

One way to fight this problem is a company’s brand name. When I trust a company and a corporation has a reputation, I might rather choose BlackRock instead of a competitor. I might also just choose BlackRock as it reduces searching costs – if I don’t want to do a lot of research which ETF is the best, I will just choose those that are easily available (and in many cases, this is BlackRock).

Aside from the brand name, BlackRock has another competitive advantage to fight price wars: cost advantages through the scale of its operations. Being one of the major asset managers with trillions in assets under management enables BlackRock to offer cheaper fees than many competitors as expenses are usually the same for an ETF with $1 billion in AUM or $100 billion in AUM. And in case of a price war, BlackRock’s profitability might suffer, but most likely the company will emerge as one of the winners.

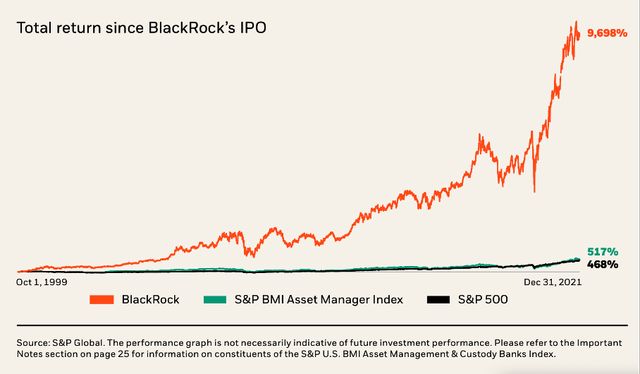

And that wide economic moat is clearly visible in the stock performance over the last two decades. Since the IPO, BlackRock could outperform the S&P 500 as well as the “S&P BMI Asset Manager Index” in an impressive way.

Dividend and Share Buybacks

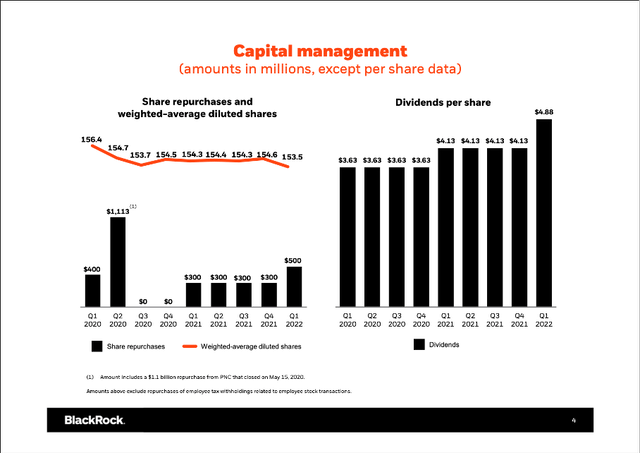

BlackRock also increased its quarterly dividend from $4.13 to $4.88 recently – an increase of 18%. And the combination of a declining share price and an increasing dividend is making BlackRock also interesting for dividend investors. Right now, the stock has a dividend yield of 2.9% and in the last five years, the dividend grew with a CAGR of 13%. And when also considering that BlackRock increased the dividend 18 years in a row, the stock might be interesting for dividend growth investors. And since 2003, the dividend was increased with a CAGR of 18%. When using the trailing twelve months earnings per share of $39.80 and a forward dividend of $19.52, we get an acceptable payout ratio of 49%.

BlackRock is also buying back shares – but not in every single quarter. In the first quarter of fiscal 2022, BlackRock bought back shares worth $500 million. During the last ten years, BlackRock decreased the number of outstanding shares about 14.5%. And when considering that the stock was not cheap in the last few quarters, it seems reasonable for management not to spend high amounts on share buybacks. It is also worth mentioning that BlackRock spent $1.11 billion on share buybacks in the second quarter of 2020 – at a point when the stock was trading for low prices due to the COVID-19 crash.

