gesrey

Investment thesis

BlackRock, Inc. (NYSE:BLK) has been promoting ESG investment for years, but only recently it got bigger publicity in the financial media. This article will focus on the ESG debate BlackRock faces and its effect on the company and the asset management sector. I believe that the heated debate will have some effects on the company’s reputation, possibly affecting its AUM slightly, but it is temporary and long-term shareholders do not have to worry. In addition, if the debate negatively affects the share price, and we will see a market downturn in the next months, investors might be able to lock in a 3.5% dividend yield on BlackRock shares.

ESG issue

BlackRock has been caught in a heated debate about ESG investing and its position to it. One part of the financial press describes BLK as a company that tries to influence climate initiatives and forcing institutional investors to invest in ESG initiatives that help to reduce the impact of climate change, but underperform the market. In late November, the Mississippi treasurer urged pension funds to divest from BlackRock due to its ESG policies. At the beginning of December, the same happened with Florida, and it seems the Treasury is not only threatening BLK but pulling the funds. They will start pulling $2 billion worth of assets managed by BlackRock due to its ESG initiatives. On the other hand, the other part of the financial media describes BlackRock as a hero that they started to push for a more sustainable future, Larry Fink appears in ESG conferences and talks about this issue. Now it seems that BlackRock has been caught in the middle because some people criticize the company for doing too little about ESG while some people criticize it for doing too much. Some investors fear that this could hurt their reputation, AUM, and eventually their profit. I agree, but only in the short term. Other asset managers have similar problems, a couple of days ago, 13 states protested against Vanguard’s support of clean energy. I think in the short term, asset managers might experience some outflows due to this ESG debate, but I feel it is becoming more political rather than a financial discussion.

If we are looking at the big trend, ESG investing seems to be the way investors will invest in the future and possibly 20-30 years from now there will only be ESG types of investing. By 2020, global sustainable funds totaled $35.3 trillion, or more than a third of professionally managed assets. In the US, they accounted for $17.1 trillion, which is more than the combined AUM of both Vanguard and BlackRock, the two largest asset managers. In addition, this debate only exists in the U.S., in Europe, there is virtually no discussion about it, partly because of the Ukrainian war. They relied heavily on Russian gas and oil, but now it is very urgent to invest in ESG projects because of the war and lack of energy supply.

BlackRock is aware of this ESG problem, and they are trying to tackle it. Obviously, in the short term, they need to do something about it to stay competitive. Larry Fink states in almost every TV show and conference he goes to that BLK’s goal is to give choices to investors. He personally supports ESG investing, but BlackRock as a company does not want to be the company that enforces energy transition goals. They believe that stakeholder capitalism is the future and companies have to care about their employees otherwise they will lose competitive advantage. However, why I feel it is rather a political discussion than a financial one because investors are not forced to invest in ESG funds, 40% of BLK’s AUM is in index funds and in cash which has nothing to do with ESG. In addition, U.S. flows in the third quarter were around $85 billion, $133 billion for the year, and $258 billion over the last 12 months. I strongly believe this ESG policy is a temporary debate, but it does not matter for the company’s long-term shareholders and people who invest in BlackRock will likely see great returns on their investment and sustainable dividend payments over the next 10 years despite this current ESG issue. Especially, because in economic downturns, the company can very much expand its competitive moat because it can invest and others can’t. This is what we saw during the 2008-09 financial crisis.

Valuation and risks

As I said, the ESG issue will likely not matter in 10 years, but the current valuation investors can buy BlackRock will. S&P 500 and BlackRock move relatively similarly, but BLK has a 1.31 beta, so the volatility is higher compared to the general market. According to Larry Fink, the stock market in general will see more uncertainty in the next 9-12 months. Fear and confidence will be changing constantly so, therefore, he expects a lot of volatility with range bounds. Investors have to keep in mind this statement because it means BLK stock can be experiencing volatile trading. Calculating with the classic DCF model and looking at the next 8 years, with no FCF growth in the next 2 years, the fair value of the stock is approximately $600. It means it is currently overvalued, but some future market consolidation can present a buying opportunity for investors.

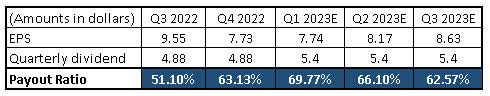

The dividend yield suggests the same, but not so drastically. The current 2.7% dividend yield is only slightly higher than the 4-year average of 2.5%. If the management increases the dividend as expected in the first quarter of 2023 the forward dividend yield immediately jumps to 3% and if a slight downturn reduces the stock price to the fair valuation level of around $600, we can easily see a 3.5% dividend yield. On those levels, I would consider buying into the U.S.’s largest asset manager.

The short-term risk BlackRock faces is the current ESG situation and if the management is not careful enough they can get caught in the 2024 presidential election debate with its ESG policies where both parties will try to take advantage of the situation and eventually hurt BLK’s reputation. I do not see this risk as a major one. The longer-term risk could be a bigger issue, which is the low shareholder return due to the next 9-12 months’ volatile markets. It is possible that the company cannot grow as fast as expected, they already updated their guidance on G&A expenses. If the markets fall further, the AUM and the base fees will decline in the upcoming months. On the other hand, it is not that worrying to me because there will always be inflows just into different asset classes. In May, BLK witnessed the largest ETF bond purchases in years due to recession fears.

BlackRock’s dividend

BlackRock is a stable dividend payer for 20 years and the management has been increasing the dividend consecutively for 13 years. Even during the turbulent times of the financial crisis, they did not cut the dividend, but were able to maintain it. I see no existential threat to BLK’s dividend in the next years. The management has always been quite generous in raising the dividend by 10%+ over the last 10 years. It is because the capital expenditure and the R&D require much less capital investment than a traditional bank due to the nature of the business and the 50%+ share of passively managed funds. However, in the next 2-3 years, I calculate a more moderate dividend growth based on Larry Fink’s general market expectations and the market’s high volatility with range bounds. This would mean less inflows, which equal fewer fees and less free cash flow.

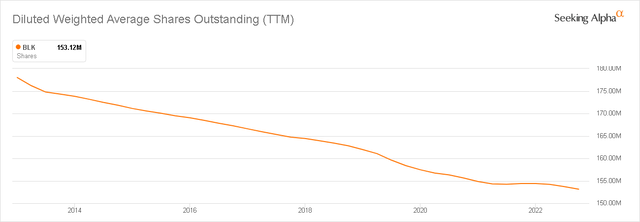

The management policy is to return excess cash to investors, which is unnecessary to grow and maintain the business. They will buy back approximately $1.77 billion worth of shares in 2022. In the third quarter, the CFO stated:

“We still anticipate repurchasing at least $375 million of shares in the fourth quarter consistent with our previous guidance.”

Seeking Alpha The table is made by the author. All figures are based on the company’s estimates and past results.

Final thoughts

I strongly believe that the ESG debate will fade away and will not play a key role in the company’s long-term shareholder returns. However, the short-term turbulence might present good buying opportunities for new and existing shareholders and with the expected 10-11% dividend increase investors can lock up a 3.5%+ dividend yield on BlackRock shares.

Be the first to comment