Intrinsic Value Calculation

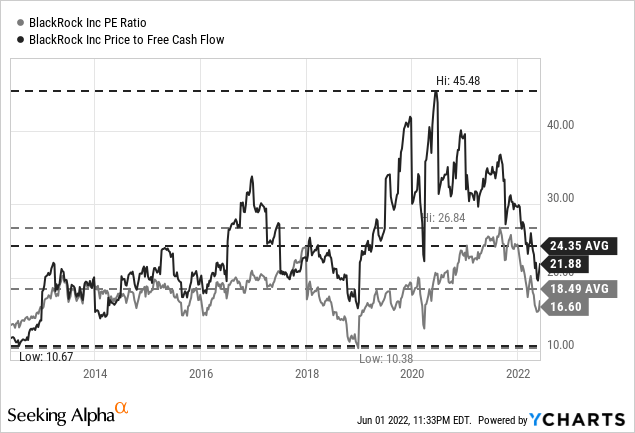

In my last article about BlackRock, which was published in March 2021, I considered the stock slightly overvalued. However, in the meantime, the stock price has declined and the business improved, making it necessary to calculate an intrinsic value again. This becomes obvious when looking at simple valuation metrics.

Right now, BlackRock is trading for a P/E ratio of 16.6, and since 2021, when BlackRock was trading for 27 times earnings, the P/E ratio has constantly declined. And right now, BlackRock is also trading below the average P/E ratio of the last 10 years. The picture for the price-free-cash-flow ratio is similar: right now, BlackRock is trading for 21.88 times free cash flow, which is also below the previous highs of 45 and below the 10-year average of 24.35.

Based on these numbers we could draw the conclusion that BlackRock might be fairly valued or even a bit undervalued. But as simple valuation metrics are only a small part of the entire picture, we always complement the valuation section by using a discount cash flow calculation. And like in my last articles, I will offer three different calculation – a bull case scenario, a bear case scenario, and a base case scenario.

Base Case Scenario

As basis for our calculation, we take the free cash flow of the last four quarters and we will assume a potential recession in fiscal 2020, which will lead to a 20% decline in FCF. For fiscal 2024 we assume 20% growth followed by 8% growth till fiscal 2031 followed by 6% growth till perpetuity (similar to the assumptions used in my last article). When calculating with these numbers (and 10% discount rate as well as 154 million outstanding shares), we get an intrinsic value of $715.88 for Blackrock and the stock would be a bit undervalued right now.

Bear Case

I mentioned above that I expect a recession and bear market in the next few quarters, and although I included a potential recession scenario in my base case scenario, we must assume a steeper decline in the next few years. The risk of the next recession being more extreme than previous recessions is high. And considering the high valuation levels of the U.S. stock market, I expect a rather steep decline. And we could see a bear market that is lasting for several years (maybe two or three years) before we find a bottom. And in my opinion, such a bear market would also have a huge effect on BlackRock’s business.

Let’s assume 30% decline in fiscal 2023 followed by another 20% decline in fiscal 2024. And after such a bear market I expect a rather slow recovery. 20% growth in fiscal 2025, 15% growth in fiscal 2026 and 10% in fiscal 2027 followed by 8% till fiscal 2031 followed by 6% growth till perpetuity. As basis, we assume once again the free cash flow of the last four quarters – this would lead to an intrinsic value of $510.74 for BlackRock.

And we must keep in mind that the declines could be even steeper. I don’t necessarily expect that due to the wide economic moat of BlackRock, but we never know.

Bull Case

And while I consider a recession and bear market likely, we could also calculate a bull case scenario with more optimistic assumptions. And I don’t think we can avoid a bear market in the United States in the next few quarters, but BlackRock might be able to perform better than expected. Let’s assume BlackRock won’t be affected by a recession and can grow 10% annually for the next ten years – in line with the average growth of the last few years. For perpetuity, we assume 6% growth. This will lead to an intrinsic value of $998.26.

Conclusion

I would still see BlackRock rather as a “Hold” right now. On the one side, I consider the stock undervalued, but I also don’t know what will happen in the next few years if the United States should enter a recession and the stock market be in a bear market. Financial services companies – even the ones with a wide economic moat – face a high risk of performing badly in a bear market. This is the main reason I would rather rate BlackRock as a “Hold” right now.

Be the first to comment